Europe Market Open: House Rules Committee approved Trump's bill, it faces the floor next

22 May 2025, 06:50 by Newsquawk Desk

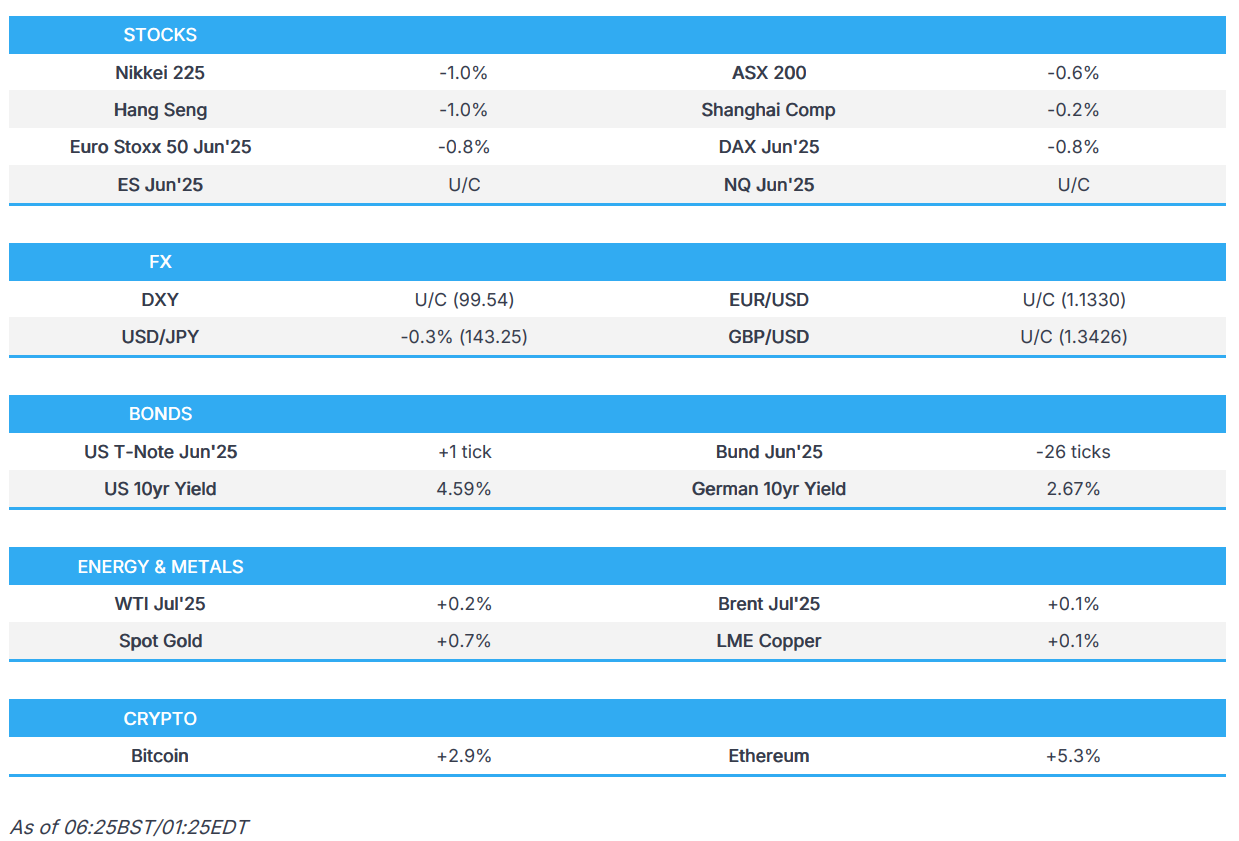

- APAC stocks were on the back foot following the sell-off on Wall St where stocks, treasuries and the dollar were pressured amid deficit concerns and a weak 20-year auction.

- US President Trump said he was feeling very good about the bill in Congress; US House Speaker Johnson said on Wednesday that they were yet to decide on a vote on the tax bill that night or on Thursday but added that the Trump tax bill is moving forward.

- Bitcoin extended on gains and printed a fresh all-time high of above the USD 111k level; Texas House approved the bill to create a Bitcoin reserve.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.8% after the cash market closed flat on Wednesday.

