US Market Open: Sentiment boosted after NVIDIA results & CIT blocking Liberation Day tariffs

29 May 2025, 11:20 by Newsquawk Desk

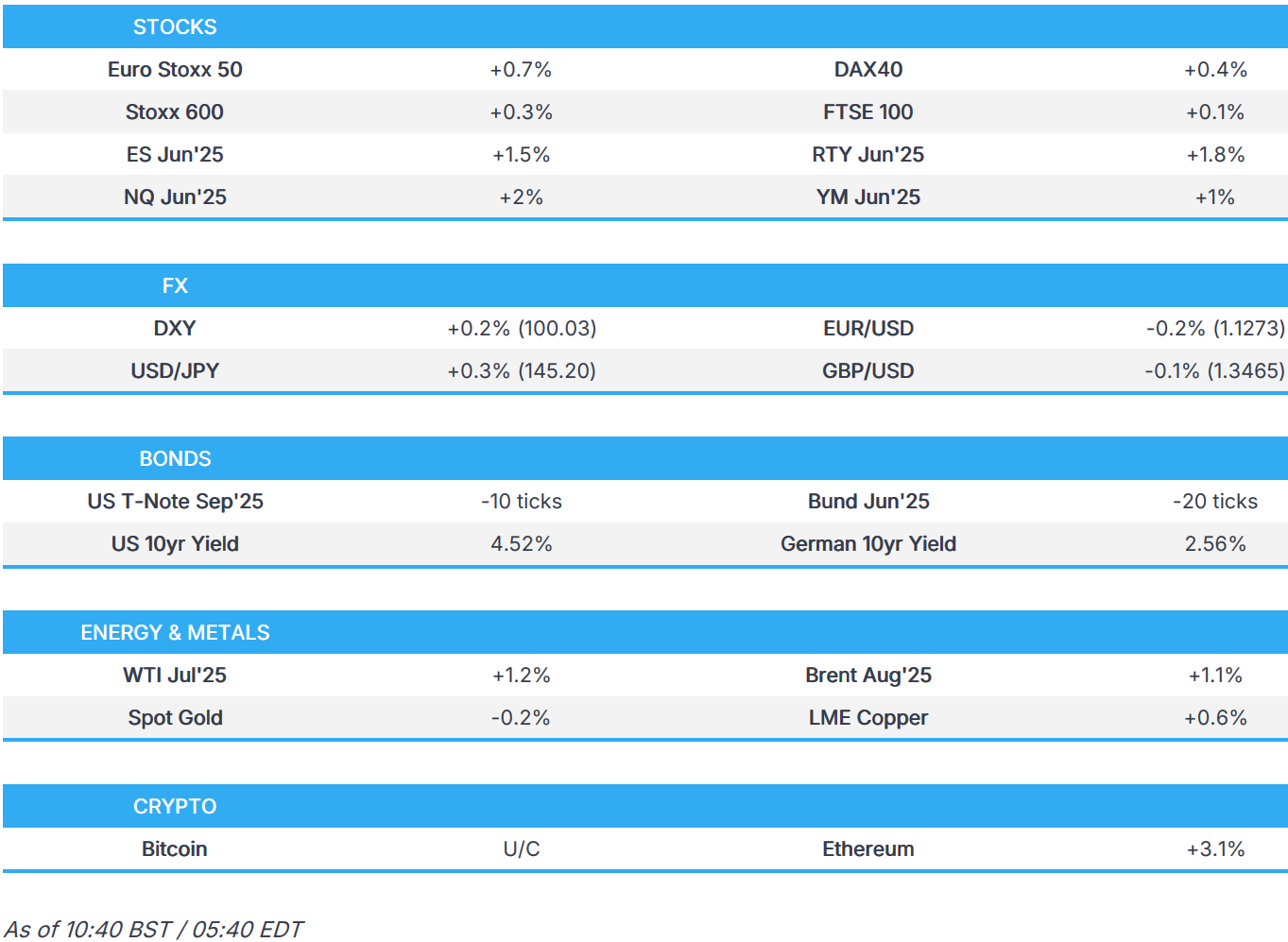

- Stocks boosted after NVIDIA's earnings and after the Manhattan-based Court of International Trade blocked President Trump's Liberation Day tariffs.

