US Market Open: USD continues to slip while Bonds edge higher awaiting Fed speak; Trump is pushing the EU to cut tariffs or face extra duties

23 May 2025, 11:09 by Newsquawk Desk

- US President Trump is pushing the EU to cut tariffs or face extra duties with US negotiators to tell Brussels they expect unilateral concessions, according to FT.

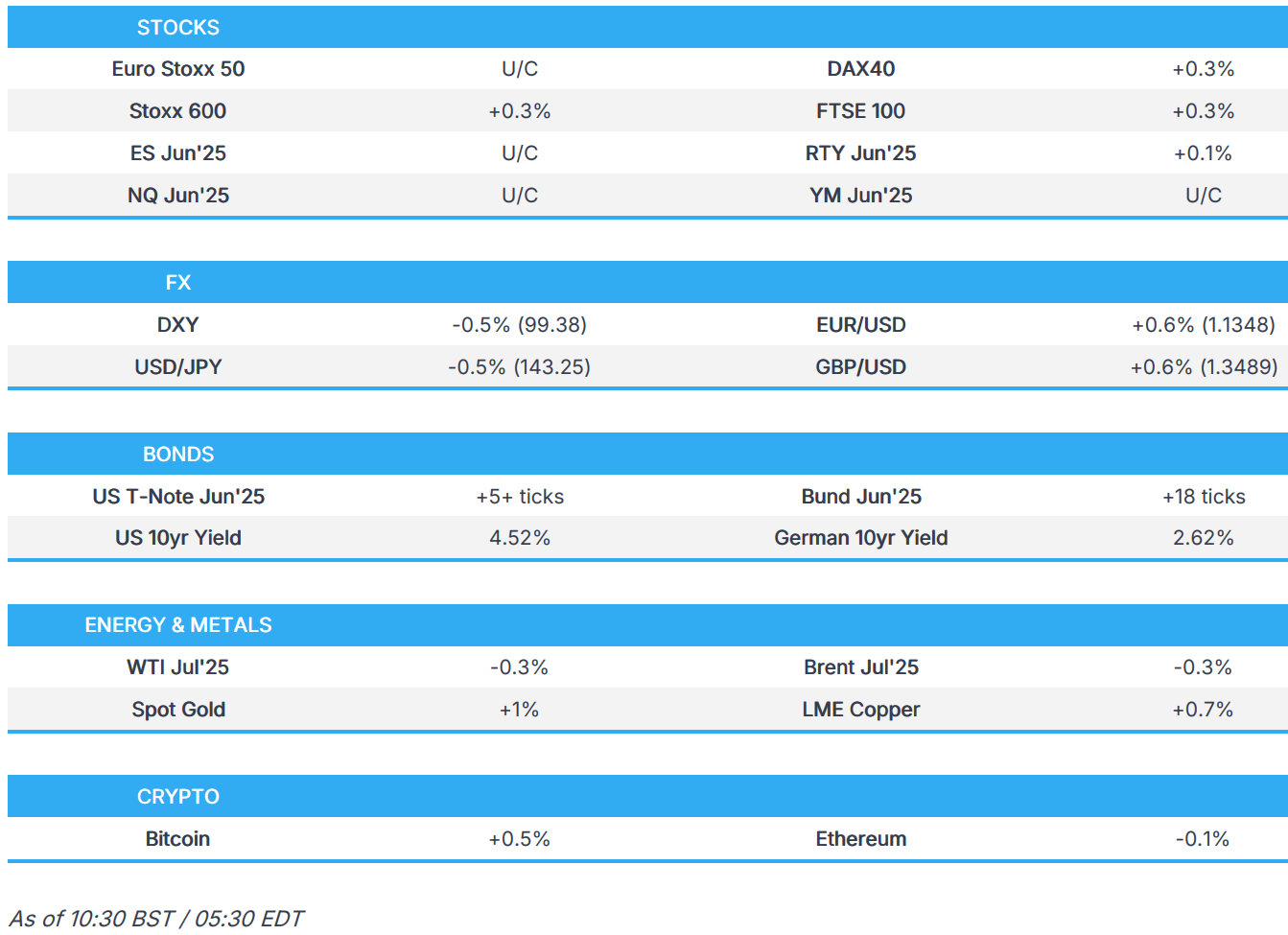

- European and US equity futures are trading mixed and generally reside on either side of the unchanged mark.

