Europe Market Open: Stocks hit with ES -1.0% after Moody's strips US AAA rating; Trump-Putin call expected

19 May 2025, 07:00 by Newsquawk Desk

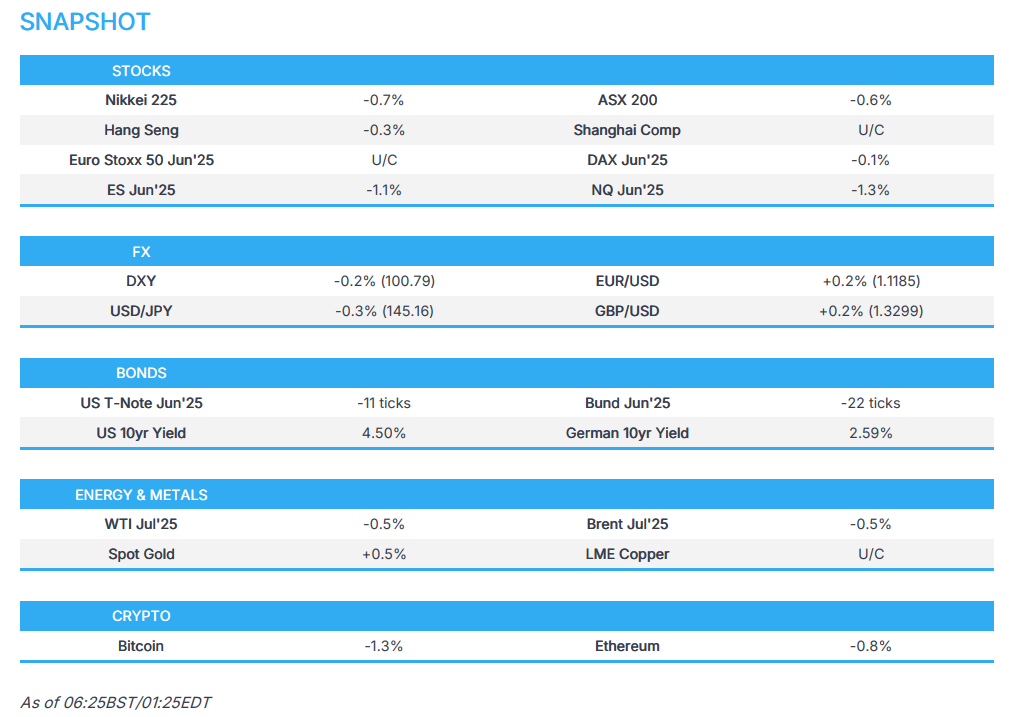

- APAC stocks were mostly subdued following the US sovereign rating downgrade by Moody's which spurred a mild 'sell America' impulse (ES -1.1%).

- US Treasury Secretary Bessent said countries will get a letter with a US tariff rate if they are not negotiating in good faith and he thinks that rate would be the April 2nd level.

- The House Budget Committee approved President Trump's tax cut bill to set up a possible vote as soon as this week.

- Chinese Industrial Production topped forecasts, Retail Sales disappointed, House Prices continued to contract Y/Y.

- USD is slightly softer vs. peers, EUR/USD stalled just shy of 1.12, Cable sits around the 1.33 mark, JPY marginally outperforms peers.

- UK and the EU are expected to agree on Monday to a major post-Brexit reconciliation, according to the FT.

- US President Trump said he will speak with Russian President Putin on Monday at 10:00EDT/15:00BST.

- Looking ahead, highlights include US Leading Index Change, EU-UK Talks, Speakers including Fed’s Bostic, Williams, Logan & Kashkari, Supply from the EU.

SNAPSHOT

US TRADE

EQUITIES

- US stocks finished with mild gains on Friday but with the upside capped amid thin newsflow while participants also digested several data releases including import/export prices which surprisingly rose, albeit marginally, while housing data and UoM disappointed.

- SPX +0.70% at 5,958, NDX +0.43% at 21,428, DJI +0.78% at 42,655, RUT +0.89% at 2,113.

- Click here for a detailed summary.

TRADE/TARIFFS

- US President Trump said he would be willing to travel to China to speak with Chinese President Xi regarding foreign policy and economic issues. It was separately reported that President Trump said Walmart (WMT) should stop trying to blame tariffs as the reason for raising prices throughout the chain, while he added that between Walmart and China, they should “eat the tariffs” and not charge valued customers anything.

