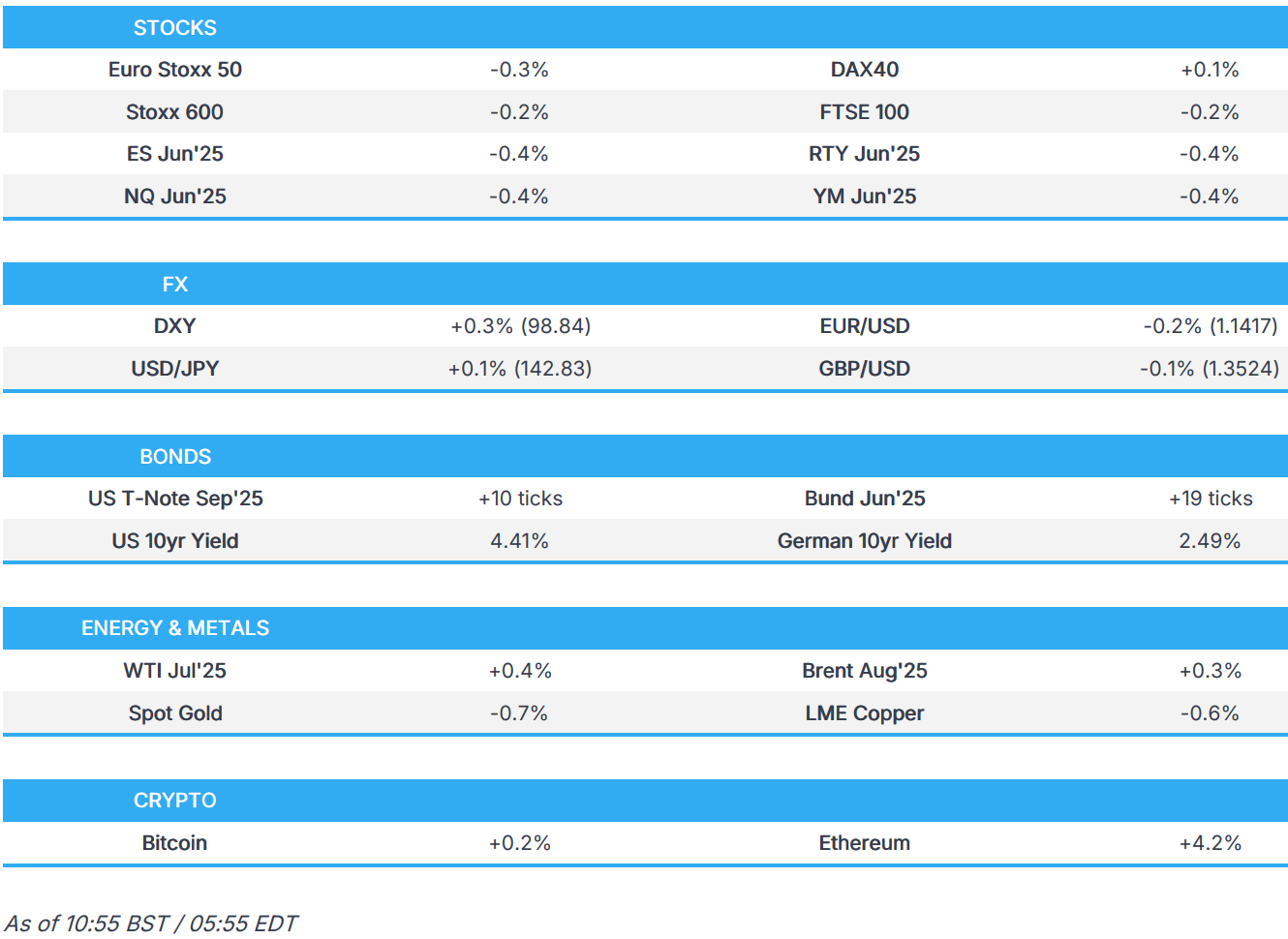

US Market Open: DXY is firmer ahead of JOLTS & Fed speak, EUR pressured post-HICP

03 Jun 2025, 11:40 by Newsquawk Desk

- The EU did not receive a US letter demanding best trade negotiations offers by Wednesday, according to Reuters sources.

