Europe Market Open: APAC stocks gained as the region took impetus from the rally on Wall St; European equity futures indicate a higher open

24 Apr 2024, 06:35 by Newsquawk Desk

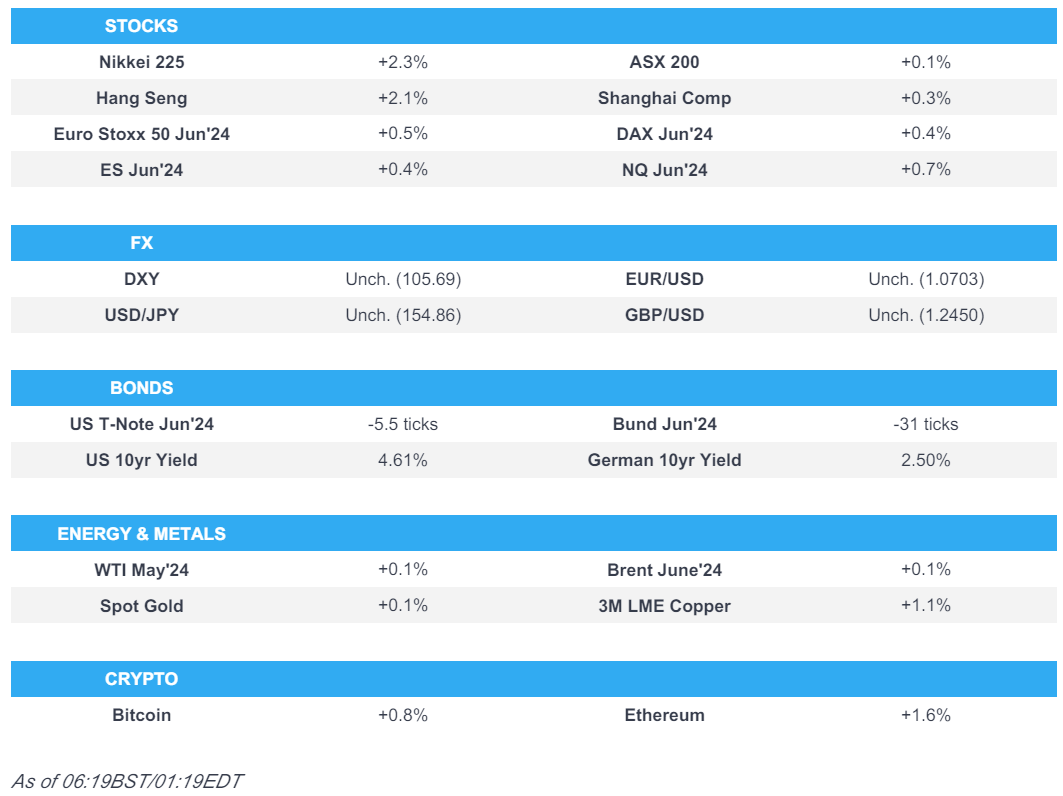

- APAC stocks gained as the region took impetus from the rally on Wall St where soft PMI data spurred a dovish reaction across asset classes.

- Tesla shares were up 13% post-earnings despite its results falling short of estimates as the Co. flagged a sooner launch of new and more affordable models.

- DXY holds below the 106 mark following yesterday's sell-off, EUR/USD is lingering around the 1.07 level, AUD boosted post-CPI.

- European equity futures indicate a higher open with the Euro Stoxx 50 future +0.4% after the cash market closed up 1.4% on Tuesday.

- Looking ahead, highlights include German Ifo, US Durable Goods, Canadian Retail Sales, BoC’s Minutes, Comments from ECB’s Cipollone & Schnabel, Supply from Germany & US

- Earnings from Vinci, Carrefour, Orange, Air Liquide, Iberdrola, Roche, Volvo Car, Boeing, Boston Scientific, Meta, Chipotle, AT&T, Thermo Fisher Scientific, IBM, Norfolk Southern & Ford.

US TRADE

EQUITIES

- US stocks continued their recovery from last week's slump with the upside spurred by soft US PMI data and some cautious commentary on the labour market which resulted in a broad dovish reaction in equities, while the dollar sold off and T-notes bull steepened. Furthermore, the 2-year auction was solid although it had little impact on the market as the PMI data drove the price action throughout the session.

- Tesla Inc (TSLA) - Q1 2024 (USD): Adj. EPS 0.45 (exp. 0.51), Revenue 21.30bln (exp. 22.15bln). Co. still forecasts a ‘notably lower’ volume growth rate for 2024 and experienced numerous challenges in Q1, from the Red Sea conflict and the arson attack at Gigafactory Berlin. The vehicle volume growth rate in 2024 may be notably lower than the growth rate achieved in 2023. Co. flagged new vehicles including more affordable models, and said updated future vehicle line-up to accelerate the launch of new models ahead of the previously communicated start of production in H2 2025. (Tesla IR) Shares rose 13.3% after-hours on optimism of the launch of cheaper models sooner than previously communicated.

- SPX +1.20% at 5,070, NDX +1.51% at 17,471, DJIA +0.69% at 38,503, RUT +1.79% at 2,002.

- Click here for a detailed summary.

