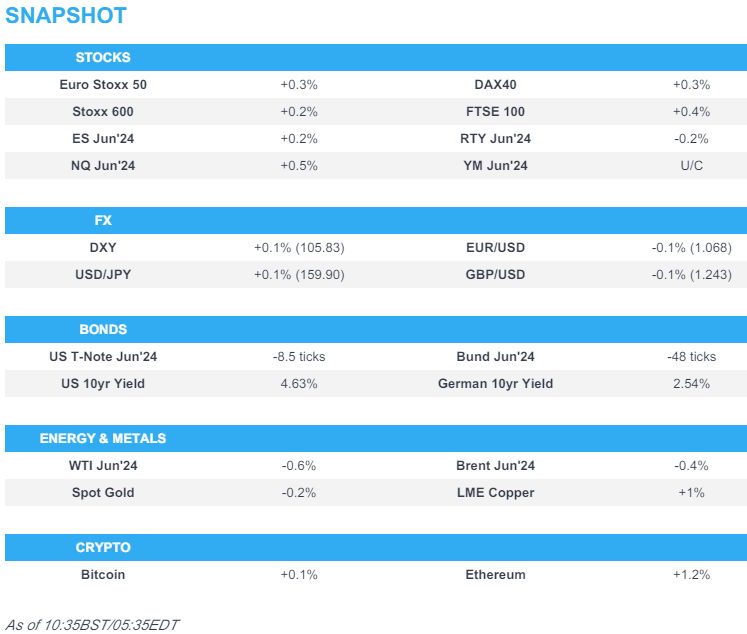

US Market Open: NQ outperforms, benefiting from gains in TSLA, USD firmer & AUD bid post-CPI, Bonds at lows

24 Apr 2024, 10:54 by Newsquawk Desk

- European bourses are mostly firmer; NQ outperforms, propped up by gains in Tech names – TSLA +10.5% pre-market, TXN +7.3%

- Dollar is firmer, AUD benefits from the risk tone and on hotter Aussie CPI, USD/JPY printed a high of 154.96

- USTs are pressured, giving back some of the PMI-induced gains; Bunds follow suit and eye YTD lows

- Crude and XAU are subdued by Dollar strength, base metals remain resilient

- Looking ahead, US Durable Goods, Canadian Retail Sales, BoC Minutes, Comments from ECB’s Cipollone & Schnabel, Supply from the US, Earnings from Vinci, Carrefour, Boeing, Boston Scientific, Meta, Chipotle, AT&T, Thermo Fisher Scientific, IBM, Norfolk Southern & Ford

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.2%) are mostly firmer; price action today has been contained within tight ranges, although bourses remained at session highs throughout the morning.

- European sectors are mixed; Tech is the clear outperformer, following significant post-earnings strength in ASM International (+10.5%). Basic Resources benefits from broader strength in base metals prices. Banks are found towards the bottom of the pile, after Lloyds (-0.9%) reported softer NII metrics.

- US Equity Futures (ES +0.2%, NQ +0.6%, RTY -0.2%) are mixed, with clear outperformance in the NQ, whilst the RTY lags. The former benefits from Tech-led gains, after Texas Instruments (+7%) reported strong results. Additionally, Tesla (+10.5%) benefits pre-market, despite missing on top and bottom lines, as traders focus on plans for affordable models.

- Click here and here for the sessions European pre-market equity newsflow.

- Click here for more details.

FX

- Dollar is showing mixed performance vs. peers but higher on an index basis following yesterday's PMI-induced losses. Currently towards the upper end of today's 105.59-88 range, and still yet to test its 10DMA at 105.96.

- EUR is a touch softer vs. the USD and back below the 1.07 mark after diverging PMI metrics yesterday helped prop up the pair. ECB speakers continue to talk up a June cut and as such attention is turning towards what happens beyond that meeting. Notable Opex for the pair: 1.0600-10 (1.5BLN), 1.0650 (1.06BLN), 1.0685-90 (426M), 1.0700-10 (3.07BLN), 1.0715-25 (1.3BLN), 1.0730 (260M), 1.0750 (230M).

- GBP is on the backfoot after a session of hefty gains yesterday thanks to PMI data and comments from BoE's Pill. Cable managed to top yesterday's best and print a peak at 1.2464 before trimming gains.

- Another day, another multi-decade high for the JPY with 154.96 the peak thus far. As the pair moves ever-closer to 155, focus is firmly placed on intervention watch. However, comments from a Japanese lawmaker earlier suggested that 160 could be the new "line in the sand" for officials.

- Antipodeans are underpinned by the risk environment and with outperformance in AUD due to firmer-than-expected inflation data. AUD/USD is back above the 0.65 mark with the pair topping out around its 200DMA at 0.6528.

- PBoC set USD/CNY mid-point at 7.1048 vs exp. 7.2336 (prev. 7.1059).

- Click here for more details.

- Click here for NY Option Expiry details.

FIXED INCOME

- USTs pulling back after yesterday's PMI-induced gains which sent the 10yr benchmark to a 108.08 peak. Today's calendar sees US durables, however, greater focus may fall on the USD 70bln 5yr note auction given the well-received 2yr offering yesterday.

- Bunds are following suit to the selling pressure in global peers with traders also mindful of better-than-expected German IFO data. Bunds remains at session lows with focus on a potential test of the 130.52 YTD trough.