- European bourses opened higher but tilted lower as the Dutch Government collapsed; US futures also in the red.

- USD attempts to claw back recent losses, EUR/USD digests soft inflation data.

- 10yr JGB sale bolsters bonds and Bunds see some modest action on EZ HICP; Fed speak ahead.

- Crude continues to gain while base metals falter on a recovering dollar and dismal Chinese PMI.

- Looking ahead, US Durable Goods, JOLTS Job Openings, RCM/TIPP Economic Optimism, Speakers including Fed’s Goolsbee, Logan & Cook, ECB's Lagarde. Earnings from CrowdStrike, Hewlett Packard, Dollar General & NIO.

TARIFFS/TRADE

- US sent a "long" and "tough" list of requests to Vietnam in tariff negotiations, via Reuters citing sources; US requests Vietnam to effectively cut off its reliance on Chinese supply chains.

- EU did not receive a US letter demanding best trade negotiations offers by Wednesday, according to Reuters sources.

- US reportedly extends the tariff pause on some Chinese goods to August 31st, according to Bloomberg.

- US President Trump posted "If other Countries are allowed to use Tariffs against us, and we’re not allowed to counter them, quickly and nimbly, with Tariffs against them, our Country doesn’t have, even a small chance, of Economic survival."

- US President Trump posts on Truth "Because of Tariffs, our Economy is BOOMING!"

- UK Trade Minister Reynolds will meet USTR Greer on Tuesday to discuss the implementation of a trade deal that has been complicated by the announcement of fresh US tariffs on steel, according to Reuters.

- China's Chamber of Commerce to the EU expressed disappointment and serious concerns about the EU's move to limit Chinese enterprises' participation in the healthcare sector.

- Chinese Foreign Ministry spokesperson says there is no information to share on a call between US President Trump and Chinese President Xi.

- India and Europe are said to have agreed on almost half of trade deal talk chapters, according to FT.

- Japan's trade negotiator Akazawa said they are aiming to have cabinet discussions towards a US trade deal and are seeking to accelerate talks ahead of the mid-June G7 talks.

- Japan is said to be considering cooperation with the US on the missile defence system "golden dome", according to Nikkei.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.3%) opened modestly firmer across the board, but sentiment soon slipped surrounding reports that Dutch Far Right Leader Wilders, confirmed to quit government coalition.

- European sectors opened with a strong positive bias, but sentiment soon dwindled to display a negative picture in Europe. Telecoms took the top spot, then joined by Utilities; Financial Services was the morning’s outperformer, lifted by upside in UBS (+2.7%) after it received a broker upgrade at Jefferies. Basic Resources have been pressured today given the downside in metals prices following weaker-than-expected Chinese Caixin Manufacturing PMI.

- US equity futures are broadly in negative territory, in-fitting with the risk tone and scaling back from some of the upside seen in the prior session.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is attempting to atone for recent losses after being sold yesterday on account of trade woes, ongoing fiscal concerns and a miss on ISM manufacturing PMI. Focus thus far has been on the trade front after a Reuters report noting that US President Trump's administration wants countries' "best offer" by Wednesday. Elsewhere, the White House Press Secretary said US President Trump and Chinese President Xi will likely talk this week; note, we have not seen any confirmation of this from the Chinese side. Focus now turns to US JOLTS Job Openings and Fed speak.

- EUR is on the backfoot vs. the USD but just about holding above the 1.14 mark. Losses were extended in early European trade alongside a deterioration in the risk environment as news broke that Dutch Far Right Leader Wilders confirmed he is to quit the government coalition. Flash CPI metrics were cooler-than-expected with both the headline and core figures printing shy of expectations.

- JPY is softer vs. the USD but to a lesser degree than peers. USD/JPY briefly reclaimed the 143 level but failed to hold onto the level alongside a deterioration in the risk environment and a slew of comments from BoJ Governor Ueda who reiterated the Bank will continue to raise rates if the economy and prices move in line with forecasts. On the trade front, Japan's trade negotiator Akazawa said they are aiming to have cabinet discussions towards a US trade deal and are seeking to accelerate talks ahead of the mid-June G7 talks. USD/JPY is back on a 142 handle and has traded within a 142.39-143.27 range.

