US Market Open: DXY lower and oil prices boosted on reports that Israel is looking to attack Iranian nuclear facilities

21 May 2025, 11:14 by Newsquawk Desk

- US House Speaker Johnson said a Thursday tax bill floor vote is still realistic.

- China’s Commerce Ministry said US measures on China's advanced chips are typical of unilateral bullying and protectionism.

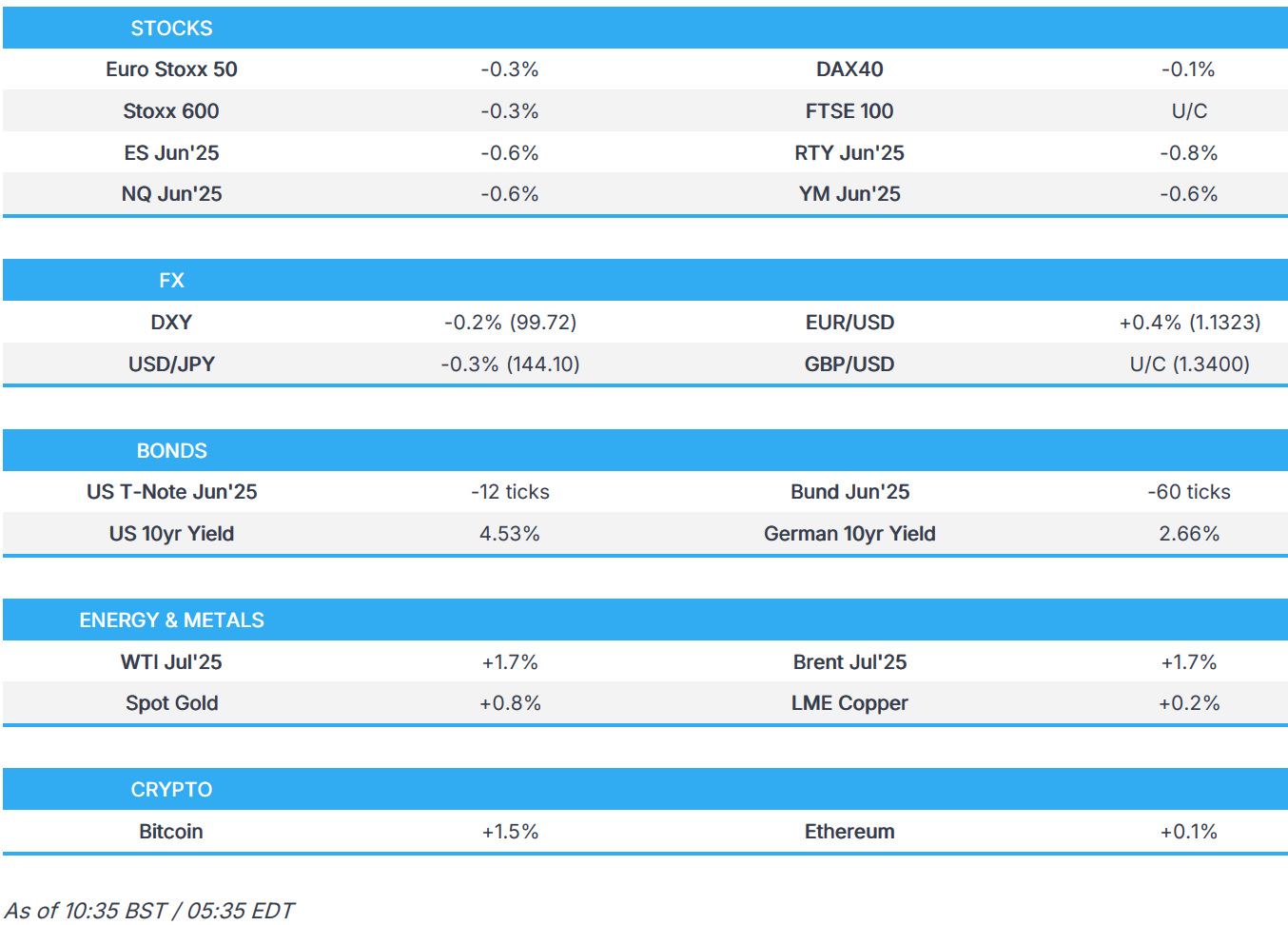

- Europe opened mostly lower but now trade mixed, US equity futures are in the red.

