US Market Open: US equity futures lower, DXY flat and Bunds firmer post-EZ HICP; US ADP and OPEC+ JMMC due

03 Apr 2024, 11:15 by Newsquawk Desk

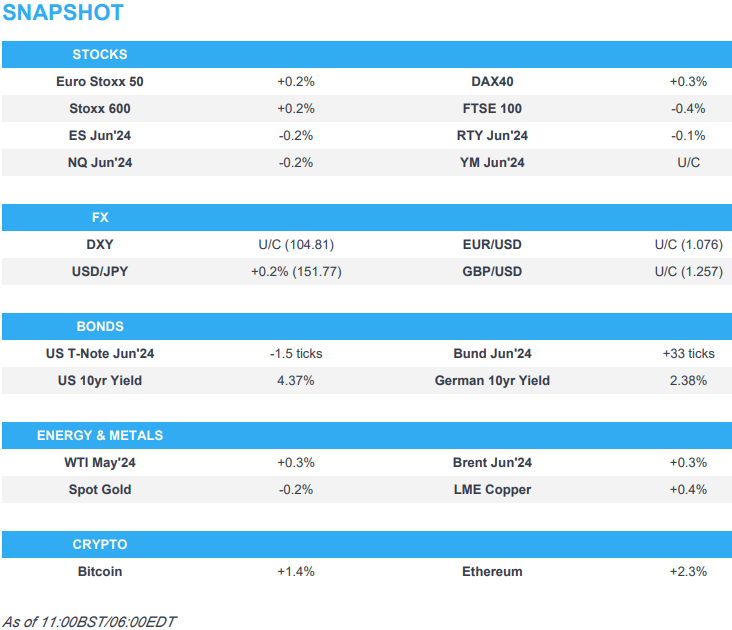

- European bourses are modestly firmer, US equity futures are in the red though with trade contained

- Dollar is flat and G10 peers are incrementally softer

- USTs are incrementally softer whilst Bunds are firmer after dovish-tilting speak from ultra-hawk Holzmann coupled with softer EZ-HICP metrics

- Crude is incrementally firmer but within recent levels, XAU is off best

- Looking ahead, US ADP, ISM Services, Australian PMI (F), OPEC+ JMMC, Comments from Fed’s Powell, Bowman, Goolsbee, Barr & Kugler.

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (+0.2%), were mostly but modestly firmer at the open, and trade remained directionless up until the EZ CPI; following the print, stocks trudged higher.

- European sectors hold a negative tilt, though with no overarching theme or bias. Banks and Tech take the top spots, whilst Real Estate continues to be hampered by the yield environment.

- US Equity Futures (ES -0.2%, NQ -0.2%, RTY -0.3%) are all marginally lower continuing the downside seen in the prior session. Intel (-4.6%) suffers pre-market after reporting its Foundry had an op. loss for 2023 at USD 7bln.

- Click here and here for the sessions European pre-market equity newsflow, including earnings.

- Click here for more details.

FX

- USD on net steady vs. peers after failing to hold above the 105 mark, within a tight 104.84-70 range; topped out at 105.10 yesterday.

- EUR is contained vs. the USD as post-CPI downside proved to be fleeting. The data may accelerate calls for a move next week but June still firmly the base case. EUR/USD holding above yesterday's 1.0724 low.

- USD/JPY remains in consolidation mode around recent highs as recent Fed repricing provides support. Upside targets include the YTD high at 151.97 and the psych 152 mark, above which, there is clean air.

- Antipodeans are both a touch softer vs. the USD after yesterday's session of gains. AUD able to hold onto a 0.65 handle and above yesterday's 0.6482 low.

- PBoC set USD/CNY mid-point at 7.0949 vs exp. 7.2282 (prev. 7.0957).

- Chile Central Bank cut its benchmark interest rate by 75bps to 6.50%, as expected, with the decision unanimous. Chile Central Bank said the board will continue cutting rates, while the size and timing of rates will consider the trajectory of inflation and the macroeconomic scenario.

- Click here for more details.

FIXED INCOME

- USTs were contained during APAC trade as participants took a slight breather from Tuesday's pronounced bear-steepening, though overnight Fed speak was on the hawkish side of things. Modest pressure emerged in the European morning, USTs down to a 109-18 base before Tuesday's 109-14+ trough.

- Bunds were initially contained, in-fitting with USTs, before experiencing modest upside on Holzmann's remarks which had an uncharacteristic dovish-tilt. A dovish but fleeting reaction was seen following the cooler than expected EZ HICP print. Currently near session peaks around 132.50.

