Europe Market Open: Stocks reverse gains as Trump tariffs reinstated during appeal, DXY unreactive to Trump-Powell meeting

30 May 2025, 06:55 by Newsquawk Desk

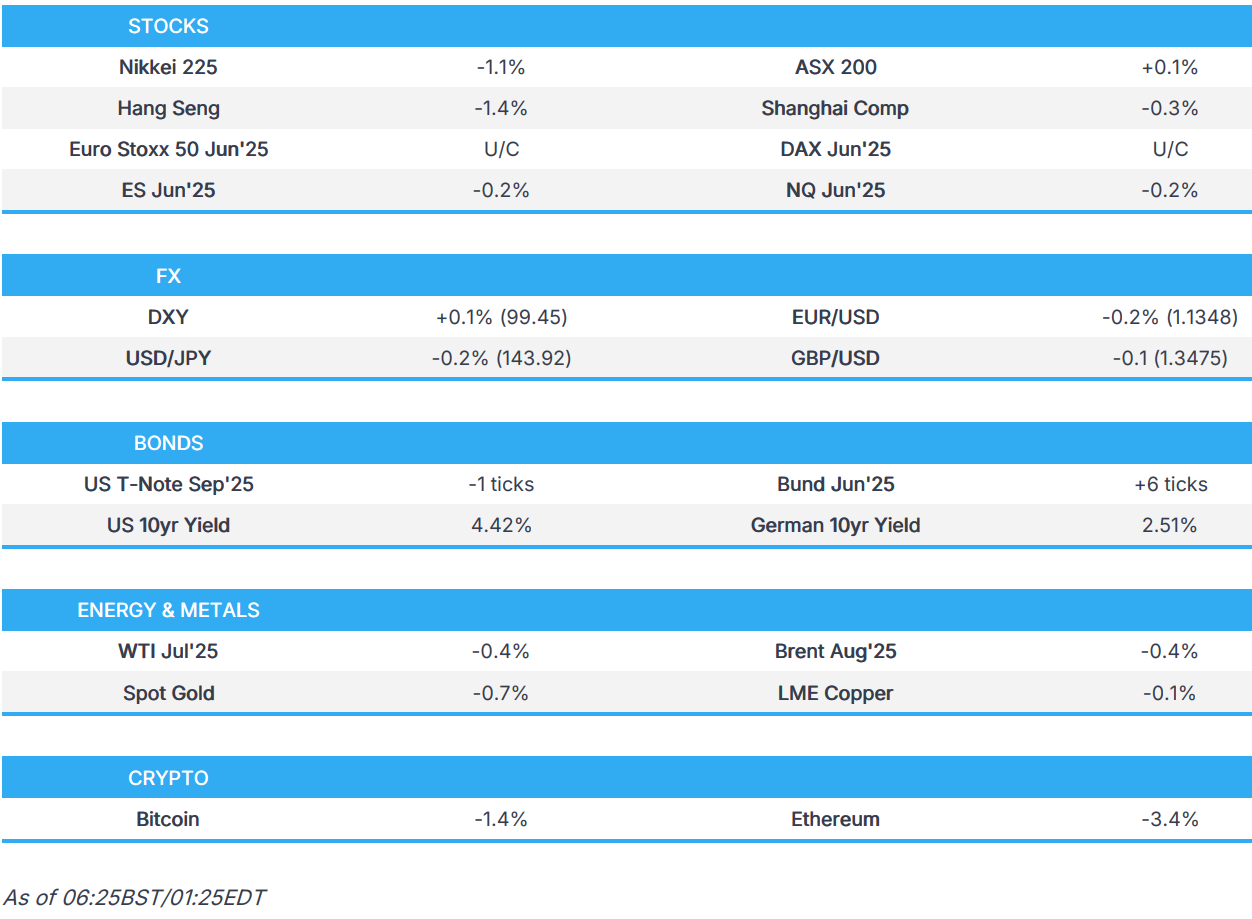

- APAC stocks were subdued heading into month-end as participants digested a slew of data and amid trade uncertainty; Euro Stoxx 50 futures indicate a flat open.

- DXY little moved after US President Trump-Fed Chair Powell meeting, JPY benefits after mostly-firmer than expected Tokyo CPI.

