US Market Open: Equities boosted by EZ PMIs & EU-US trade updates, USD flat into key US data

04 Jun 2025, 11:20 by Newsquawk Desk

- EU Trade Commissioner Sefcovic says he had constructive talks with USTR Greer; are advancing in the correct direction at "pace".

- US President Trump's order to increase steel and aluminium tariffs to 50% has taken effect, aside from the UK. The UK is still subject to 25% tariffs on steel, with the UK failing to get the 0% tariffs promised in the US ‘deal’ implemented in time.

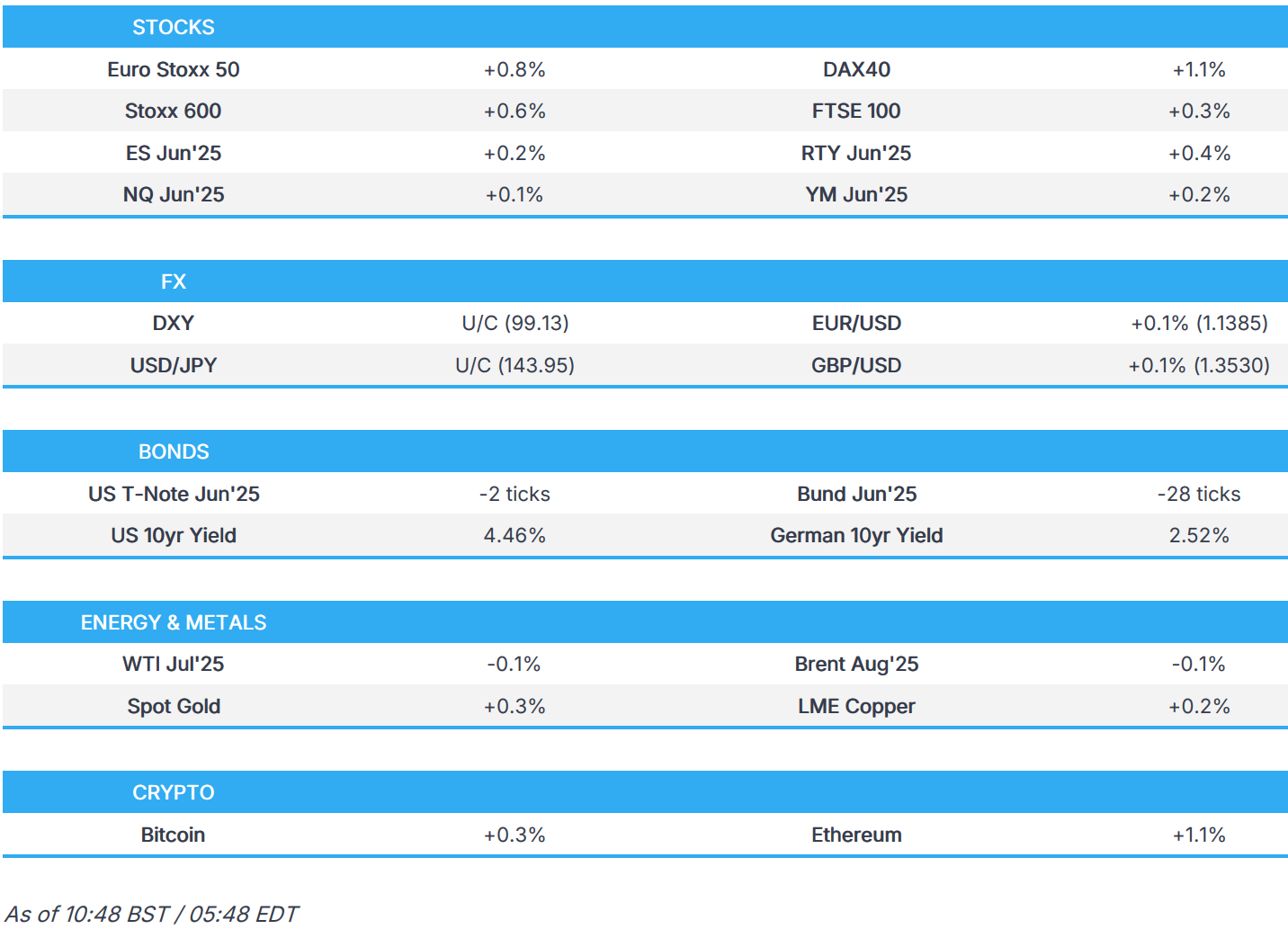

- European bourses climb higher and currently at session highs; US futures are modestly higher with some outperformance in the RTY.

- USD is incrementally lower/flat, whilst Antipodeans lead the G10 list.

- Bonds are weighed on by upward revisions to PMIs, Gilts lag after US metal measures.