- BTPs were dented after Economy Minister Giorgetti announced that the EU is likely to begin deficit infringement procedures against the nation and others, sending BTPs down from 117.90 to 117.50 where they currently reside.

- Click here for more details.

COMMODITIES

- Horizontal trade in the crude complex overnight and in early European hours ahead of the OPEC+ JMMC at 12:00BST, although no recommendations are expected. Brent holds around USD 88.20/bbl.

- Mixed trade for precious metals with some potential profit-taking (ahead of US ADP and a slew of Fed speakers) in the yellow metal after hitting a fresh ATH this morning at USD 2,288.43/oz; XAU has pulled back towards the bottom of a USD 2,269.27-2,288.82/oz intraday range.

- Flat/mixed picture across base metals amid quiet newsflow and with the complex taking a breather after yesterday's data-induced rally.

- US Energy Inventory Data (bbls): Crude -2.3mln (exp. -1.5mln), Gasoline -1.5mln (exp. -0.8mln), Distillate -2.5mln (exp. -0.6mln), Cushing -0.8mln.

- Mexico's Pemex requested trading unit PMI to cancel up to 436k bpd of Mexican crude exports in April which would increase the availability of crude for domestic use including for a new refinery, according to a document cited by Reuters.

- US President Biden is reportedly open to ending LNG export pause for Ukraine aid, according to Reuters.

- Russian Deputy PM Novak said gasoline and diesel fuel stocks remain high in Russia.

- Kazahkstan's Kashagan oil field operator says output was fully restored on April 2 after brief stoppage on April 1.

- Indian oil secretary says higher oil prices are a cause of concern; oil prices reflect geopolitical premium; firms will take appropriate decision on fuel prices if global oil prices stay high for more than a month.

- Spot premiums for US Mars crude exports to Asia reportedly jump after Mexico cuts supply, according to Reuters sources.

- Some Japanese aluminium buyers agree April-June premium at USD 148/ton, +64% from prev. quarter.

- BofA research increases 2024 Brent and WTI crude forecasts to USD 86 and USD 81/bbl respectively; sees prices peaking at around USD 95/bbl in the summer

- OPEC's JMMC will meet at 12:00BST on April 3rd, according to Energy Intel's Bakr.

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- ECB's Holzmann says he has no in-principle objection to a June rate cut, but wants to see more supportive data. Holzmann added that cutting out-of-sync with the Fed would diminish the impact of easing, whilst also noting that a 3.0% deposit rate could prove too tight over the longer-term, given weak EZ productivity.

- Italian Finance Minister Giorgetti says the EU is to open a deficit infringement procedure against Italy and several other countries. Adds, Italy is already in line with the EU requirements to cut deficit below 3% of GDP over time

- German VDMA says Engineering Orders (Feb) -10% Y/Y (Domestic -11%, Foreign -10%); Engineering Orders (Dec-Feb) -8% Y/Y (Domestic -11, Foreign -7%)

- Barclays raises Eurostoxx600 target to 540 (prev. target 510, current 508); upgrades Europe to overweight.

- Norwegian Parliament received a bomb threat, according to local reports; debate continues in Norway's parliament despite bomb threat

DATA RECAP

- EU HICP Flash YY (Mar) 2.4% vs. Exp. 2.6% (Prev. 2.6%); HICP-X F, E, A, T Flash MM (Mar) 1.10% (Prev. 0.70%); HICP-X F,E,A&T Flash YY (Mar) 2.9% vs. Exp. 3.0% (Prev. 3.1%); HICP-X F&E Flash YY (Mar) 3.1% vs. Exp. 3.2% (Prev. 3.3%)

- EU Unemployment Rate (Feb) 6.5% vs. Exp. 6.4% (Prev. 6.4%, Rev. 6.5%)

- Italian Unemployment Rate (Feb) 7.5% vs. Exp. 7.2% (Prev. 7.2%)

- French Budget Balance (Feb) -44.03B (Prev. -25.74B)

- Turkish CPI MM (Mar) 3.16% vs. Exp. 3.5% (Prev. 4.53%); YY (Mar) 68.5% vs. Exp. 69.1% (Prev. 67.07%); PPI YY (Mar) 51.47% (Prev. 47.29%); PPI MM (Mar) 3.29% (Prev. 3.74%)

NOTABLE US HEADLINES

- Tesla (TSLA) CEO Musk "While I don’t own any Disney (DIS) shares today, I would definitely buy their shares if Nelson were elected to the board. His track record is excellent."