- USD shunned once again after Thursday’s attempted bounce; JPY benefits from hot core inflation data overnight; GBP little moved to firmer-than-expected Retail Sales.

- Bonds are higher as USTs look to claw back recent losses; some downside in Bunds following German GDP but proved fleeting.

- Crude remains subdued whilst metals benefit from the softer Dollar ahead of US-Iran talks at 12:00 BST / 07:00 EDT.

- Looking ahead, Canadian Retail Sales, Speakers including ECB’s Schnabel, BoE’s Pill, Fed’s Musalem & Cook.

TARIFFS/TRADE

- US Deputy Secretary of State Landau spoke with Chinese Vice Foreign Minister Ma on Thursday and acknowledged the importance of the bilateral relationship to the people of both countries, while they discussed a wide range of issues of mutual interest and agreed on the importance of keeping open lines of communication.

- US President Trump is pushing the EU to cut tariffs or face extra duties with US negotiators to tell Brussels they expect unilateral concessions, while USTR Greer is preparing to tell EU counterpart Sefcovic that recent "explanatory note" falls short of US expectations, according to FT.

- Japanese PM Ishiba said he held a call with US President Trump in which they discussed tariffs, diplomacy and security, while there might be an occasion where he visits the US for in-person talks with Trump. Furthermore, Ishiba said there are no changes to Japan's stance on US tariffs and demand for the elimination of tariffs, nor to Japan's policy of talking with the US on creating US jobs.

- Japan’s chief tariff negotiator Akazawa reiterated there is no change to stance on requesting elimination of US tariffs, but noted they aim to reach an agreement, while he plans to visit the US around May 30th for the fourth round of trade talks, according to sources cited by Reuters.

- Japan is to reportedly propose investments by Nippon Steel (5401 JT) in tariff talks with the US, according to NHK.

EUROPEAN TRADE

EQUITIES

- European bourses opened incrementally firmer and trudged higher throughout the morning - though more recently, some downside has been seen to display a mixed picture in Europe.

- European sectors opened without a clear bias, but have since moved to a strong positive direction. Basic Resources tops the pile, joined closely by Travel & Leisure and then Healthcare. Retail lags.

- US equity futures are flat/modestly firmer, following similar price action seen in Europe. Docket ahead is lacking in terms of Tier 1 data, but the focus will be on Fed speak from Musalem and Cook.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- This week's downtrend for the USD has resumed. For today's session, the calendar is light in terms of tier 1 data but Fed's Goolsbee, Musalem, Schmid and Cook are all due on the speaker slate. DXY has just slipped below the bottom end of Thursday's 99.44-100.11 range.

- EUR is capitalising on the softer USD with EUR/USD back on a 1.13 handle. Today's detailed release of Q1 German GDP exceeded expectations but failed to engineer much in the way of additional support from the EUR given that the beat was attributed to front-loading ahead of expected tariff actions by the Trump admin. On the trade front, the FT has reported that US President Trump is pushing the EU to lower tariffs or face additional duties with US negotiators to tell Brussels they expect unilateral concessions. On the speaker front, ECB dove Stournaras has stated that he sees a June rate cut and then a pause, whilst Rehn has backed a June rate reduction, data permitting. The pair was little moved to the latest ECB Wage Tracker. EUR/USD currently around 1.1337.

- JPY is out-muscling the USD in the wake of hot Japanese core inflation data overnight. ING writes that "Excluding both fresh food and energy, core-core inflation rose to 3.0%, suggesting that underlying inflation will remain above the BoJ's target of 2.0%". On the trade front, Japan’s chief tariff negotiator Akazawa reiterated there is no change to the stance on requesting the elimination of US tariffs. However, he noted they aim to reach an agreement and plans to visit the US around May 30th for the fourth round of trade talks. USD/JPY currently sits within Thursday's 142.80-144.40 range.

- GBP stronger vs. the broadly weaker USD with Cable at its highest level since February 2022 - today's peak at 1.3491. Sentiment for the GBP has been underpinned by a strong showing for UK retail sales in April (M/M 1.2% vs. exp. 0.2%, prev. 0.1%). BoE's Pill is due to speak later in the session, however, he gave quite an extensive explanation over his dissent earlier in the week and therefore is unlikely to add much more that will be of use to markets.

