Europe Market Open: Apple numbers bolstered US futures, NFP looms

03 May 2024, 06:35 by Newsquawk Desk

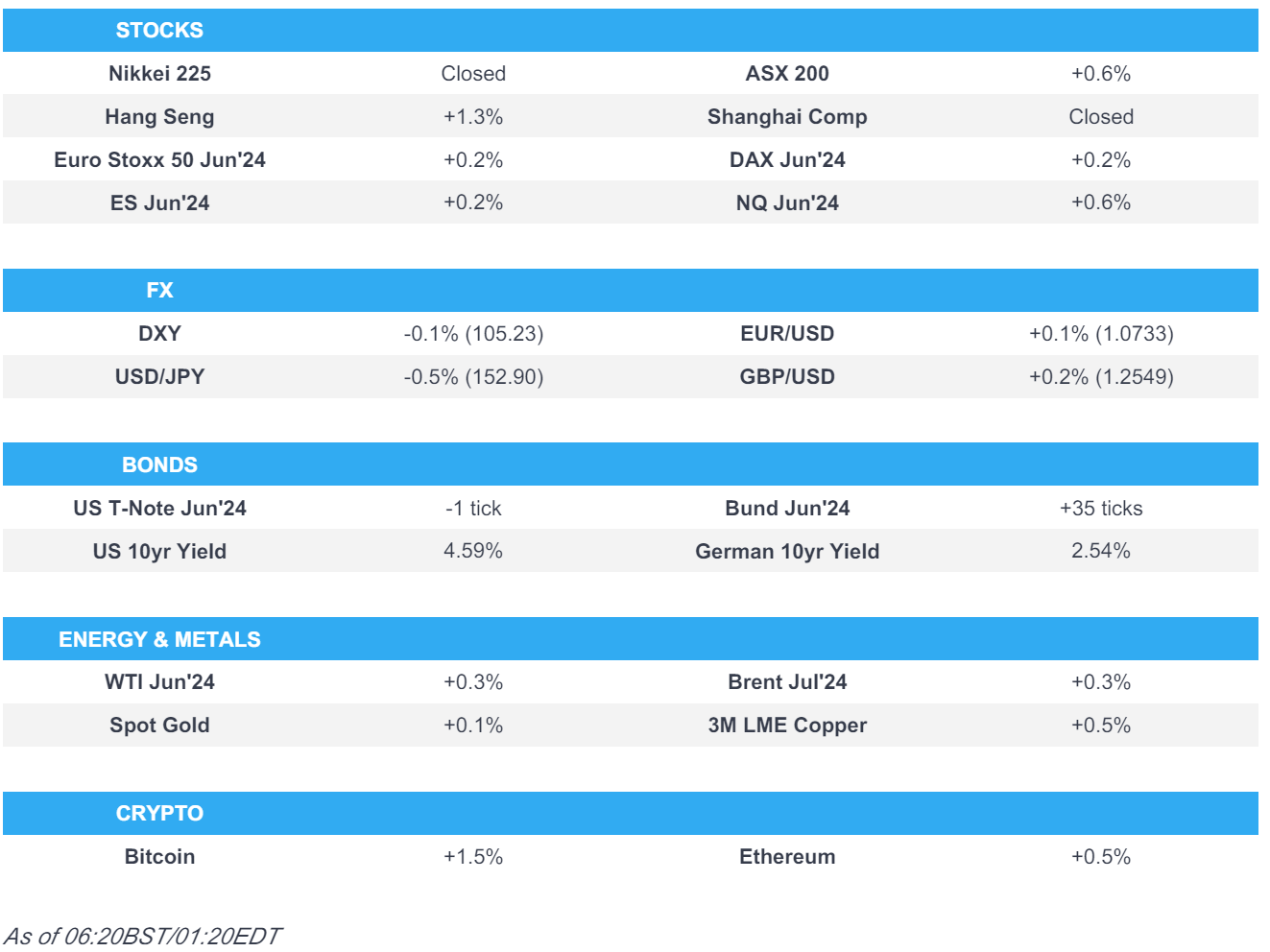

- US equity futures were boosted after-hours following better-than-expected earnings from Apple (+6%) which announced an additional USD 110bln buyback.

- APAC stocks took impetus from Wall St where equities extended on post-FOMC gains; Hang Seng extended its rally after having recently entered a bull market; Japan and Mainland China were closed.

- DXY was lacklustre with markets now awaiting key US jobs data; USD/JPY continued to decline and printed fresh intervention lows beneath the 153.00 handle.

- European equity futures indicate a positive open with Euro Stoxx 50 futures up 0.2% after the cash market closed down 0.6% on Thursday.

- Looking ahead, highlights include EZ Unemployment Rate, UK Services & Composite Final PMIs, US NFP, Services PMI & ISM Non-Manufacturing, Norges Bank Policy Announcement, Comments from Norges Bank Chair Bache.

- Earnings from Intesa Sanpaolo, Societe Generale, Credit Agricole & Daimler Truck.

US TRADE

EQUITIES

- US stocks trended higher in a resumption of the post-FOMC impulse although they were briefly knocked after the hotter-than-expected Unit Labour Costs and beneath-forecast Initial Jobless Claims data, with all eyes now turning to today's NFP report. Futures were further boosted after-hours following better-than-expected earnings from Apple which announced an additional USD 110bln buyback - shares rose 6% after closing higher by 2.2%.

- SPX +0.91% at 5,064, NDX +1.29% at 17,541, DJIA +0.85% at 38,225, RUT +1.81% at 2,016.

- Click here for a detailed summary.