- After a session of gains yesterday, GBP is softer vs. the USD but still managing to hold above the 1.35 mark. In terms of UK-specific newsflow, UK Trade Minister Reynolds will meet USTR Greer on Tuesday to discuss the implementation of a trade deal that has been complicated by the announcement of fresh US tariffs on steel, according to Reuters. Elsewhere, BoE's Mann said the BoE cannot exactly offset high long-term rates caused by QT by cutting the bank rate further. Cable's session low sits at 1.3511. Do note that the BoE's Treasury Select Hearing on the BoE May MPR is ongoing. Just to pick out the key commentary so far; Breeden reiterated the Bank's gradual and careful approach; Bailey highlighted that the May rate decision were domestic and not tariffs; Mann kept her usual hawkish tone and suggested Services is above what she viewed as consistent to get inflation back to target.

- Antipodeans are both softer vs. the USD and at the bottom of the G10 leaderboard in a reversal of yesterday's price action. Losses come as risk sentiment has deteriorated. RBA minutes noted that the Board considered keeping rates unchanged and cutting by 25bps or 50bps, but decided the case for a 25bps cut was the stronger one and preferred for policy to be cautious and predictable. Elsewhere, Australian data saw a surprise contraction in net exports contribution to GDP.

- PBoC set USD/CNY mid-point at 7.1869 vs exp. 7.1872 (Prev. 7.1848).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Japan’s 10yr sale was met with strong demand overnight and a very small price tail, a well-received outing that sparked immediate upside in JGBs and weighed on yields. Japanese paper was unreactive to BoJ Governor Ueda comments overnight.

- Bunds picked up at the resumption of trade, perhaps acknowledging ongoing trade uncertainty and the commentary from China in response to the EU on Monday taking action to limit China’s participation in healthcare. Thereafter, German paper picked up following the strong Japanese 10yr auction overnight, a move which has continued into the European morning. There was some choppy action on news that the Dutch government collapsed. As for EZ HICP, metrics were cooler-than-expected sparking some modest upside in Bunds but failed to test the earlier peak of 131.49.

- As above, USTs picked up on the Japanese auction and has continued to grind higher since. As high as 110-25, but so far at least has stalled ahead of a double-top at 110-30 from the two sessions prior. Ahead, the docket features JOLTS, Factory Orders, RCM/TIPP, the latest Discount Rate Minutes and remarks from Fed’s Cook (voter), Goolsbee (2025) and Logan (2026).

- Gilts began the day on the front-foot, given the outlined bullish bias. Specifically, it opened higher by 24 ticks and then climbed another 22 to take out last week’s 91.89 best and print a 92.01 peak for the day. Do note that the BoE's Treasury Select Hearing on the BoE May MPR is ongoing. Just to pick out the key commentary so far; Breeden reiterated the Bank's gradual and careful approach; Bailey highlighted that the May rate decision were domestic and not tariffs; Mann kept her usual hawkish tone and suggested Services is above what she viewed as consistent to get inflation back to target.

- UK sells GBP 1.25bln 4.0% 2063 Gilt: b/c 3.51x (prev. 2.8x), average yield 5.281% (prev. 5.076%), tail 0.3bps (prev. 0.3bps)

- Germany sells EUR 3.678bln vs exp. EUR 4.5bln 1.70% 2027 Schatz: b/c 2.9x (prev. 2.2x), average yield 1.78% (prev. 1.94%), retention 18.27% (prev. 24.42%).

- Click for a detailed summary

COMMODITIES

- Crude is trading in positive territory and has been trading with a modest upward bias throughout the European morning. This comes in contrast to a mostly downbeat mood across markets, with energy traders still very much focused on the current geopolitical backdrop with Iran dismissing the US proposal for a nuclear deal as "unrealistic". Brent Aug'25 currently trading towards the mid-point of a USD 64.68-65.09/bbl range. Do note that Kpler's Bakr reported that there was no OPEC+ discussion about a higher hike than the 411k bpd over the weekend - but the complex was little moved on this.

- Precious metals are broadly in the red, with some modest underperformance in spot silver. As for spot gold, the yellow-metal was subdued overnight and scaled back from the upside seen in the prior session; it has traded sideways throughout the European morning. XAU/USD currently trades in a USD 3,351.81-3,392.10/oz range.

