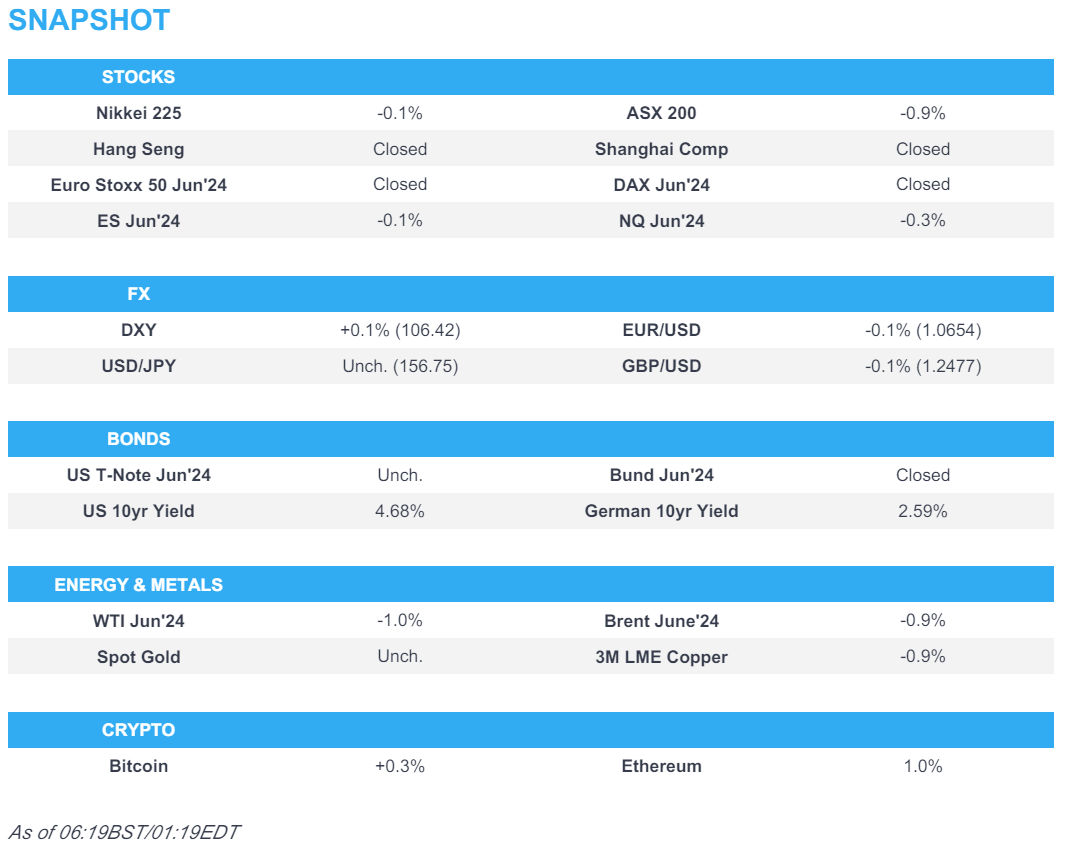

Europe Market Open: Mass holiday closures limiting action, FOMC ahead

01 May 2024, 06:35 by Newsquawk Desk

- NOTE: All major European markets (ex-UK) are closed for Labour Day.

- APAC stocks took their cues from the losses on Wall St and with trade mired by mass holiday closures.

- DXY is rangebound on a 106 handle, EUR/USD sits just above 1.0650, USD/JPY edged closer to 158.00.

- Amazon beat on top and bottom lines; Co. shares were up 1.2% after-hours.

- Looking ahead, highlights include UK, US Manufacturing PMI, US ADP, JOLTS, FOMC Announcement, Treasury QRA, Fed Chair Powell, BoC’s Macklem & Rogers, Supply from UK & US.

- Earnings: Next, GSK, Smith & Nephew, CVS, Qualcomm, MetLife, Pfizer, ADP, Marriott, Estee Lauder, Mastercard & eBay.

US TRADE

EQUITIES

- US stocks were pressured as the surprise rise in the Q1 Employment Cost Index ramped the hawkish pressure on the Fed ahead of the FOMC on Wednesday. The data resulted in a kneejerk decline for stocks which gradually extended throughout the US session with the rate-sensitive small caps (Russell 2k) leading the losses, while Treasuries bear-flattened after the hot ECI print and amid an article from WSJ's Timiraos titled "Fed to Signal It Has Stomach to Keep Rates High for Longer".

- SPX -1.57% at 5,035, NDX -1.92% at 17,440, DJIA -1.49% at 37,815, RUT -2.09% at 1,973.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US Treasury Secretary Yellen said high inflation is due largely to fading supply shocks and inflation has come down considerably although prices of many goods are higher than before the pandemic, while she added that people are generally better off despite price increases, but there is more work to be done to reduce living costs.

- WSJ's Timiraos wrote "It's another wait-and-see meeting for the Fed, but this time, the questions are likely to be tilted in the direction of filling out the Fed's reaction function for upside risks on inflation and wages rather than downside risks or benign inflation", via social media platform X.

AFTER-MARKET EARNINGS

- Amazon.com Inc (AMZN) Q1 2024 (USD): EPS 0.98 (exp. 0.83), Revenue 143.31bln (exp. 142.5bln) Co. shares were up 1.2% in after-hours trade

- Advanced Micro Devices Inc (AMD) Q1 2024 (USD): Adj. EPS 0.62 (exp. 0.61), Revenue 5.47bln (exp. 5.46bln) Co. shares were down 6.9% in after-hours trade

APAC TRADE

EQUITIES

- APAC stocks took their cues from the losses on Wall St amid a hawkish impulse owing to the firmer-than-expected Employment Cost data heading into today's FOMC and with trade mired by mass holiday closures.

