US Market Open: US equity futures & DXY lower ahead of a slew of Fed speak, Crude choppy on Iran updates

20 May 2025, 11:00 by Newsquawk Desk

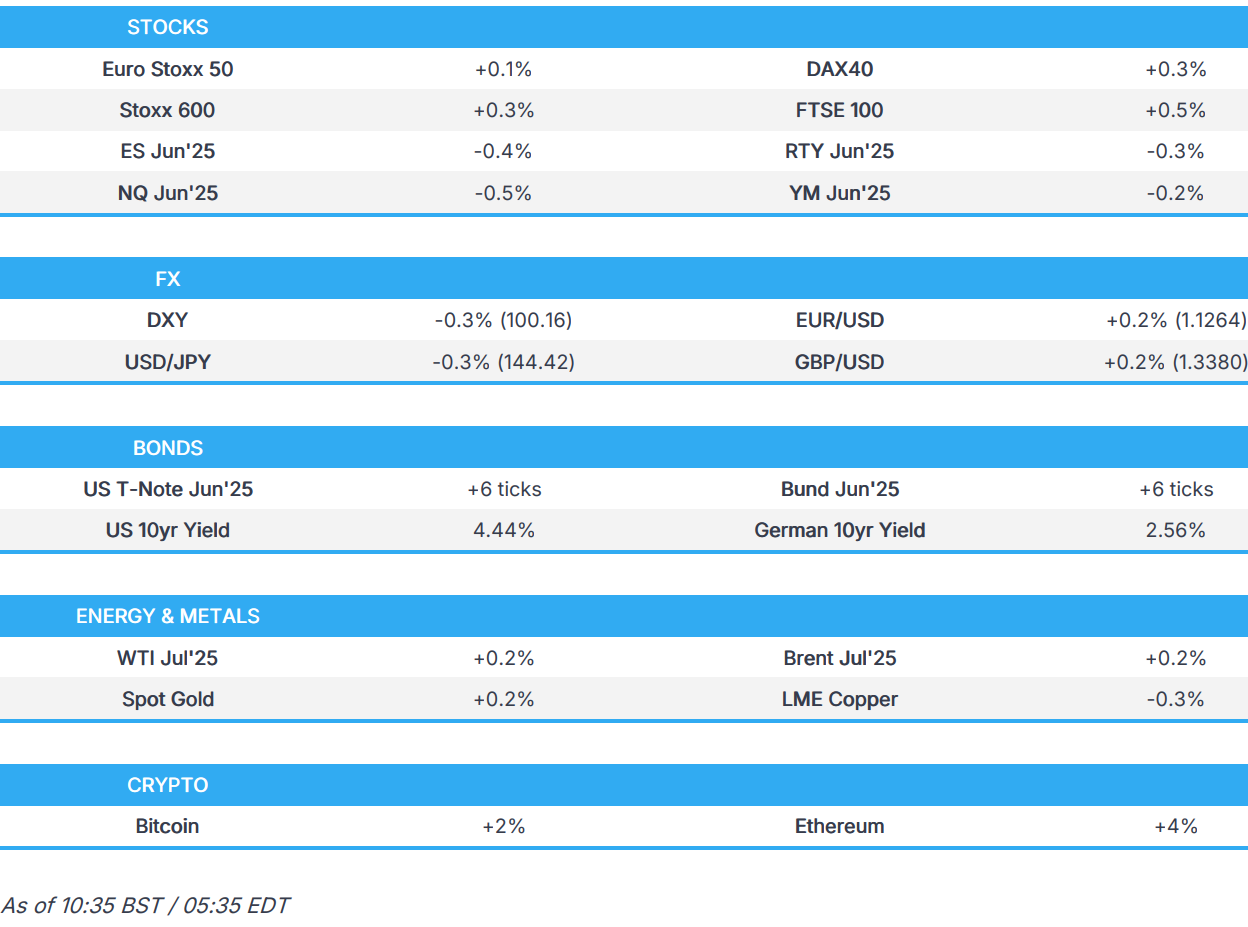

- European bourses are modestly firmer whilst US equity futures sit in negative territory.

- USD remains out of favour, AUD weighed on after the RBA delivered a 25bps cut (as expected) and amid discussion of a 50bps cut.

- JGBs briefly hit by a poor auction, fixed recovery continues into numerous Fed speakers.

- Crude choppy on mixed geopolitics regarding Russia/Ukraine and Iranian nuclear talks.

- Iranian Supreme Leader Khamenei said "I don't think nuclear talks with the US will be successful", via Mehr news.

- Looking ahead, Canadian Inflation, NZ Trade, G7 Finance Ministers Meeting, ECB's Cipollone, Nagel, Fed's Bostic, Barkin, Collins, Musalem, Kugler, Daly & Hammack. Earnings from Home Depot & Bilibili.

