US Market Open: Relatively contained trade into NFP as Europe catches up to geopols

05 Apr 2024, 11:35 by Newsquawk Desk

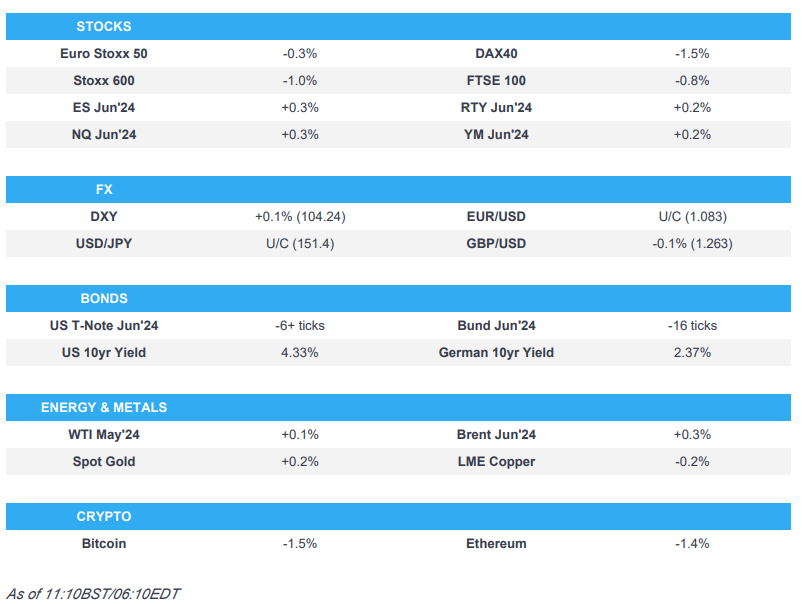

- European equities lower across the board in catch-up play from the late selling seen on Wall St.

- DXY unchanged with G10s rangebound into NFP

- Fixed income benchmarks slightly softer as they give back some of Thursday’s risk-inspired upside

- Commodities feature modest gains for crude and XAU

- Payrolls aside, markets attentive for any further escalation in geopolitical tensions into a potential risk-fuelled weekend

- Looking ahead, highlights include US NFP, Canadian Jobs. Comments from Fed's Collins, Barkin, Bowman & Logan.

EUROPEAN TRADE

EQUITIES

- Equities lower across the board on catch-up play from the late selling seen on Wall Street given geopols/hawkish Fed rhetoric; Stoxx 600 -1.0%.

- Sectors in-fitting with defensives outperforming slightly given the tone and macro drivers.

- Stateside, futures are slightly firmer but action is more a consolidation than an uptick after the pressure seen late doors on Thursday, ES +0.3%.

- Click here and here for the sessions European pre-market equity newsflow, including earnings.

- Click here for more details.

FX

- DXY is essentially unchanged in 104.13-35 parameters as markets count down to the NFP report. Strong release could see a test of 105.00 while a softer print brings 104.00 and below into play.

- G10 peers generally rangebound given the tepid USD action into Payrolls with specifics otherwise light as broader market focus remains on geopols into a potential risk-filled weekend.

- GBP slightly softer despite the Construction PMI moving back into expansionary territory, EUR treading water into the data and was unaffected by the morning's German data points.

- USD/JPY holding at the top-end of a 150.82-151.45 bound; little move to familiar commentary from officials overnight.

- Click here for more details.

- Click here for today's option expiries for the NY cut.

FIXED INCOME

- Benchmarks slightly softer as they give back some of Thursday's risk-inspired upside which more than offset any hawkish impulses at the time from Fed speak.

- Bunds at the session low of 132.53 with no real reaction to a handful of German data points as markets remain focused on Payrolls.

- Gilts are pulling back a touch more than peers, with losses in excess of 30 ticks currently but holding just above Thursday's 98.64 trough, a pullback which is largely a function of their relative outperformance on Thursday.

- USTs a touch softer but remain towards the top-end of Thursday's parameters; NFPs and Fed speak the highlights ahead where an above-forecast number could see a resumption of the earlier bear-steepening while a soft print could see this unwind further - geopolitical updates also a potential key factor.

- Click here for more details.

COMMODITIES

- Modest gains across the crude complex following yesterday's geopolitically-induced upside which led a bid into the settlement. Rhetoric this morning remains heightened, but as of yet no significant follow through to price action.

- WTI and Brent currently firmer by around USD 0.20/bbl, towards the top-end of Thursday's parameters.

- Mixed trade for precious metals with slight underperformance in silver/palladium while gold is more resilient and underpinned by remarks from RBI's Das that they are building reserves; XAU near highs of USD 2293/oz.

- RBI Governor Das says they are building up gold reserves.

- LME says no further deliveries of aluminium alloy brand SMI, produced by State Metals Industrial, will be accepted for LME warranting with effect from 05 July.

- Click here for more details.

DATA RECAP

- German Industrial Orders MM (Feb) 0.2% vs. Exp. 0.8% (Prev. -11.3%, Rev. -11.4%)

- German Import Prices MM (Feb) -0.2% vs prev. 0.00% (exp. 0.00%); YY (Feb) -4.9% vs. Exp. -4.6% (Prev. -5.9%)

- EU HCOB Construction PMI (Mar) 42.4 (Prev. 42.9); German HCOB Construction PMI (Mar) 38.3 (Prev. 39.1)

- EU Retail Sales YY (Feb) -0.7% vs. Exp. -1.3% (Prev. -1.0%, Rev. -0.9%); MM (Feb) -0.5% vs. Exp. -0.4% (Prev. 0.1%, Rev. 0.0%)

- UK S&P Construction PMI (Mar) 50.2 vs. Exp. 50 (Prev. 49.7)

NOTABLE US HEADLINES

- Fed's Barkin (voter) said it is hard to reconcile the current breadth of inflation with the progress the Fed needs to see for rate cuts and noted disinflation is likely to continue but the speed of that remains unclear and he is open to rate cuts once it is clear progress on inflation will be sustained and apply more broadly in the economy, as well as noted that businesses acknowledged less pricing power than before although are still finding strategies that may keep inflation too high.

