Europe Market Open: Equity futures rebounding; Aussie lags after RBA discussed 50bps cut & JGBs see dismal auction

20 May 2025, 06:50 by Newsquawk Desk

- APAC stocks were marginally higher as the region took impetus from the rebound stateside; S&P 500 and Dow notched six-day win streaks

- European equity futures indicate a positive cash market open with Euro Stoxx 50 future up 0.5% after the cash market closed flat on Monday.

- FX markets are broadly steady. AUD lags after the RBA delivered a 25bps cut and cut its inflation outlook.

- US President Trump stated that Russia and Ukraine are to immediately begin negotiations on a ceasefire and an end to the war.

- US House Speaker Johnson said they are almost there on the tax bill and he is very confident they will get it done.

- Looking ahead, highlights include German Producer Prices, Canadian Inflation, EZ Consumer Confidence, NZ Trade, G7 Finance Ministers Meeting, RBA’s Bullock, BoE's Pill, ECB's Cipollone, Nagel, Fed's Bostic, Barkin, Collins, Musalem, Kugler, Daly & Hammack, Supply from Germany.

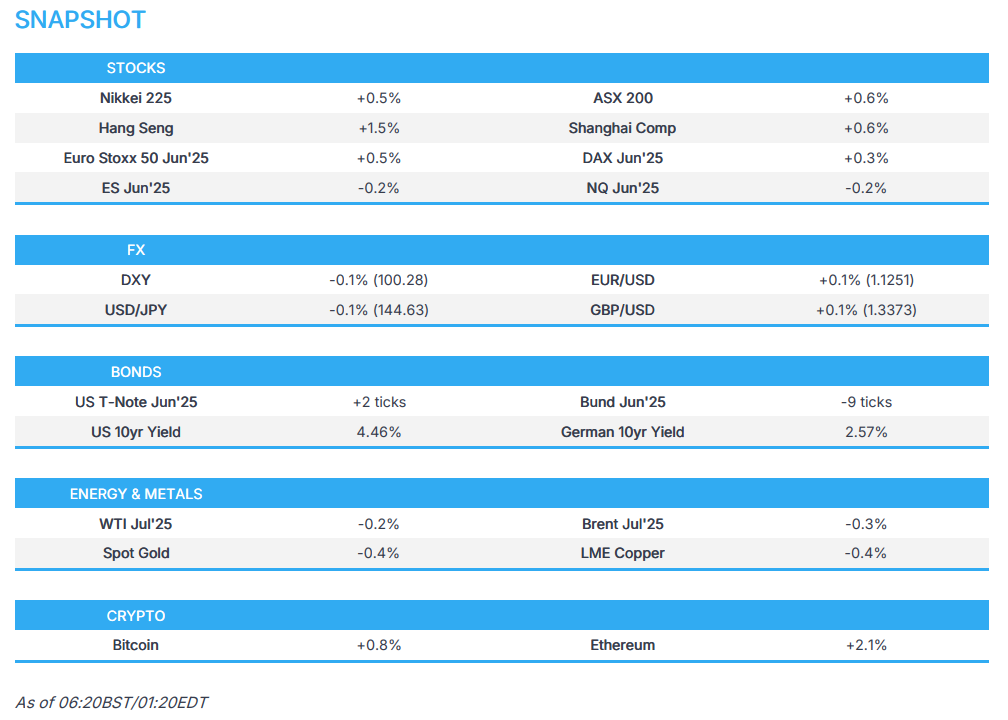

SNAPSHOT

US TRADE

EQUITIES

- US stocks saw two-way price action and ultimately closed little changed, albeit with underperformance in the small-cap Russell 2000 index. The session began on a sombre note with downside in US stocks, bonds and the dollar in the wake of Moody's downgrading the US credit rating which sparked selling in Asia and European sessions, although the downside had largely rebounded throughout US trade which saw equities close mixed, while attention was also on geopolitics following the Trump-Putin phone call which was said to have gone very well.

- SPX +0.09% at 5,964, NDX +0.09% at 21,447, DJI +0.32% at 42,792, RUT -0.42% at 2,104.

- Click here for a detailed summary.

TARIFFS/TRADE

- US Treasury does not anticipate any trade deal announcements at the G7 Finance Meeting in Canada this week, according to a source briefed on US preparations cited by Reuters. Treasury Secretary Bessent will travel to Canada to participate in the G7 Finance Ministers and Central Bank Governors meeting, while he will focus on the need to address global economic imbalances and non-market practices.

- Japanese Economy Minister Akazawa said Japan and the US conducted working-level talks on bilateral trade on Monday, while he added there was no change to Japan's stance of demanding the elimination of US tariffs. It was also reported that the US and Japan could hold talks as soon as this Friday although US Treasury Secretary Bessent is not expected to attend, according to Kyodo.

