US Market Open: USD steady & US equity futures lower awaiting NVIDIA & FOMC Minutes, NZD bid post-RBNZ

28 May 2025, 11:05 by Newsquawk Desk

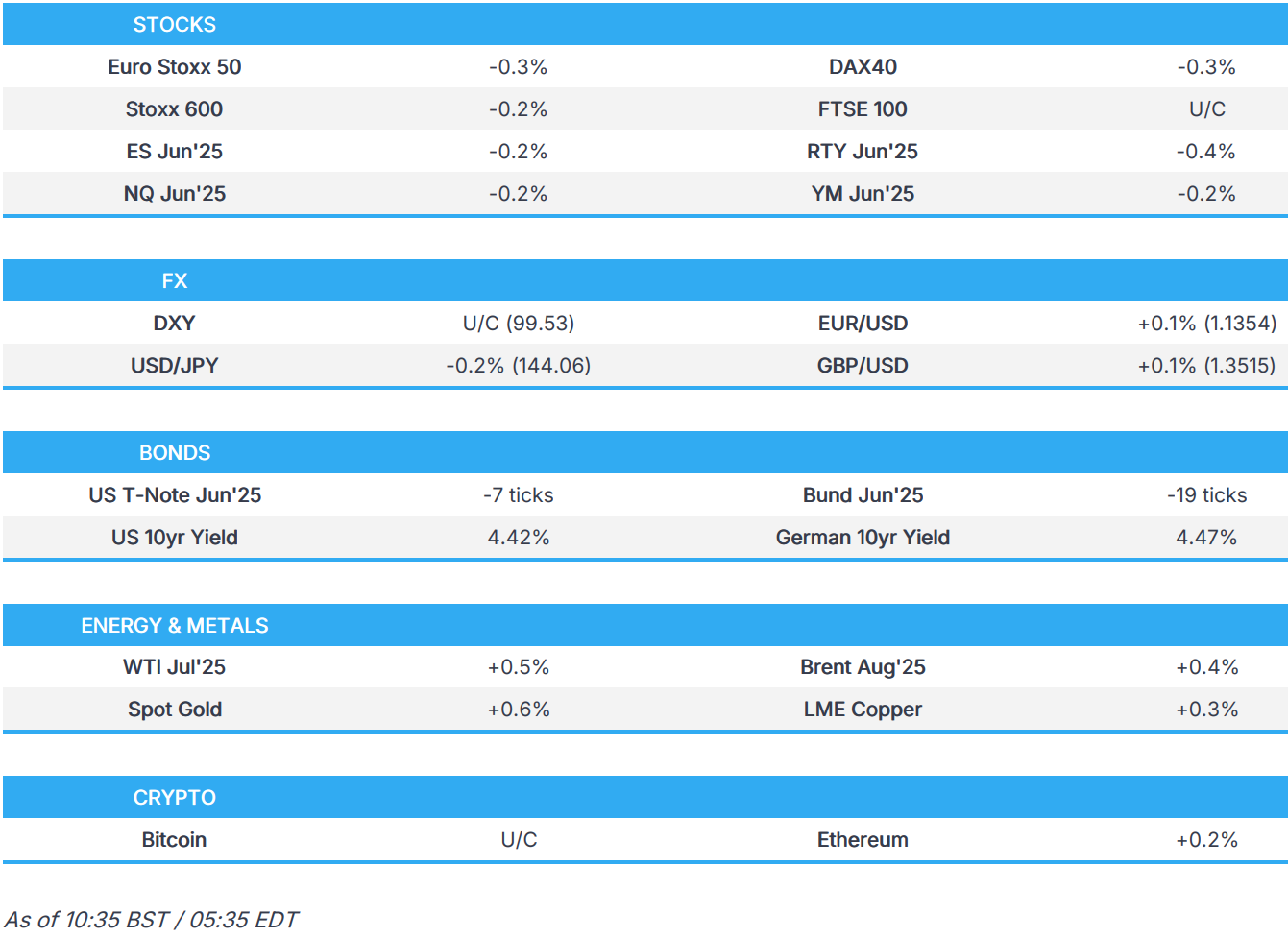

- European bourses opened mixed but now in the red, US futures also lower ahead of NVIDIA results.

- USD is fractionally extending on Tuesday’s upside, Kiwi leads after RBNZ delivers a hawkish cut.