- NVIDIA (NVDA) shares +6% pre-market following earnings which beat on top and bottom lines despite incurring a USD 4.5bln charge in Q1; Q2 revenue outlook 45.0bln (exp. 46.4bln).

- US President Trump ordered US chip designers to stop selling to China, according to FT; US halts exporting aircraft engine technology and chip software to China, according to NYT.

- DXY firmer & havens broadly lag given the risk tone; USTs/XAU both in the red.

- Looking ahead, Highlights include US GDP 2nd Estimate (Q1), Core PCE Prices (Q1), Jobless Claims, SARB Policy Announcement, Swiss & Scandinavian Holiday, Speakers including Fed’s Barkin, Goolsbee, Kugler & Daly, BoE's Bailey & Breeden, Supply from the US Earnings from Marvell, Costco, Dell, Gap, ULTA, Foot Locker, Best Buy & Kohl's.

TARIFFS/TRADE

-

Manhattan-based Court of International Trade blocked President Trump's Liberation Day tariffs in a ruling related to a case brought on behalf of five small businesses that import goods from other countries. It was also reported that US President Trump's administration filed an appeal following the ruling by the Court of International Trade and the White House stated it is not for unelected judges to decide how to properly address a national emergency.

- Goldman Sachs noted that the ruling on Liberation Day tariffs gives the administration 10 days to halt tariff collection but does not affect sectoral tariffs and the admin can impose across-the-board tariff and country-specific tariffs under other legal authorities.

- US President Trump ordered US chip designers to stop selling to China, according to FT. Trump administration told US companies that offer software used to design semiconductors to stop selling their services to Chinese groups, in the latest attempt to make it harder for China to develop advanced chips. Several people familiar with the move said the Commerce Department told Electronic Design Automation groups, which include Cadence, Synopsys and Siemens EDA, to stop supplying their technology to China and in some cases, the Commerce Department has suspended existing export licenses or imposed additional license requirements while the review is pending.

- US Secretary of State Rubio said the US will begin revoking visas of Chinese students, including those with connections to the Chinese Communist Party or studying in critical fields and it will also revise visa criteria to enhance scrutiny of all future visa applications from the People's Republic of China and Hong Kong.

- US halts exporting aircraft engine technology and chip software to China, according to NYT.

- UK is seeking to accelerate the implementation of trade deals with the US when Business Secretary Reynolds meets with US Commerce Secretary Lutnick next week, according to FT.

- Japanese PM Ishiba said to be arranging call with US President Trump on Thursday evening.

- Click for analysis on the US CIT ruiling

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.3%) opened with a strong positive bias with sentiment boosted following well received NVIDIA results and after the Manhattan-based Court of International Trade blocked President Trump's Liberation Day tariffs. Sentiment has waned in recent trade, but with indices still broadly in the green.

- European sectors hold a positive bias, with the more cyclicals sectors topping the pile. Tech takes the top spot, with sentiment in the sector boosted after strong NVIDIA results afterhours; ASML +2.7%.

- US equity futures (ES +1.5%, NQ +2%, RTY +1.8%) are entirely in the green, with sentiment in the complex boosted following well received NVIDIA results and a US Court ruling blocking Trump’s tariffs.

- To recap those NVIDIA results; shares are currently higher by 6.0% after a Q1 sales and profit beat, with other inner components such as gaming revenue also strong. Though the report was not all positive, with its Q2 revenue a little light of expectations, reflecting USD 8bln loss in H20 revenue.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- The dollar is extending recent gains, buoyed by Wednesday’s legal ruling that curtailed the scope of President Trump’s tariff powers, whilst the FOMC minutes did little to shift the dial. Broader market sentiment is also supported by NVIDIA earnings. DXY touched a high of 100.48 overnight before waning and returning back to 100 at the time of writing (vs low 99.98).

- EUR/USD is softer following the US court ruling that limits Trump’s tariff powers – a development that marginally improves US growth prospects and supports the dollar by narrowing its risk premium. EUR/USD currently resides in a 1.1209-1.1297 range at the time of writing, with the 50 DMA seen at 1.1183.