TARIFFS/TRADE

- Japan is reportedly mulls accepting US tariff reduction, not exemption, according to Kyodo. The Japanese government is reportedly considering the option of accepting a reduction in the rate of additional tariffs and reciprocal tariffs on automobiles and other items. Due to the US, according to sources, refusing to eliminate tariffs in prior negotiations and is said to have "indicated its intention to exclude additional tariffs on automobiles, steel, and aluminium, which are important to Japan, from the talks".

- US Treasury Secretary Bessent will travel to Canada to participate in the G7 Finance Ministers and Central Bank Governors meeting, while he will focus on the need to address global economic imbalances and non-market practices.

- Japanese Economy Minister Akazawa said Japan and the US conducted working-level talks on bilateral trade on Monday, while he added there was no change to Japan's stance of demanding the elimination of US tariffs. It was also reported that the US and Japan could hold talks as soon as this Friday although US Treasury Secretary Bessent is not expected to attend, according to Kyodo.

- Taiwan's President Lai said tariff talks with the US are going smoothly, while he added that Taiwan is to initiate a national wealth fund and is to broaden economic connections with nations other than the US.

- India is discussing a US trade deal structured in three tranches and expects to reach an interim agreement before July.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.3%) opened modestly firmer across the board and have traded within a tight range thus far, given the lack of pertinent updates.

- European sectors are mixed, and aside from the top performer, the breadth of the market is fairly narrow. Utilities takes the top spot, with sentiment in wind names boosted after the Trump administration lifted a stop-work on Equinor’s (+1.3%) New York offshore wind farm project; the name is higher by around 1.5% - peers such as Orsted (+14%) have also been edging higher.

- US equity futures are modestly lower across the board, in contrast to a mostly positive APAC/Europeans session. The US data docket is exceptionally thin, but there are a slew of Fed speakers to keep traders busy; Bostic, Barkin, Collins, Musalem, Kugler, Daly & Hammack are all due.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- After a contained start, DXY has extended on Monday's downside which was largely attributed to the Moody's downgrade on the US on Friday. Newsflow on the trade front has been non-incremental aside from a Reuters sources piece noting that the US Treasury does not anticipate any trade deal announcements at the G7 Finance Meeting in Canada this week.

- PBoC set USD/CNY mid-point at 7.1931 vs exp. 7.2112 (Prev. 7.1916). Today's speaker slate includes Fed's Bostic, Barkin, Collins, Musalem, Kugler, Daly & Hammack. DXY is just about holding above the 100 mark.

- EUR fractionally firmer vs. the USD with not a great deal in terms of Eurozone newsflow aside from ongoing ECB speak with Executive Board member Schnabel noting that disinflation is on track, though new shocks could pose new challenges. EUR/USD sits towards the top end of Monday's 1.1169-1.1288 range.

- JPY at the top of the G10 leaderboard with some of the move attributed to moves in Japanese yields with the 30yr JGB yield hitting its highest level since its debut since 1999 following a soft JGB auction overnight. On the trade front, Japanese Economy Minister Akazawa said Japan and the US conducted working-level talks on bilateral trade on Monday. Note, Japanese Finance Minister Kato and US Treasury Secretary Bessent are expected to discuss exchange rates on the sidelines of the G7 meeting in Canada this week. USD/JPY has delved as low as 144.10 but stopped shy of the 144 mark.

- GBP is a touch firmer vs. the USD and steady vs. the EUR. This morning has seen remarks from BoE Chief Economist Pill, who dissented at the 8th May rate decision by voting for an unchanged rate vs. consensus for a 25bps cut. Pill noted that his dissenting vote stemmed from a concern that the pace of withdrawal of monetary policy restriction since last summer is too rapid, given the balance of risks to price stability. He added that his vote should be seen as a skip and not a halt to the withdrawal of the restriction process. The remarks had little follow-through to GBP; currently around 1.3370.

- Antipodeans are both softer vs. the USD with AUD lagging across the majors post-RBA. As expected, the RBA pulled the trigger on a 25bps cut whilst offering a cautious view on the outlook and lowering its inflation forecasts in its accompanying Statement on Monetary Policy. At the follow-up press conference, AUD/USD hit a session low at 0.6409 after Governor Bullock revealed that the board discussed cutting by 25bps or 50bps.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- JGBs were initially firmer, in-fitting with peers after Monday’s eventual intraday recovery from Moody’s-driven pressure. However, upside in Japan was limited into supply. But a poor 20yr outing caused JGBs to slip from 134.40 to a 138.78 base - pressure which has since pared.