- Fed's Harker (non-voter) said inflation is still too high and the jury is still out on whether AI will boost productivity.

- US Treasury Secretary Yellen says China is too large to export its way to rapid growth, addressing industrial overcapacity is in China's interests.

- Samsung (006930 KS) is to reportedly fortify US chip revival by raising its Texas investment to USD 44bln, according to WSJ.

GEOPOLITICS

MIDDLE EAST

- Israel told the US that if Iran launched an attack from its soil against Israel in retaliation for the killing of an Iranian General earlier this week, it would draw a strong response from Israel and take the current conflict to another level, according to Axios.

- White House said US President Biden emphasised to Israeli PM Netanyahu that the strikes on humanitarian workers and the overall humanitarian situation are unacceptable, while Biden made it clear Israel needs to announce and implement a series of specific, concrete, and measurable steps to address, civilian harm, humanitarian suffering, and the safety of aid workers. It was also stated that US policy with respect to Gaza will be determined by its assessment of Israel's immediate action of these steps.

- US President Biden’s administration recently authorised the transfer of over 1k 500-pound bombs and over 1k small-diameter bombs to Israel, despite US concerns over the country’s conduct in Gaza, according to CNN sources. It was also reported that the White House said the process of US military aid to Israel was not tied to the Hamas conflict.

- Israeli government approved opening Erez crossing into Gaza and opening of Ashdod Port to expand aid into Gaza, according to Times of Israel.

- "IRGC commander: Any aggression against Iran will not go unanswered", according to Sky News Arabia; "IRGC commander: Israel is in our crosshairs and knows what will happen", via Al Arabiya.

- Iranian official says the decision to retaliate against Israel has been made and will be implemented, via Al Arabiya.

OTHER

- US Secretary of State Blinken commented via X that the US and its allies are united in their commitment to Ukraine, while he added they reaffirmed at the Foreign Ministers meeting of the NATO-Ukraine Council that Ukraine's future is in NATO.

- Japan's METI announced Japan will expand the export ban to Russia to include more industrial items such as lithium-ion batteries, thermostats and grinders effective April 17th.

- Russian Foreign Ministry said Sweden's plans to set up a NATO base on Gotland Island are provocative, according to RIA.

CRYPTO

- Bitcoin a touch softer as markets await the NFP print and any fresh geopolitical developments to drive the macro narrative into the weekend.

APAC TRADE

- APAC stocks followed suit to the losses in the US amid geopolitical concerns and hawkish-leaning Fed rhetoric.

- ASX 200 suffered amid weakness in tech and mining stocks, while data showed a monthly contraction in Australian exports.

- Nikkei 225 retreated beneath 39,000 with intraday losses of around 1,000 points amid currency strength.

- KOSPI was dragged lower with Samsung Electronics pressured following its preliminary Q1 results in which operating EPS topped forecasts but it missed on revenue.

NOTABLE ASIA-PAC HEADLINES

- US Treasury Secretary Yellen seeks healthy China ties and warned of overcapacity during China visit, according to Bloomberg.

- US Commerce official Lago met with a Chinese official where she raised commercial and market access issues impacting US companies and workers like data flows and regulatory transparency, while she also raised 'strong concerns' regarding growing overcapacity in a range of Chinese industrial sectors that impact US workers and businesses, according to the Commerce Department.

- BoJ Governor Ueda said the chance of sustainably and stably achieving the bank's 2% inflation target is in sight and likely to keep heightening, while he added the BoJ will adjust the level of interest rates in accordance to the distance towards sustainably and stably achieving 2% inflation, according to Asahi newspaper. Ueda said whether to raise interest rates again this year will be dependant on data and if the BoJ become more convinced that trend inflation will approach 2%, that will be one reason to adjust interest rates but also stated as long as trend inflation is below 2%, it is necessary to maintain accommodative monetary conditions. Furthermore, he said if FX moves appear to have an impact on the wage-inflation cycle in a way that is hard to ignore, they could respond via monetary policy.

- Japanese Finance Minister Suzuki said rapid FX moves are undesirable and he is closely watching FX moves with a high sense of urgency, while he reiterated it is important for currencies to move in a stable manner reflecting fundamentals and won't rule out any options to deal with excessive FX moves.

- RBI kept its Repurchase Rate unchanged at 6.50%, as expected, while it maintained the stance of remaining focused on the withdrawal of accommodation in which 5 out of 6 members voted in favour of the rate and policy stance. RBI Governor Das stated monetary policy must be actively disinflationary and the MPC will remain resolute in its commitment to aligning inflation to the target, while he also stated that they must ensure the descent of inflation to the target of 4% and the last mile of disinflation is challenging.

DATA RECAP

- Japanese All Household Spending MM (Feb) 1.4% vs. Exp. 0.5% (Prev. -2.1%); YY (Feb) -0.5% vs. Exp. -3.0% (Prev. -6.3%)

- Australian Trade Balance (AUD)(Feb) 7.3B vs Exp. 10.5B (Prev. 11.0B)

- Australian Exports MM (Feb) -2.2% (Prev. 1.6%); Imports MM (Feb) 4.8% (Prev. 1.3%)