- Base metals are entirely in negative territory, in reaction to weaker-than-expected Chinese Caixin Manufacturing PMI data and as the Dollar moves a little higher. 3M LME Copper currently trades in a USD 9,521.55-9,610.90/t range.

- "During the OPEC-plus meeting on Saturday with the 8 member states, there were no discussions at all about a higher hike than the 411kbd, according to delegates attending the meeting", via Kpler's Bakr." Russia did propose a pause which was also supported by Oman, but quick consensus was reached to go ahead with the 411kbpd addition in July".

- Click for a detailed summary

NOTABLE DATA RECAP

- Swiss CPI YY (May) -0.1% vs. Exp. -0.1% (prev. 0.0%); CPI MM (May) 0.1% vs. Exp. 0.1% (prev. 0.0%)

- French Budget Balance (Apr) -69.3B (Prev. -47.03B)

- EU HICP Flash YY (May) 1.9% vs. Exp. 2.0% (Prev. 2.2%); services inflation 3.7% (prev. 4.0%)

- EU HICP-X F, E, A, T Flash YY (May) 2.3% vs. Exp. 2.5% (Prev. 2.7%)

- EU HICP-X F&E Flash YY (May) 2.4% vs. Exp. 2.5% (Prev. 2.7%)

- EU Unemployment Rate (Apr) 6.2% vs. Exp. 6.2% (Prev. 6.2%, Rev. 6.3%)

NOTABLE EUROPEAN HEADLINES

- Dutch Far Right Leader Wilders, confirms to quit government coalition (as expected), according to NOS. Dutch Far Right leader Wilders tells PM Schoof that all of his ministers will quit government.

- Dutch Cabinet scheduled to meet at 13:30 CET (12:30 BST) to "discuss next steps".

- OECD GDP Forecasts: Forecasts generally downgraded, with the exception of the EZ (maintained) and Japan 2026 (upgraded). Click for full details

- Polish Parliament Speaker has proposed a government confidence vote to take place next week.

BoE TSC

- BoE Governor Bailey says the key factors for the May rate decision were domestic and not tariffs; have not seen particular inflation surprises. Labour market has loosened somewhat, pay growth is above levels consistent with the 2% inflation target but lower than expected in February. Gradual and careful remain "my guide for rates". Savings to public finances through changing reserve remuneration by tiering would be illusory.

- BoE's Breeden says sees merit in maintaining a gradual and careful approach to adjusting the policy stance. As the BoE approaches a neutral policy stance, evidence of restrictiveness will become less clear, and the decision to further loosen policy will require a greater degree of certainty that inflation is on track. Has gained greater confidence that the disinflationary process is progressing at a steady pace. The economy appears to be moving gradually into excess supply. Sees downside risks from greater trade diversion, but also sees upside risks from the introduction of supply chain frictions globally. Thinks this latter channel is likely under-represented in models. Tariffs expected to have a small impact on the UK economy. In March, “I expected that I would vote to cut again in May”.

- BoE's Mann said must consider interactions of QT and rate decisions, while she added that the BoE cannot exactly offset high long-term rates caused by QT by cutting the bank rate further and extra cuts to short rates to compensate for QT could run counter to the need to purge structural rigidities in the UK labour and product markets. Furthermore, she expects these issues will be part of MPC considerations before the September QT decision.

- BoE's Dhingra says risks to inflation and growth are tilted to the downside; would have preferred the bank rate to followed a different path. Overly restrictive policy risks supressing demand and disincentivising investment.

NOTABLE US HEADLINES

- US President Trump posted on "Passing THE ONE, BIG, BEAUTIFUL BILL is a Historic Opportunity to turn our Country around after four disastrous years under Joe Biden. We will take a massive step to balancing our Budget by enacting the largest mandatory Spending Cut, EVER, and Americans will get to keep more of their money with the largest Tax Cut, EVER, and no longer taxing Tips, Overtime, or Social Security for Seniors".

GEOPOLITICS

MIDDLE EAST

- US President Trump posted on Truth Social "The AUTOPEN should have stopped Iran a long time ago from “enriching.” Under our potential Agreement — WE WILL NOT ALLOW ANY ENRICHMENT OF URANIUM!"

- An Iranian official reportedly said the US nuclear proposal is unrealistic, according to CNN.

