Europe Market Open: Hawkish-leaning Fed rhetoric and geopolitics dented risk appetite

05 Apr 2024, 06:35 by Newsquawk Desk

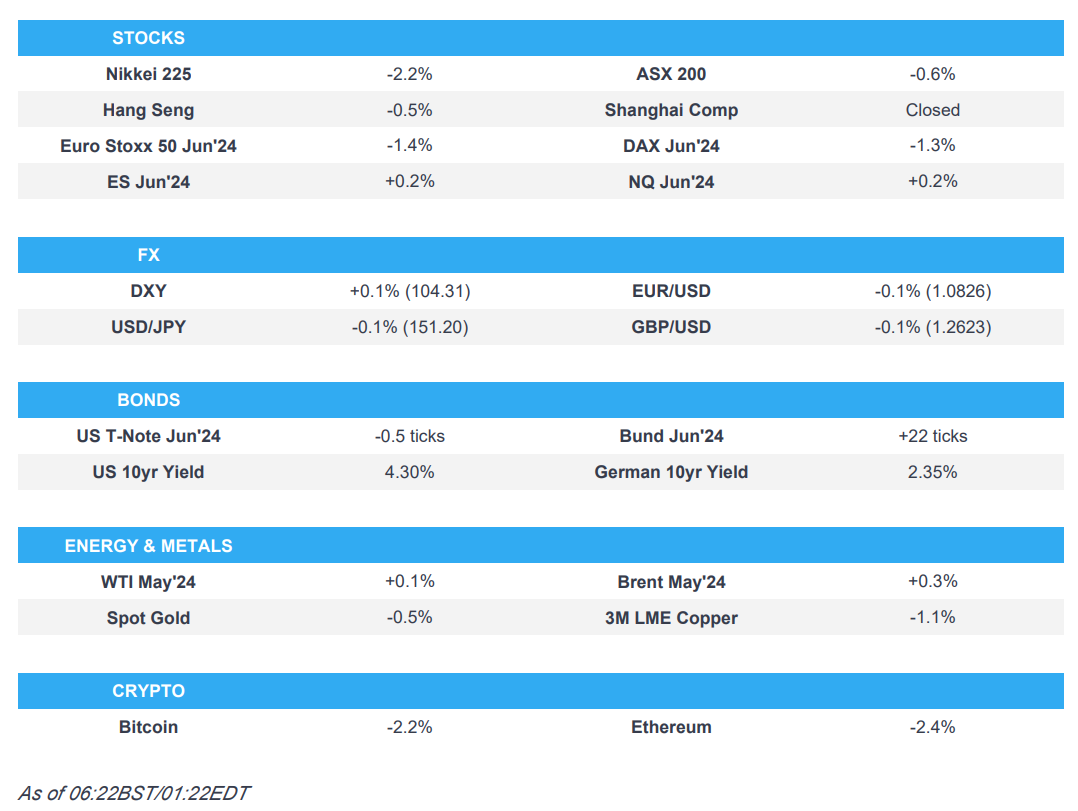

- APAC stocks followed suit to the losses in the US amid geopolitical concerns and hawkish-leaning Fed rhetoric.

- Fed's Kashkari and Goolsbee noted that it is possible the Fed will not cut this year if inflation stalls.

- European equity futures indicate a weaker open with the Euro Stoxx 50 future -1.3% after the cash market closed flat on Thursday.

- DXY is a touch firmer, EUR/USD eased back from two weeks highs but remains on a 1.08 handle, antipodeans lag.

- The CIA reportedly warned of an imminent retaliatory attack on Israel by Iran, while Israel raised its alert level at embassies worldwide.

- Looking ahead, highlights include US NFP, Canadian Jobs, German Industrial Orders, EZ/UK Construction PMIs, EZ Retail Sales, Comments from Fed's Collins, Barkin, Bowman & Logan.

US TRADE

EQUITIES

- US stocks finished lower with heavy selling in late US trade as part of a broader haven influx amid concerns regarding Iran's response amid warnings of a potential retaliatory attack on Israel within 48 hours and with Israel raising its alert level at embassies worldwide. Participants also digested disappointing initial jobless claims and Challenger layoffs data earlier in the session, while there was a slew of Fed commentary which was hawkish-leaning as Goolsbee and Kashkari both cast some doubts regarding cuts this year.