- Crude tilts higher with US-Iran negotiations seemingly at a stalemate.

- Looking ahead, US Composite/Services PMI Final, US ADP National Employment, US ISM Services, BoC & NBP Policy Announcements, Fed Beige Book, Speakers including Fed’s Bostic, Cook & US Treasury Secretary Bessent. Earnings from PVH & Dollar Tree.

TARIFFS/TRADE

- US President Trump signed a Proclamation to double steel and aluminium tariffs to 50% under section 232 authority which took effect at midnight EDT, while it was reported that the White House said US tariffs on UK steel and aluminium will remain at 25% for now, with the UK failing to get the 0% tariffs promised in the US ‘deal’ implemented in time, and all other countries will be hit by 50% tariffs, according to Bloomberg's Wickham.

- US President Trump posts "I like President XI of China, always have, and always will, but he is VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!", via Truth Social.

- Canadian PM's office said additional US tariffs on Canadian steel and aluminium are 'unlawful and unjustified', while it added that the Canadian government is engaged in intensive and 'live negotiations' to have US tariffs removed.

- Mexico's Economy Minister said Mexico will ask on Friday to be excluded from the US's 50% steel tariff like the UK was, while he added the US increase of steel tariffs to 50% is unfair, unsustainable and inconvenient.

- China's Commerce Minister Wang met with EU Trade Commissioner Sefcovic in France on Tuesday and said at the WTO that the WTO should strengthen supervision over unilateral tariffs, as well as put forward objective and neutral policy proposals.

- Japanese Chief Cabinet Secretary Hayashi said they have not received any letter from the US asking to make the best offers on trade talks. It was also reported that Japan is to form a think tank with an eye on Trump tariffs and Taiwan, according to Nikkei.

- EU Chamber of Commerce in China held several meetings with China's Commerce Ministry, reportedly "senses Beijing is overwhelmed with applications to export the minerals vital for many hi-tech goods", via SCMP citing the Chamber's secretary general Dunnett. "Emergency meetings" were held in recent days, after expressions of anxiety across European industry.

- EU Trade Commissioner Sefcovic says he had constructive talks with USTR Greer; are advancing in the correct direction at "pace".

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.6%) opened modestly firmer across the board and have traded with an upward bias throughout the morning – currently at session highs. Aided by PMIs and potentially the readout from Sefcovic on his call with Greer.

- European sectors hold a strong positive bias and aside from the top performer, the breadth of the market is fairly narrow. The European auto sector has been in focus today, with European auto supplier association, Clepa, suggesting production lines and plants have already been shut and the impact will likely grow in the next 3-4 weeks. This sparked some modest pressure in the sector.

- US equity futures (ES +0.2%, NQ +0.1%, RTY +0.4%) are broadly in positive territory, with some modest outperformance in the RTY, continuing the upside seen in the prior session. Focus now turns to US ISM Services, ADP National Employment and a few Fed speakers.

- Barclays lifts its S&P 500 end-2025 price target to 6050 (prev. 5900).

- China is said to be mulling ordering hundreds of Airbus (AIR FP) jets in a major deal, according to Bloomberg sources; potentially as many as 500 craft.

- China Auto Industry Body CPCA says Tesla (TSLA) sold 61,662 China-made vehicles in May, -15% Y/Y (prev. 58,459 in April; 72,600 Y/Y).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is fractionally lower following Tuesday's session of gains which were in part a bounce back from Monday's losses and supported by JOLTS data. On the trade front, markets await the call between Trump and Xi on Friday. Ahead of which, Trump has posted that his Chinese counterpart is "very tough, and extremely hard to make a deal with". Ahead, attention will be on the data slate with ADP due on deck ahead of Friday's all-important NFP print. Elsewhere, ISM services and the Fed's Beige Book are also set to be released. DXY currently trading around 99.03.

- EUR is a touch firmer vs. the USD but stuck on a 1.14 handle following a soft EZ inflation release in the run-up to Thursday's ECB policy announcement (25bps cut is pretty much nailed on). Elsewhere, on the data front; an upward revision to the EZ composite PMI into positive territory has little follow-through into EUR with EUR/USD currently topped out at 1.1396.

- JPY is flat vs. the USD but holding onto most of the prior day's spoils after returning to the 144.00 territory amid a firmer buck and the positive risk tone. Incremental newsflow out of Japan has been on the light side aside from Japanese Chief Cabinet Secretary Hayashi said they have not received any letter from the US asking to make the best offers on trade talks. USD/JPY had ventured as high as 144.38 overnight before drifting back towards the top end of Tuesday's 142.37-144.11 range. GBP firmer vs. the USD and flat vs. the EUR with pertinent UK-specific newsflow lacking aside from the White House announcing that US tariffs on UK steel and aluminium will remain at 25% for now, with the UK failing to get the 0% tariffs promised in the US ‘deal’ implemented in time, according to Bloomberg. Elsewhere, an upward revision to UK services PMI had little impact on the GBP.