- USD remains out of love, GBP digests hot CPI data, EUR/USD back above 1.13.

- Bearish bias in play, Gilts lag after hot CPI, USTs await fiscal updates.

- Energy and gold boosted by reports Israel is preparing a possible strike on Iranian nuclear facilities.

- Looking ahead, G7 Central Bank and Finance Ministers Meeting, Speakers including ECB's Lagarde, Lane, Nagel & Cipollone, Fed's Barkin & Bowman, Supply from the US, Earnings from Snowflake, Zoom, Target, TJX, VF Corp & Medtronic.

TARIFFS/TRADE

- China’s Commerce Ministry said US measures on China's advanced chips are typical of unilateral bullying and protectionism, while it added that US chip measures seriously undermine the stability of the global semiconductor industry chain and supply chain. MOFCOM also stated that the US abuses export controls to contain and suppress China, violating international law and basic norms. Furthermore, it said China urges the US to immediately correct its erroneous practices and to abide by international economic and trade rules and respect other countries' rights to scientific and technological development.

- Japan’s Economy Minister Akazawa, who is the country’s top tariff negotiator, is to visit the US for the third time on Friday and a fourth visit to the US this month is also a possibility, according to Nikkei.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.3%) opened mostly lower across the board, but sentiment in Europe has picked up a little this morning to display a more mixed picture.

- European sectors are mostly lower and hold a slight defensive bias. Utilities takes the top spot, benefiting from its defensive status but with sentiment also boosted after post-earning strength in SSE (+1%). Retail is found at the foot of the pile, with JD Sports (-5%) responsible for much of this after the Co. reported a 2% decline in Q1 Sales.

- US equity futures are modestly lower, continuing the similar price action seen in the prior session. US data docket is very light; Fed’s Barkin and Bowman are both due to speak.

- Baidu (9888 HK/ BIDU) Q1 2025 (USD): EPS 2.55 (exp. 1.96), Revenue 4.47bln (exp. 4.30bln), FCF -476mln (prev. +6.34bln Y/Y)

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY has extended its losing streak into a third session with incremental macro drivers on the light side as the data calendar remains quiet and Fed speak proves to be non-incremental given the uncertainty surrounding the outlook. On the trade front, the deal flow appears to have slowed down and there is unlikely to be much in the way of breakthroughs at the G7 finance ministers meeting this week. Elsewhere, focus is on the fiscal front as Trump attempts to push his "big beautiful bill" through Congress. DXY has slipped onto a 99.0 handle with a session trough at 99.42.

- EUR/USD has extended its rally for the week with a current session peak at 1.1352 vs. an opening price on Monday at 1.1172. This week has been a quiet one in terms of Eurozone newsflow with ECB speak not shifting the dial on market pricing with a June cut near-enough fully priced. For now though, EUR remains underpinned by its appeal of being a liquid alternative to the USD, currently holding around 1.1325.

- JPY is capitalising on the broadly softer USD with USD/JPY slipping as low as 143.57 overnight before returning to a 144 handle. Focus surrounding Japan remains on the trade front with reporting in the Nikkei noting that Japan’s Economy Minister Akazawa, who is the country’s top tariff negotiator, is to visit the US for the third time on Friday.

- GBP is steady vs. the USD following a choppy reaction to UK CPI metrics. The series saw an across-the-board hotter-than-expected outturn with Y/Y CPI rising to 3.5% from 2.6% (exp. 3.3%) and the all-important services component rose to 5.4% from 4.7% (exp. 4.8%). This elicited a surge in Cable to a multi-year high at 1.3468. However, the move ran out of steam given the negative connotations of a stagflationary outlook in the UK.

- Mildly diverging fortunes for the antipodeans with AUD firmer vs. the USD and NZD steady. Fresh macro drivers are lacking for both with the payback in AUD likely a by-product of Tuesday's RBA-induced losses.