- JPY weakens amid an unwind in risk premium following the aforementioned US court ruling on US President Trump's Liberation Day tariffs. Japan's Finance Minister Kato overnight said they will monitor financial market moves including super-long bond trade. On FX, Kato said they are able to deepen discussions with US Treasury Secretary Bessent about a basic understanding of FX policy, and did not discuss FX. USD/JPY trades on either side of its 50 DMA (145.35) in a 144.73-146.28 intraday range.

- GBP is more resilient to the dollar strength, potentially amid reports that the UK is seeking to accelerate the implementation of trade deals with the US when Business Secretary Reynolds meets with US Commerce Secretary Lutnick next week, according to FT. GBP/USD resides in a 1.3409-1.3474 range as attention now turns to BoE's Breeden and Bailey.

- Antipodeans are diverging with the AUD benefitting despite a miss in Capex data, but the currency is boosted by the aforementioned trade developments. The Kiwi is giving back some of the post-RBNZ upside.

- PBoC set USD/CNY mid-point at 7.1907 vs exp. 7.2023 (Prev. 7.1894).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are softer with fixed losing out due to its usual haven properties amid the constructive risk tone. In brief, the tone is buoyed by well-received NVIDIA earnings and the US CIT ruling that Trump’s Liberation Day tariffs are unlawful. Across the morning, this has sent USTs to a 109-26+ base, taking out Wednesday’s trough but stalling just shy of the WTD base at 109-24+. The docket features weekly claims, Q1 PCE/GDP (2nd), 7yr supply and Fed speak. Fed speak includes Barkin and Daly, no text expected, in addition to Goolsbee and Kugler where a text is expected.

- German paper also hold a bearish bias, which has pushed Bunds to a 130.39 base, which as is the case for USTs, has stopped just before the 130.15 WTD low. Specifics for the bloc are a little light so far, we await the first of a regular series of calls between EU Trade Commissioner Sefcovic, US Commerce Secretary Lutnick and USTR Greer later on today. A call which will perhaps draw even greater interest after the referenced CIT ruling. As the morning progresses the risk tone has faded a touch from best, more so in Europe than in US futures, and as such EGBs have lifted off worst by around 20 ticks for Bunds.

- Gilts are falling the risk tone and are also in the red. Down to a 90.70 base but has since bounced off worst, the move is slightly more pronounced than the discussed one in EGBs, owing to the UK tone pulling back the hardest and particularly an easing in energy benchmarks from highs, of particular note for the FTSE 100 given its exposure to the sector.

- HSBC has cut exposure to US Treasurys and extended its underweight in developed market sovereigns, warning yields above 4.7% could trigger broad risk-off moves, WSJ reports.

- UK sells GBP 3.2bln 0.125% 2031 I/L, via tender: b/c 2.57x, real yield 0.827%.

- Italy sells EUR 6.5bln vs exp. EUR 6.0-6.5bln 2.95% 2030, 3.60% 2035 BTP & EUR 3.5bln vs exp. EUR 3.0-3.5bln 2034 CCTeu.

- Click for a detailed summary

COMMODITIES

- Crude has been boosted amid the upbeat sentiment driven by the US Court Ruling on Trump's tariffs and an NVIDIA earnings beat - crude benefits with the contracts higher by USD 0.75/bbl. Energy-specific updates have been light aside from Kazakhstan reiterating that it cannot cut oil production right now and hopes to increase output to above its current plan later this year. Brent sits in a USD 64.55-65.50/bbl parameter.

- Spot gold is subdued amid haven outflows emanating from the aforementioned tariff updates, which unwinds some risk premium across havens. Spot gold trades in a USD 3,245.56-3,295.24/oz range at the time of writing, with the 50 DMA seen at USD 3,222.38/oz.

- Copper is benefitting from the risk environment. Specifically, it trades within a USD 9,561.3-9,645.4/t range and is currently approaching session highs.

- US Private Inventory Data (bbls): Crude -4.2mln (exp. +0.1mln), Distillate +1.3mln (exp. +0.5mln), Gasoline -0.5mln (exp. -0.5mln), Cushing -0.3mln.

- Iraqi Oil Minister urged commitment to agreements reached in the OPEC+ meeting and affirmed that unity of stance is crucial for the stability of oil markets, according to a statement.

- Libya's eastern-based government may announce a force majeure on oil fields and ports citing repeated assaults on the National Oil Corporation.