- US VP Vance said Europe is an important ally of the US but disagreements on trade, while he hoped the meeting in Rome with European Commission President Von der Leyen would lead to long-term trade negotiations and trade advantages.

- US VP Vance discussed with Canadian PM Carney the shared interests and goals of the US and Canada including fair trade policies and the continued lasting relationship between the two countries.

- US Treasury Secretary Bessent said regarding new tariff rates that countries are coming up with very good proposals with few exceptions and the timing of deals depends on whether countries are negotiating in good faith, while he thinks they will do a lot of regional deals. Furthermore, he said countries will get a letter with a US tariff rate if they are not negotiating in good faith and he thinks that rate would be the April 2nd level, according to interviews with CNN and NBC.

- US-China trade truce and China’s prior defiant stance in negotiating with the US is said to have convinced some countries they need to take a tougher position in their own negotiations with the Trump administration, according to Bloomberg.

- Australian PM Albanese said he is "up for a deal" with Europe on free trade following years of trade discussions, according to Bloomberg.

NOTABLE HEADLINES

- US President Trump said it is almost everyone’s consensus that the Fed should cut rates sooner rather than later, while he added that Fed Chair Powell “will probably blow it again”.

- Moody’s lowered the US’s sovereign rating from AAA to Aa1; Outlook Revised to Stable from Negative and warned of rising government debt and a widening budget deficit.

- US Treasury Secretary Bessent said he doesn’t put much credence in Moody’s when asked about the US credit downgrade and thinks Moody’s is a lagging indicator, while he said the US will grow GDP faster than debt and they are determined to bringing spending down and growing the US economy, according to interviews with CNN and NBC.

- US House Panel approved the Trump tax cut bill, which sets up a possible vote on passage this week.

- Kentucky Governor announced that at least 14 died in the wake of severe storms and the death toll is expected to increase.

- FBI said a bomb explosion outside a fertility clinic on Saturday, which killed one person and injured four others, was an “intentional act of terrorism”, and it later identified the suspect who was said to have ‘nihilistic’ views and attempted to stream the bombing.

APAC TRADE

EQUITIES

- APAC stocks were mostly subdued following the US sovereign rating downgrade by Moody's which spurred a mild 'sell America' impulse, while participants also digested mixed Chinese activity data.

- ASX 200 declined with underperformance in the commodity-related sectors but with the downside stemmed ahead of tomorrow's RBA rate decision in which money markets are pricing around a 99% likelihood of a 25bps cut.

- Nikkei 225 retreated amid currency-related headwinds while the data calendar for Japan is very light to start the week and BoJ Deputy Governor Uchida stuck to the script in which he maintained the rate hike signal should prices improve as forecast.

- Hang Seng and Shanghai Comp were lacklustre amid the glum mood across the Asia-Pac region but with the downside in the mainland limited after mixed Chinese data in which Industrial Production topped forecast but Retail Sales disappointed, while the latest House Prices continued to contract Y/Y albeit at a slightly slower than previous pace.

- US equity futures (ES -1.1%, NQ -1.3%) gapped lower at the resumption of trade with risk sentiment dampened by the Moody's downgrade on the US from AAA to Aa1 which effectively put it in line with the ratings by S&P and Fitch.

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 future flat after the cash market closed with gains of 0.3% on Friday.

FX

- DXY was pressured in reaction to Moody's downgrading the US sovereign rating for the first time in over a century with the rating agency warning of government debt and a widening budget deficit, while there were renewed calls by US President Trump for the Fed to cut rates but added that Fed Chair Powell “will probably blow it again”. Nonetheless, the downside in the dollar was limited as it was also reported that the House Budget Committee approved President Trump's tax cut bill to set up a possible vote on the passage of the 'big beautiful bill' as soon as this week after it initially hit a snag due to a conservative revolt on Friday.

- EUR/USD mildly benefitted from the early headwinds in the dollar but with the upside capped by resistance around the 1.1200 level, while the recent comments from ECB officials were mixed as ECB’s Wunsch said the ECB may have to cut interest rates below 2% and noted that downside risks to growth and inflation have become bigger, while ECB’s Schnabel said the ECB should remain cautious on interest rate moves and that a steady hand is needed for now.

- GBP/USD edged higher and just about returned to the 1.3300 territory with the UK and the EU expected to agree on Monday on a major post-Brexit reconciliation in which they will sign a security and defence partnership as the centrepiece of a “reset”.

- USD/JPY retreated owing to the early dollar weakness and haven flows which dragged the pair momentarily to sub-145.00 territory where it gradually rebounded from its lows and clawed back some of the losses.