- PBoC set USD/CNY mid-point at 7.1937 vs exp. 7.2133 (Prev. 7.1931).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs started the day on the backfoot, down to a 109-25 base and a few ticks beneath the 109-28+ low from Tuesday. If the move continues, then the 109-20 WTD base is next. The bearish bias has been moderate so far, ahead of an expected floor reading of the US tax/spending bill on Thursday, a 20yr auction this evening in addition to Fed’s Barkin & Bowman.

- Bunds are lower marginally underperforming USTs at this moment in time though not to quite the same degree as Gilts, see below. Updates thus far include the ECB FSR, which highlighted that a shifting geopolitical environment could test EZ financial stability. ECB's de Guindos also provided some remarks, but little of note. Into the German 2035 Bund auction the downside has increased taking Bunds to a fresh trough at 129.60 - a decent outing, but had little impact on German paper.

- Gilts are the underperformer this morning with downside in excess of 60 ticks at worst. Driven lower by the above, the morning’s hot inflation series and possibly some concession into supply factoring. To recap the data, Services came in at 5.4% Y/Y, eclipsing the BoE’s 5.0% view, and the headline at 3.5% Y/Y, surpassing the BoE’s average forecast for Q2 of 3.4%. In reaction to this, Gilts gapped lower by 41 ticks at the open and have since slipped another 26 to a 90.46 trough, notching a fresh WTD low in the process and lifting the 10yr yield to 4.77%, its highest since early April when 4.79% printed.

- Germany sells EUR 3.052bln vs exp. EUR 4bln 2.50% 2035 Bund: b/c 2.4x (prev. 1.4x), average yield 2.66% (prev. 2.47%) & retention 23.7% (prev. 23.80%)

- UK's DMO says due to ongoing issues with the Bloomberg terminal, the bidding window for today's 2031 auction has been extended; expects closing time of the auction to be 11:30BST.

- Click for a detailed summary

COMMODITIES

- Crude futures are overall boosted following a CNN report that new intelligence suggested Israel is preparing a possible strike on Iranian nuclear facilities, although it added that it was not clear whether Israeli leaders have made a final decision. Oil prices waned off their best levels during APAC trade amid the cautious risk tone across markets. Aside from that, complex-specific newsflow has been light, WTI resides in a USD 62.20-64.19/bbl range while Brent sits in a USD 65.96-66.63/bbl range.

- Spot gold is kept afloat by dollar weakness and amid the ongoing backdrop of trade and geopolitical uncertainty. Spot gold resides in a USD 3,285.34-3,320.84/oz range at the time of writing after topping yesterday's USD 3,295.79/oz high and now eyeing the 12th May peak at USD 3,325.39/oz.

- Base metals overall trade mixed whilst copper futures extends on the prior day's intraday rebound after gaining on a softer dollar and as Asian bourses mostly shrugged off the weak handover from US peers. 3M LME copper trades in a USD 9,528.70-9,599.00/t range at the time of writing.

- Iraq's Oil Minister says lower oil prices are on the back of rising crude stocks; hopes oil prices will improve in H2'25.

- US Private Inventory Data (bbls): Crude +2.5mln (exp. -1.3mln), Distillates -1.4mln (exp. -1.4mln), Gasoline -3.2mln (exp. -0.5mln), Cushing -0.4mln.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK CPI YY (Apr) 3.5% vs. Exp. 3.3% (Prev. 2.6%); M/M 1.2% vs. Exp. 1.0% (Prev. 0.3%)

- UK Core CPI YY (Apr) 3.8% vs. Exp. 3.6% (Prev. 3.4%); MM 1.4% vs. Exp. 1.2% (Prev. 0.5%)

- UK CPI Services YY (Apr) 5.4% vs. Exp. 4.8% (Prev. 4.7%); MM 2.2% vs. Exp. 1.7% (Prev. 0.4%)

- UK ONS House Price Index (Mar): 6.4% Y/Y (prev. 5.4%)

NOTABLE EUROPEAN HEADLINES

- ECB's de Guindos says equity valuations are high and credit spreads are out of sync with risk. Says the US downgrade was discounted by markets. EZ bond yields have decoupled from US, and spreads are contained. Markets are complacent but that can change.