- ASX 200 was pressured as gold miners led the declines after the precious metal slid beneath the USD 2,300/oz level, with underperformance also seen in rate-sensitive sectors.

- Nikkei 225 slipped at the open but held on to 38,000 status and briefly clawed back all of its losses with the downside cushioned by a weaker currency and as participants digested another batch of earnings releases, while it was also reported that Japan could provide tax breaks for companies repatriating foreign profits into the JPY.

- US equity futures (ES -0.1%) were lacklustre after the prior day's sell-off and failed to benefit from AMZN and AMD earnings.

- European equity futures were closed and the Euro Stoxx 50 cash market closed down 1.2% on Tuesday.

FX

- DXY traded rangebound in severely holiday-quietened conditions ahead of the FOMC but held on to the spoils from the hotter-than-expected employment cost data.

- EUR/USD languished firmly beneath 1.0700 after giving way to the dollar strength and with EU markets shut.

- GBP/USD was lacklustre after retreating to a sub-1.2500 level and with little in the way of fresh UK catalysts.

- USD/JPY edged closer towards the 158.00 level despite BoJ data suggesting Japan may have intervened in the FX market on Monday.

- Antipodeans were subdued amid a steadfast greenback and with brief pressure in NZD following disappointing jobs data for Q1 which showed a surprise contraction in Employment Change and a larger-than-expected increase in the Unemployment Rate.

FIXED INCOME

- 10-year UST futures attempted to nurse some of the losses from the recent data-induced bear flattening but with the rebound limited ahead of the FOMC and Quarterly Refunding Announcement.

- Bund futures suffered notable month-end unwinding yesterday ahead of risk events and with trade shut today for Labour Day..

- 10-year JGB futures tracked recent declines in global peers amid a lack of additional BoJ purchases.

COMMODITIES

- Crude futures retreated with WTI nearing the USD 81/bbl level to the downside amid headwinds from a firmer dollar and a surprise headline crude build in the latest private sector inventory data.

- US Energy Inventory Data (bbls): Crude +4.9mln (exp. -1.1mln), Gasoline -1.5mln (exp. -1.1mln), Distillate -2.2mln (exp. -0.2mln), Cushing +1.5mln.

- OPEC April oil output fell by 100k BPD M/M to 26.49mln BPD led by Iran, Iraq and Nigeria, according to a Reuters survey.

- Spot gold languished around the prior day's lows after sliding beneath USD 2,300/oz.

- Copper futures were subdued amid the risk aversion and with demand sapped by holiday closures.

- US and Philippines reportedly eye a partnership to cut China's nickel dominance, according to Bloomberg.

CRYPTO

- Bitcoin remained pressured and briefly dipped below the USD 60,000 level.

NOTABLE ASIA-PAC HEADLINES

- NDRC said China will promote the development and growth of leading companies in the NEV industry, as well as accelerate the exit of lagging enterprises and capacities. Furthermore, China will lift foreign investment access restrictions in the manufacturing industry and it welcomes global automotive companies to deeply integrate into China's market and industrial chain system.

- Japan may introduce measures to provide tax breaks for companies repatriating foreign profits into the JPY and include it in the government's annual mid-year policy blueprint, according to Sankei.

- RBNZ Financial Stability Report stated New Zealand’s financial system remains strong and rising nominal incomes are helping many households navigate the transition onto higher interest rates, while it added some are doing it tough and reducing their spending or extending their repayment timelines. RBNZ also stated that although non-performing loans to businesses have increased, they remain low by historical standards and there remains a risk that new or persistent inflation pressures could mean global interest rates remain restrictive for longer.

- RBNZ Deputy Governor Hawkesby said New Zealand's employment data is confirmation of the trend they were expecting to see and higher interest rates will involve a cooling of the labour market.

DATA RECAP

- Japanese Manufacturing PMI (Apr F) 49.6 (Prelim. 49.9)

- Australian Manufacturing PMI (Apr F) 49.6 (Prelim. 49.9)

- Australian AIG Manufacturing Index (Apr) -13.9 (Prev. -7.0)

- Australian AIG Construction Index (Apr) -25.6 (Prev. -12.9)

- New Zealand HLFS Job Growth QQ (Q1) -0.2% vs. Exp. 0.3% (Prev. 0.4%)

- New Zealand HLFS Unemployment Rate (Q1) 4.3% vs. Exp. 4.2% (Prev. 4.0%)

- New Zealand HLFS Participation Rate* (Q1) 71.5% vs. Exp. 71.9% (Prev. 71.9%)

- New Zealand Labour Cost Index QQ (Q1) 0.8% vs. Exp. 0.8% (Prev. 1.0%)

- New Zealand Labour Cost Index YY (Q1) 3.8% vs. Exp. 3.8% (Prev. 3.9%)

GEOPOLITICS

- US State Department said the US has not seen a credible Israeli plan that would address the varying areas of concerns in Rafah and the US remains committed to reaching a deal for an immediate ceasefire that secures hostages and allows for more aid.

- Philippines Coast Guard official said China's Coast Guard has elevated the tension and level of aggression, while the official added the Chinese Coast Guard's use of a water cannon is still not an armed attack but is using higher water pressure, according to Reuters.