Europe Market Open: Stocks gain and DXY firmer after US data, Trump-Xi call expected Friday.

04 Jun 2025, 06:55 by Newsquawk Desk

- US President Trump is reportedly set to speak with Chinese President Xi on Friday, according to sources. It was also reported that White House Press Secretary said the Trump-Xi call will be held very soon.

- White House said the Wednesday trade offer deadline letter was authentic and they are on track for good deals.

- APAC stocks traded mostly higher following the gains on Wall St where sentiment was lifted by better-than-expected JOLTS data and with some slight optimism with US President Trump and Chinese President Xi reportedly set to speak this Friday.

- KOSPI outperformed and is on course for a bull market following the Presidential Election which was won by the DP's Lee Jae-Myung who was later sworn in.

- European equity futures indicate a mildly positive cash market open with Euro Stoxx 50 futures up 0.3% after the cash market finished with gains of 0.4% on Tuesday.

- Looking ahead, highlights include EZ, UK, US Composite/Services PMI Final, US ADP National Employment, US ISM Services, BoC & NBP Policy Announcements, Fed Beige Book, Speakers include Fed’s Bostic, Cook & US Treasury Secretary Bessent, Supply from UK, Earnings from PVH & Dollar Tree.

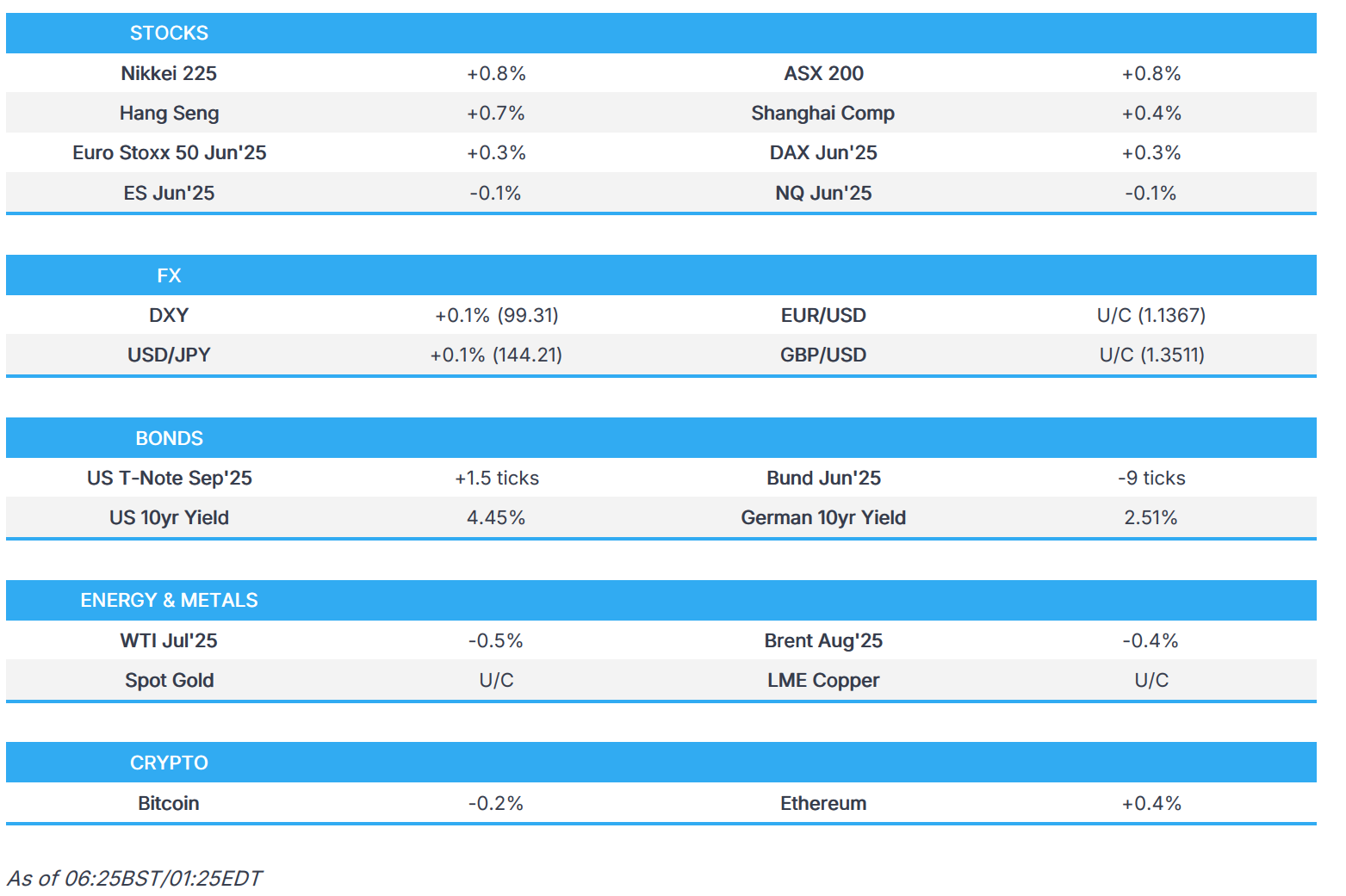

SNAPSHOT

US TRADE

EQUITIES

- US stocks reversed the recent weakness that was triggered by trade worries and with further upside seen in the wake of the rise in April JOLTS ahead of the May NFP due on Friday, which also saw bonds pare earlier gains.

- Sectors were predominantly firmer with outperformance in Technology, Energy and Materials, while Communication Services, Real Estate and Consumer Staples lagged with the comms. sector weighed on by losses in Alphabet (GOOGL) following more reports that Apple (AAPL) is considering Perplexity as an iPhone search alternative from Google Search.

- SPX +0.59% at 5,970, NDX +0.80% at 21,662, DJI +0.51% at 42,519, RUT +1.58% at 2,102.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump signed a Proclamation to double steel and aluminium tariffs to 50% under section 232 authority which took effect at midnight EDT, while it was reported that the White House said US tariffs on UK steel and aluminium will remain at 25% for now, with the UK failing to get the 0% tariffs promised in the US ‘deal’ implemented in time, and all other countries will be hit by 50% tariffs, according to Bloomberg's Wickham.

- US President Trump is reportedly set to speak with Chinese President Xi on Friday, according to sources. It was also reported that White House Press Secretary said the Trump-Xi call will be held very soon, while she noted USTR Greer is in Paris to meet with trading partners and a deal will be made soon. She also stated regarding China's critical mineral curbs that the White House is actively monitoring compliance with the Geneva trade agreement.

