Europe Market Open: Firmer Wall St. handover, now awaiting NVIDIA metrics; JGBs hit by a mixed 40yr

28 May 2025, 06:50 by Newsquawk Desk

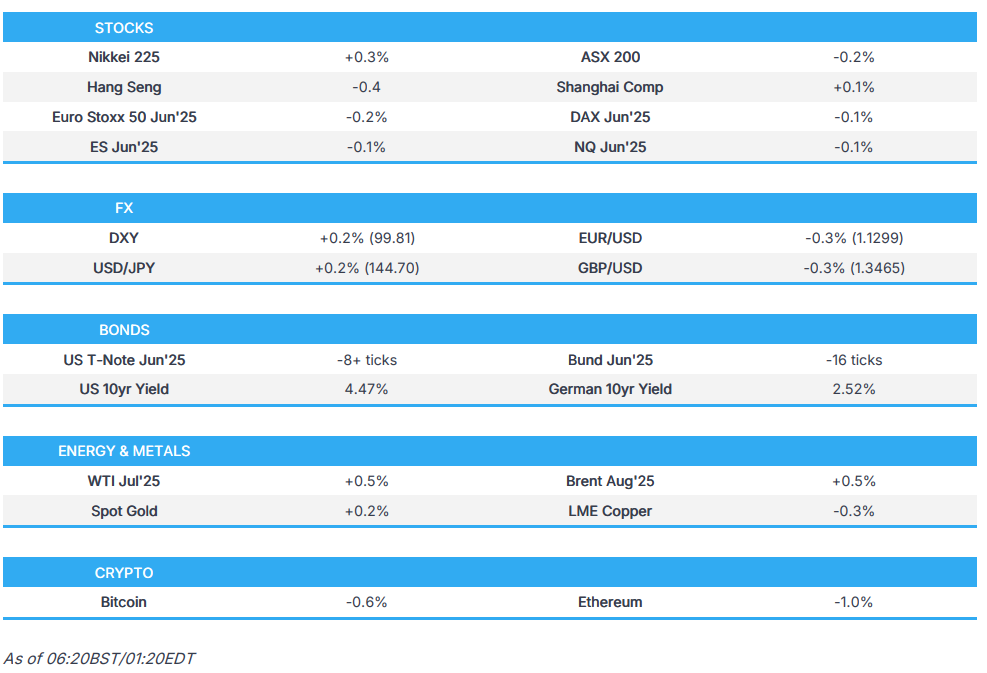

- APAC stocks mostly higher following the Wall St. strength, futures since off best awaiting NVIDIA earnings

- US President Trump says Canada joining the Golden Dome is free if they are the 51st State, adding "They are considering the offer!"

- DXY continues to pick up, EUR/USD tests 1.13 to the downside & Cable lost 1.35, JPY choppy

- RBNZ cut as expected, but refrained from overtly dovish language

- JGBs came under pressure after a somewhat mixed 40yr auction, USTs & EGBs also soft

- Crude marginally firmer ahead of OPEC, gold indecisive, base peers lacklustre

- Looking ahead, highlights include German Unemployment Rate, ECB SCE, US Richmond Fed Index, FOMC Minutes, OPEC+/JMMC, Speakers including Fed’s Williams, Kashkari & BoE’s Pill, Supply from UK, Germany & US, Earnings from NVIDIA, Salesforce, Abercrombie & Macy's.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks rallied on Tuesday after returning from the long weekend as markets reacted to US President Trump delaying his 50% tariff threat to the EU to 9th July from 1st June, which will allow more time for negotiations, while the heightened risk appetite was also facilitated by a decline in yields and a sharp rebound in US Consumer Confidence which topped even the most optimistic analysts' estimates.

- SPX +1.90% at 5,913, NDX +2.14% at 21,364, DJI +1.67% at 42,297, RUT +2.33% at 2,087.

- Click here for a detailed summary.

TARIFFS/TRADE

- Japan is said to propose buying US-made semiconductor chips as part of US trade talks.

- Mexico's Agricultural Ministry said Mexico and the US agreed on measures targeted at reopening Mexican cattle exports to the US and the USDA mission is to travel to Mexico in the coming days.

