US Market Open: US equity futures in the red & USD gains ahead of PCE and Fed speak

30 May 2025, 11:05 by Newsquawk Desk

- US President Trump's advisers are considering a stopgap tariff regime if the court appeal against the tariff block fails, while the effort that the Trump administration is considering would allow tariffs of up to 15% for 100 days, according to WSJ.

- US Treasury Secretary Bessent said a couple of large deals are close. Furthermore, he said China talks are a bit stalled but believes they will have more talks in a few weeks and noted the EU's deal is in motion.

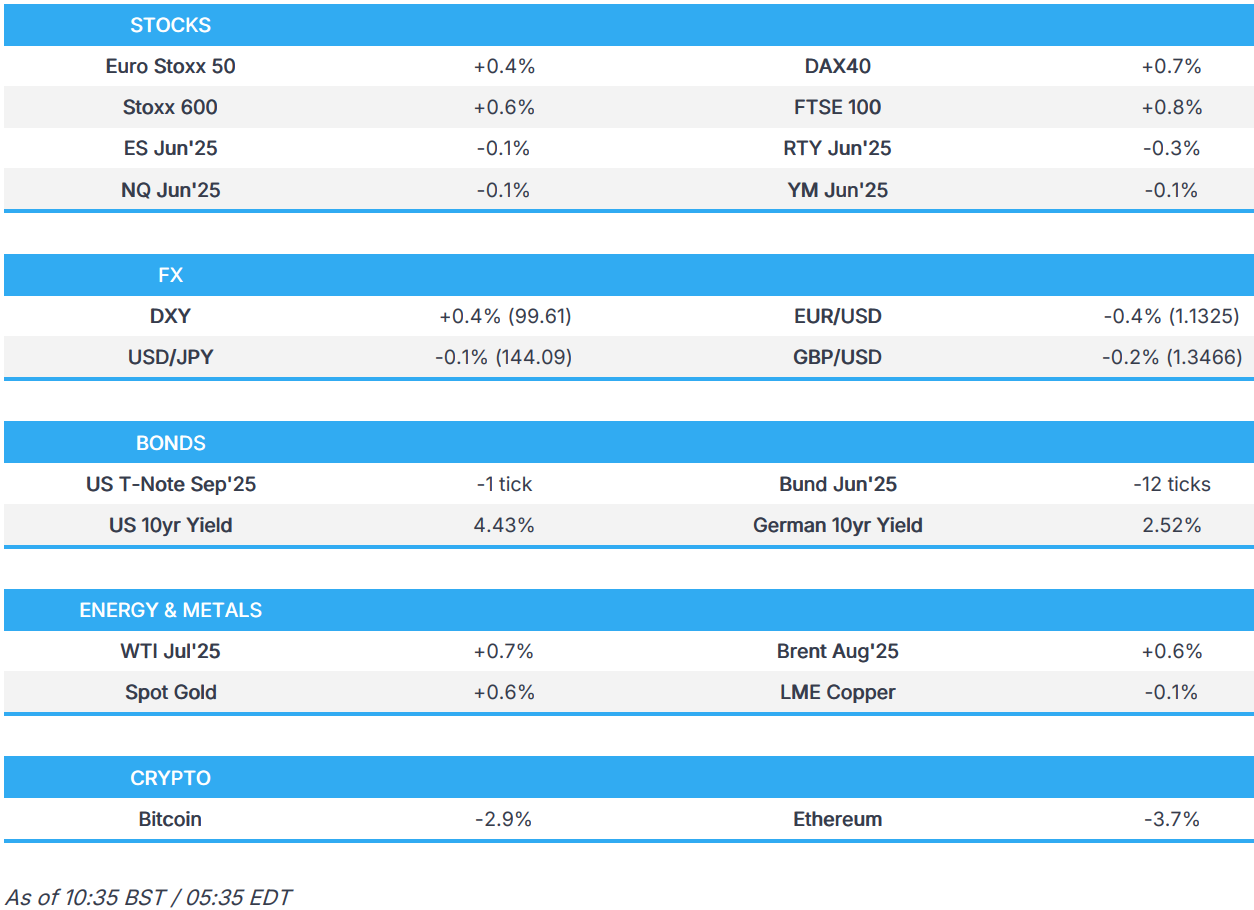

- European stocks opened with modest gains and have continued to build on that, whilst US equity futures are incrementally lower.