NOTABLE HEADLINES/EARNINGS

- Apple Inc (AAPL) Q2 2024 (USD): EPS 1.53 (exp. 1.50), Revenue 90.75bln (exp. 90.01bln); to buy back additional 110bln of shares and boosts quarterly dividend 4% to 0.25/shr, Revenue breakdown: Products 66.89bln (exp. 66.95bln), iPhone 45.96bln (exp. 45.76bln), Mac 7.45bln (exp. 6.79bln), iPad 5.56bln (exp. 5.91bln), Wearables, home and accessories 7.91bln (exp. 8.29bln), Service 23.87bln (exp. 23.28bln), Greater China revenue 16.37bln (exp. 15.87bln).

APAC TRADE

EQUITIES

- APAC stocks took impetus from Wall St where equities extended on post-FOMC gains and futures were also lifted by Apple's earnings beat, but with upside capped in the region amid key market closures including in Japan and Mainland China.

- ASX 200 traded higher as real estate led the outperformance in the rate-sensitive sectors.

- Hang Seng extended its rally after having recently entered a bull market and following stronger GDP data.

- US equity futures were boosted after-hours owing to Apple's earnings beat and record share buyback.

- European equity futures indicate a positive open with Euro Stoxx 50 futures up 0.2% after the cash market closed down 0.6% on Thursday.

FX

- DXY was lacklustre after post-FOMC selling pressure and with markets now awaiting key jobs data.

- EUR/USD edged mild gains thanks to the recent dollar weakness and despite continued dovish signals from ECB officials, while technicians are eyeing 1.0700 as a key support level where the 200 DMA resides close by.

- GBP/USD extended on its recent upside after yesterday's resurgence from beneath the 1.2500 level, while early results from the local election have started to come in and will be announced sporadically from today onwards.

- USD/JPY continued to decline and printed fresh intervention lows beneath the 153.00 handle after recent BoJ data suggested intervention had occurred for the second time this week.

- Antipodeans held on to recent spoils and remained afloat amid the constructive mood but with price action quiet amid a lack of drivers.

FIXED INCOME

- 10-year UST futures took a breather following the continued post-FOMC bull steepening and with overnight cash treasuries trade shut amid the holiday closure in Tokyo.

- Bund futures remained underpinned as the latest ECB rhetoric continued to signal approaching cuts.

COMMODITIES

- Crude futures were rangebound after yesterday's choppy performance and mixed geopolitical headlines.

- Spot gold traded sideways after reclaiming the USD 2,300/oz level with participants awaiting the US jobs data.

- Copper futures got some reprieve from yesterday's selling but with the rebound limited by the absence of its largest buyer.

CRYPTO

- Bitcoin traded higher overnight but with gains capped by resistance at the USD 60,000 level.

NOTABLE ASIA-PAC HEADLINES

- China May Day railway travel reached a record high of around 20.7mln trips, according to Xinhua.

- US FCC said roughly 40% of US telecom companies cannot replace Huawei or ZTE equipment in US networks without additional government funding.

DATA RECAP

- Australian Judo Bank Services PMI Final (Apr) 53.6 (Prelim. 54.2)

- Australian Judo Bank Composite PMI Final (Apr) 53.0 (Prelim. 53.6)

GEOPOLITICS

MIDDLE EAST

- Israeli air strike hit a security building outside the Syrian capital of Damascus, according to a security source cited by Reuters, while Syrian state media later reported that 8 soldiers were injured in the Israeli airstrike on the outskirts of Damascus.

- Hezbollah announced it targeted the headquarters of Israel's 91st Division in the Branet barracks with rocket-propelled grenades, according to Sky News Arabia.

- Islamic Resistance in Iraq launched attacks on targets in Israel with Arqab-type cruise missiles from Iraqi territory which was the first attack targeting Israel's Tel Aviv by the Islamic Resistance in Iraq, according to a source in the group.

- Israel National Security Minister Gvir called on PM Netanyahu to remove Defence Minister Galant from office as he is not fit to continue his work as the defence minister.

- Israel's Foreign Minister said Turkish President Erdogan is breaking agreements by blocking ports for Israeli imports and exports.

OTHER

- Russian military personnel entered an air base in Niger that is hosting US troops which follows a decision by Niger's Junta to expel US forces from the country, according to Reuters citing a US official. However, US Defense Secretary Austin later commented that Russians do not have access to US forces or equipment in Niger and they will continue to watch the presence of Russian forces in Niger.

EU/UK

NOTABLE HEADLINES

- UK opposition Labour party wins Blackpool South by-election, taking the seat from the Conservatives in a blow for PM Sunak, according to BBC. It was also reported that the Labour party gained Hartlepool from no overall control in the local elections and they also claimed a win for Thurrock Council which the Tories won last year but had moved to no overall control after defections. Thus far, only around 30 of the 107 councils have declared but the swing as it stands is to Labour at the expense of the Conservatives. As a reminder, there have been reports in recent days that a bad result at the local elections could see MPs put in a no-confidence vote in PM Sunak in the next week or so.

- ECB's Lane said given the lags in transmission, the tightening effects from past interest rate hikes are still unfolding, while he noted expectations of future inflation normalising further and that leaving nominal rates unchanged implies a mechanical increase in real interest rates. Lane said moving from one meeting to the next meeting and from one projection round to the next projection round allows for the accumulation of further data that can help inform the rate decision. Furthermore, Lane said inflation has declined more quickly than expected and noted the more the data validates inflation coming back to the target, the more they will be able to remove restrictions this year and next year.

- ECB's Stournaras said three ECB rate cuts are more likely this year and the latest euro-area GDP figures were a positive surprise, according to comments made to Liberal cited by Bloomberg.