- SPX -1.23% at 5,147, NDX -1.55% at 17,878, DJIA -1.35% at 38,596, RUT -1.08% at 2,053.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Barkin (voter) said it is smart for the Fed to take its time on rate cuts and that early 2024 data is less encouraging which raises the issue of whether the outlook is shifting or just a "bump along the way". Barkin said there is no case to be made that 2% inflation is not achievable and adhering to that target has brought benefits, while he has no interest in backing off from the 2% target. Barkin also said it is hard to reconcile the current breadth of inflation with the progress the Fed needs to see for rate cuts and noted disinflation is likely to continue but the speed of that remains unclear and he is open to rate cuts once it is clear progress on inflation will be sustained and apply more broadly in the economy, as well as noted that businesses acknowledged less pricing power than before although are still finding strategies that may keep inflation too high.

- Fed's Mester (voter) said she now thinks growth this year will be above trend and does not think the disinflation pace this year will match last year but does anticipate the Fed will be in a position to lower the FFR later this year. Mester said if the Fed slows the QT runoff, there is less likelihood of running into a September 2019 situation and she would be comfortable reducing the pace of the runoff soon.

- Fed's Goolsbee (non-voter) said the biggest danger to the inflation picture is continued high inflation in housing services, while he added housing inflation has to come down which he thinks will happen but added it is a threat to the economic Fed's 2% target if it doesn't. Furthermore, he said that he jotted down two rate cuts this year but if inflation continues to move sideways, it makes him wonder if they should cut rates at all this year.

- Fed's Harker (non-voter) said inflation is still too high and the jury is still out on whether AI will boost productivity.

- Fed's Kashkari (non-voter) said need to see some more inflation progress before a cut, while he said he wrote down two rate cuts this year in the March projection but said it is possible the Fed will not cut this year if inflation stalls. Furthermore, he does not see any reason why it cannot continue with the balance sheet plan when the Fed cuts FFR and he expects to see more mergers in the banking sector.

APAC TRADE

EQUITIES

- APAC stocks followed suit to the losses in the US amid geopolitical concerns and hawkish-leaning Fed rhetoric.

- ASX 200 suffered amid weakness in tech and mining stocks, while data showed a monthly contraction in Australian exports.

- Nikkei 225 retreated beneath 39,000 with intraday losses of around 1,000 points amid currency strength.

- KOSPI was dragged lower with Samsung Electronics pressured following its preliminary Q1 results in which operating EPS topped forecasts but it missed on revenue.

- Hang Seng conformed to the downbeat mood on return from holiday and with mainland markets still shut.

- US equity futures (ES +0.2%) languished around yesterday's lows ahead of the NFP report and more Fed speakers.

- European equity futures indicate a weaker open with the Euro Stoxx 50 future -1.3% after the cash market closed flat on Thursday.

FX

- DXY was marginally firmer after the prior day's haven flows and hawkish Fed rhetoric in which Fed's Goolsbee and Kashkari both cast some doubts on future rate cuts and suggested potentially not cutting at all this year if inflation stalls.

- EUR/USD eased back from near 2-week highs as the dollar rebounded in a flight to safety.

- GBP/USD was mildly pressured alongside weakness in activity currencies but retained the 1.2600 status.

- USD/JPY briefly dipped beneath the 151.00 handle after BoJ Governor Ueda kept the door open for further policy adjustments including potentially responding to the effects of FX moves, while there was also familiar jawboning by Japanese Finance Minister Suzuki.

- Antipodeans weakened amid the broad risk aversion and predominantly softer Australian trade data.

FIXED INCOME

- 10-year UST futures were flat around the 110.00 level following yesterday's geopolitically-triggered haven bid.

- Bund futures remained firmer but with price action rangebound on both sides of the 133.00 level.

- 10-year JGB futures faded its opening gains after recent comments from BoJ Governor Ueda who provided balanced remarks but kept the door open for further policy adjustments, while the 2-year JGB yield printed its highest since April 2011 early in the session.

COMMODITIES

- Crude futures held on to the prior day's gains after surging on Israel-Iran geopolitical concerns with the CIA reportedly warning of a retaliatory attack on Israel by Iran within 48 hours, while Israel raised its alert level at embassies worldwide.

- Qatar set May marine crude OSP at Oman/Dubai plus USD 0.65/bbl and land crude OSP at Oman/Dubai plus USD 0.40/bbl, according to a pricing document.

- Spot gold continued its pullback from the USD 2,300/oz level after the recent hawkish-leaning Fed rhetoric.

- Copper futures were pressured as the negative sentiment and lack of Chinese buyers provided an opportunity for investors to book some of the profits seen earlier in the week.

- Chile Codelco's said Q1 copper output was near to 300k metric tons.

CRYPTO

- Bitcoin weakened amid the broad risk aversion and reverted to beneath the USD 68,000 level.

NOTABLE ASIA-PAC HEADLINES

- US Treasury Secretary Yellen seeks healthy China ties and warned of overcapacity during China visit, according to Bloomberg.