- White House said the Wednesday trade offer deadline letter was authentic and they are on track for good deals.

- Canadian PM's office said additional US tariffs on Canadian steel and aluminium are 'unlawful and unjustified', while it added that the Canadian government is engaged in intensive and 'live negotiations' to have US tariffs removed.

- Mexico's Economy Minister said Mexico will ask on Friday to be excluded from the US's 50% steel tariff like the UK was, while he added the US increase of steel tariffs to 50% is unfair, unsustainable and inconvenient.

- EU’s trade chief and Chinese counterpart are to hold a fourth round of trade talks in June ahead of the July EU-China summit.

- China's Commerce Minister Wang met with EU Trade Commissioner Sefcovic in France on Tuesday and said at the WTO that the WTO should strengthen supervision over unilateral tariffs, as well as put forward objective and neutral policy proposals.

- Japanese Chief Cabinet Secretary Hayashi said they have not received any letter from the US asking to make the best offers on trade talks. It was also reported that Japan is to form a think tank with an eye on Trump tariffs and Taiwan, according to Nikkei.

NOTABLE HEADLINES

- Fed Governor Cook said Fed policy is well positioned for a range of scenarios and she is committed to keeping longer-term inflation expectations in check, while she said the Fed has to be open to all possibilities and can't prejudge what the FOMC will do now with rates.

- Fed's Goolsbee (2025 voter) said the Fed has to wait and see if tariffs have a big or small inflation impact, while he reiterated they could see a direct tariff effect on prices within a month.

- Fed's Logan (2026 voter) said monetary policy framework should be robust to a range of scenarios and the Fed should focus on achieving 2% inflation, while she added they should not try to make up for past inflation shortfalls and should pay attention to overshooting full employment and not just employment shortfalls. Furthermore, she stated that the Fed should consider how to better convey key risks, uncertainties, and policy responses.

- FOMC Discount Rate Minutes stated that directors voted to establish the primary credit rate at the existing level of 4.5%, while no sentiment was expressed by the Board at the meeting for changing the primary credit rate at this time.

- US President Trump is expected to waive statutory requirements under the Defence Production Act to help boost domestic production of critical minerals and weapons, with Trump expected to waive the requirement for congressional approval for projects above the USD 50mln threshold, according to Reuters citing a document.