- Antipodeans are both a touch firmer vs. the slightly softer USD with AUD able to overlook disappointing Australian GDP data which has heightened calls for a looser approach by the RBA. Both currencies will be eyeing the outcome of the Trump-Xi call on Friday given that China is both of their largest trading partners.

- CAD is flat vs. the USD ahead of today's BoC policy announcement. The BoC is expected to keep rates on hold at 2.75%, although some (6/26 surveyed by Reuters) expect a 25bps rate cut; markets price such an outcome at 30%. USD/CAD is currently tucked within Tuesday's 1.3701-43 range.

- PBoC set USD/CNY mid-point at 7.1886 vs exp. 7.1977 (Prev. 7.1869).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs started the day contained. Focus overnight was on the largely as expected implementation of Trump’s 50% steel and aluminium tariff rate for all ex-UK, which is subject to a lower 25% rate, for now. Now focus remains firmly on US-China relations and specifically on Friday's call which features the Presidents of the two countries. USTs currently hold at the low end of a 110-12+ to 110-18+ band, ahead of ISM Services and ADP National Employment.

- Bunds held a slight bearish bias overnight but not particularly pronounced. This bias accelerated throughout the European morning in the wake of Final PMIs. No overly significant reaction to any one figure, but Bunds fell from 131.30 to an initial 131.04 low across the PMI window. The EZ-wide figure was revised a little higher with the accompanying commentary suggesting that ECB cuts/German fiscal spending should be enough to offset the impact of higher tariffs/uncertainty.

- Most recently, EU Trade Commissioner Sefcovic said he had constructive talks with USTR Greer; are advancing in the correct direction at "pace"; a comment which may have helped push the benchmark to a 130.94 base, alongside European equity bourses picked up slightly at the time.

- Gilts are under pressure throughout the morning in catch-up to the general overnight tone, the above factors (particularly PMIs) and ahead of supply. Additionally, yields pushed higher by the inflationary implications of the UK finding itself subject to 25% tariffs on metals; while better than global peers, the levy is a disappointment for those who hoped the UK-US deal would result in a full exemption.

- UK Chancellor Reeves has been on the wires today, where she ruled out increasing tax for "working people" in the Autumn Budget. UK assets were little moved.

- UK Sells GBP 4.75bln 4.375% 2028 Gilt: b/c 3.08x (prev. 3.48x), average yield 4.062% (prev. 3.834%) & tail 0.3bps (prev. 0.2bps).

- Orders for the new Italian 5yr BTP in excess of EUR 95bln, Green BTP orders in excess of EUR 85bln, via Reuters citing leads.

- Click for a detailed summary

COMMODITIES

- Crude has been tilting upwards in early European hours after taking a breather in APAC trade after advancing on Tuesday amid the positive risk appetite and ongoing geopolitical tensions, with demand contained overnight following mixed private sector inventory data. Tight parameters are seen across crude futures - WTI Jul resides in a USD 63.07-63.52/bbl range while Brent Aug sits in a USD 65.31-65.77/bbl band.

- Mixed trade across precious metals as traders await the next macro catalyst, with spot gold and silver caged to narrow ranges. XAU/USD currently trades in a USD 3,346.53-3,372.71/oz range and well within Tuesday's USD 3,333.17-3,392.30/oz.

- Spot palladium narrowly underperforms, potentially with headwinds from the European auto supplier association Clepa who said production lines and a couple of plants are already shut due to China rare earth export curbs.

- Base metals are tilting firmer in tandem with upticks seen across equities, and in broader sentiment, albeit gains are capped ahead of risk events including a slew of Fed speakers, the US Jobs report on Friday, but arguably more importantly for the complex, traders await news on a potential call between US President Trump and Chinese President Xi.

- US Private Inventory Data (bbls): Crude -3.3mln (exp. -1mln), Distillates +0.8 (exp. +1mln), Gasoline +4.7mln (exp. +0.6mln), Cushing +1.0mln.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU HCOB - Composite Final PMI (May) 50.2 vs. Exp. 49.5 (Prev. 49.5); Services Final PMI (May) 49.7 vs. Exp. 48.9 (Prev. 48.9)

- German HCOB Services PMI (May) 47.1 vs. Exp. 47.2 (Prev. 47.2); Composite Final PMI (May) 48.5 vs. Exp. 48.6 (Prev. 48.6)

- French HCOB Composite PMI (May) 49.3 vs. Exp. 48.0 (Prev. 48.0); Services PMI (May) 48.9 vs. Exp. 47.4 (Prev. 47.4)