- US State Department said Secretary of State Rubio spoke with Saudi's Foreign Minister and discussed Ukraine and Russia talks, stabilisation in Syria and the situation in Gaza.

RUSSIA-UKRAINE

- Russian-controlled parts of Zaporizhzhia in Ukraine lost power as a result of Ukraine's attacks although the power cut-off had not affected the Zaporizhzhia nuclear power plant, according to Russian agencies.

- Ukraine's Energy Minister says Russian Rocket attack hit a large energy generation facility in overnight attack

CRYPTO

- Bitcoin is a little firmer and trades just shy of USD 106k whilst Ethereum moves higher and tops USD 2.6k.

APAC TRADE

- APAC stocks traded mostly higher as the region took impetus from the rebound on Wall St but with gains capped following disappointing Chinese Caixin Manufacturing data and as trade uncertainty lingered.

- ASX 200 edged higher amid strength in mining stocks but with further upside limited as defensives lagged and after mixed data releases including a surprise contraction in net exports contribution to GDP.

- Nikkei 225 kept afloat but lacked firm conviction after recent currency fluctuations and after a deluge of comments from BoJ Governor Ueda who reiterated they will continue to raise interest rates if the economy and prices move in line with forecasts, but also noted there was no preset plan for rate hikes and that they will raise interest rates only if the economy and prices turn up again and outlooks are likely to be realised.

- Hang Seng and Shanghai Comp were underpinned after the US reportedly extended the tariff pause on some Chinese goods to August 31st, while the White House Press Secretary stated that US President Trump and Chinese President Xi will likely talk this week, although the upside was restricted in the mainland given the lack of confirmation by Beijing regarding Trump-Xi talks and as participants also digested disappointing Caixin Manufacturing PMI data which showed its first contraction in eight months and printed its weakest since September 2022.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda said Japan's economy is modestly recovering despite some weakness seen, corporate profits are improving and business sentiment is solid, but noted the slowdown in the overseas economy pressures corporate profits and the pace of economic growth is expected to slow down. Ueda reiterated that they will continue to raise interest rates if the economy and prices move in line with forecasts and they will conduct monetary policy appropriately depending on price, and economic developments to achieve the 2% target in a stable and sustainable manner. However, he noted it is important to make judgments without any preset ideas and that they said in the Outlook Report that the baseline scenario could change significantly, as well as stated there is no preset plan for rate hikes and they will raise interest rates only if the economy and prices turn up again and outlooks are likely to be realised. Furthermore, Ueda said they will review bond taper plans at the next policy meeting taking into account the opinions of bond market participants and he is aware of the market view that some investors' appetite for super-long JGBs has declined.

- BoJ Governor Ueda says domestic and overseas economic developments have changed shape since Liberation day, which the levels exceeded many expectations; price environment is becoming more complex. Uncertainty is high; could weigh on corporate and household spending. Must look at underlying inflation, which excludes direct cost-push factors, in judging whether Japan sustainably achieves the BoJ's 2% inflation target.

- RBA Minutes from the May meeting stated the Board considered keeping rates unchanged and cutting by 25bps or 50bps but decided the case for a 25bps cut was the stronger one and preferred policy to be cautious and predictable. RBA said inflation is still not at the mid-point of the target band and the labour market is still tight, while the Board agreed developments in the domestic economy alone warranted a rate cut and progress on inflation meant policy did not need to be as restrictive. Furthermore, it was stated that a larger move might offer more insurance against adverse global scenarios although the Board was not persuaded that 50bps was needed and US tariffs had not yet affected the Australian economy, while it would be challenging for businesses and households if aggressive easing had to be reversed and the Board judged it was not yet time to move monetary policy to an expansionary setting.

DATA RECAP

- Chinese Caixin Manufacturing PMI Final (May) 48.3 vs. Exp. 50.6 (Prev. 50.4)

- Australian Current Account Balance (AUD)(Q1) -14.7B vs. Exp. -13.1B (Prev. -12.5B)

- Australian Net Exports Contribution (Q1) -0.1% vs Exp. 0.0% (Prev. 0.2%)

- Australian Business Inventories (Q1) 0.8% vs. Exp. 0.1% (Prev. 0.1%)

- Australian Gross Company Profits (Q1) -0.5% vs. Exp. 1.3% (Prev. 5.9%)