- Brazil's government decided to renew trade defence measures in the steel sector with Brazil's trade body maintaining a 25% tariff on 19 steel products and extended the measure to four other products, while renewed tariffs on steel products are valid for 12 months.

NOTABLE HEADLINES

- Fed's Williams (voter) said inflation expectations are well anchored and he wants to avoid inflation becoming highly persistent as that could become permanent, while he added that a way to avoid that is to respond relatively strongly when inflation begins to deviate from target and noted they have to be very aware that inflation expectations could shift in ways that could be detrimental.

- US Financial Housing Finance Agency head Pulte posted on X that Fed Chair Powell should lower interest rates now.

- US President Trump posted that he is working on taking Fannie Mae and Freddie Mac public but wants to be clear that the government will keep its implicit guarantees.

- US President Trump posted that he told Canada, which wants to be part of the Golden Dome System, it will cost USD 61bln if they remain a separate nation, but will cost zero if they become our 51st State, while he added "They are considering the offer!"

- A new highly infectious COVID strain that has led to a spike in hospitalisations in China has now been detected in the US, including cases in New York City, according to a report in NY Post citing the CDC.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher following the rally on Wall St where sentiment was underpinned by strong consumer confidence and as US participants took their first opportunity to react to President Trump's tariff delay for the EU.

- ASX 200 lacked conviction after mixed data including firmer-than-expected CPI data and disappointing Construction Work.

- Nikkei 225 gapped higher at the open following the recent currency weakness and the drop in super-long JGB yields.

- Hang Seng and Shanghai Comp traded indecisively after mixed earnings releases and a lack of major fresh macro drivers.

- US equity futures traded rangebound and took a breather after the prior day's rally and with NVIDIA's earnings on the horizon.

- European equity futures indicate a slightly lower cash market open with Euro Stoxx 50 futures down 0.2% after the cash market closed with gains of 0.4% on Tuesday.

FX

- DXY added on to the prior day's spoils after strengthening against all G10 peers following several data releases including US Consumer Confidence which surpassed the top end of the forecast range, while the recent comments from Fed officials did little to influence price action ahead of today's FOMC Minutes with Williams noting inflation expectations are well anchored and he wants to avoid inflation becoming highly persistent.

- EUR/USD tested the 1.1300 level to the downside amid the firmer buck, while there were comments from ECB's Lane who stated they will pay close attention to the data in the next meetings and if they see signs of further falling inflation, they will respond with further interest rate cuts but added the range of discussion is not that wide and that no one is talking about dramatic rate cuts.

- GBP/USD extended on its declines and breached through near-term support at the 1.3500 level to the downside due to the dollar strength and with a lack of UK-specific newsflow.

- USD/JPY was choppy after rallying yesterday alongside the broad dollar strength and a drop in super-long JGB yields owing to reports that Japan is considering reducing such issuances.

- Antipodeans mildly diverged with AUD/USD contained amid mixed data releases and with NZD/USD supported after the RBNZ delivered its 6th consecutive rate cut as widely expected, but refrained from overtly dovish language, while RBNZ Governor Hawkesby stated during the press conference that the key message is they have come a long way and are well placed to respond to developments but are not pre-programmed on moves now.

- PBoC set USD/CNY mid-point at 7.1894 vs exp. 7.1996 (Prev. 7.1876).

- SNB Chair Schlegel said cannot rule out negative inflation in Switzerland in the coming months and price stability is the central contribution a central bank can make. Schlegel stated that trade uncertainties are currently enormous, related to tariffs from the US, while he added that focus is not on the current rate of inflation, but price stability over the mid-term.

FIXED INCOME

- 10yr UST futures pulled back after recent bull flattening with demand constrained as supply and the FOMC Minutes loomed.

- Bund futures retreated beneath the 131.00 level with German unemployment data and Bund issuances scheduled today.

- 10yr JGB futures retreated as super-long end yields regained some composure after yesterday's drop which was triggered by speculation that the BoJ could reduce issuances in the super-long end, while further selling in JGBs was seen following the somewhat mixed 40yr auction which saw softer demand but higher accepted prices than the last auction in March.