- Looking ahead, highlights include EZ, UK, US Flash PMIs, German Ifo, US Jobless Claims, Canadian Producer Prices, NZ Retail Sales, ECB Minutes, Speakers including RBA’s Hauser, BoE’s Breeden, Dhingra & Pill, ECB’s Elderson & de Guindos, BoC’s Gravelle, Fed’s Barkin & Williams, Supply from Spain, France & US.

- Earnings from BT, British Land, easyJet, QinetiQ, Tate & Lyle, ConvaTec, Intertek, Generali, PKN Orlen, Allegro, Julius Baer, Galenica, Autodesk, Ross & Analog Devices.

US TRADE

EQUITIES

- US stocks declined on what was a "sell US" day in which all major indices posted notable losses and Treasuries were sold across the curve.

- The focus has largely been on Trump's tax bill with an agreement made on the SALT deductions, although some Republican hardliners are still worried that not enough spending cuts are included in the bill, while the CBO estimated the bill would add USD 2.3tln to deficits over the next decade, raising fiscal fears.

- Furthermore, the selling was later exacerbated in the aftermath of a weak 20-year bond auction, which saw a chunky 1.2bps tail and soft bid-to-cover.

- SPX -1.61% at 5,845, NDX -1.34% at 21,080, DJI -1.91% at 41,860, RUT -2.8% at 2,047.

- Click here for a detailed summary.

TARIFFS/TRADE

- EU is open to extending lobster deal as part of a package to remove tariffs imposed by US President Trump, according to FT.

- South African President Ramaphosa said following a meeting with US President Trump that they had discussions on trade and there will continue to be engagement on tariffs. It was also reported that South Africa's Trade Minister said they submitted a proposal regarding a framework agreement with the US and had some US feedback, while they then resubmitted a revised document with the proposal about a trade agreement.

- Canada's Minister of International Trade and Intergovernmental Affairs LeBlanc is to visit Washington DC to meet with Trump admin officials, while it was also reported that Canada's Finance Minister Champagne said he will discuss Canada's role as the largest customer for US exports in meeting with US Treasury Secretary Bessent.

- Japanese Finance Minister Kato said he told Bessent that US tariffs are regrettable and stated tariffs are not an appropriate means to correct macroeconomic imbalances that are behind trade imbalances, while Kato noted that he did not directly discuss Japan's US Treasury holdings in the meeting with Bessent.

- US Treasury Secretary Bessent and Japanese Finance Minister Kato discussed global security and bilateral trade and currency issues on the sidelines of the G7, while they reaffirmed shared belief that exchange rates should be market-determined and reaffirmed USD/JPY exchange rate currently reflects fundamentals.

NOTABLE HEADLINES

- US President Trump posted "I am giving very serious consideration to bringing Fannie Mae and Freddie Mac public. I will be speaking with Treasury Secretary Scott Bessent, Secretary of Commerce Howard Lutnick, and the Director of the Federal Housing Finance Agency, William Pulte, among others, and will be making a decision in the near future."

- US President Trump said he was feeling very good about the bill in Congress.

- US House Speaker Johnson said on Wednesday that they were yet to decide on a vote on the tax bill that night or on Thursday but added that the Trump tax bill is moving forward. It was later reported that the US House Rules Committee approved Trump's sweeping tax cut bill which sets the stage for a full House floor vote on the tax cut bill.

- US HHS Secretary's widely anticipated “Make America Healthy Again” report is expected to criticise food additives, lobbyists and vaccines, but go easier than expected on pesticides in farming, according to WSJ citing sources.

APAC TRADE

EQUITIES

- APAC stocks were on the back foot following the sell-off on Wall St where stocks, treasuries and the dollar were pressured amid deficit concerns and a weak 20-year auction.

- ASX 200 retreated with energy and tech front-running the declines, although continued strength in gold producers atoned for some of the losses.

- Nikkei 225 gapped beneath the 37,000 level amid a firmer currency and proceeded in a somewhat choppy fashion as participants also digested data releases, including a surprise surge in Japanese Machinery Orders and mixed PMI figures.

- Hang Seng and Shanghai Comp conformed to the downbeat sentiment in the absence of any fresh bullish catalysts and after recent earnings results failed to inspire, while the mainland initially showed resilience in early trade before succumbing to the broad risk-off mood.

- US equity futures were little changed but saw some mild reprieve from the recent 'sell America' impulse.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.8% after the cash market closed flat on Wednesday.

FX

- DXY remained lacklustre beneath the 100.00 level after weakening yesterday as US assets were pressured after a poor US 20yr bond auction and with some concerns regarding the ramifications of the US tax bill on the deficit, while it has been extremely quiet so far this week on the data front although will begin to pick up with US Jobless claims and PMI figures scheduled later.