- US appeals court temporarily reinstated US President Trump’s tariffs during the appeal and said it needs time to consider filings.

- US President Trump's advisers are considering a stopgap tariff regime if the court appeal against the tariff block fails, while the effort that the Trump administration is considering would allow tariffs of up to 15% for 100 days, according to WSJ.

- US Treasury Secretary Bessent said the China talks are a bit stalled but believes they will have more talks in a few weeks and noted the EU's deal is in motion.

- Germany is reportedly eyeing a 10% digital tax on global tech giants like Meta (META) and Google (GOOGL), according to FT.

- Looking ahead, German Retail Sales, Spanish, German & Italian Inflation, US PCE (Apr), Canadian GDP, S&P Credit Review on France, DBRS on Germany & Spain, Speakers including Fed’s Logan, Bostic & Daly.

LOOKING AHEAD

- Highlights include German Retail Sales, Spanish, German & Italian Inflation, US PCE (Apr), Canadian GDP, S&P Credit Review on France, DBRS on Germany & Spain, Speakers including Fed’s Logan, Bostic & Daly.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks finished marginally higher and futures wiped out most of the initial gains that were spurred by the US Court of International Trade's ruling that President Trump's tariffs were illegal, with pressure seen after soft US data releases and as White House officials voiced optimism regarding appealing against the court ruling, while it was also later reported that the US Court of Appeals for the Federal Circuit temporarily reinstated US President Trump's tariffs "until further notice" during the appeal.

- SPX +0.40% at 5,912, NDX +0.21% at 21,364, DJI +0.28% at 21,216, RUT +0.34% at 2,075.

- Click here for a detailed summary.

TARIFFS/TRADE

- US appeals court temporarily reinstated US President Trump tariffs during appeal and said it needs time to consider filings, while it was earlier reported that a second US court blocked Trump tariffs in a case filed by a toy company and the US said it may ask the Supreme Court on Friday to keep tariffs intact.

- US President Trump's advisers are considering a stopgap tariff regime if the court appeal against the tariff block fails, while the effort that the Trump administration is considering would allow tariffs of up to 15% for 100 days, according to WSJ.

- White House said countries intend to continue trade talks despite the ruling and US trade policy will continue, while it added that the President has other authorities for tariffs and they are reviewing other avenues for trade policies. White House also said Treasury Secretary Bessent and USTR Greer have been in touch with counterparts on tariffs after the court ruling. Furthermore, it said they will win the trade battle in court and called the trade court ruling judicial overreach and said the court should have no role in tariffs.

- US Treasury Secretary Bessent said the President has the right to set the trade agenda for the US and trading partners are coming to us in good faith with no change seen in their attitudes in the past 48 hours, while a couple of large deals are close. Bessent said they may have a call between US President Trump and Chinese President Xi at some point and China talks are complex enough that will require both leaders to weigh in. Furthermore, he said China talks are a bit stalled but believes they will have more talks in a few weeks and noted the EU's deal is in motion.

- White House Economic Adviser Hassett said he expects trade deals in the next week or two and has been briefed on three that are about to happen, while he had productive talks with India.

- White House Adviser Navarro said it can be assumed that even if they lose the tariff cases, they will do it another way.

- Japanese Economic Minister Akazawa said he plans to meet US Treasury Secretary Bessent and others for Japan-US tariff talks, while he said they will take appropriate actions while gathering necessary information when asked about US court blocking Trump tariffs.

- Germany is reportedly eyeing a 10% digital tax on global tech giants like Meta (META) and Google (GOOGL), according to FT.

NOTABLE HEADLINES

- Fed Chair Powell met with US President Trump at the White House to discuss economic developments including growth, employment, and inflation, while Powell did not discuss his expectations for monetary policy, except to stress that the path of policy will depend entirely on incoming economic information and what that means for the outlook. Powell also said that he and his colleagues on the FOMC will set monetary policy, as required by law, to support maximum employment and stable prices and will make those decisions based solely on careful, objective, and non-political analysis. Furthermore, the White House said US President Trump told Fed Chair Powell that it is a mistake not to lower interest rates and WSJ's Timiraos wrote "A White House official said the purpose of Trump’s meeting with Powell was “simply to say hello and catch up”.