- DXY is firmer and towards session highs, JPY marginally benefits post-Tokyo CPI.

- USTs marginally lower/flat, two-way EGB action on prelim. inflation prints ahead of Germany's figure and US PCE.

- Crude is trading with modest gains given the risk tone and into weekend OPEC events, base metals move lower.

- Looking ahead, German Inflation, US PCE (Apr), Canadian GDP, S&P Credit Review on France, DBRS on Germany & Spain, Speakers including Fed’s Logan, Bostic & Daly.

TARIFFS/TRADE

- EU Trade Commissioner Sefcovic says he had another call with US Commerce Secretary Lutnick, "staying in permanent contact".

- US President Trump's advisers are considering a stopgap tariff regime if the court appeal against the tariff block fails, while the effort that the Trump administration is considering would allow tariffs of up to 15% for 100 days, according to WSJ.

- US Treasury Secretary Bessent said the President has the right to set the trade agenda for the US and trading partners are coming to us in good faith with no change seen in their attitudes in the past 48 hours, while a couple of large deals are close. Bessent said they may have a call between US President Trump and Chinese President Xi at some point and China talks are complex enough that will require both leaders to weigh in. Furthermore, he said China talks are a bit stalled but believes they will have more talks in a few weeks and noted the EU's deal is in motion.

- White House Economic Adviser Hassett said he expects trade deals in the next week or two and has been briefed on three that are about to happen, while he had productive talks with India.

- White House Adviser Navarro said it can be assumed that even if they lose the tariff cases, they will do it another way.

- Japanese Economic Minister Akazawa said he plans to meet US Treasury Secretary Bessent and others for Japan-US tariff talks, while he said they will take appropriate actions while gathering necessary information when asked about US court blocking Trump tariffs.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.5%) opened with very modest gains, with markets digesting the slew of trade-related updates on Thursday/overnight. In essence, US Officials generally pushed back against the severity of the latest ITC Court ruling, suggesting there are other ways to implement tariffs. As the session progressed, indices proceeded to trade with an upward bias and currently reside towards session highs.

- European sectors are mostly higher but with no clear theme aside from the day’s underperformer, Basic Resources. This is seemingly a factor of the aforementioned trade updates which seems to suggest that the US administration will implement tariffs irrespective of the ITC Court Ruling – as such, base metals are broadly in the red.

- US equity futures (ES -0.1% NQ -0.1% RTY -0.3%) are modestly lower across the board, continuing similar price action seen in the APAC session and as indices pare back some of Thursday’s advances.

- US President Trump has reportedly tapped Palantir (PLTR) to compile data on the US, via NY Times.

- Synopsys (SNPS) suspends sales and services in China, and stops taking new orders, according to a letter cited by Reuters; notes it will impact all customers.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is on a firmer footing today as traders digest a slew of trade-related updates on Thursday/overnight; but in essence US Officials generally pushed back against the severity of the latest ITC Court ruling, suggesting there are other ways to implement tariffs. Elsewhere, a meeting between US President Trump and Fed Chair Powell seemed to discuss economic developments but Powell refrained from discussing his expectations on monetary policy. DXY currently trades at the upper end of a 99.12-61 range ahead of the much-anticipated US PCE.

- EUR is pressured and towards the bottom of the G10 performers list; pressure which seemingly stems from broader Dollar strength. There have been a number of key European data points today, but nothing that fundamentally changed the downward bias for the Single-Currency. For European-specific trade updates, Bessent suggested that the EU's deal is in motion. Elsewhere, the FT reported that Germany is eyeing a 10% digital tax on global tech giants like Meta and Google. EUR/USD currently trades towards the lower end of a 1.1328-1.1389 range.

- JPY is currently the incrementally firmer vs the Dollar, largely thanks to the tepid risk tone and following a mostly firmer Tokyo inflation report overnight. To recap, headline Y/Y printed a little below expectations, but the core and super-core figures beat consensus. BoJ Governor Ueda spoke overnight, saying that “we are aware of firms' aggressive price and wage setting behaviour continuing”, he also highlighted the uncertain nature of the economy. USD/JPY trades in a 143.45-144.21 range.

- GBP is modestly lower vs the broader Dollar strength but ultimately faring a little better vs peers. UK-specific updates today have been very light; focus on Thursday was on BoE’s Bailey who provided little by way of surprises – he reiterated a gradual monetary policy approach and highlighted the uncertainty surrounding the economy. Cable currently trading in a 1.3456-1.3510 range; further downside could see a test of Thursday’s low at 1.3415.