- ECB FSR: Rapidly shifting geopolitical environment could test euro area financial stability.

- UK Deputy PM Rayner sent a secret memo to UK Chancellor Reeves, pushing for a new tax raid on savers, according to The Telegraph. The memo proposed eight tax increases including reinstating the pensions lifetime allowance and changing dividend taxes.

NOTABLE US HEADLINES

- Fed's Bostic (2027 voter) said further instability in the Treasury market would add to uncertainty and noted the current US tariff level is better than it was as initially proposed, but still high enough that it is difficult to assess what will happen. Bostic added the Fed needs to be more certain about the outlook to be comfortable about how monetary policy should shift.

- Fed's Daly (2027 voter) said the net effect of Trump administration trade, immigration and other policies remains unknown.

- US President Trump said the Golden Dome defence shield will include space-based interceptors and should be operational by the end of his term, while he added that Canada said they want to be part of it and said the total cost is about USD 175bln.

- US House Speaker Johnson said they will complete SALT discussions on Tuesday night and are very near a final agreement on IRA energy credits, while he added that a Thursday tax bill floor vote is still realistic. It was later reported that a group of blue-state Republicans and GOP leaders reached a tentative deal for a USD 40,000 SALT deduction, according to POLITICO.

- White House Director of the Office of Management and Budget Vought said the Moody's downgrade timing was trying to jeopardise the ability to get the budget bill done, although he thinks the budget bill will pass this week and is optimistic.

- US House Rules panel is "still meeting on the bill after working overnight and no sign of amendment making final changes", via Bloomberg's Wasson.

- Morgan Stanley mid-year outlook: turns Overweight on US equities and US Treasuries; expects USD to continue to weaken - expects EUR/USD at 1.25 and USD/JPY at 130 by Q2 2026

GEOPOLITICS

MIDDLE EAST

- New intelligence suggested that Israel is preparing a possible strike on Iranian nuclear facilities, according to US officials cited by CNN although the report added it was not clear whether Israeli leaders have made a final decision.

- Iranian Foreign Minister says "We are considering whether or not to participate in the next round of negotiations with US. We are still examining whether productive talks can take place on that date", via Iran Nuances.

- UK is reportedly considering sanctions against Israeli far-right ministers, via FT citing sources; discussions are over an asset ban and travel freeze on Finance Minister Smotrich and Security Minister Ben-Gvir.

INDIA-PAKISTAN

- Pakistani army says "Indian terror proxies" used by India to attack a school bus in southwest Pakistan.

RUSSIA-UKRAINE

- Ukraine's Finance Minister Marchenko said G7 ministers will discuss all necessary and critical issues related to Ukraine's reconstruction, while he will reiterate the need for stronger sanctions on Russia.

- US President Trump said he is not worried about reports of a Russian military buildup along Finland.

CRYPTO

- Bitcoin is a little firmer and trades around USD 106k whilst Ethereum meanders around USD 2.5k.

APAC TRADE

- APAC stocks traded with a mild positive bias as the region mostly shrugged off the lacklustre lead from Wall St but with the gains capped in the absence of any major fresh macro drivers and tier-1 data releases.

- ASX 200 was led by strength in utilities and the commodity-related stocks with gold miners lifted by recent gains in the precious metal.

- Nikkei 225 faded its opening gains with headwinds from a firmer currency and after mixed Japanese trade data.

- Hang Seng and Shanghai Comp conformed to the predominantly upbeat mood in the region but with the upside limited in the mainland as frictions lingered after China renewed its criticism against the US for its chip controls and urged the US to immediately correct its erroneous practices.

NOTABLE ASIA-PAC HEADLINES

- South Korea's government will prepare support measures for the biopharmaceutical sector and will prepare additional measures for the auto industry if needed.

DATA RECAP

- Japanese Trade Balance (JPY)(Apr) -115.8B vs. Exp. 227.1B (Prev. 559.4B)

- Japanese Exports YY (Apr) 2.0% vs. Exp. 2.0% (Prev. 4.0%); Imports YY (Apr) -2.2% vs. Exp. -4.5% (Prev. 1.8%)