US Market Open: Stocks lower in reaction to Trump doubling steel tariffs, Crude soars post-OPEC+ ahead of US ISM Manufacturing & Powell

02 Jun 2025, 11:40 by Newsquawk Desk

- US President Trump said he will double US steel and aluminum tariffs from 25% to 50%, effective June 4th.

- US Treasury Secretary Bessent said China is holding back products essential to the industrial supply chain and he believes President Trump will talk to Chinese President Xi very soon, according to a CBS interview.

- Crude soars on OPEC+. OPEC+ members that voluntarily restricted output agreed to a 411k BPD oil production increase in July, as expected, which could be paused or reversed subject to market conditions.

- Chinese Official PMI data over the weekend was mixed, with manufacturing improving as expected but non-manufacturing surprisingly easing, albeit slightly.

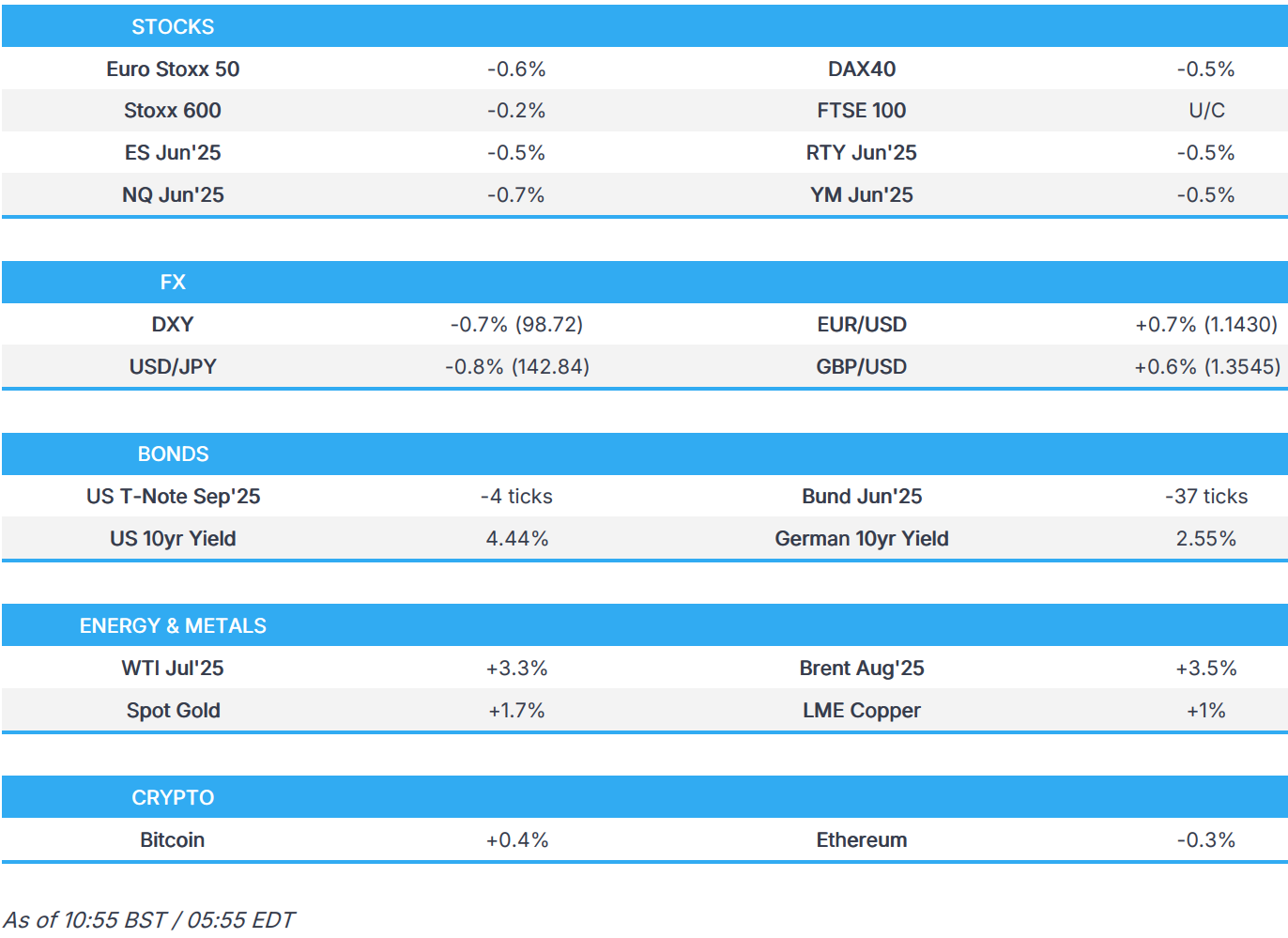

- Stocks mostly lower in reaction to Trump's steel tariffs and US-China commentary; ES -0.5%.