- USTs experienced a slight bearish blip on the above auction. However, Monday’s intraday recovery remained intact for USTs overnight and the benchmark has since extended to a 110-14+ high, eyeing 110-21+ from last week as the next point of resistance. Today's speaker slate includes Fed's Bostic, Barkin, Collins, Musalem, Kugler, Daly & Hammack.

- Bunds a little firmer today, in-fitting with peers. Early doors remarks from Schnabel this morning, though nothing that has fundamentally changed the narrative. Numerous speakers ahead incl. Cipollone, Knot & Nagel. Similarly, no move to German Producer Prices printing lower than expectations and the prior, driven primarily by energy prices for both Y/Y & M/M components. Continues to rebound from Monday’s pressure, at best has been 15 ticks above that session’s 130.60 peak. German 10yr and 30yr auctions were well received but had little impact on German paper.

- Gilts are firmer and currently outperforming. Outperformance which comes as Gilts didn’t get as much time to benefit from Monday’s late-door rebound and as the UK benchmark was that session’s underperformer, given EU-UK updates. As it stands, at the upper-end of a 91.45-91.91 band. BoE’s Pill outlined that his vote in May to leave rates unchanged was a “skip”. In fitting with his preference for “cautious and gradual” cuts and stemmed from a view that the recent quarterly pace “is too rapid given the balance of risks to price stability”. No move in Gilts to his speech.

- Hong Kong pension fund managers are reportedly sounding the alarm of potential forced selling of US Treasury holdings following Moody's downgrading US' rating, according to Bloomberg sources Hong Kong Investment Fund Association (HKFIA) has recommended that an exception to the maximum 10% holding rule is made for US Treasuries, to allow funds to invest above the limit even if the US is rated one notch below AAA, according to the sources. Japan's R&I still has an AAA rating (outlook stable) on the US, and is not considering a downgrade currently "don't believe the situation described there has significantly changed"

- UK price guidance for new 5.375% 2056 Gilt in sale via syndication seen +1.75bps to +2.25bps over 4.25% 2055 Gilt, orders over GBP 70bln.

- Click for a detailed summary

COMMODITIES

- Crude is lower this morning despite a softer dollar but amid a cautious risk tone in Europe and following some of the more sanguine tones from US President Trump regarding Russia, whilst upside was seen on less conciliatory commentary from the Iranian Supreme Leader. He said that he "does not think nuclear talks with the US will be successful", via Mehr news. Brent Jul'25 rose from USD 65.07/bbl to USD 66.00/bbl over three minutes - a move which has since mostly faded.

- Relatively flat and lacklustre trade across precious metals amid a lack of pertinent macro drivers this morning, and following a relatively contained session on Monday. Spot gold resides in a current USD 3.204.67-3.232.85/oz range.

- Mixed trade across base metals and in narrow ranges amid a lack of pertinent catalysts during the European session, whilst the broader risk tone remains cautious. 3M LME copper currently resides in a USD 9,443.05-9,520.90/t.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Producer Prices MM (Apr) -0.6% vs. Exp. -0.3% (Prev. -0.7%); YY -0.9% vs. Exp. -0.6% (Prev. -0.2%)

- EU Current Account SA, EUR (Mar) 50.9B (Prev. 34.3B); Current Account NSA,EUR (Mar) 60.1B (Prev. 33.1B)

NOTABLE EUROPEAN HEADLINES

- BoE's Pill says "dissenting vote stems from a concern that the pace of withdrawal of monetary policy restriction since last summer – quarterly cuts of 25bp – is too rapid given the balance of risks to price stability". Dissent was in line with his preference for “cautious and gradual” cuts in Bank Rate expressed over the past twelve months. Would characterise his dissenting vote as favouring a ‘skip’ in the quarterly pattern of Bank Rate cuts. It should not be seen as favouring a halt to (still less a reversal of) that withdrawal of restriction. Is concerned that structural changes in the price and wage setting behaviour have increased the intrinsic persistence of the UK inflation process. The underlying disinflation continues. The prospective path of Bank Rate from here is downward. Dissent from the most recent decision does not reflect a fundamental difference with the MPC. Says "we should not be dependent on how the data turns out". Can't assume that the inflation "pain" of new economic shocks will dissipate quickly. Agrees with the MPC that there is an easing in the labour markets, has questions over the pace. Some key pay indicators "remain quite strong".

- ECB's Schnabel says disinflation is on track, though new shocks could pose new challenges. Tariffs could be disinflationary in the short run but result in upside risk over the medium term. "We are facing a historical opportunity to foster the international role of the euro" & "When the inflation regime changes, we must be ready to respond swiftly".