- Kazakhstan's Energy Minister says he thinks oil price above USD 70-75/bbl is suitable for all countries; Kazakhstan is not the reason why oil price is declining, due to its relatively small output.

- Click for a detailed summary

NOTABLE DATA RECAP

- Italian Manufacturing Business Confidence (May) 86.5 vs. Exp. 86.2 (Prev. 85.7, Rev. 85.8)

- Italian Consumer Confidence (May) 96.5 vs. Exp. 93.0 (Prev. 92.7)

- Italian Flash Trade Balance Non-EU (Apr) 2.18B (Prev. 5.96B)

NOTABLE EUROPEAN HEADLINES

- Slovakian court says ECB's Kazmir (Hawkish) has been found guilty of bribery, via Bloomberg; given a 200k fine, according to Reuters

NOTABLE US HEADLINES

- NY Fed said it will start morning standing repo facility operations on June 26th with offerings to take place between 08:15-08:30ET and will maintain afternoon standing repo facility offerings.

- White House plans to send a small package of DOGE spending cuts to Congress next week, according to Politico.

- Elon Musk said his scheduled time as a special government employee is coming to an end, while a White House official said Elon Musk leaving the administration is accurate and his off-boarding would begin on Wednesday night.

- Bank of America Total Card Spending (w/e May 24th) +0.2% (April average +1%); initial read suggestive of softer Memorial Day spending weekend likely due to colder weather.

GEOPOLITICS

- Russia's Kremlin says there are currently no plans for Russian President Putin to speak to US President Trump; have had no answer from Kyiv on June 2nd talks. Main thing right now is to continue the direct Russia-Ukraine talks Its not constructive to claim Russia is delaying the process.

CRYPTO

- Bitcoin is a little weaker and trades just ahead of USD 108k whilst Ethereum pushes on.

APAC TRADE

- APAC stocks were mostly higher with sentiment underpinned following NVIDIA's earnings and after the Manhattan-based Court of International Trade blocked President Trump's Liberation Day tariffs and deemed that the sweeping tariffs under the emergency powers law were unlawful. However, the Trump administration has since filed an appeal and has other tools it could apply to maintain such tariffs.

- ASX 200 was led higher by outperformance in energy, telecoms and tech although gains were capped with miners, real estate and defensives at the other end of the spectrum.

- Nikkei 225 outperformed and climbed back above the 38,000 level following the recent currency weakness and blow to Trump's tariff agenda.

- Hang Seng and Shanghai Comp conformed to the constructive mood although US-China frictions lingered after the Trump administration ordered US chip designers to stop selling to China and US Secretary of State Rubio announced to ‘aggressively’ revoke visas of Chinese students.

NOTABLE ASIA-PAC HEADLINES

- BoK cut the 7-day Repo Rate by 25bps to 2.50%, as expected, with the decision made unanimously. BoK said it will maintain its rate cut stance to mitigate downside risks to economic growth and will adjust the timing and pace of any further base rate cuts, while it is to closely monitor changes in domestic and external policy environments. The central bank also stated that South Korean exports are seen continuing to slow down and that a high degree of uncertainty in the trade environment is a risk to growth. Furthermore, BoK Governor Rhee said they see bigger room for further cuts given the downside risks to growth and noted that four board members saw room for further cuts for the next three months.

- Japan's Finance Minister Kato says will monitor financial markets moves including super-long bond trade. See large movement in super-long bond yield at the moment. Will conduct through communications with market players. Able to deepen discussions with US Treasury Secretary Bessent about a basic understanding of FX policy. Did not discuss about FX levels at all with the previous discussion with Bessent.

DATA RECAP

- Australian Capital Expenditure (Q1) -0.1% vs. Exp. 0.5% (Prev. -0.2%)

- Australian Private Capital Expenditure for 2024-25 (AUD)(Estimate 6) 187.6B (Prev. 183.4B)

- Australian Private Capital Expenditure for 2025-26 (AUD)(Estimate 2) 155.9B (Prev. 148.0B)

- New Zealand ANZ Business Outlook (May) 36.6% (Prev. 49.3%)

- New Zealand ANZ Own Activity (May) 34.8% (Prev. 47.7%)