- Dollar in the doldrums as "sell America" trade seemingly back on the table.

- Bearish bias in the fixed complex awaiting ISM Manufacturing and Powell.

- Looking ahead, Canadian & US Manufacturing PMI Finals, ISM Manufacturing, Speakers including BoE’s Mann, ECB President Lagarde, Fed’s Logan, Goolsbee & Powell.

TARIFFS/TRADE

- US President Trump said he will double US steel and aluminium tariffs from 25% to 50%, effective June 4th.

- US President Trump is finalising an executive order for new restrictions that could effectively end Chinese drone sales to the US, according to the Washington Post.

- US Treasury Secretary Bessent said China is holding back products essential to the industrial supply chain and he believes President Trump will talk to Chinese President Xi very soon, according to a CBS interview. Bessent stated the US will never default on its debt, and they are on the warning track and will never hit the wall.

- China's Mofcom said China has taken seriously, strictly implemented and actively upheld the consensus reached at the talks with the US in Geneva, while it is firm in safeguarding its rights and interests, and it is honest in implementing the consensus. Mofcom added the US has successively introduced a number of ‘discriminatory restrictive measures’ against China after talks in Geneva and that these practices by the US seriously violate the consensus reached by both sides. It also stated that if the US insists on going its own way and continues to undermine China's interests, China will continue to resolutely take forceful measures to safeguard its legitimate rights and interests. Furthermore, it urged the US to immediately correct the relevant ‘wrong practices’ and said the US has made ‘groundless accusations’ against China for violating the consensus with China resolutely rejecting these ‘unreasonable accusations’.

- Japan's tariff negotiator Akazawa plans to visit the US for tariff talks for four days from Thursday, according to Jiji News.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.2%) opened entirely in the red following a mostly subdued APAC session; selling pressure briefly exacerbated in early morning trade, but this proved fleeting. Thereafter, the risk tone improved a touch, alongside the release of the EZ PMIs - they were mixed, but with the underlying narrative shown by the metrics as constructive.

- European sectors opened with a negative bias and have remained subdued throughout the morning. Energy tops the index given the recent surge in oil prices as the complex reacts to the latest OPEC+ decision over the weekend. Consumer Products and Services sits at the foot of the pile, with Luxury doing much of the dragging.

- US equity futures are lower across the board, with sentiment in the complex hit following Trump’s decision to double steel import tariffs to 50% and after hawkish rhetoric from the US side on China.

- Meta (META) is said to be working towards fully automating the ad creation process for brands by end-2026 with the aid of AI technology, according to WSJ citing sources. weighing on sensitive European names such as Publicis

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- Hefty losses for the dollar so far as the "sell America" trade resumes following the punchy rhetoric seen between the US and China since Friday, alongside Trump upping the blanket steel and aluminium tariffs to 50% from 25%. To recap, the US President on Friday took aim at China in which he noted how they are violating their agreement with the US after Trump dialled back the tariffs on Chinese goods. Traders look ahead to the US ISM Manufacturing data at 15:00 BST followed by a speech by Fed Chair Powell at 18:00 BST. DXY has ventured as low as 98.67 today from a 99.358 high.

- EUR is benefitting from the slide in the Dollar and with strength also emanating from the EUR's stable status in a "sell America" environment. Aside from that, newsflow for the bloc has been light with no reaction seen to mixed Final Manufacturing PMI data from countries in the region. EUR/USD topped 1.1400 at the time of writing and resides in a 1.1340-1.1436 range at the time of writing.

- JPY is firmer amid the softer US dollar coupled with risk aversion amid Trump upping steel and aluminium tariffs, coupled with the punchy rhetoric between the US and China. USD/JPY resides towards the bottom of a 142.77-144.09 range.

