Europe Market Open: European equity futures higher, DXY lower; reports suggest Trump is pushing the EU to cut tariffs or face extra duties

23 May 2025, 06:44 by Newsquawk Desk

- APAC stocks were mostly in the green albeit with gains in the region capped following the indecisive performance stateside.

- US President Trump and Chinese President Xi have not spoken since the Geneva agreement, according to CNN.

- US President Trump is pushing the EU to cut tariffs or face extra duties with US negotiators to tell Brussels they expect unilateral concessions, according to FT.

- European equity futures indicate a mildly positive cash market open with Euro Stoxx 50 futures up 0.2% after the cash market closed with losses of 0.6% on Thursday.

- Looking ahead, highlights include German GDP, UK Retail Sales, EZ Negotiated Wage Rates, Canadian Retail Sales, Speakers including ECB’s Lane & Schnabel, BoE’s Pill, Fed’s Musalem & Cook.

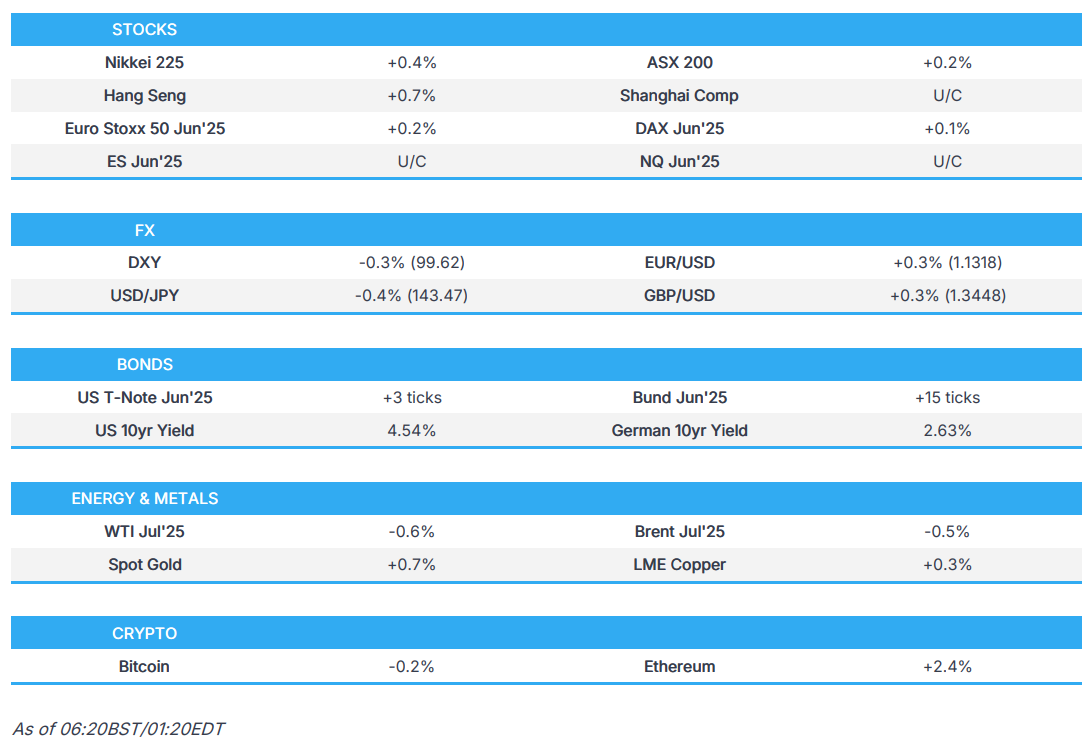

SNAPSHOT

US TRADE

EQUITIES

- US stocks were very choppy with initial pressure seen in both equities and Treasuries in response to the House passing Trump's tax bill, although markets pared the earlier losses and more.

- The rebound in stocks was led by the Nasdaq as Communication and Tech were among the outperformers in the mixed picture for sectors with Utilities, Health and Energy the laggards, while the major indices mostly wiped out their gains in the last few minutes of trade to finish mostly flat.

- SPX -0.04% at 5,842, NDX +0.15% at 21,112, DJI unch. at 41,859, RUT -0.05% at 2,046

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump and Chinese President Xi have not spoken since the Geneva agreement, according to CNN.