- Antipodeans were kept afloat but with price action rangebound amid the subdued risk appetite and after the mixed Chinese activity data, while participants also await tomorrow's RBA policy decision with the central bank unanimously expected to cut rates.

- PBoC set USD/CNY mid-point at 7.1916 vs exp. 7.2057 (Prev. 7.1938).

FIXED INCOME

- 10yr UST futures declined after the Moody's downgrade on the US rating and eventually breached below the 110.00 level.

- Bund futures faded some of last week's late gains amid the absence of pertinent drivers and with EU supply ahead.

- 10yr JGB futures conformed to the lacklustre picture in global peers with a quiet data calendar for Japan at the start of the week, while there was a lack of surprises in the rhetoric from BoJ Deputy Governor Uchida who reiterated the familiar line that they will keep raising interest rates if the economy and prices improve in line with forecasts.

COMMODITIES

- Crude futures were marginally lower in rangebound trade following quiet energy-specific newsflow and after somewhat mixed geopolitical-related headlines from over the weekend including the announcement of a Trump-Putin call scheduled for Monday, while there was criticism from Iran's Supreme Leader against US President Trump's 'disgraceful' remarks about being peace to the region.

- EU will need to spend at least EUR 10bln more than last year to refill its gas reserves ahead of winter, after the first cold season in four years left its reserves heavily depleted, according to FT.

- Estonia’s Foreign Ministry said Russia detained a Liberia-flagged oil tanker after it left an Estonian Baltic Sea port.

- Oman’s Energy and Minerals Ministry signed an agreement with Occidental Petroleum (OXY) to amend and extend the Block 53 exploration and production sharing agreement.

- Spot gold was lifted in an early flight to quality and a softer dollar in reaction to Moody's downgrade on the US sovereign rating but then gradually pared back the initial gains after hitting resistance near the USD 3,250/oz level.

- Copper futures weakened amid the downbeat risk tone and as participants digested mixed Chinese activity data.

CRYPTO

- Bitcoin retreated overnight following the whipsawing over the weekend and reverted to beneath the USD 104,000 level.

NOTABLE ASIA-PAC HEADLINES

- South Korean presidential front-runner Lee said ties with Russia and China are also important, while he also stated that South Korea should not go all in on the alliance with the US and there is no need to rush a trade agreement with the US.

- US White House and Congressional officials reportedly scrutinised in recent months Apple’s (AAPL) plan to strike a deal to make Alibaba’s (9988 HK) AI available on iPhones in China.

DATA RECAP

- Chinese Industrial Output YY (Apr) 6.1% vs. Exp. 5.5% (Prev. 7.7%)

- Chinese Retail Sales YY (Apr) 5.1% vs. Exp. 5.5% (Prev. 5.9%)

- Chinese Unemployment Rate Urban Area (Apr) 5.1% (Prev. 5.2%)

- Chinese Urban Investment (YTD)YY (Apr) 4.0% vs. Exp. 4.2% (Prev. 4.2%)

- Chinese House Prices MM (Apr) 0.0% (Prev. 0.0%)

- Chinese House Prices YY (Apr) -4.0% (Prev. -4.5%)

GEOPOLITICS

MIDDLE EAST

- Israeli airstrikes killed at least 100 in Gaza as negotiators sought a ceasefire, while Israel’s military said it began a wide ground operation in northern and southern Gaza.

- Israeli PM Netanyahu’s office announced that Israel will allow the entry of a basic quantity of food into Gaza to prevent a hunger crisis.

- Israeli PM Netanyahu’s office said Gaza talks in Doha now include ending the war or a truce and hostage deal, while it added that the end of the war must include Gaza demilitarisation, Hamas exile and the release of all hostages. However, a senior Israeli official said there was little progress in Gaza talks that include ending the war.

- Hamas confirmed a new round of ceasefire talks with Israel in Doha and said both sides are discussing all issues without preconditions, according to an official cited by Reuters. It was separately reported that a series of Israeli airstrikes last week killed the de facto commander of Hamas in Gaza, Muhammad Sinwar, according to reports by Israeli press on Sunday.

- Yemen’s Houthis claimed to target Israel’s Ben Gurion airport with a ballistic missile, although Israel’s military said it successfully intercepted the missile from Yemen, while Houthis announced on Sunday evening that it planned to target Israeli airports in the coming few hours.