- GBP is another beneficiary of the softer Dollar whilst UK specifics remain light. BoE's hawk Mann is due for a text release at 15:00 BST. GBP/USD resides towards the upper end of a 1.3455-1.3557 range at the time of writing.

- Antipodeans are the biggest gainers on the dollar weakness and upside in base metals on the back of Trump upping steel and aluminium tariffs to 50% from 25%, with the high-beta pairs unfazed by the downbeat risk tone and New Zealand holiday closure.

- The Polish Zloty initially strengthened on the second round exit poll, which showed Trzaskowski the victor with 50.3% of the vote, following this, he claimed victory in the Presidential election. However, the full vote count showed right-wing Nawrocki was the victor and new Polish President. A result that has hit the PLN.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs were relatively contained overnight, but into the European session the complex came under pressure. A move that has been relatively pronounced with USTs trimming by just under 10 ticks from overnight levels to a 110-19 base. No clear or overt driver behind this and the move occurred without a broader risk move but was more pronounced in EGBs. Focus today is on US ISM Manufacturing and then Fed Chair Powell thereafter. Note, today’s move has been relatively noteworthy in European hours thus far but the benchmark remains just above Friday’s 110-18 base.

- As mentioned, Bunds also found themselves coming under pressure in the European morning but to a larger extent than USTs. Again, no clear fundamentals behind it as the action has not coincided with PMIs or other updates. Thus far, down to a 130.72 base. While there has not been anything specific behind the EGB pressure the accompanying upside in yields, particularly relative to the US, has led to some modest strength emerging in the EUR and GBP vs the USD.

- Gilts are in-fitting with the above, no reaction to its own PMI being upwardly revised though the 91.16 session low printed around 15 minutes after. Down to a 91.16 base and holding around that mark, last Tuesday’s base at 91.08 the next point to watch and from an events perspective, BoE’s Mann at 15:00 BST is the next catalyst, a text is expected.

- Click for a detailed summary

COMMODITIES

- Crude complex is boosted amid an as-expected OPEC+ confab on Saturday but also following a few updates from Iran, in which this weekend's IAEA report was damning towards the nation, whilst Iranian media quoting informed sources suggested the US proposal on the nuclear deal is "imaginary, one-sided and very far from being a fair basis for any possible settlement". ING suggests "Despite the large increase, oil prices rallied this morning. This could be because there had been suggestions that the group may go for an even larger supply increase", albeit it's working, noting most sources flagged the 411k BPD increase for weeks beforehand.

- Firmer trade across precious metals amid the punchy US-Sino rhetoric and Iran-related headline from the weekend. Traders look ahead to the US ISM Manufacturing data at 15:00 BST followed by a speech by Fed Chair Powell at 18:00 BST, whilst risk events towards the end of the week include the US NFP. XAU/USD rose from a USD 3,288.75/oz low to a USD 3,358.79/oz intraday peak at the time of writing, with the 23rd May peak seen at USD 3,365.76/oz.

- Copper futures rallied overnight despite the absence of its largest buyer and the mostly downbeat risk sentiment in the Asia-Pac region, with prices lifted after US President Trump announced late on Friday to double US steel and aluminium prices, with the tailwinds in copper due to potential stockpiling and supply-side concerns.

- OPEC+ members that voluntarily restricted output agreed to a 411k BPD oil production increase in July, as expected, which could be paused or reversed subject to market conditions.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK S&P Global Manufacturing PMI (May) 46.4 (Prev. 45.1)

- EU HCOB Manufacturing Final PMI (May) 49.4 vs. Exp. 49.4 (Prev. 49.4)

- German HCOB Manufacturing PMI (May) 48.3 vs. Exp. 48.8 (Prev. 48.8)

- French HCOB Manufacturing PMI (May) 49.8 vs. Exp. 49.5 (Prev. 49.5)

- Italian HCOB Manufacturing PMI (May) 49.2 vs. Exp. 49.5 (Prev. 49.3)

- Spanish HCOB Manufacturing PMI (May) 50.5 (Prev. 48.1)

- Swiss Manufacturing PMI (May) 42.1 vs. Exp. 46.5 (Prev. 45.8)