- US Deputy Secretary of State Landau spoke with Chinese Vice Foreign Minister Ma on Thursday and acknowledged the importance of the bilateral relationship to the people of both countries, while they discussed a wide range of issues of mutual interest and agreed on the importance of keeping open lines of communication.

- Japanese PM Ishiba said he held a call with US President Trump in which they discussed tariffs, diplomacy and security, while there might be an occasion where he visits the US for in-person talks with Trump. Furthermore, Ishiba said there are no changes to Japan's stance on US tariffs and demand for the elimination of tariffs, nor to Japan's policy of talking with the US on creating US jobs.

- Japan’s chief tariff negotiator Akazawa reiterated there is no change to stance on requesting elimination of US tariffs, but noted they aim to reach an agreement, while he plans to visit the US around May 30th for the fourth round of trade talks, according to sources cited by Reuters.

- US President Trump is pushing the EU to cut tariffs or face extra duties with US negotiators to tell Brussels they expect unilateral concessions, while USTR Greer is preparing to tell EU counterpart Sefcovic that recent "explanatory note" falls short of US expectations, according to FT.

- EU's Dombrovskis said G7 finance leaders had a positive and successful meeting, while they advanced discussion in support of Ukraine and addressing economic imbalances. Furthermore, Dombrovskis stated that trade discussions were a difficult topic, and discussions focused on the economic implications of tariffs and economic fragmentation.

- Canadian Finance Minister Champagne said the G7 decided to look more closely at the increase in low-value shipments to protect domestic small retailers and combat smuggling, while he added that G7 ministers were not skating around the fact that tariffs are an issue for G7 economies.

- Mexico's Economy Minister said he would talk about steel and aluminium tariffs, as well as tariffs related to fentanyl and immigration during his visit to Washington.

NOTABLE HEADLINES

- Fed Chair Powell is to testify before the House Committee on June 24th.

- Fed's Williams (voter) didn’t comment on monetary policy or the economic outlook but stated central bank lending facilities reduce uncertainty over reserve levels, while there is no one best way to supply reserves to the financial system.

- NY Fed's Perli encourages eligible firms to use the standing repo facility as needed and reiterated the Fed will soon launch morning standing repo operations, while Perli noted they are seeing some 'early' signs of pressure in repo markets but added the rise of repo market pressure was not a source of concern.

- US President Trump is to sign orders to boost nuclear power as soon as Friday and will invoke a wartime act over US uranium independence, according to sources.

APAC TRADE

EQUITIES

- APAC stocks were mostly in the green albeit with gains in the region capped following the indecisive performance stateside where participants digested PMI data and the House approved US President Trump's tax bill to send it to the Senate.

- ASX 200 eked mild gains as the strength in real estate, energy, tech, telecoms and financials was partially offset by losses in defensives and miners.

- Nikkei 225 returned to above the 37,000 level with the index unfazed by the firmer-than-expected Core CPI data, while Japanese Economy Minister Akazawa is visiting the US for a third round of talks and is reportedly planning to visit again late next week for a fourth round of discussions. Furthermore, Japanese PM Ishiba had a call with US President Trump and discussed US tariffs, diplomacy and security although no major developments were announced.

- Hang Seng and Shanghai Comp gained but with advances in the mainland limited in the absence of any fresh significant macro drivers, although there were some talks between the US and China at a deputy ministerial level, in which the US Deputy Secretary of State spoke with his Chinese counterpart on Thursday and discussed a wide range of issues of mutual interest. The two agreed on the importance of keeping open lines of communication.

- US equity futures were little changed with a lack of conviction following yesterday's choppy mood.

- European equity futures indicate a mildly positive cash market open with Euro Stoxx 50 futures up 0.2% after the cash market closed with losses of 0.6% on Thursday.

FX

- DXY resumed the weakening trend seen throughout most of the week following its recent failure to sustain the 100.00 status and after the tailwinds from a better-than-expected PMI report petered out. Furthermore, the attention stateside was also on the US tax bill which the House passed but still requires Senate approval, while recent comments from Fed officials had very little sway on the greenback.