APAC TRADE

EQUITIES

- APAC stocks gained as the region took impetus from the rally on Wall St where soft PMI data spurred a dovish reaction across asset classes.

- ASX 200 was led by gold miners after several quarterly production updates but with the advances in the index capped by firmer-than-expected CPI data.

- Nikkei 225 outperformed its peers and rose above the 38,000 level amid tech strength.

- Hang Seng and Shanghai Comp. conformed to the broad upbeat sentiment seen across the region amid tech strength in Hong Kong as SenseTime shares surged over 30% following the unveiling of its latest AI model. However, gains in the mainland were capped after the US Senate passed the Ukraine, Israel and Taiwan aid package which includes the threat to ban TikTok in the US.

- US equity futures (ES +0.4%) are higher with the Nasdaq 100 (+0.7%) front running the advances after Texas Instruments and Tesla were boosted post-earnings with shares in the latter up over 13% despite its results falling short of estimates as the Co. flagged a sooner launch of new and more affordable models.

- European equity futures indicate a higher open with the Euro Stoxx 50 future +0.4% after the cash market closed up 1.4% on Tuesday.

FX

- DXY languished beneath the 106.00 level after suffering from the weak US PMI data.

- EUR/USD marginally extended on advances following a reclaim of the 1.0700 status.

- GBP/USD held on to yesterday's spoils after outperforming on hawkish BoE commentary.

- USD/JPY lacked direction but retained a firm footing in 154.00 territory, while EUR/JPY printed its highest since August 2008.

- Antipodeans were underpinned by the risk environment and with outperformance in AUD/USD due to firmer-than-expected inflation data which spurred Westpac to push back its RBA rate cut call to November from September.

- PBoC set USD/CNY mid-point at 7.1048 vs exp. 7.2336 (prev. 7.1059).

FIXED INCOME

- 10-year UST futures faded some of yesterday's data-driven advances with prices below 108.00.

- Bund futures remained subdued beneath the 131.00 level ahead of a 10-year Bund auction.

- 10-year JGB futures traded sideways with headwinds from firmer Services PPI data offset by the BoJ's presence in the market for nearly JPY 1.2tln of JGBs.

COMMODITIES

- Crude futures were rangebound after the whipsawing seen during the prior session where oil reversed an initial dip with the rebound facilitated by a softer dollar.

- US Energy Inventory Data (bbls): Crude -3.2mln (exp. +1.8mln), Gasoline -0.6mln (exp. -1.4mln), Distillate +0.7mln (exp. -0.9mln), Cushing -0.9mln.

- Spot gold was contained as havens were largely shunned amid the positive risk sentiment.

- Copper futures eventually strengthened owing to the broad constructive mood.

- Chile's Cochilco estimates a 5% increase in copper output in 2024 to 5.51mln tons and estimates a 6% increase in copper output in 2025 to 5.84mln tons.

- Brazil is to establish quotas for imports of 11 steel products and impose a 25% fee when volumes have been exceeded, while import measures will be in place for 12 months, according to Valor.

CRYPTO

- Bitcoin was marginally higher with price action somewhat choppy as equities took the spotlight.

NOTABLE ASIA-PAC HEADLINES

- EU opened a probe into China's procurement of medical devices, according to Bloomberg.

- BoJ is to discuss the impact of the yen's rapid slide at this week's policy meeting and a further rate hike is seen as unlikely on Friday as the Bank keeps a close eye on inflation, according to Nikkei. BoJ is closely watching core inflation as it weighs the timing of additional hikes and rather than rushing further tweaks, the BoJ aims to carefully monitor moves by smaller businesses to raise pay and pass along increased costs to customers. Furthermore, a BoJ source said they want to confirm that the cycle between wage and price growth is strengthening and many at the BoJ believe that the weak Yen is not currently adding to inflation, while the increase in long-term interest rates is helping to keep the yen from weakening further.

DATA RECAP

- Australian CPI QQ (Q1) 1.0% vs. Exp. 0.8% (Prev. 0.6%)

- Australian CPI YY (Q1) 3.6% vs. Exp. 3.5% (Prev. 4.1%)

- Australian Weighted CPI YY (Mar) 3.5% vs. Exp. 3.4% (Prev. 3.4%)

- Japanese Services PPI (Mar) 2.30% (Prev. 2.10%)

GEOPOLITICS

MIDDLE EAST

- Israel’s army is preparing to launch a military operation in Rafah very soon, according to Israeli Media cited by Al Arabiya.

- US Pentagon called on Iraq’s government to take all necessary steps to defend US forces.

OTHER

- US Senate voted (79-18) to pass the USD 95bln bill with aid for Ukraine, Israel and Taiwan which also includes the threat to ban TikTok, while US President Biden said he will sign it into law on Wednesday.

- China's Taiwan Affairs Office said it resolutely opposes the inclusion of Taiwan-related content in the relevant bill of the US Congress, while it urged the US to fulfill its commitment not to support 'Taiwan independence' with concrete actions and stop arming Taiwan in any way.

- North Korean leader Kim's sister said North Korea will continue to build overwhelming military power to protect sovereignty and that the regional security environment is spiralling into turmoil because of US military manoeuvres, according to KCNA.