- EUR/USD held on to its recent spoils against the greenback although the upside was capped and there was little reaction to recent ECB rhetoric.

- GBP/USD traded rangebound with support near the 1.3400 level although gains were limited after the recent CPI-triggered momentum lost steam.

- USD/JPY saw two-way price action following mixed data and with an initial uplift following a report that US Treasury Secretary Bessent and Japanese Finance Minister Kato discussed global security, bilateral trade and currency issues on the sidelines of the G7 where they affirmed that the USD/JPY exchange rate currently reflected fundamentals. Nonetheless, the initial advance was gradually reversed amid dollar weakness and the negative risk tone.

- Antipodeans lacked direction as tailwinds from the softer dollar were offset by the risk-averse sentiment, while the New Zealand Budget and forecasts garnered little fanfare.

- PBoC set USD/CNY mid-point at 7.1903 vs exp. 7.2009 (Prev. 7.1937).

FIXED INCOME

- 10yr UST futures attempted to regain some composure after declining yesterday on deficit concerns and a weak 20yr auction.

- Bund futures languished around this week's worst levels after retreating to sub-130.00 territory and with German Ifo data scheduled later.

- 10yr JGB futures tracked the losses in global peers amid mild upside in Japanese yields and mixed results from the 10yr inflation-indexed JGB auction.

COMMODITIES

- Crude futures lacked direction after fully reversing the recent spike that was triggered by Iran/Israel headlines, with prices pressured overnight by the downbeat mood and following bearish inventory data.

- UK urged lowering price cap on Russian oil at the G7 meeting, according to Bloomberg.

- Spot gold continued to edge higher above the USD 3,300/oz level owing to a weaker dollar and US deficit concerns.

- Copper futures rebounded from the prior day's trough following the recent choppy performance and with prices helped by early resilience in its largest buyer.

CRYPTO

- Bitcoin extended on gains and printed a fresh all-time high of above the USD 111k level.

- Texas House approved the bill to create a Bitcoin reserve.

DATA RECAP

- Japanese Machinery Orders MM (Mar) 13.0% vs. Exp. -1.6% (Prev. 4.3%)

- Japanese Machinery Orders YY (Mar) 8.4% vs. Exp. -2.2% (Prev. 1.5%)

- Japanese JibunBK Manufacturing PMI Flash SA (May) 49.0 (Prev. 48.7)

- Japanese JibunBK Services PMI Flash SA (May) 50.8 (Prev. 52.4)

- Japanese JibunBK Composite Op Flash SA (May) 49.8 (Prev. 51.2)

- Australian S&P Global Manufacturing PMI Flash (May) 51.7 (Prev. 51.7)

- Australian S&P Global Services PMI Flash (May) 50.5 (Prev. 51.0)

- Australian S&P Global Composite PMI Flash (May) 50.6 (Prev. 51.0)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said Israel probably killed Hamas leader Sinwar and Iran still poses a serious threat to Israel, while he added that in the end, all parts of Gaza will be under Israeli control.

- Israeli military said it identified and intercepted a missile launched from Yemen towards Israel.

- Two Israeli embassy employees were killed in a shooting near a Jewish museum in Washington DC, while the Washington DC police chief announced the suspect was detained by event security and had chanted "Free Palestine" while in custody.

- Oman's Foreign Minister announced the fifth round of Iran-US nuclear talks will take place in Rome on May 23rd.

RUSSIA-UKRAINE

- US President Trump told European leaders in private that Russian President Putin isn't ready to end the war, according to WSJ.

OTHER

- North Korea said it will convene the ruling party central committee meeting in late June and North Korean leader Kim watched the launch of a 5000-ton destroyer, while an accident occurred during the launch of the North Korean warship. Furthermore, Kim said the accident was unacceptable and was the result of negligence and irresponsibility.

EU/UK

NOTABLE HEADLINES

- ECB's Escriva said the Euro's recent appreciation was a surprise and it is more difficult to predict how tariffs impact inflation.

- ECB's Nagel sees progress on the US tariff dispute but more hurdles to overcome and noted the US was showing a better understanding of Europe's point of view, while he is a little more confident than perhaps was a few days ago. Nagel stated that German economic growth in Q1 could surprise on the upside but will get worse in Q2 and could see 1% plus growth in 2026.