- Iran’s President Pezeshkian questioned whether they should believe US President Trump, who speaks of peace and threatens Iran at the same time, while he added that Tehran will continue nuclear talks with the US but is not afraid of threats.

- Iran’s Supreme Leader Khamenei said US President Trump’s comments during his regional visit are an embarrassment and that the US must and will leave the region, while he also commented that Israel is a dangerous and deadly cancerous tumour which must be uprooted.

RUSSIA-UKRAINE

- US President Trump said he will speak with Russian President Putin on Monday at 10:00EDT/15:00BST about stopping the bloodshed in Ukraine, while he will speak to Ukrainian President Zelensky and NATO members after. However, it was later reported that UK PM Starmer spoke with leaders of the US, Italy, France and Germany regarding the situation in Ukraine and catastrophic costs of the war to both sides, while they also discussed the use of sanctions if Russia failed to engage seriously in a ceasefire and peace talks.

- US President Trump said he thinks that they will make a deal with Russian President Putin and said he will use leverage against Putin if he has to, while he added that they have to meet and thinks they will probably schedule it, according to Fox News.

- US Secretary of State Rubio spoke with Russian Foreign Minister Lavrov and welcomed the prisoner exchange agreement reached, while Rubio emphasised President Trump’s call for an immediate ceasefire and an end to the violence. Furthermore, Lavrov discussed with Rubio further contacts between Russia and the US, while Lavrov noted the positive role of the US in the resumption of Russia-Ukraine talks.

- Russia’s Kremlin spokesperson said preparations are underway for a Putin-Trump conversation, while it stated that a Putin-Zelensky meeting could happen but only if certain agreements are reached.

- Russian negotiators at Istanbul talks demanded that Ukraine withdraw troops from all Ukrainian regions claimed by Moscow before a ceasefire can start, while they also demanded international recognition that five Ukrainian regions are Russian, neutrality for Ukraine, and no reparations, according to a Ukrainian official familiar with the talks.

- Ukrainian President Zelensky met with US VP Vance and Secretary of State Rubio on the sidelines of the Pope’s inauguration.

- Ukraine’s military said Kyiv was under a long-lasting drone attack. It was also reported that Ukrainian military intelligence agency said Russia plans to conduct a ‘training and combat’ launch of an intercontinental ballistic missile late on Sunday to intimidate Ukraine and the West.

OTHER

- Turkish President Erdogan said it is possible to say that US sanctions on the Turkish defence sector have eased somewhat, while he added that NATO allies US and Turkey should not have restrictions in the defence sector.

- Taiwan Coast Guard said it does not rule out China launching political warfare to disrupt public morale ahead of President Lai’s inauguration anniversary on Tuesday.

GLOBAL NEWS

- Exit polls showed pre-EU centrist Nicusor Dan is on course to win in the Romanian Presidential Election after beating far-right leader George Simion, according to FT and Sky News.

EU/UK

NOTABLE HEADLINES

- UK and the EU are expected to agree on Monday on a major post-Brexit reconciliation in which they will sign a security and defence partnership as the centrepiece of a “reset”, although some sticking points were said to remain with talks ‘going down to the wire‘, according to FT. More recently, Sky's Coates posted "Sky News understands there was a late breakthrough on the deal and that you expect news on it mid morning. Talks went well post midnight last night".

- ECB’s Wunsch said the ECB may have to cut interest rates below 2% and noted that downside risks to growth and inflation have become bigger, while he currently sees no case for a half-point cut in the foreseeable future. Furthermore, he said the Euro area may be exposed to a negative economic shock in the short term which may be followed by a positive shock in 2026 and 2027, according to FT.

- ECB’s Schnabel said the ECB should remain cautious on interest rate moves and that a steady hand is needed for now, while she commented it is to be seen what will happen regarding a June cut and noted that declining energy prices and slowing global growth may lower inflation in the short term but could reverse in the medium term.

- Portugal's incumbent centre-right party won the election with around 32% of the votes, while PM Monetenegro said after the election win that another minority government is the most likely option.

- Portugal will appeal to the European Commission to pressure France over cross-border electricity links after a blackout last month, according to FT.

- Polish pro-EU candidate Trzaskowski was narrowly ahead in Poland’s first round presidential vote and will enter a run-off with right-wing rival Nawrocki.

- Fitch affirmed Greece at BBB: Outlook Revised to Positive from Stable.

DATA RECAP

- UK House Price Rightmove MM (May) 0.6% (Prev. 1.4%)

- UK House Price Rightmove YY (May) 1.2% (Prev. 1.3%)