- 40yr JGB auction weighs, awaiting US supply & FOMC Minutes.

- Energy markets await JMMC/OPEC+; Metals tread water.

- US President Trump says Canada joining the Golden Dome is free if they are the 51st State, adding "They are considering the offer!".

- Looking ahead, US Richmond Fed Index, FOMC Minutes, OPEC+/JMMC, Speakers including BoE’s Pill, Supply from the US, Earnings from NVIDIA, Salesforce, Abercrombie & Macy's.

TARIFFS/TRADE

- Japan is said to propose buying US-made semiconductor chips as part of US trade talks.

- Mexico's Agricultural Ministry said Mexico and the US agreed on measures targeted at reopening Mexican cattle exports to the US and the USDA mission is to travel to Mexico in the coming days.

- Brazil's government decided to renew trade defence measures in the steel sector with Brazil's trade body maintaining a 25% tariff on 19 steel products and extended the measure to four other products, while renewed tariffs on steel products are valid for 12 months.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.2%) opened around the unchanged mark but sentiment has since slipped to display a mostly negative picture in Europe. Nothing specific for the recent downside, but perhaps as focus turns to FOMC Minutes and NVIDIA results thereafter.

- European sectors are mixed, in-fitting with the indecisive risk-tone. Real Estate leads, with UK homebuilders boosting the sectors amid reports that the UK Government will ease planning hurdles for small housebuilders. Retail posts very narrow losses, with pressure stemming from post-earning downside in Kingfisher (-2.9%).

- US equity futures are very modestly in negative territory, taking a breather following the hefty gains seen in the prior session. NVIDIA (-0.1%) earnings will be due after-hours; US Richmond Fed Index, Dallas Survey and the FOMC Minutes also on the docket.

- Fashion retailer Shein reportedly working towards a Hong Kong listing after London IPO plans stalled; will file prospectus in the coming weeks; plans to IPO within this year, according to Reuters sources.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is marginally extending on Tuesday's upside which was triggered by optimism on the trade front and a strong Consumer Confidence release. Newsflow has been light, but docket ahead will include US Richmond Fed Index, FOMC Minutes and NVIDIA results which could impact sentiment.

- Note, Citi's month-end rebalancing model points to a net selling of USD vs. all of the major currencies with the strongest signals vs. JPY and GBP.

- EUR has seen a slight extension of losses vs. the USD after printing a MTD high on Monday at 1.1419. Focus remains on the trade front given the slew of headlines across recent sessions which has seen the EU seemingly increasing efforts to reach a deal with the US after President Trump threatened an escalation last week. The ECB Consumer Expectations Survey for April showed the 12-month ahead inflation expectation rise to 3.1% from 2.9% and the 12-month ahead growth forecast cut to -1.9% from -1.2%. EUR/USD briefly slipped onto a 1.12 handle with a session trough at 1.1296.

- JPY is fractionally firmer vs. the USD after a soft showing yesterday on account of a strong USD and declines in long-end Japanese yields after reports that Japan's MoF could trim the issuance of super long debt. It's worth noting that the 40yr JGB auction overnight was weak. Elsewhere, the latest reports note that Japan is said to propose buying US-made semiconductor chips as part of US trade talks. USD/JPY had ventured as high as 144.76 overnight but has since pulled back to levels closer to the 144 mark.

- GBP flat vs. the USD in what has been a week lacking in major updates from the UK and could well remain the case. BoE Chief Economist is due to speak at 16:00BST, however, the text release will be from a speech delivered on 22nd May. Cable is currently lingering just above the 1.35 mark after hitting a multi-year high on Monday at 1.3593.

- NZD is top of the G10 leaderboard post-RBNZ. As expected, the bank delivered a 25bps rate cut, however, the decision was subject to hawkish dissent from one member. Furthermore, whilst the bank lowered its OCR forecasts, ING notes that they don't fully signal that rates will be trimmed to 2.75%.

- PBoC set USD/CNY mid-point at 7.1894 vs exp. 7.1996 (Prev. 7.1876).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- JGBs pulled back at the start of APAC trade after the marked upside seen on Tuesday after reporting around the MOF. An acceleration of this occurred after the highly anticipated 40yr JGB auction. Overall, the outing was a disappointment, featuring an elevated yield and weak cover.