- US Commerce official Lago met with a Chinese official where she raised commercial and market access issues impacting US companies and workers like data flows and regulatory transparency, while she also raised 'strong concerns' regarding growing overcapacity in a range of Chinese industrial sectors that impact US workers and businesses, according to the Commerce Department.

- BoJ Governor Ueda said the chance of sustainably and stably achieving the bank's 2% inflation target is in sight and likely to keep heightening, while he added the BoJ will adjust the level of interest rates in accordance to the distance towards sustainably and stably achieving 2% inflation, according to Asahi newspaper. Ueda said whether to raise interest rates again this year will be dependant on data and if the BoJ become more convinced that trend inflation will approach 2%, that will be one reason to adjust interest rates but also stated as long as trend inflation is below 2%, it is necessary to maintain accommodative monetary conditions. Furthermore, he said if FX moves appear to have an impact on the wage-inflation cycle in a way that is hard to ignore, they could respond via monetary policy.

- Japanese Finance Minister Suzuki said rapid FX moves are undesirable and he is closely watching FX moves with a high sense of urgency, while he reiterated it is important for currencies to move in a stable manner reflecting fundamentals and won't rule out any options to deal with excessive FX moves.

- RBI kept its Repurchase Rate unchanged at 6.50%, as expected, while it maintained the stance of remaining focused on the withdrawal of accommodation in which 5 out of 6 members voted in favour of the rate and policy stance. RBI Governor Das stated monetary policy must be actively disinflationary and the MPC will remain resolute in its commitment to aligning inflation to the target, while he also stated that they must ensure the descent of inflation to the target of 4% and the last mile of disinflation is challenging.

DATA RECAP

- Japanese All Household Spending MM (Feb) 1.4% vs. Exp. 0.5% (Prev. -2.1%)

- Japanese All Household Spending YY (Feb) -0.5% vs. Exp. -3.0% (Prev. -6.3%)

- Australian Trade Balance (AUD)(Feb) 7.3B vs Exp. 10.5B (Prev. 11.0B)

- Australian Exports MM (Feb) -2.2% (Prev. 1.6%)

- Australian Imports MM (Feb) 4.8% (Prev. 1.3%)

GEOPOLITICS

MIDDLE EAST

- CIA reportedly warned Israel that Iran will attack the country in the next 48 hours, while Tehran is said to be planning a combined attack with a "rain" of drones and missiles fired from its bases at strategic locations inside Israel, according to a report in the Daily Express US citing Al Mayadeen.

- Israel raised the alert level at embassies worldwide to maximum and is evacuating missions in several countries, while it relocates representatives to secure locations due to the heightened Iranian response threat, according to Hebrew media reports.

- Israeli PM Netanyahu said Iran has been working against Israel for years and therefore, Israel is operating against Iran and its proxies. It was also reported that senior Israeli officials told Walla News that they made it clear to the US that if Iran attacks them from its territory, they will have to respond.

- Israel told the US that if Iran launched an attack from its soil against Israel in retaliation for the killing of an Iranian General earlier this week, it would draw a strong response from Israel and take the current conflict to another level, according to Axios.

- White House said US President Biden emphasised to Israeli PM Netanyahu that the strikes on humanitarian workers and the overall humanitarian situation are unacceptable, while Biden made it clear Israel needs to announce and implement a series of specific, concrete, and measurable steps to address, civilian harm, humanitarian suffering, and the safety of aid workers. It was also stated that US policy with respect to Gaza will be determined by its assessment of Israel's immediate action of these steps.

- US President Biden’s administration recently authorised the transfer of over 1k 500-pound bombs and over 1k small-diameter bombs to Israel, despite US concerns over the country’s conduct in Gaza, according to CNN sources. It was also reported that the White House said the process of US military aid to Israel was not tied to the Hamas conflict.

- Israeli government approved opening Erez crossing into Gaza and opening of Ashdod Port to expand aid into Gaza, according to Times of Israel.

- Senior Hamas leader said Egypt recently put forward a proposal but it doesn't include anything new, while he added that Americans and Egyptians want to keep the ceasefire process alive despite their conviction about the wide gap between the two conflicting parties.

- Yemen Houthi leader said a total of 90 ships have been targeted in the Red Sea since Houthi attacks began.

OTHER

- US Secretary of State Blinken commented via X that the US and its allies are united in their commitment to Ukraine, while he added they reaffirmed at the Foreign Ministers meeting of the NATO-Ukraine Council that Ukraine's future is in NATO.

- Japan's METI announced Japan will expand the export ban to Russia to include more industrial items such as lithium-ion batteries, thermostats and grinders effective April 17th.

- Russian Foreign Ministry said Sweden's plans to set up a NATO base on Gotland Island are provocative, according to RIA.