COMMODITIES

- Crude futures mildly extended its rebound from the prior day's lows albeit with the upside contained ahead of the OPEC+ talks beginning with the JMMC on Wednesday, while this week's inventory reports are delayed by a day due to the recent holiday.

- US issued narrow authorisation for Chevron (CVX) to keep joint venture stakes in Venezuela although the new authorisation does not allow oil production operations or exports, according to the sources cited by Reuters.

- DoE is reportedly weighing emergency authority to keep coal plants running, according to Axios.

- Spot gold traded indecisively and struggled to sustain the USD 3,300/oz status amid a firmer dollar.

- Copper futures remained lacklustre and resumed the prior day's declines with price action not helped by the lack of conviction in its largest buyer.

CRYPTO

- Bitcoin traded choppy and briefly returned to the USD 109k level before paring its gains.

- US Senator Lummis said the bill to buy 1mln Bitcoin will hit the Senate floor next week, while she added that “President Trump supports the bill” and the Senate will shift focus to creating a Strategic Bitcoin Reserve after the stablecoin vote.

NOTABLE ASIA-PAC HEADLINES

- RBNZ cut the OCR by 25bps to 3.25%, as expected, while it stated inflation is within the target band but core inflation is declining and that it is well placed to respond to domestic and international developments. RBNZ said both tariffs and policy uncertainties overseas are to moderate recovery, although conditions are consistent with inflation returning to the mid-point of the 1-3% target band over the medium term. In terms of the projections, it lowered its forecasts for the OCR across the projection horizon with the OCR seen at 3.12% in September 2025 (prev. 3.23%), 2.87% in June 2026 (prev. 3.1%) and 2.9% in September 2026 (prev. 3.1%). Furthermore, the minutes from the meeting stated the Committee discussed the options of keeping the OCR on hold at 3.50% or reducing it to 3.25% and the Committee noted that the full economic effects of cuts in the OCR since August 2024 are yet to be fully realised, while it also revealed that the decision to cut was made by a majority of 5 votes to 1.

- RBNZ Governor Hawkesby said the decision to hold a vote on rates was a healthy sign and not unusual at turning points, while he stated they did form a consensus projection for the cash rate, but added there is a high degree of uncertainty and central projections are wide enough for them to not have a bias either way in terms of what the next step is at the next meeting. Furthermore, he stated the key message is that they have come a long way and are well placed to respond to developments but are not pre-programmed on moves now.

- BoJ Governor Ueda said many tariff negotiations, including those between the US and Japan, are still ongoing, so the outlook remains uncertain and it remains unclear how tariff policies would affect the world and Japan's economy Ueda said they will carefully examine data and will closely monitor the bond market, as well as be mindful that large swings in super long bond yields could impact other yields.

DATA RECAP

- Australian Weighted CPI YY (Apr) 2.4% vs. Exp. 2.3% (Prev. 2.4%)

- Australian CPI Annual Trimmed Mean YY (Apr) 2.80% (Prev. 2.70%)

- Australian Construction Work Done (Q1) 0.0% vs. Exp. 0.5% (Prev. 0.5%)

GEOPOLITICS

RUSSIA-UKRAINE

- US President Trump said what Russian President Putin does not realise, is that if it was not for him, lots of really bad things would have already happened to Russia, while he added that Putin is playing with fire.

- Russia's Medvedev said regarding US President Trump's comment that Russian President Putin is "playing with fire" that "I only know of one really bad thing-WWIII".

- Russian Defence Ministry said air defence units destroyed and intercepted 112 Ukrainian drones over a three-hour period, while Moscow's Mayor said Russian air defence units repelled six Ukrainian drones headed for the capital.

EU/UK

NOTABLE HEADLINES

- ECB's Lane said the central bank's task to bring inflation back to 2% is mostly completed and inflation is to remain close to 2% in the coming months, while he added that services inflation is still too high. Lane also stated they will pay close attention to the data in the next meetings and if they see signs of further falling inflation, they will respond with further interest rate cuts, but noted the range of discussion is not that wide and that no one is talking about dramatic rate cuts.