- Fed's Kugler (voter) said watching to better understand the link between trade and market vulnerability, while she is monitoring shifts in possible lower demand for US assets and said needs to better understand US assets' safe haven status.

- Fed's Goolsbee (2025 voter) said if tariffs are avoided by a deal or otherwise, could return to a situation where rates can come down. Goolsbee separately commented that if the court ruling on tariffs leads to further extension of uncertainty that would be more negative, according to WJR radio.

- Fed's Logan (2026 voter) said risks to employment and inflation goals are roughly balanced, while she added monetary policy is in a good place for now and it could take quite some time to see a shift in the balance of risks, as well as noted that if the balance shifts, the Fed is well prepared to respond.

- Fed's Daly (2027 voter) said the labour market is in solid shape and will not get to 2% inflation this year, while she added they are really making progress on inflation. Daly said workers are worried about inflation and the Fed is resolute to get the job on inflation done. Furthermore, she said Fed policy and the US economy are in a good place with the Fed in "wait to see", as well as stated that two rate cuts this year would make sense if the labour market stays solid and inflation falls, but the range of possible risks is large.

- US House Speaker Johnson said the House will codify cuts made by DOGE and the tax bill will reduce the deficit if you do the maths right, according to Fox.

APAC TRADE

EQUITIES

- APAC stocks were subdued heading into month-end as participants digested a slew of data and amid trade uncertainty.

- ASX 200 traded rangebound amid a lack of conviction after soft data releases including a contraction in Retail Sales.

- Nikkei 225 underperformed with the index back beneath the 38,000 level amid recent currency strength and after the latest Tokyo CPI data mostly topped forecasts, while trade remained in focus following Japanese PM Ishiba's call with US President Trump and as top trade negotiator Akazawa plans to meet with US Treasury Secretary Bessent for trade talks later today.

- Hang Seng and Shanghai Comp conformed to the downbeat mood ahead of an extended weekend and with PMI data scheduled on Saturday, while US Treasury Secretary Bessent commented that China talks are a bit stalled but believes they will have more talks in a few weeks.

- US equity futures lacked demand after wiping out the entire gains from the United States Court of International Trade ruling, with Trump officials suggesting optimism regarding their appeal and are said to be reviewing other avenues for trade policies.

- European equity futures indicate a flat cash market open after the cash market closed with losses of 0.1%.

FX

- DXY nursed some of its recent losses but remained below the 100.00 level after retreating on Thursday following soft data releases and amid trade-related uncertainty after the CIT ruling to block Trump's Liberation Day tariffs, although the administration has appealed and the Appeals Court has since paused the ruling, while Trump's advisers are considering a stopgap tariff regime effort that would allow tariffs of up to 15% for 100 days should the court appeal fail. Furthermore, there were several comments from Fed officials, and it was also reported that Fed Chair Powell met with US President Trump, although there was little to influence the currency, with participants now looking ahead to the monthly Core PCE data later today.

- EUR/USD marginally eased back after outperforming yesterday alongside the dollar pressure, but with the pullback in the single currency limited ahead of a slew of data releases from across the bloc including the latest Spanish, German and Italian inflation figures.

- GBP/USD slightly softened after hitting resistance again around the 1.3500 level, while comments from BoE Governor Bailey did little to shift the dial in which he noted there is currently a lot of uncertainty and that UK issues, not tariffs and trade, will be the main driver for UK rates.

- USD/JPY continued to trickle lower amid the downbeat risk tone and recent soft US data releases, while participants also digested the latest Tokyo inflation report which printed mostly firmer-than-expected and is seen as a leading indicator for national price trends.

- Antipodeans were constrained as the dollar regained some composure and amid the lacklustre risk appetite.

- PBoC set USD/CNY mid-point at 7.1848 vs exp. 7.1859 (Prev. 7.1907).

FIXED INCOME

- 10yr UST futures plateaued overnight after rallying yesterday on weak data and as the White House sounded optimistic it can appeal the court tariff decision, while it was also reported that the US Appeals Court temporarily reinstated US President Trump's tariffs.