- UK Nationwide House Price MM (May) 0.5% vs. Exp. 0.1% (Prev. -0.6%); YY 3.5% vs. Exp. 2.9% (Prev. 3.4%)

- Swiss Retail Sales YY (Apr) 1.3% (Prev. 2.2%, Rev. 2.1%)

- Swiss GDP QQ (Q1) 0.5% vs. Exp. 0.4% (Prev. 0.2%, Rev. 0.3%); GDP YY (Q1) 2.0% vs. Exp. 1.5% (Prev. 1.5%, Rev. 1.6%)

NOTABLE EUROPEAN HEADLINES

- EU is said to be poised to curb China's access to medical device procurement, according to Bloomberg

- BoE Deputy Governor Breeden highlighted a weakening labour market and slow economic growth, while she stated that "waves of disinflation are continuing" and noted the BoE's narrative about continuing interest rate cuts was "not a million miles away from where the market is".

- UK is to build a billion-pound weapons works as UK PM Starmer calls for war readiness.

- US President Trump is to meet with German Chancellor Merz on Friday.

- German Finance Minister Klingbeil is planning a number of corporate tax breaks aimed at spurring investment and lifting the economy out of stagflation, according to DPA.

- Official results showed Polish nationalist candidate Nawrocki won 50.89% of the vote vs 49.11% for pro-EU candidate Trzaskowski. Subsequently, Polish PM Tusk said to consider asking Parliament for a vote of confidence.

NOTABLE US HEADLINES

- "AFP on a source in the Ukrainian delegation to the peace talks in Istanbul: Kiev is ready to take 'big steps towards peace'", according to Sky News Arabia

- Fed's Waller (voter) said ‘good news’ that rate cuts remain possible later this year and the rate cut view rests on easing inflation, as well as noted that tariffs are on the lower end of the range and a strong economy through April gives the Fed time to see how trade shakes out with tariffs likely to create a one-time price increase Fed can look through. Waller also stated that none of what drove the pandemic inflation surge is in place now and he doesn't see how tariffs would create persistent inflation, while he added the policy should look at the real side of the economy if inflation is close to the target and noted that the Fed is close to reaching inflation target.

- Fed’s Daly (2027 voter) said April PCE is a good relief but is incomplete as a picture and wants to ensure inflation stays sustainably at 2%. Daly said she sees incoming information as very positive and noted that monetary policy is in a good place, while she is comfortable with the projection for two rate cuts this year.

- White House sent a ‘partial’ FY26 budget proposal to Congress, leaving out standard projections.

GEOPOLITICS

MIDDLE EAST

- "Iranian media quoting informed sources: The US proposal on the nuclear deal is "imaginary, one-sided and very far from being a fair basis for any possible settlement"

- It was reported that an Israeli strike on an aid distribution point operated by a US-based Gaza aid group killed at least 26 in Rafah. However, the Israeli military said initial findings indicated that the army did not fire at Palestinian civilians near or within the humanitarian aid distribution site, while it added that drone footage showed armed and masked individuals opened fire at Gazan civilians attempting to collect looted humanitarian aid in southern Khan Younis.

- Israeli PM Netanyahu said Hamas is continuing its refusal of US envoy Witkoff’s proposal for a Gaza ceasefire, and Israel will continue its action in Gaza for the return of hostages and defeat of Hamas.

- US envoy Witkoff said Hamas’s response to the US proposal is totally unacceptable and only takes us backwards.

- Hamas said it submitted a response regarding US envoy Witkoff’s proposal to mediators and it expressed to immediately start a round of indirect negotiations on points of contention in a Gaza ceasefire deal, while a spokesperson said they have considered US envoy Witkoff’s proposal acceptable for negotiations and that Israel’s response was ‘incompatible’. Furthermore, they have not rejected Witkoff’s ceasefire proposal but stated that Witkoff’s position towards Hamas was unfair and shows complete bias toward Israel.

- White House Press Secretary Leavitt said envoy Witkoff sent a “detailed and acceptable” nuclear deal proposal to Iran and it is in their interests to accept it.

- Iran’s Foreign Minister said his Omani counterpart visited Tehran on Saturday to present the elements of the US proposal for a nuclear deal. In relevant news, Iran said the UN nuclear watchdog is politically motivated and repeats baseless accusations.