- Antipodeans are lower but with clear underperformance in the Aussie, with downside facilitated by broader losses in the metals complex. For AUD specifically, it is pressured after the region reported a contraction in Retail sales.

- PBoC set USD/CNY mid-point at 7.1848 vs exp. 7.1859 (Prev. 7.1907).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are contained. Newsflow this morning has been virtually non-existent for USTs as we continue to digest the court-related trade updates and confirmation that Liberation Day measures will remain in place during the appeals process; timeline remains unknown. In a 110-19 to 110-25 band. A marginal new high for the week with USTs holding onto the gains that began mid-day on Thursday and then continued into the evening as the initial court-related pressure abated with the administration sticking to its plans. Focus now turns to US PCE (Apr).

- Bunds were initially contained, in-fitting with the above. Modest uptick to the 131.39 session high after cooler-than-expected Spanish Flash inflation, the series featured a marked cooling in the core figure. Thereafter, some choppiness following the German State CPI figures, which were a little mixed vs mainland implications; ultimately sending Bunds to a 131.02 trough.

- Gilts are directionally in-fitting with the above but holding at the unchanged mark given the lack of UK specifics. Handful of BoE speakers over the last 24 hours though nothing that has fundamentally shifted the narrative. Specifics for the UK have been very light, nothing of particular note on the docket so instead the benchmark will likely get dragged along by any move to German mainland CPI and then US PCE.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks are in the green, having been supported by a bounce in the risk tone around the cash open. WTI Jul and Brent Aug have both gained around USD 0.30/bbl, to USD 61.27/bbl and 63.66/bbl respectively.

- Spot gold is underperforming within the precious metals complex, amid the weaker dollar, and subdued demand ahead of the weekend. The session so far has been absent of any fresh macro catalysts, and gold trades within narrow parameters of USD 3,287.54-3,322.64/oz, currently towards the session low.

- Base metals are broadly in negative territory, suffering from the stronger dollar and fading trade optimism.

- US EIA Weekly Crude Stocks w/e -2.795M vs. Exp. 0.118M (Prev. 1.328M)

- Click for a detailed summary

NOTABLE DATA RECAP

- German State CPIs were mixed vs the mainland implications, which are due at 13:00 BST / 08:00 EST.

- German Retail Sales MM Real (Apr) -1.1% vs. Exp. 0.2% (Prev. -0.2%); YY Real (Apr) 2.3% vs. Exp. 1.8% (Prev. 2.2%)

- Spanish CPI YY Flash NSA (May) 1.9% vs. Exp. 2.00% (Prev. 2.20%); Core 2.1% (prev. 2.4%)

- Spanish HICP Flash YY (May) 1.9% vs. Exp. 2.0% (Prev. 2.2%); MM (May) -0.1% vs. Exp. 0.00% (Prev. 0.60%)

- Italian Consumer Price Prelim MM (May) 0.0% vs. Exp. 0.1% (Prev. 0.1%) 10:00; Consumer Price Prelim YY (May) 1.7% vs. Exp. 1.7% (Prev. 1.9%); CPI (EU Norm) Prelim YY (May) 1.9% vs. Exp. 1.9% (Prev. 2.0%); CPI (EU Norm) Prelim MM (May) 0.1% vs. Exp. 0.0% (Prev. 0.4%)

- EU Loans to Non-Fin (Apr) 2.6% (Prev. 2.3%); Loans to Households (Apr) 1.9% (Prev. 1.7%)

- Italian GDP Final YY (Q1) 0.7% vs. Exp. 0.6% (Prev. 0.6%); Final QQ (Q1) 0.3% vs. Exp. 0.3% (Prev. 0.3%)

NOTABLE EUROPEAN HEADLINES

- BoE Governor Bailey said the current challenge is that they don't know what the outcome of the trade situation will be, while he added that they are taking a gradual and careful approach as the economy is hard to read. Bailey responded there is a lot of uncertainty around at the moment when asked about rate cuts and said labour market data is pretty much in line with what they thought, as well as noted that UK issues, not tariffs and trade, will be the main driver for UK rates.

- BoE's Taylor said he is seeing more risk piling up on the downside scenario because of global developments, while he added the trade war is going to be negative for growth and he thought they needed to be on a lower monetary path, according to FT.