- Bund futures held on to recent spoils after returning to above the 131.00 level but with further upside capped amid a busy data calendar for Europe including German Retail Sales and CPI figures.

- 10yr JGB futures remained afloat but were off recent peaks as participants digested a slew of data releases including the mostly firmer-than-expected Tokyo CPI, while the latest two-year auction results showed higher demand and higher accepted prices but had little market impact.

COMMODITIES

- Crude futures remained subdued after the prior day's declines as risk appetite dwindled and with prices not helped by the looming meeting of eight OPEC+ members on Saturday where another output hike is widely anticipated.

- US EIA Weekly Crude Stocks w/e -2.795M vs. Exp. 0.118M (Prev. 1.328M)

- White House is weighing a plan to deal with a record backlog of requests for refiner exemptions from US biofuel laws, while the plan is to give immediate relief on 2025 biofuel exemption requests and delay decisions on older ones, according to Reuters citing sources.

- Spot gold pulled back after its recent advances with prices constrained as the dollar regained some composure overnight.

- Copper futures remained lacklustre following the soft data releases stateside and amid ongoing trade uncertainty.

CRYPTO

- Bitcoin recovered from an early dip as support held at the USD 105k level before gradually climbing to around USD 106k.

NOTABLE ASIA-PAC HEADLINES

- Chinese tech groups reportedly prepare for an AI future without NVIDIA (NVDA) as tougher US export controls on advanced chips increase the urgency to test domestic alternatives, according to FT.

DATA RECAP

- Tokyo CPI YY (May) 3.4% vs Exp. 3.5% (Prev. 3.5%)

- Tokyo CPI Ex. Fresh Food YY (May) 3.6% vs Exp. 3.5% (Prev. 3.4%)

- Tokyo CPI Ex. Fresh Food & Energy YY (May) 3.3% vs Exp. 3.2% (Prev. 3.1%)

- Japanese Industrial Production MM (Apr P) -0.9% vs. Exp. -1.4% (Prev. 0.2%)

- Japanese Retail Sales YY (Apr) 3.3% vs. Exp. 3.1% (Prev. 3.1%)

- Australian Building Approvals (Apr) -5.7% (Prev. -8.8%)

- Australian Retail Sales MM Final (Apr) -0.1% (Prev. 0.3%)

GEOPOLITICS

MIDDLE EAST

- White House said Israel signed off on the ceasefire proposal and talks are continuing but Hamas has not accepted it yet.

- US plan for Gaza proposes a 60-day ceasefire and includes the release of 28 Israeli hostages, alive and dead, within the first week of the ceasefire, while remaining Israeli hostages are to be released after implementation of a permanent ceasefire and Israel is to release 125 Palestinian prisoners sentenced for life and 1,111 prisoners detained after October 7th within the first week of the agreement. The plan includes sending aid to Gaza as soon as Hamas signs off on the ceasefire agreement and the Israeli military operation will cease upon implementation of the ceasefire agreement with Israeli troops to redeploy after the release of hostages and ceasefire agreement to be guaranteed by US President Trump, according to Reuters.

RUSSIA-UKRAINE

- US told the UN Security Council if Russia decides to continue the war in Ukraine, the US will have to consider stepping back from negotiation efforts to end the conflict, while it added the deal on offer now is Russia's best possible outcome and the Russian President Putin should take the deal. Furthermore, it said additional sanctions on Russia are still on the table.

- Russian Foreign Ministry said the composition of the Russian delegation for the second round of Russia-Ukraine talks in Istanbul will be the same, according to TASS.

EU/UK

NOTABLE HEADLINES

- BoE Governor Bailey said the current challenge is that they don't know what the outcome of the trade situation will be, while he added that they are taking a gradual and careful approach as the economy is hard to read. Bailey responded there is a lot of uncertainty around at the moment when asked about rate cuts and said labour market data is pretty much in line with what they thought, as well as noted that UK issues, not tariffs and trade, will be the main driver for UK rates.

- BoE's Taylor said he is seeing more risk piling up on the downside scenario because of global developments, while he added the trade war is going to be negative for growth and he thought they needed to be on a lower monetary path, according to FT.

DATA RECAP

- UK Lloyds Business Barometer (May) 50 (Prev. 39)