- USTs fell alongside JGBs after the 40yr auction results. Pressure which took USTs to a 110-07+ base and essentially eroded the strength seen after the US’ robust 2yr tap. The results of this helped to drive the complex to a 110-18 high. Ahead, the docket features a 5yr auction, FOMC Minutes, the latest executive order signing by POTUS and NVIDIA earnings.

- Bunds hit an overnight in tandem with JGBs. Since, have been a little choppy in a slim 130.73 to 131.00 band, which is just below Tuesday’s 130.75 base. Modest bounce on cooler-than-expected German import prices this morning, the series posted the largest M/M decline (-1.7%) since April 2020, driven primarily by energy prices. No significant move to the ECB SCE which saw a rise in 12-month inflation expectations and a cut in growth expectations. German auction had little impact on Bunds.

- Gilts opened lower by a handful of ticks, acknowledging the JGB auction. Action since has been slightly bearish, in-fitting with above peers, but minimal in nature as UK specifics have been largely non-existent.

- UK DMO announces the syndicated launch of a new I/L 2038 Gilt, to launch in the week of June 9th.

- Demand for Spain's new 10yr syndicated bond exceeds EUR 105bln, according to the Lead Manager.

- Orders for the new BTP Italia reach EUR 4bln, via Reuters citing bourse data.

- UK sells GBP 2.75bln 0.875% 2033 Green Gilt: b/c 3.56x (prev. 3.1x), avg. yield 4.511% (prev. 4.473%) & tail 0.3bps (prev. 0.7bps)

- Click for a detailed summary

COMMODITIES

- Choppy trade once again in the crude complex as the clock ticks down to today's JMMC and OPEC+ meetings; sources suggest 09:00ET or 09:30ET. Market focus will largely be on the Saturday meeting, assuming no policy decision is front-run and announced at the Wednesday meeting.

- Modest upward tilt in precious metals but with newsflow quiet in the run-up to the FOMC minutes, with trade updates also on the lighter side. The yellow metal currently resides in a USD 3,291.70-3,323.89/oz range.

- Modest upward tilt across base metals, albeit with the breadth of the market particularly narrow amid a lack of macro newsflow and ahead of the FOMC minutes. Copper futures overnight remained lacklustre and resumed the prior day's declines with price action not helped by the lack of conviction in its largest buyer. 3M LME copper remains north of USD 9,500/t in a USD 9,567.00-9,651.45/t.

- US issued narrow authorisation for Chevron (CVX) to keep joint venture stakes in Venezuela although the new authorisation does not allow oil production operations or exports, according to the sources cited by Reuters.

- DoE is reportedly weighing emergency authority to keep coal plants running, according to Axios.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Import Prices MM (Apr) -1.7% vs. Exp. -1.4% (Prev. -1.0%); YY (Apr) -0.4% vs. Exp. 0.1% (Prev. 2.1%)

- French Non-Farm Payrolls Rev (Q1) -0.1%; Producer Prices MM (Apr) -4.3% (Prev. -0.6%, Rev. -0.5%); GDP QQ Final (Q1) 0.1% vs. Exp. 0.1% (Prev. 0.1%)

- German Unemployment Change SA (May) 34.0k vs. Exp. 10.0k (Prev. 4.0k); Unemployment Rate SA (May) 6.3% vs. Exp. 6.3% (Prev. 6.3%); Unemployment Total SA (May) 2963.0M (Prev. 2.922M); Unemployment Total NSA (May) 2919.0M (Prev. 2.932M)

NOTABLE EUROPEAN HEADLINES

- ECB Consumer Expectations Survey (April): See inflation in next 12 months at 3.1% (prev. 2.9%); 3y ahead sees 2.5% (prev. 2.5%); Economic growth expectations for the next 12 months -1.9% (prev. -1.2%)

- ECB's Lagarde has reportedly discussed stepping down as ECB President early in order to chair the WEF, via FT citing WEF founder Schwab. ECB spokesperson said ECB President Lagarde is determined to complete her term at the ECB.

NOTABLE US HEADLINES

- Fed's Williams (voter) said inflation expectations are well anchored and he wants to avoid inflation becoming highly persistent as that could become permanent, while he added that a way to avoid that is to respond relatively strongly when inflation begins to deviate from target and noted they have to be very aware that inflation expectations could shift in ways that could be detrimental.