- Antipodeans are both at the top of the G10 leaderboard alongside a pick-up in risk sentiment with newsflow otherwise light.

- PBoC set USD/CNY mid-point at 7.1919 vs exp. 7.2151 (Prev. 7.1903).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are on a firmer footing, venturing as high as 110.03+ with the next target coming via Wednesday's peak at 110.10+. After a soft start to the week on account of the Moody's downgrade and concerns over the deficit impact of Trump's Tax/Spending Reconciliation bill, US paper is attempting to recover off the lows. Fresh US newsflow is relatively light after yesterday's passage of Trump's bill, which will now move to various Senate committees before being debated and voted on by the Senate floor. Today's Fed docket includes remarks from Goolsbee, Musalem, Schmid and Cook.

- German paper is on the front foot and tracking gains in global peers. Downticks from a better-than-expected outturn for German GDP proved to be fleeting with the beat attributed to front-loading ahead of expected tariff actions by the Trump admin. On the trade front, the FT has reported that US President Trump is pushing the EU to lower tariffs or face additional duties with US negotiators to tell Brussels they expect unilateral concessions. Note, USTR Greer and EU Trade Commissioner are set to meet in June. ECB speak and the latest ECB Wage Tracker today has had little impact on Bunds. Jun'25 Bund is currently sitting just above Thursday's best at 130.00 but down from its earlier session peak at 130.28.

- Gilts are higher despite a strong showing for UK retail sales in April (M/M 1.2% vs. exp. 0.2%, prev. 0.1%). BoE's Pill is due to speak later in the session, however, he gave quite an extensive explanation over his dissent earlier in the week and therefore is unlikely to add much more of note. After hitting a fresh MTD low on Thursday at 90.10, Gilts have ventured as high as 90.73.

- Click for a detailed summary

COMMODITIES

- Another subdued session for the crude complex despite the slide in the dollar and a revision higher in German Q1 GDP, with sentiment capped by Thursday's source reports that OPEC+ members are discussing whether to agree to another output hike of 411k BPD in July. In other news, the US-Iran nuclear talks will be going ahead today from 12:00 BST/ 07:00 EDT, although views heading into the meeting are rather pessimistic, with Iran suggesting any deal which includes zero enrichment will not go ahead. Most recently, the complex has lifted off worst levels but still resides in negative territory.

- Precious metals are mixed with the yellow metal underpinned by the softer dollar and ongoing tariff uncertainty. Spot gold gradually rebounded from yesterday's trough and returned to above the USD 3,300/oz level in APAC hours amid the cautious risk tone. Spot gold currently resides in a USD 3,287.07-3,334.46/oz range.

- Copper futures traded rangebound and were kept afloat alongside the mildly positive sentiment during the Asia-Pacific trade. 3M LME copper remains north of USD 9,500/t in a USD 9,502.80-9,598.95/t range.

- Russia's Arctic LNG 2 plant has shut down its first production train, according to Reuters sources.

- Japan's Steel Industry Head says Japan must urgently take trade measures against rising steel shipments from China.

- Click for a detailed summary

NOTABLE DATA RECAP

- ECB Wage Tracker: Q1 Q/Q 2025 2.38% vs Q4 Q/Q 2024 4.12%.

- UK Retail Sales MM (Apr) 1.2% vs. Exp. 0.2% (Prev. 0.4%, Rev. 0.1%)

- UK Retail Sales YY (Apr) 5.0% vs. Exp. 4.5% (Prev. 2.6%, Rev. 1.9%)

- UK Retail Sales Ex-Fuel YY (Apr) 5.3% vs. Exp. 4.4% (Prev. 3.3%, Rev. 2.6%)

- UK Retail Sales Ex-Fuel MM (Apr) 1.3% vs. Exp. 0.3% (Prev. 0.5%, Rev. 0.2%)

- German GDP Detailed QQ SA (Q1) 0.4% vs. Exp. 0.2% (Prev. 0.2%)

- German GDP Detailed YY NSA (Q1) -0.2% vs. Exp. -0.4% (Prev. -0.4%)

- French Consumer Confidence (May) 88.0 vs. Exp. 93.0 (Prev. 92.0, Rev. 91)

- Swedish Unemployment Rate (Apr) 8.9% (Prev. 8.5%)

- Swedish Total Employment (Apr) 5.261M (Prev. 5.24M)

- Swedish Unemployment Rate SA (Apr) 8.5% vs. Exp. 8.7% (Prev. 8.1%)

NOTABLE EUROPEAN HEADLINES

- ECB's Rehn said a June rate cut is appropriate if backed by data, via Kathimerini.

