US Market Open: Upward revisions to European PMIs support bourses & EUR modestly

04 Apr 2024, 11:35 by Newsquawk Desk

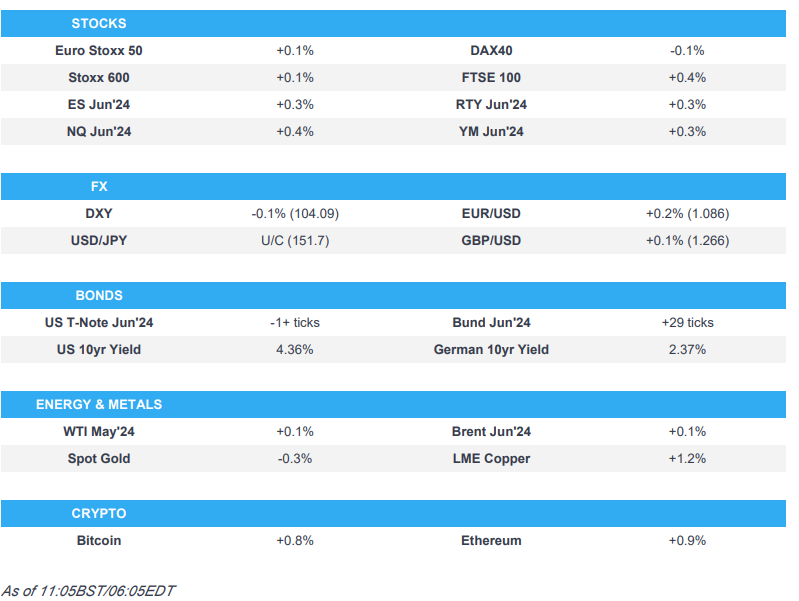

- European bourses a touch firmer post-PMIs after a flat open, US futures tilting higher in tandem into IJC and Fed appearances

- DXY softer and approaching 104.00, EUR inches higher post-PMIs, JPY stead, CHF lags

- EGBs bid despite PMI pressure though off highs in somewhat limited newsflow, USTs flat

- Base metals continue to climb with 3M LME Copper at a 52-week high, crude contained and XAU slightly softer

- Looking ahead, highlights include US Challenger Layoffs, IJC, Canadian Trade, ECB Minutes and Appearances from Fed’s Harker, Barkin, Goolsbee, Mester & Kashkari

EUROPEAN TRADE

EQUITIES

- European bourses are modestly in the green after a relatively flat/directionless cash open, Euro Stoxx 50 +0.1%; modest post-open upside emerged after revisions to the Final EZ PMIs where Composite returned to expansion.

- Sectors do not have any overarching theme or bias present; basic resources outperform given base metal prices.

- Stateside, ES +0.3%, futures are tilting higher in tandem with European futures into another session dominated by Fed appearances alongside weekly IJC data before attention focuses on Friday's payrolls.

- Click here and here for the sessions European pre-market equity newsflow, including earnings.

- Click here for more details.

FX

- USD remains under modest pressure following on from the post-ISM sell off; DXY nearing 104.00 to the downside below which the 50- & 200-DMAs reside at 103.88 and 103.76.

- EUR continues to inch higher after a softer start to the week, modest support perhaps arising from the PMI revisions while the docket ahead is headlined by ECB Minutes, though these are likely stale; last week's EUR/USD high next at 1.0864.

- Sterling steady and unaffected by PMIs or the latest BoE DMP; GBP/USD yet to convincingly surpass the 100- & 50-DMAs at 1.2663 and 1.2667 respectively.

- JPY steady and unreactive to light jawboning overnight, former top-diplomat Watanabe said intervention is not likely unless USD/JPY sharply eclipses 155.00.

- CHF the current laggard after another cool Swiss inflation print which has seen market pricing move more convincingly in favour of a second cut in June, though multiple months of data due before then.

- Click here for more details.

- Click here for today's option expiries for the NY cut.

FIXED INCOME

- EGBs bid despite modest pressure emerging on the morning's upwardly-revised PMIs. Action which eroded some of the concession into supply from France & Spain, though the auctions were still well received.

- Bunds firmer by around 30 ticks but within a similar magnitude of the post-PMI 132.30 base; ECB minutes ahead.

- Gilts followed EGBs into their own data points, with the benchmark unreactive to a modest revision lower (commentary focused on the stickiness of inflation) while the BoE DMP saw inflation expectations edge lower once again. Despite a robust DMO sale, Gilts lost the 99.00 mark but continue to modestly outperform EGBs.