- US Financial Housing Finance Agency head Pulte posted on X that Fed Chair Powell should lower interest rates now.

- US President Trump posted that he is working on taking Fannie Mae and Freddie Mac public but wants to be clear that the government will keep its implicit guarantees.

- US President Trump posted that he told Canada, which wants to be part of the Golden Dome System, it will cost USD 61bln if they remain a separate nation, but will cost zero if they become our 51st State, while he added "They are considering the offer!"

GEOPOLITICS

- Russian Foreign Minister Lavrov told International Security Conference that they will announce the next round of direct talks with Ukraine in the near future.

- Ukrainian President Zelensky says he will attend the G7. Wants USD 30bln to fully fund Ukraine's defence manufacturing capacity. Russia offered Belarus as a location for talks, this is not possible for Ukraine. Most realistic places for a peace agreement to be attained are Switzerland, Turkey & Vatican.

- Russian Defence Ministry said air defence units destroyed and intercepted 112 Ukrainian drones over a three-hour period, while Moscow's Mayor said Russian air defence units repelled six Ukrainian drones headed for the capital.

- Israeli officials told US counterparts in April that they were preparing to attack nuclear sites in Iran, according to NYT. Subsequently, Israeli PM Netanyahu's office denies New York Times report of attack on Iran: "Fake news", according to Kann News.

- Iranian Nuclear Chief Eslami says, in the scenario of a US nuclear deal, then Iran could allow US inspectors as part of IAEA teams.

- German Chancellor Merz will not deliver Taurus to Ukraine, according to Politico Journalist Hans von der Burchard.

CRYPTO

- Bitcoin is incrementally lower and trading just above the USD 109k mark; Ethereum hovers around USD 2.6k.

APAC TRADE

- APAC stocks were mostly higher following the rally on Wall St where sentiment was underpinned by strong consumer confidence and as US participants took their first opportunity to react to President Trump's tariff delay for the EU.

- ASX 200 lacked conviction after mixed data including firmer-than-expected CPI data and disappointing Construction Work.

- Nikkei 225 gapped higher at the open following the recent currency weakness and the drop in super-long JGB yields.

- Hang Seng and Shanghai Comp traded indecisively after mixed earnings releases and a lack of major fresh macro drivers.

NOTABLE ASIA-PAC HEADLINES

- RBNZ cut the OCR by 25bps to 3.25%, as expected, while it stated inflation is within the target band but core inflation is declining and that it is well placed to respond to domestic and international developments. RBNZ said both tariffs and policy uncertainties overseas are to moderate recovery, although conditions are consistent with inflation returning to the mid-point of the 1-3% target band over the medium term. In terms of the projections, it lowered its forecasts for the OCR across the projection horizon with the OCR seen at 3.12% in September 2025 (prev. 3.23%), 2.87% in June 2026 (prev. 3.1%) and 2.9% in September 2026 (prev. 3.1%). Furthermore, the minutes from the meeting stated the Committee discussed the options of keeping the OCR on hold at 3.50% or reducing it to 3.25% and the Committee noted that the full economic effects of cuts in the OCR since August 2024 are yet to be fully realised, while it also revealed that the decision to cut was made by a majority of 5 votes to 1.

- RBNZ Governor Hawkesby said the decision to hold a vote on rates was a healthy sign and not unusual at turning points, while he stated they did form a consensus projection for the cash rate, but added there is a high degree of uncertainty and central projections are wide enough for them to not have a bias either way in terms of what the next step is at the next meeting. Furthermore, he stated the key message is that they have come a long way and are well placed to respond to developments but are not pre-programmed on moves now.

- BoJ Governor Ueda said many tariff negotiations, including those between the US and Japan, are still ongoing, so the outlook remains uncertain and it remains unclear how tariff policies would affect the world and Japan's economy Ueda said they will carefully examine data and will closely monitor the bond market, as well as be mindful that large swings in super long bond yields could impact other yields.

DATA RECAP

- Australian Weighted CPI YY (Apr) 2.4% vs. Exp. 2.3% (Prev. 2.4%)

- Australian CPI Annual Trimmed Mean YY (Apr) 2.80% (Prev. 2.70%)

- Australian Construction Work Done (Q1) 0.0% vs. Exp. 0.5% (Prev. 0.5%)