- EUR/USD clawed back some of the prior day's losses and regained the 1.1300 handle after retreating in the wake of EZ PMI data yesterday.

- GBP/USD gradually edged higher following the recent choppy performance and as participants awaited UK Retail Sales data.

- USD/JPY trickled lower and returned to sub-144.00 territory with price action predominantly driven by movements of the greenback and following the latest Japanese inflation which either matched or topped estimates.

- Antipodeans benefited from the renewed pressure in the dollar and the mostly positive overnight risk appetite.

- PBoC set USD/CNY mid-point at 7.1919 vs exp. 7.2151 (Prev. 7.1903).

FIXED INCOME

- 10yr UST futures extended on its recovery to test the 110.00 level despite the recent tax bill passage by the House.

- Bund futures continued its rebound from this week's trough and briefly returned to the 130.00 territory after the recent soft German PMIs.

- 10yr JGB futures nursed some of this week's losses but with the recovery limited after Japan's Core CPI topped forecasts.

COMMODITIES

- Crude futures remained subdued after a source report yesterday that OPEC+ members are discussing whether to agree to another output hike of 411k BPD in July.

- European official said the US was not convinced about lowering the G7 oil price cap during the G7 finance meeting as the US position was that oil prices are going down and already hurting Russia but does not exclude the idea of lowering the price cap level, and discussions will continue.

- Spot gold gradually rebounded from yesterday's trough and returned to above the USD 3,300/oz level.

- Copper futures traded rangebound and were kept afloat alongside the mildly positive sentiment during Asia-Pac trade.

CRYPTO

- Bitcoin slightly eased back after its recent surge to fresh record highs but with the pullback limited with prices remaining around the USD 111k level.

NOTABLE ASIA-PAC HEADLINES

- Philippine Central Bank Governor said they are looking at cutting holdings of US Treasuries, while he added they are looking at two more rate cuts which would not necessarily be consecutive and noted that a rate cut is on the table for June.

DATA RECAP

- Japanese National CPI YY (Apr) 3.6% vs Exp. 3.6% (Prev. 3.6%)

- Japanese National CPI Ex. Fresh Food YY (Apr) 3.5% vs Exp. 3.4% (Prev. 3.2%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Apr) 3.0% vs Exp. 3.0% (Prev. 2.9%)

- New Zealand Retail Sales QQ (Q1) 0.8% vs. Exp. 0.7% (Prev. 0.9%)

- New Zealand Retail Sales YY (Q1) 0.7% vs. Exp. 0.0% (Prev. 0.2%)

GEOPOLITICS

MIDDLE EAST

- White House said US President Trump spoke with Israeli PM Netanyahu in which they discussed a potential deal with Iran and Trump believes things are moving in the right direction.

- Israeli PM's office said PM Netanyahu and US President Trump discussed the war in Gaza, while Trump expressed support to secure the release of all hostages, to bring about the elimination of Hamas, and to advance the Trump plan. Furthermore, Trump agreed to ensure that Iran does not obtain nuclear weapons, while it was reported that Netanyahu said he is ready for a temporary ceasefire in Gaza to secure the release of hostages.

- Iranian Foreign Minister Araghchi said if the US wants to end Iranian uranium enrichment then there will be no nuclear deal and that the idea of a uranium enrichment consortium is not bad, but it will not replace enrichment on Iranian soil. Furthermore, he said the 2015 nuclear deal is not dead yet but cannot be revived, while he added that they have the capability to build a nuclear weapon, but don't have the will to do so.

RUSSIA-UKRAINE

- G7 Joint Communique stated if a Russia/Ukraine ceasefire is not agreed upon, they will continue to explore all possible options, including ramping up sanctions, while it underscored the need to address excessive imbalances and strengthen macro fundamentals, given potential global spillovers.

OTHER

- US considers withdrawing thousands of troops from South Korea, according to WSJ. However, South Korea's Defence Ministry later stated that South Korea and the US have not discussed the withdrawal of US troops in Korea.

- Taiwan’s military plans new drone units in preparation for a potential China invasion, according to WSJ.

DATA RECAP

- UK GfK Consumer Confidence (May) -20.0 vs. Exp. -22.0 (Prev. -23.0)