- US Treasuries are essentially flat, have been directionally moving with the above but yet to differ from the unchanged mark by more than a handful of ticks. Action which comes as a slight breather from recent sessions and after Powell reassured those who were expecting/concerned about a hawkish shift.

- Click here for more details.

COMMODITIES

- 3M LME Copper tested USD 9.4k/T to the upside and resides at a fresh 52 week high on the morning's PMIs paint a healthy demand picture; action which comes after an APAC session which saw Chinese markets closed (mainland China returns on Monday).

- Crude benchmarks near the unchanged mark and at the mid-point of circa. USD 0.80/bbl bounds with specifics light thus far into broader macro events.

- Spot gold a touch softer irrespective of the modest USD pullback, action which comes as the yellow metal takes a modest breather from recent upside and as US yields inch higher.

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- Riksbank Minutes (Mar): No overt mention of preference between May or June for a rate cut among the members. Click here for the full breakdown.

- BoE Monthly Decision Maker Panel - One-year ahead CPI inflation expectations declined further to 3.2% in March, down from 3.3% in February.

- ECB's Kazimir says he opposed reviving any “special tools of monetary policy”, according to Bloomberg; declined to comment on current monetary policy due to the ECB's quiet period ahead of next week's meeting.

DATA RECAP

- Swiss CPI YY (Mar) 1.0% vs. Exp. 1.3% (Prev. 1.2%); Core 1.0% (prev. 1.1%)

- EU HCOB Services Final PMI (Mar) 51.5 vs. Exp. 51.1 (Prev. 51.1); Composite Final PMI (Mar) 50.3 vs. Exp. 49.9 (Prev. 49.9)

- EU Producer Prices YY (Feb) -8.3% vs. Exp. -8.6% (Prev. -8.6%, Rev. -8.0%); MM (Feb) -1.0% vs. Exp. -0.7% (Prev. -0.9%)

- UK S&P Global Services PMI (Mar) 53.1 vs. Exp. 53.4 (Prev. 53.4); Composite PMI (Mar) 52.8 vs. Exp. 52.9 (Prev. 52.9)

NOTABLE US HEADLINES

- Fed's Kugler (voter) said her policy rate expectation is consistent with March FOMC meeting policymaker projections and if disinflation and labour market conditions proceed as she is currently expecting, then some lowering of the policy rate this year would be appropriate. Kugler said policy is currently restrictive and her baseline expectation is that disinflation will continue without a broad economic slowdown, but added that inflation progress has sometimes been bumpy and such an outcome cannot be assured.

GEOPOLITICS

MIDDLE EAST

- US official said the Biden administration is calling on the Israeli army to modify its way of transmitting information about the stationing of aid workers and Biden plans to demand these changes. Furthermore, Biden is angry and largely frustrated over the killing of aid workers in Gaza and is ready to clarify his view to Netanyahu during their expected phone call today, while the official added there is no shift in Washington's policy towards Israel, but there is a shift in President Biden's frustrations, according to CNN.

- US Pentagon said Defence Secretary Austin spoke with Israeli Defence Minister Gallant on Wednesday and expressed his outrage at the Israeli strike on a World Central Kitchen humanitarian aid convoy, while Austin stressed the need to immediately take concrete steps to protect aid workers and Palestinian civilians in Gaza after repeated coordination failures with foreign aid groups.

OTHER

- France denied it showed any readiness for Ukraine dialogue in talks with Russia, according to a French government source.

- Tokyo is in talks with Manila over sending troops to the Philippines in which a possible deployment comes as they boost efforts to deter China in the South China Sea, according to FT.

- Russia's Kremlin says relations with NATO have slid to a level of direct confrontation; NATO continues "to move towards our borders"

CRYPTO

- Bitcoin is a touch firmer and at the top-end of the session's range around USD 66k.

APAC TRADE

- APAC stocks traded higher as sentiment picked up from the choppy mood and mixed data releases stateside, despite thinned conditions with markets across Greater China shut for the Qingming Festival.

- ASX 200 was led by strength in gold miners after the precious metal rose above USD 2,300/oz for the first time.

- Nikkei 225 outperformed and spent most of the session above the 40,000 level with the help of a predominantly weaker currency.

- KOSPI was boosted by tech strength with Samsung underpinned ahead of its preliminary earnings results on Friday with its profit seen to rise to the largest in six quarters on higher chip prices, while SK Hynix was lifted amid plans to invest USD 3.9bln to build an Indiana plant.

DATA RECAP

- Australian Building Approvals (Feb) -1.9% vs. Exp. 3.3% (Prev. -1.0%, Rev. -2.5%)

- New Zealand ANZ Commodity Price MM -1.3% (Prev. 3.5%, Rev. 3.6%)