RUSSIA-UKRAINE

- A bridge collapsed in Russia’s Kursk as a freight train passed, according to the regional governor, while a senior Russian senator said the blowing up of the bridge and derailment of the train in Bryansk indicate that Ukraine has turned into a terrorist enclave. Furthermore, it was reported that Russia's security service thwarted Ukraine-ordered railway sabotage in the Far East region of Primorye, according to RIA.

- Russian Defence Ministry said Ukraine carried out a terrorist attack using drones against airfields in Murmansk, Ikutsk, Ivanovo, Ryazan and Amur regions, while it stated that all attacks on airfields have been repelled although several aircraft caught fire, according to RIA and Interfax. Furthermore, Ukrainian President Zelensky said the attack on Russian bases was a brilliant operation and their longest-range operation, while he stated that 117 drones were used in the operation and there were very tangible Russian losses.

- Russian Foreign Minister Lavrov discussed the Ukraine settlement and talks with US Secretary of State Rubio, while Rubio expressed condolences to Lavrov over the death in the Russian rail bridge incident.

- Russian Defence Ministry said Russian forces captured Oleksiivka in Ukraine’s Sumy region, while it was separately reported that Ukraine experienced one of the longest barrages from Russian missiles and drones early on Sunday, in which air sirens sounded for more than 9 hours, according to Bloomberg.

- Ukrainian negotiators at peace talks in Istanbul are to propose a roadmap for peace which includes a 30-day ceasefire, release of all POWs, negotiations involving the US and Europe, as well as a meeting between Putin and Zelensky. Furthermore, Ukraine wants reparations, no curbs on its military, no international recognition for territory taken by Russia and with the current front lines to be the starting point for talks, while the framework for Ukrainian terms for peace are largely unchanged from Kyiv’s previous position.

- Meeting between Russian and Ukrainian delegates in Istanbul is expected to take place at 11:00BST/06:00EDT in Ciragan Palace on Monday, according to a Turkish Foreign Ministry source.

OTHER

- US Secretary of Defense Hegseth said the US does not seek conflict with China, but Beijing wants to control and dominate the Indo-Pacific, while he added that Beijing is credibly preparing to use force to alter the balance of power in the region and that the threat from China is real and could be imminent.

- China’s Defence Ministry spokesperson said the US is accustomed to using the Shangri-La Dialogue to create disputes, sow discord and seek selfish interests, which China strongly deplores and resolutely opposes. Furthermore, the spokesperson said the US has no right to make irresponsible remarks about the Taiwan issue, let alone use it as a bargaining chip to contain China, while it stated regarding the South China Sea issue that the US is the biggest threat to regional peace and stability.

CRYPTO

- Bitcoin is a little firmer and trading around USD 105k whilst Ethereum edges a little lower.

APAC TRADE

- APAC stocks were mostly in the red, albeit to varying degrees, at the start of a new trading month and ahead of this week's risk events, while trade uncertainty lingered after President Trump announced to double steel and aluminium tariffs to 50% from this Wednesday.

- ASX 200 was rangebound with the index constrained by weakness in miners and the commodity-related sectors amid trade uncertainty following US President Trump's latest tariff offensive but with the downside cushioned given the actual boost to underlying commodity prices.

- Nikkei 225 slumped at the open with headwinds from recent currency strength and after US and Japanese officials met on Friday for trade talks, while Economic Minister Akazawa said the latest round of discussions have them on track towards a deal as early as this month but stated that nothing is agreed until everything is agreed and there was no change in the US stance on tariffs, including those on auto parts, which was regrettable.

- Hang Seng underperformed amid the closure in the mainland and Stock Connect trade, while participants also reacted to mixed PMI data and recent criticisms between the US and China including from US President Trump who stated that China has violated the deal with the US.

NOTABLE ASIA-PAC HEADLINES

- BoJ set aside maximum provisions for losses on bond transactions for fiscal 2024 which was increased to 100% for the first time with the provisions raised by JPY 427.7bln.

- Taiwan's Central Bank warned exporters against currency speculation.

DATA RECAP

- Chinese NBS Manufacturing PMI (May) 49.5 vs. Exp. 49.5 (Prev. 49.0); Non-Manufacturing PMI (May) 50.3 vs Exp. 50.6 (Prev. 50.4)

- Chinese Composite PMI (May) 50.4 v (Prev. 50.2)