- Gilts remain pressured in an extension of yesterday's Pill-induced price action which saw traders re-evaluate the dovish price action prompted by Ramsden last Friday. The 96.40 low today is the lowest since 17th April with 96.01 thereafter.

- Orders for UK 4.375% 2054 Gilt exceed GBP 75bln (prev. GBP 57bln); price guidance 1.75bps (prev. 1.75-2bps), via bookrunner

- Click here for more details.

COMMODITIES

- Crude was initially propped up, benefiting from the post-US PMI Dollar weakness; though the complex has since succumbed to selling pressure amid the recent resurgence in the Dollar. Brent June currently holds around USD 88/bbl.

- Subdued trade across precious metals with spot gold and silver on a marginally softer footing, in fitting with the modest gains in the USD. XAU/USD sits in a tight range within USD 2,315.84-2,331.37/oz.

- Base metals are firmer across the board despite the stronger Dollar, but amidst a positive risk tone across global markets, with Chinese markets showcasing a strong performance underpinned by its tech and property sectors.

- China Coal Industry Group said cement industry capacity utilisation down to 50% (prev. 80% Y/Y), negatively impacting coal demand. Current domestic coal price of around CNH 800/metric ton seem as price floor for this year.

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- ECB's Nagel said June rate cut is not necessarily followed by a series of rate cuts; not fully convinced that inflation will actually return to target in a timely sustained manner, services inflation remains high, driven by continued strong wage growth.

- ECB's Cipollone "Innovation, integration and independence: taking the Single Euro Payments Area to the next level"; text release not on monetary policy.

DATA RECAP

- German Ifo Curr Conditions New (Apr) 88.9 vs. Exp. 88.7 (Prev. 88.1); Ifo Expectations New (Apr) 89.9 vs. Exp. 88.7 (Prev. 87.5, Rev. 87.7); Ifo Business Climate New (Apr) 89.4 vs. Exp. 88.8 (Prev. 87.8, Rev. 87.9); German ifo Institute President is more optimistic about the German economy in Q2; manufacturing companies lacking orders but positive consumption, via Bloomberg

NOTABLE US HEADLINES

EARNINGS

GEOPOLITICS

- US Senate voted (79-18) to pass the USD 95bln bill with aid for Ukraine, Israel and Taiwan which also includes the threat to ban TikTok, while US President Biden said he will sign it into law on Wednesday.

- China's Taiwan Affairs Office said it resolutely opposes the inclusion of Taiwan-related content in the relevant bill of the US Congress, while it urged the US to fulfill its commitment not to support 'Taiwan independence' with concrete actions and stop arming Taiwan in any way.

- North Korean leader Kim's sister said North Korea will continue to build overwhelming military power to protect sovereignty and that the regional security environment is spiralling into turmoil because of US military manoeuvres, according to KCNA.

- Ambrey is aware of an incident Southwest of Aden, Yemen; "Yemeni sources: Houthis launch a ballistic missile towards the sea from in central Yemen", according to Sky News Arabia; details light.

CRYPTO

- Bitcoin was flat and sits just above USD 66k, whilst Ethereum posted incremental gains and above USD 3.2k.

APAC TRADE

- APAC stocks gained as the region took impetus from the rally on Wall St where soft PMI data spurred a dovish reaction across asset classes.

- ASX 200 was led by gold miners after several quarterly production updates but with the advances in the index capped by firmer-than-expected CPI data.

- Nikkei 225 outperformed its peers and rose above the 38,000 level amid tech strength.

- Hang Seng and Shanghai Comp. conformed to the broad upbeat sentiment seen across the region amid tech strength in Hong Kong as SenseTime shares surged over 30% following the unveiling of its latest AI model. However, gains in the mainland were capped after the US Senate passed the Ukraine, Israel and Taiwan aid package which includes the threat to ban TikTok in the US.

NOTABLE ASIA-PAC HEADLINES

- EU opened a probe into China's procurement of medical devices, according to Bloomberg.

- BoJ is to discuss the impact of the yen's rapid slide at this week's policy meeting and a further rate hike is seen as unlikely on Friday as the Bank keeps a close eye on inflation, according to Nikkei. BoJ is closely watching core inflation as it weighs the timing of additional hikes and rather than rushing further tweaks, the BoJ aims to carefully monitor moves by smaller businesses to raise pay and pass along increased costs to customers. Furthermore, a BoJ source said they want to confirm that the cycle between wage and price growth is strengthening and many at the BoJ believe that the weak Yen is not currently adding to inflation, while the increase in long-term interest rates is helping to keep the yen from weakening further.

- Indonesian Lending Facility Rate (Apr) 7.0% vs. Exp. 6.75% (Prev. 6.75%); Deposit Facility Rate (Apr) 5.5% vs. Exp. 5.25% (Prev. 5.25%); 7-Day Reverse Repo (Apr) 6.25% vs. Exp. 6.0% (Prev. 6.0%).

- SK Hynix (000660 KS) announces investment in new DRAM chip production base in South Korea; will invest KRW 20tln

APAC DATA RECAP

- Australian CPI QQ (Q1) 1.0% vs. Exp. 0.8% (Prev. 0.6%); CPI YY (Q1) 3.6% vs. Exp. 3.5% (Prev. 4.1%); Weighted CPI YY (Mar) 3.5% vs. Exp. 3.4% (Prev. 3.4%)

- Japanese Services PPI (Mar) 2.30% (Prev. 2.10%)