- US President Trump invited the Senate Financial Committee to the White House with the meeting reportedly to be held at 16:00EDT on Wednesday.

- OMB Director Vought said the rescission package sent on Tuesday is just the start and they chose the easiest DOGE cuts to start rescissions, while he added there are consequences for Congress failing to rescind. Vought said the rescission package will be on the floor next week and they will send many more rescissions once this passes, as well as noted that they have tools to make cuts permanent by the end of the FY.

- Elon Musk posted on X that the "massive, outrageous, pork-filled Congressional spending bill is a disgusting abomination. Shame on those who voted for it: you know you did wrong. You know it." It was later reported that House Speaker Johnson said Musk's comments on the bill are ‘very disappointing’ and that he is "terribly wrong" about the tax bill.

- BLS said some April jobs data will be corrected on Friday and major measures such as the unemployment rate are unaffected, while it added that many numbers are to be corrected but the impact is 'negligible'.

APAC TRADE

EQUITIES

- APAC stocks traded mostly higher following the gains on Wall St where sentiment was lifted by better-than-expected JOLTS data and with some slight optimism with US President Trump and Chinese President Xi reportedly set to speak this Friday.

- ASX 200 was led higher by outperformance in the energy sector and with participants unfazed by recent data releases including the miss on Q1 GDP.

- Nikkei 225 advanced at the open following recent currency weakness but with further upside capped by a lack of drivers.

- KOSPI outperformed and is on course for a bull market following the Presidential Election which was won by the DP's Lee Jae-Myung who was later sworn in.

- Hang Seng and Shanghai Comp conformed to the positive mood but with gains capped as China remained quiet regarding a potential Trump-Xi call.

- US equity futures plateaued after yesterday's ascent and as US tariffs on steel and aluminium took effect.

- European equity futures indicate a mildly positive cash market open with Euro Stoxx 50 futures up 0.3% after the cash market finished with gains of 0.4% on Tuesday.

FX

- DXY extended on gains after clawing back the data-induced losses from the beginning of the week with some brief support seen following the latest JOLTS data which exceeded expectations as the vacancy rate rose and the quits rate fell, while US factory orders showed a larger-than-expected contraction but did little to derail the dollar's recovery. Nonetheless, price action has since quietened down overnight and the latest Fed rhetoric had little impact on markets including from Fed's Cook who stated Fed policy is well positioned for a range of scenarios and that she can't prejudge what the FOMC will do with rates.

- EUR/USD saw some slight reprieve after having steadily retreated beneath the 1.1400 handle owing to the dollar rebound and after softer EU HICP data.

- GBP/USD remained afloat in rangebound trade after yesterday's choppy performance amid the recent slew of BoE comments, while it was also reported that US tariffs on UK steel and aluminium will remain at 25% for now, with the UK failing to get the 0% tariffs promised in the US ‘deal’ implemented in time, while such tariffs for all other countries doubled to 50%.

- USD/JPY traded rangebound but held on to most of the prior day's spoils after returning to the 144.00 territory amid a firmer buck and the positive risk tone.

- Antipodeans lacked conviction as tailwinds from the positive risk appetite were offset by disappointing Australian GDP data.

- PBoC set USD/CNY mid-point at 7.1886 vs exp. 7.1977 (Prev. 7.1869).

- SNB's Tschudin said they look at price stability in the mid-term, not next month and that Swiss inflation fell to -0.1% in May, but that is just one data point and noted the outlook for the Swiss economy has become clearly more uncertain.

FIXED INCOME

- 10yr UST futures regained some composure after slipping yesterday in the wake of the rise in JOLTS data, but with the overnight rebound contained amid a lack of haven demand and after the latest slew of Fed comments had little sway on prices.

- Bund futures were uneventful amid a lack of pertinent catalysts heading closer towards Thursday's ECB meeting.

- 10yr JGB futures retreated amid the positive risk appetite and in a gradual pullback from the post-10yr-JGB-auction highs.

COMMODITIES

- Crude futures took a breather after advancing yesterday amid the positive risk appetite and ongoing geopolitical tensions, with demand contained overnight following mixed private sector inventory data.

- US Private Inventory Data (bbls): Crude -3.3mln (exp. -1mln), Distillates +0.8 (exp. +1mln), Gasoline +4.7mln (exp. +0.6mln), Cushing +1.0mln.

- Peru's Mining Minister said there is a rise in informal and illegal mining activity in two major copper production regions.

- Spot gold was choppy after retreating yesterday from a three-week peak and recent dollar swings.