- Taiwan's President Lai said tariff talks with the US are going smoothly, while he added that Taiwan is to initiate a national wealth fund and is to broaden economic connections with nations other than the US.

- India is discussing a US trade deal structured in three tranches and expects to reach an interim agreement before July.

NOTABLE HEADLINES

- Fed's Williams (voter) said uncertainty has led the Fed to keep interest rates steady so far this year and the path forward might not become clearer for months, while he noted it won’t be in June or July that they are going to understand what's happening and it is going to be a process of collecting data, getting a better picture, and watching those things develop.

- Fed's Kashkari (2026 voter) said coming into this year, economic conditions were good and said there is big uncertainty in the economy, while he does not know when the tariff landscape will settle out. Kashkari added that businesses are holding off on investment amid uncertainty and stated it is 'wait-and-see' until the Fed has more information.

- US House Speaker Johnson said they are almost there on the tax bill and he is very confident they will get this done but added there are a few issues to resolve.

- Freedom caucus chair Harris said the votes are not there for the Trump bill and predicts a deal on the tax bill will be delayed until June.

APAC TRADE

EQUITIES

- APAC stocks were marginally higher as the region took impetus from the rebound stateside where the major indices gradually recouped the losses triggered by the US rating downgrade, and both the S&P 500 and the Dow notched six-day win streaks.

- ASX 200 was led by outperformance in tech and financials, while the attention was on the RBA which delivered a widely expected rate cut.

- Nikkei 225 rallied at the open in tandem with a surge in USD/JPY but then gave back the majority of the spoils amid currency fluctuations and with little in the way of fresh catalysts for Japan.

- Hang Seng and Shanghai Comp were kept afloat after China's largest banks cut deposit rates and slashed the benchmark Loan Prime Rates by 10bps as guided by PBoC Governor Pan, while sentiment was also underpinned by a jump in CATL shares on its Hong Kong debut.

- US equity futures (ES -0.2%, NQ -0.3%) eased back from the prior day's peaks after mounting a recovery throughout the Wall St trading session.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 future up 0.5% after the cash market closed flat on Monday.

FX

- DXY lacked direction after ultimately weakening yesterday on the recent rating downgrade and with little reaction seen to a slew of comments from Fed officials in which Jefferson, Williams and Kashkari all noted uncertainty related to tariffs, while Bostic reiterated that he only sees one cut this year but added it depends on how the tariff situation plays out.

- EUR/USD traded little changed with the single currency contained amid a lack of pertinent drivers ahead of Eurozone Consumer Confidence data and comments from ECB officials.

- GBP/USD price action was uneventful after yesterday's early rally was stalled by resistance at the 1.3400 level.

- USD/JPY returned to flat territory after whipsawing through the 145.00 level amid a quiet calendar and with little fresh catalysts for Japan.

- Antipodeans eased back after gaining yesterday with AUD/USD also mildly pressured after the RBA delivered a widely expected 25bps rate cut and noted that the board remained cautious about the outlook given the heightened level of uncertainty.

- PBoC set USD/CNY mid-point at 7.1931 vs exp. 7.2112 (Prev. 7.1916).

- SNB's Chairman Schlegel said the SNB tolerates a negative inflation rate in the short term, while he added that Swiss 2025 growth will be lower than expected and uncertainty is currently very high. Furthermore, he said the Swiss Franc is often sought as a safe haven in times of uncertainty and commented that negative interest rates cannot be ruled out.

FIXED INCOME

- 10yr UST futures remained afloat above the 110.00 level following Monday's intraday recovery, while there was little reaction seen to recent Fed commentary in which officials continued to highlight the ongoing uncertainty.

- Bund futures held on to yesterday's gains after recovering from a brief dip beneath the 130.00 level, although upside was capped ahead of supply with a total of EUR 6bln of Bund issuances scheduled for today and tomorrow.

- 10yr JGB futures initially tracks the recent gains in global counterparts but later slumped after the 20yr JGB auction which resulted in the weakest b/c since 2012 and the widest tail in price since 1987.

COMMODITIES

- Crude futures lacked direction following the prior day's indecisive performance as markets digested the US downgrade and Trump/Putin call.

- Spot gold traded rangebound and gradually retreated amid an indecisive dollar and the improved risk appetite.

- Copper futures slightly pulled back overnight after climbing yesterday in tandem with the rebound in sentiment.

CRYPTO

- Bitcoin ultimately returned to flat territory following a return journey from above the USD 106k level.

- US Senate voted to advance the GENIUS Act through the procedural vote which sets the major stablecoin cryptocurrency regulation bill up for debate on the Senate floor.