- ECB's Stournaras said he sees a June rate cut and then a pause, via Kathimerini

- EU confirms it will soon delay bank trading rules by one year, according to Bloomberg.

- UK's OFGEM says from 1 July to 30 September 2025 price for energy for the typical household will go down by 7% to GBP 1,720/yr; this is 9% higher than the price cap set for the same period last year.

NOTABLE US HEADLINES

- US President Trump is to sign orders to boost nuclear power as soon as Friday and will invoke a wartime act over US uranium independence, according to sources.

- BofA Flow Show: USD 1.8bln outflows from US equities, USD 4bln from Japanese equities, inflows into European equities for a six week, EM saw largest inflow in 14 weeks

GEOPOLITICS

- Russian Foreign Minister says work on the memorandum leading to a ceasefire in Ukraine is at an advanced stage; will hold a second round of direct negotiations with Ukraine.

- Iran-US nuclear talks reportedly set to begin at 12:00 BST/07:00 EDT, according to IRNA.

- "Member of the Security Committee of the Iranian Parliament: The fifth round of negotiations will not reach a result", according to Al Arabiya.

CRYPTO

- Bitcoin takes a breather following recent advances, still holding above USD 110k.

APAC TRADE

- APAC stocks were mostly in the green albeit with gains in the region capped following the indecisive performance stateside where participants digested PMI data and the House approved US President Trump's tax bill to send it to the Senate.

- ASX 200 eked mild gains as the strength in real estate, energy, tech, telecoms and financials was partially offset by losses in defensives and miners.

- Nikkei 225 returned to above the 37,000 level with the index unfazed by the firmer-than-expected Core CPI data, while Japanese Economy Minister Akazawa is visiting the US for a third round of talks and is reportedly planning to visit again late next week for a fourth round of discussions. Furthermore, Japanese PM Ishiba had a call with US President Trump and discussed US tariffs, diplomacy and security although no major developments were announced.

- Hang Seng and Shanghai Comp gained but with advances in the mainland limited in the absence of any fresh significant macro drivers, although there were some talks between the US and China at a deputy ministerial level, in which the US Deputy Secretary of State spoke with his Chinese counterpart on Thursday and discussed a wide range of issues of mutual interest. The two agreed on the importance of keeping open lines of communication.

NOTABLE ASIA-PAC HEADLINES

- China reportedly lowers deposit rate ceiling to protect banks' interest margins, according to Reuters sources.

- Philippine Central Bank Governor said they are looking at cutting holdings of US Treasuries, while he added they are looking at two more rate cuts which would not necessarily be consecutive and noted that a rate cut is on the table for June.

- Indian economic growth is on track, according to Reuters sources.

- Fast Retailing (9983 JT) 6M (JPY): Net Profit 233.57bln, +19.2% Y/Y, Op. Profit 304.22bln, +18.3% Y/Y; affirms FY24/25 outlook.

- China Vice Premier He Lifeng says China's economy continues to show an upward trend; growth potential of the primary, secondary and tertiary industries are being released, via Xinhua; The economy has shown great resilience and vitality

DATA RECAP

- Japanese National CPI YY (Apr) 3.6% vs Exp. 3.6% (Prev. 3.6%)

- Japanese National CPI Ex. Fresh Food YY (Apr) 3.5% vs Exp. 3.4% (Prev. 3.2%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Apr) 3.0% vs Exp. 3.0% (Prev. 2.9%)

- New Zealand Retail Sales QQ (Q1) 0.8% vs. Exp. 0.7% (Prev. 0.9%)

- New Zealand Retail Sales YY (Q1) 0.7% vs. Exp. 0.0% (Prev. 0.2%)