- German VCI Chemical Industry Association: Q1 Production +0.6% Y/Y; Revenue +1.8% Y/Y; notes that production is expected to stagnate this year and industry sales will decrease slightly.

NOTABLE US HEADLINES

- Freedom caucus chair Harris said the votes are not there for the Trump bill and predicts a deal on the tax bill will be delayed until June.

GEOPOLITICS

MIDDLE EAST

- Iranian Supreme Leader Khamenei says "I don't think nuclear talks with the US will be successful"; via Mehr news. Says to the US that they must remain from making outrageous demands. Saying that Iran will not be allowed to enrich uranium is excessive and outrageous.

- "Israel Broadcasting Corporation: Netanyahu extends the stay of the Israeli negotiating team in Doha for an additional day", according to Alhadath.

- Israeli PM Netanyahu says "Gaza war could end "tomorrow" if hostages return and Hamas leaders lay down their arms", via Sky News Arabia.

- Iran has received a proposal for the next round of indirect negotiations with the US, according to Iran International.

- "Iranian Foreign Ministry Spokesman: The time and place of the next round of nuclear negotiations with the United States have not yet been decided", according to Sky News Arabia

RUSSIA-UKRAINE

- US President Trump said the US isn't stepping back from Russia-Ukraine negotiations and that it would be helpful to host Ukraine-Russia talks at the Vatican, while he repeated it is not his war and thinks something is going to happen with Russia and believes Putin wants to stop. Furthermore, Trump said he has a red line in his head on when he will stop pushing on Russia-Ukraine but won't say what that red line is and noted there could be a time when Russia sanctions will happen.

- Kremlin spokesman said US President Trump and Russian President Putin talked about a direct conversation between Putin and Ukrainian President Zelensky although there is no decision yet on the place for the next direct contact between Russia and Ukraine. The spokesman stated there cannot be a deadline for preparing a memorandum between Russia and Ukraine, as well as noted that everyone is interested in a speedy settlement in Ukraine and that Russia is interested in eliminating the root causes of the conflict.

CRYPTO

- Bitcoin is a little firmer and trades just above USD 105k; Ethereum is also higher.

APAC TRADE

- APAC stocks were marginally higher as the region took impetus from the rebound stateside where the major indices gradually recouped the losses triggered by the US rating downgrade, and both the S&P 500 and the Dow notched six-day win streaks.

- ASX 200 was led by outperformance in tech and financials, while the attention was on the RBA which delivered a widely expected rate cut.

- Nikkei 225 rallied at the open in tandem with a surge in USD/JPY but then gave back the majority of the spoils amid currency fluctuations and with little in the way of fresh catalysts for Japan.

- Hang Seng and Shanghai Comp were kept afloat after China's largest banks cut deposit rates and slashed the benchmark Loan Prime Rates by 10bps as guided by PBoC Governor Pan, while sentiment was also underpinned by a jump in CATL shares on its Hong Kong debut.

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1Y (May) 3.00% vs. Exp. 3.00% (Prev. 3.10%)

- Chinese Loan Prime Rate 5Y (May) 3.50% vs. Exp. 3.50% (Prev. 3.60%)

- China's state planner said they will make greater efforts to attract and utilise foreign capital, while China is drafting loan management rules for renewal projects and most policies will be implemented before end of June.

- BoJ releases briefing material used at a meeting with bond market participants: notes some members said JGB market functionality is improving as a trend due to the BoJ taper. Some look for an eventual end to bond buying, some are after bigger cuts in the next plan. Some seek substantial cuts in one go. Deteriorating demand-supply for super-long JGBs is not something the BoJ can fix.

RBA

- RBA cut the Cash Rate by 25bps to 3.85%, as expected, while it stated that inflation continues to moderate and that the outlook remains uncertain. RBA affirmed that maintaining low and stable inflation is the priority and the board judged that the risks to inflation have become more balanced, as well as assessed that this move on rates will make monetary policy somewhat less restrictive. Furthermore, the RBA stated that headline inflation is likely to rise over the coming year to around the top of the band as temporary factors unwind and the remains cautious about the outlook, particularly given the heightened level of uncertainty about both aggregate demand and supply. RBA also released its Quarterly Statement on Monetary Policy which noted that the escalation of global trade conflict a key downside risk to economy and that the global growth outlook was downgraded, while it added that uncertainty has increased due to US tariff policies and it trimmed its core domestic inflation forecasts.

- Governor Bullock: prepared to take further rate actions if required; price increases have slowed; Bullock adds this was a confident cut in rates; There was a discussion between a 50bps cut or a 25bps cut; discussed holding rates or cutting. Cannot say where the cash rate will end up, does not endorse market pricing (Note: ~55bps of cuts currently seen by year-end).