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1Y (May) 3.00% vs. Exp. 3.00% (Prev. 3.10%)

- Chinese Loan Prime Rate 5Y (May) 3.50% vs. Exp. 3.50% (Prev. 3.60%)

- China's state planner said they will make greater efforts to attract and utilise foreign capital, while China is drafting loan management rules for renewal projects and most policies will be implemented before end of June.

- RBA cut the Cash Rate by 25bps to 3.85%, as expected, while it stated that inflation continues to moderate and that the outlook remains uncertain. RBA affirmed that maintaining low and stable inflation is the priority and the board judged that the risks to inflation have become more balanced, as well as assessed that this move on rates will make monetary policy somewhat less restrictive. Furthermore, the RBA stated that headline inflation is likely to rise over the coming year to around the top of the band as temporary factors unwind and the remains cautious about the outlook, particularly given the heightened level of uncertainty about both aggregate demand and supply. RBA also released its Quarterly Statement on Monetary Policy which noted that the escalation of global trade conflict a key downside risk to economy and that the global growth outlook was downgraded, while it added that uncertainty has increased due to US tariff policies and it trimmed its core domestic inflation forecasts.

GEOPOLITICS

MIDDLE EAST

- UK-France-Canada leaders in a joint statement said they will take "concrete actions" if Israel does not cease its renewed military offensive in Gaza and lift aid restrictions, while they oppose expanded settlements in the West Bank and could take further action, including targeted sanctions.

- Iranian Foreign Ministry spokesman said no decision has yet been taken on the next round of negotiations on the Iranian nuclear programme, according to Sky News Arabia. - Yemen's Houthis announced a 'maritime ban' on Israel's Haifa Port.

RUSSIA-UKRAINE

- US President Trump posted on Truth that he completed a two-hour call with Russian President Putin which he believes went very well, while Russia and Ukraine are to immediately begin negotiations on a ceasefire and for an end to the war. Trump said the conditions for that will be negotiated between the two parties, while he added the tone and spirit of the conversation were excellent and that Russia wants to do large-scale trade with the US when this catastrophic “bloodbath” is over, which Trump agrees to and he also stated that progress was made during the call with Putin.

- US President Trump said the US isn't stepping back from Russia-Ukraine negotiations and that it would be helpful to host Ukraine-Russia talks at the Vatican, while he repeated it is not his war and thinks something is going to happen with Russia and believes Putin wants to stop. Furthermore, Trump said he has a red line in his head on when he will stop pushing on Russia-Ukraine but won't say what that red line is and noted there could be a time when Russia sanctions will happen.

- Russian President Putin said the call was very informative and helpful, while US President Trump said Russia favours a peaceful resolution of the Ukraine crisis, according to RIA. Furthermore, it was reported that Russia is ready to work with Kyiv on a memorandum on future peace talks and a ceasefire with Ukraine is possible once agreements are reached, while Putin said they are generally on the right track and that Russia and Ukraine must find compromises that suit both sides.

- Kremlin aide said Russian President Putin and US President Trump both noted they favoured normalisation of US-Russia relations and discussed a possible Russia-US prisoner swap. Trump reportedly spoke quite emotionally about prospects for ties with Russia and wants them to be mutually beneficial, while Trump noted that the US sees Russia as one of the most important trade and economic partners. Furthermore, they agreed to continue dialogue on all issues and intend to agree on a personal meeting in the future.

- Kremlin spokesman said US President Trump and Russian President Putin talked about a direct conversation between Putin and Ukrainian President Zelensky although there is no decision yet on the place for the next direct contact between Russia and Ukraine. The spokesman stated there cannot be a deadline for preparing a memorandum between Russia and Ukraine, as well as noted that everyone is interested in a speedy settlement in Ukraine and that Russia is interested in eliminating the root causes of the conflict.

- Ukrainian President Zelensky noted he had two calls with US President Trump in different formats on Monday in which the first call was one-on-one and second call included leaders of France, Finland, Germany, Italy and EU. Zelensky said the second conversation was long and different in character, while they are considering a meeting of all parties, including Ukraine, Russia, US, EU countries and Britain at the highest level. Furthermore, he hopes the meeting will happen as soon as possible and said Ukraine will not withdraw troops from parts of its own territory or give in to ultimatums from Russia.

- European Commission President von der Leyen said she had a good call with Trump, Macron, Meloni, Merz, Finland's Stubb and Zelensky to get debriefed on Trump's call with Putin, while she added it is important the US stays engaged.

- German government spokesman noted following US President Trump's call with European leaders, that European participants announced they would increase pressure on Russia through sanctions.

EU/UK

NOTABLE HEADLINES

- BoE's Dhingra said her vote for a 50bps rate cut was partly to make a statement on the direction of the economy, and they might see some cost pass through from US tariffs but argued that number would be quite small. Dhingra also said she would not rule out a scenario where global trade breaks up and the UK suffers inflation, but does not think that's where they are headed.