- Copper futures extended on its gains after benefitting from the positive risk tone post-JOLTS data.

CRYPTO

- Bitcoin lacked firm conviction with price action choppy above the USD 105k level.

NOTABLE ASIA-PAC HEADLINES

- South Korean conservative presidential candidate Kim Moon-soo conceded defeat and liberal candidate Lee Jae-myung was confirmed the winner of South Korea's presidential election. Furthermore, South Korea’s new President Lee vowed economic growth and said it's time to restore democracy after the martial law crisis, while he said he will respond to public calls for building a completely new country.

DATA RECAP

- Australian Real GDP QQ SA (Q1) 0.2% vs. Exp. 0.4% (Prev. 0.6%)

- Australian Real GDP YY SA (Q1) 1.3% vs. Exp. 1.5% (Prev. 1.3%)

GEOPOLITICS

MIDDLE EAST

- Israeli military warned residents of Gaza against moving into areas leading to US-backed aid group distribution centres on Wednesday, deeming them 'combat zones'.

- Gaza Humanitarian Foundation said it will not distribute any aid on Wednesday and is in talks with the Israeli military to enhance security measures beyond the immediate perimeter of GHF sites.

- Ten elected UN Security Council members asked for a Wednesday vote on a draft resolution on Gaza that demands an immediate, unconditional and permanent ceasefire in Gaza and the release of all hostages held by Hamas, while it also demands immediate lifting of all restrictions on aid into Gaza and safe, unhindered distribution at scale throughout Gaza, according to Reuters citing sources.

- Sirens sounded in Tel Aviv after a rocket fired from Yemen towards Israel and Houthis announced the targeting of Israel's Ben Gurion Airport with a hypersonic missile, according to Cairo News and Sky News Arabia.

- Syrian Foreign Ministry said reports of launches towards Israel have not been verified yet and it affirmed that Syria will not pose a threat to any party in the region following projectile launches towards Israel. Furthermore, the Syrian Foreign Ministry said Israel's strike on Daraa caused significant human and material losses, while Syrian security sources also stated that Israel launched a series of strikes on targets in southern Syria.

- US proposed an interim step in Iran nuclear talks allowing some enrichment, according to the NY Times. It was separately reported that White House Press Secretary Leavitt said Witkoff sent a detailed proposal to Iran and hopes Iran will accept the proposal, otherwise, there will be consequences, while the US State Department said the maximum pressure campaign on Iran remains in 'full force'.

- Iranian President Pezeshkian said Tehran will not bow to US pressure to dismantle its nuclear programme.

- Iran is open to basing a nuclear deal with the US around the idea of a regional uranium enrichment consortium, as long as it is located within Iran, according to Axios citing an Iranian official.

RUSSIA-UKRAINE

- Ukraine's Foreign Minister said Russia made no response to Kyiv's peace proposals at Istanbul talks and presented 'old ultimatums', while the official stated more tangible results were needed. It was separately reported that Russia's Deputy Foreign Minister said Istanbul will remain the venue for Russia-Ukraine talks, and no other venues are on the table, according to TASS.

- White House Press Secretary Leavitt said President Trump is keeping sanctions on Russia as a tool in the toolbox and Trump remains optimistic about progress in Russia-Ukraine discussions.

- US Secretary of State Rubio spoke with Turkish Foreign Minister Fidan to discuss supporting direct negotiations between Russia and Ukraine.

- US Special Envoy Kellogg believes the Russia Sanctions Act is "ready to drop and said he spoke to Senator Graham about Russia sanctions.

- Russia's top security official Shoigu is to discuss Ukraine with North Korean leader Kim, according to Russian agencies.

- Russia's Deputy Foreign Minister said NATO's planned Baltic drills are part of the alliance's preparations for a potential military clash with Russia, according to TASS.

OTHER

- South Korean President Lee said peace achieved at a high cost is better than war and he will seek dialogue with North Korea to secure peace in the Korean peninsula.

- US Secretary of State Rubio commemorated the bravery of the Chinese people killed in the Tiananmen crackdown in 1989.

- Taiwan's President Lai posted on Facebook regarding the Tiananmen crackdown anniversary in which he stated that authoritarian governments often choose to silence and forget history, while he added that they cannot ignore the infringement on global democracy and the rule of law caused by the expansion of authoritarianism.

EU/UK

NOTABLE HEADLINES

- Germany is said to be seeking to pass a package of EUR 46bln in corporate tax breaks, according to FT.