- ECB's Panetta says there is reduced room to cut rates further, though the macro outlook is weak and trade tensions could weigh on this. Future policy decisions need to be assessed on a case-by-case basis, considering the data, inflation and growth outlook. Essential to retain a pragmatic and flexible approach. Disinflation has not taken too high a toll on the EZ. Tariff-exposed sectors are already showing signs of falling confidence.

NOTABLE US HEADLINES

- Fed's Logan (2026 voter) said risks to employment and inflation goals are roughly balanced, while she added monetary policy is in a good place for now and it could take quite some time to see a shift in the balance of risks, as well as noted that if the balance shifts, the Fed is well prepared to respond.

- Fed's Daly (2027 voter) said the labour market is in solid shape and will not get to 2% inflation this year, while she added they are really making progress on inflation. Daly said workers are worried about inflation and the Fed is resolute to get the job on inflation done. Furthermore, she said Fed policy and the US economy are in a good place with the Fed in "wait to see", as well as stated that two rate cuts this year would make sense if the labour market stays solid and inflation falls, but the range of possible risks is large.

- Bank of America's weekly flow data notes USD 19.3bln into bonds, USD 2.6bln into crypto, USD 1.8bln into gold, USD 9.5bln out of stocks, and USD 18.9bln out of cash.

GEOPOLITICS

MIDDLE EAST

- US plan for Gaza proposes a 60-day ceasefire and includes the release of 28 Israeli hostages, alive and dead, within the first week of the ceasefire, while remaining Israeli hostages are to be released after implementation of a permanent ceasefire and Israel is to release 125 Palestinian prisoners sentenced for life and 1,111 prisoners detained after October 7th within the first week of the agreement. The plan includes sending aid to Gaza as soon as Hamas signs off on the ceasefire agreement and the Israeli military operation will cease upon implementation of the ceasefire agreement with Israeli troops to redeploy after the release of hostages and ceasefire agreement to be guaranteed by US President Trump, according to Reuters.

RUSSIA-UKRAINE

- US told the UN Security Council if Russia decides to continue the war in Ukraine, the US will have to consider stepping back from negotiation efforts to end the conflict, while it added the deal on offer now is Russia's best possible outcome and the Russian President Putin should take the deal. Furthermore, it said additional sanctions on Russia are still on the table.

CRYPTO

- Bitcoin continues to edge lower and trades just above the USD 105k mark.

APAC TRADE

- APAC stocks were subdued heading into month-end as participants digested a slew of data and amid trade uncertainty.

- ASX 200 traded rangebound amid a lack of conviction after soft data releases including a contraction in Retail Sales.

- Nikkei 225 underperformed with the index back beneath the 38,000 level amid recent currency strength and after the latest Tokyo CPI data mostly topped forecasts, while trade remained in focus following Japanese PM Ishiba's call with US President Trump and as top trade negotiator Akazawa plans to meet with US Treasury Secretary Bessent for trade talks later today.

- Hang Seng and Shanghai Comp conformed to the downbeat mood ahead of an extended weekend and with PMI data scheduled on Saturday, while US Treasury Secretary Bessent commented that China talks are a bit stalled but believes they will have more talks in a few weeks.

NOTABLE ASIA-PAC HEADLINES

- Japan has growing doubts that its next generation fighter project with the UK and Italy will meet a 2035 rollout target; may look at plugging air defence gaps with new F-35 stealth planes, according to Reuters sources.

- China April Phone shipments +4.0% Y/Y at 25.04mln, via CAICT.

DATA RECAP

- Tokyo CPI YY (May) 3.4% vs Exp. 3.5% (Prev. 3.5%); Ex. Fresh Food YY (May) 3.6% vs Exp. 3.5% (Prev. 3.4%)

- Tokyo CPI Ex. Fresh Food & Energy YY (May) 3.3% vs Exp. 3.2% (Prev. 3.1%)

- Japanese Industrial Production MM (Apr P) -0.9% vs. Exp. -1.4% (Prev. 0.2%)

- Japanese Retail Sales YY (Apr) 3.3% vs. Exp. 3.1% (Prev. 3.1%)

- Australian Building Approvals (Apr) -5.7% (Prev. -8.8%)

- Australian Retail Sales MM Final (Apr) -0.1% (Prev. 0.3%)