- Intel (INTC) outlines financial framework for foundry business and sets path to margin expansion, notes Intel Foundry operating loss for 2023 at USD 7.0bln. Shares -4.8% pre-market.

GEOPOLITICS

MIDDLE EAST

- US President Biden criticised Israel for failing to adequately protect civilians and is pushing for an immediate ceasefire as part of a hostage deal, while Biden said he is outraged over the deaths of World Central Kitchen staff in Gaza, according to Bloomberg and AFP.

- Deep divisions between the US and Israel over an operation in Rafah were evident in a virtual meeting between senior officials, according to three sources cited by Axios. Furthermore, the parties agreed there will be separate virtual meetings of four expert working groups in the next 10 days that will focus on different aspects of a possible Rafah operation.

OTHER

- NATO Foreign Ministers will meet on Wednesday to discuss how to put military support for Ukraine on long-term footing including a proposal for a EUR 100bln five-year military fund, according to Reuters.

- North Korea said it successfully test-fired a new mid- to long-range hypersonic missile, while its leader Kim said they completely turned all missiles to solid fuel with warhead control and capable of nuclear weaponisation, according to Yonhap.

- UK FCDO said North Korea's ballistic missile launch on April 2nd is a breach of multiple UN Security Council resolutions and the UK urges North Korea to refrain from further provocations, return to dialogue and take credible steps towards denuclearisation.

- Philippine National Security Council spokesperson said the commitment to maintain the grounded warship in Second Thomas Shoal will always be there and any attempt by China to interfere with resupply missions will be met by the Philippines in a fashion that protects its troops, while the spokesperson added that resupply missions to Second Thomas Shoal will never stop.

CRYPTO

- The Bitcoin sell-off from the prior day has cooled, with the coin now holding around USD 66.5k.

APAC TRADE

- APAC stocks followed suit to losses in the US where treasuries bear-steepened and oil prices ramped up.

- ASX 200 was led lower by tech and real estate as the rate-sensitive sectors suffered from firmer yields.

- Nikkei 225 briefly dipped beneath 39,500 with index heavyweight Fast Retailing among the worst hit after lower Uniqlo same-store sales, while Japan also issued a tsunami warning after a powerful earthquake struck Taiwan.

- TAIEX was pressured after Taiwan's most powerful earthquake in 25 years which collapsed at least 26 buildings.

- Hang Seng and Shanghai Comp. conformed to the downbeat mood across the region amid tech weakness and mixed US-China headlines with the US asking South Korea to toughen controls on semiconductor technology exports to China. However, the losses in the mainland were cushioned after an improvement in Caixin Services PMI data and Biden-Xi phone talks.

NOTABLE ASIA-PAC HEADLINES

- US Treasury Secretary Yellen is to travel to China on April 3rd-9th to continue economic dialogue with top Chinese officials and is to meet with Vice Premier He Lifeng, the Guangdong province Governor and US business executives in Guangzhou. Furthermore, Yellen is to meet with PBoC's Governor Pan Gongsheng and former Vice President Liu He on April 8th, while she is to underscore global economic consequences of Chinese industrial overcapacity in meetings with Chinese officials.

- A strong earthquake was felt in Taipei and parts of the city experienced a power outage, while the Taiwan Central Weather Administration said the earthquake registered a 7.2 magnitude and was Taiwan's most powerful earthquake in 25 years. Taipei city government said it had not yet received any reports of major damage following the earthquake and it was later reported that Taipei’s MRT resumed operations although there were reports of collapsed buildings in the city of Hualien with people reportedly trapped in the buildings, while Taiwan announced the earthquake caused 26 buildings to collapse.

- Japan issued an evacuation advisory for Okinawa coastal areas and a tsunami warning after the initial announcement of a preliminary magnitude 7.5 earthquake off southwestern Japan but later revised the Taiwan earthquake magnitude up to 7.7 and lifted the tsunami warnings.

- China March prelim car sales +7% Y/Y (vs -21% in Feb).

- Foxonn (2354 TT) says Co. shut down some of its production lines in Taiwan for inspection following the earthquake; currently normal production operations have gradually resumed; no damage to manufacturing equipment.

- PBoC monetary policy committee holds a meeting; PBoC says expectations for economic growth is relatively weak. Click here for all headlines.

DATA RECAP

- Chinese Caixin Services PMI (Mar) 52.7 vs. Exp. 52.7 (Prev. 52.5); Caixin Composite PMI (Mar) 52.7 (Prev. 52.5)