- Italian HCOB Services PMI (May) 53.2 vs. Exp. 52.0 (Prev. 52.9); Composite PMI (May) 52.5 (Prev. 52.1)

- UK S&P Global Composite PMI (May) 50.3 vs. Exp. 49.4 (Prev. 49.4); S&P Global Services PMI (May) 50.9 vs. Exp. 50.2 (Prev. 50.2)

- Swedish PMI Services (May) 50.8 (Prev. 48.4)

- Spanish Services PMI (May) 51.3 vs. Exp. 52.8 (Prev. 53.4)

NOTABLE EUROPEAN HEADLINES

- European auto supplier association Clepa says production lines and a couple of plants are already shut due to China rare earth export curbs; impact likely to grow in the next 3-4 weeks, and only 1/4 of licence requests have been granted since early April.

- Germany is said to be seeking to pass a package of EUR 46bln in corporate tax breaks, according to FT.

- Germany's VDMA says April orders -6% Y/Y (domestic -4%, foreign -7%).

- "[UK Chancellor] Rachel Reeves rules out increasing income tax, NI and VAT for 'working people' in the autumn Budget, saying she will stick to her manifesto pledges despite tight public finances", via Jason Groves on X. Will be making changes to the winter fuel payments, so they can be paid this winter (As expected).

- UK Chancellor Reeves says, "I have no intention of raising taxes again on the scale of 2024 budget".

NOTABLE US HEADLINES

- US President Trump invited the Senate Financial Committee to the White House with the meeting reportedly to be held at 16:00EDT on Wednesday.

- OMB Director Vought said the rescission package sent on Tuesday is just the start and they chose the easiest DOGE cuts to start rescissions, while he added there are consequences for Congress failing to rescind. Vought said the rescission package will be on the floor next week and they will send many more rescissions once this passes, as well as noted that they have tools to make cuts permanent by the end of the FY.

- BLS said some April jobs data will be corrected on Friday and major measures such as the unemployment rate are unaffected, while it added that many numbers are to be corrected but the impact is 'negligible'.

GEOPOLITICS

MIDDLE EAST

- Israeli military warned residents of Gaza against moving into areas leading to US-backed aid group distribution centres on Wednesday, deeming them 'combat zones'.

- Gaza Humanitarian Foundation said it will not distribute any aid on Wednesday and is in talks with the Israeli military to enhance security measures beyond the immediate perimeter of GHF sites.

- Ten elected UN Security Council members asked for a Wednesday vote on a draft resolution on Gaza that demands an immediate, unconditional and permanent ceasefire in Gaza and the release of all hostages held by Hamas, while it also demands immediate lifting of all restrictions on aid into Gaza and safe, unhindered distribution at scale throughout Gaza, according to Reuters citing sources.

- Sirens sounded in Tel Aviv after a rocket fired from Yemen towards Israel and Houthis announced the targeting of Israel's Ben Gurion Airport with a hypersonic missile, according to Cairo News and Sky News Arabia.

- Syrian Foreign Ministry said reports of launches towards Israel have not been verified yet and it affirmed that Syria will not pose a threat to any party in the region following projectile launches towards Israel. Furthermore, the Syrian Foreign Ministry said Israel's strike on Daraa caused significant human and material losses, while Syrian security sources also stated that Israel launched a series of strikes on targets in southern Syria.

- US proposed an interim step in Iran nuclear talks allowing some enrichment, according to the NY Times. It was separately reported that White House Press Secretary Leavitt said Witkoff sent a detailed proposal to Iran and hopes Iran will accept the proposal, otherwise, there will be consequences, while the US State Department said the maximum pressure campaign on Iran remains in 'full force'.

- Iran is open to basing a nuclear deal with the US around the idea of a regional uranium enrichment consortium, as long as it is located within Iran, according to Axios citing an Iranian official.

- Iranian Supreme Leader Khamenei says Iran will increase Iran's power in all fields. The US nuclear proposal is 100% against "the principle of our power".

RUSSIA-UKRAINE

- Ukraine's Foreign Minister said Russia made no response to Kyiv's peace proposals at Istanbul talks and presented 'old ultimatums', while the official stated more tangible results were needed. It was separately reported that Russia's Deputy Foreign Minister said Istanbul will remain the venue for Russia-Ukraine talks, and no other venues are on the table, according to TASS.

- White House Press Secretary Leavitt said President Trump is keeping sanctions on Russia as a tool in the toolbox and Trump remains optimistic about progress in Russia-Ukraine discussions.

- US Secretary of State Rubio spoke with Turkish Foreign Minister Fidan to discuss supporting direct negotiations between Russia and Ukraine.

- US Special Envoy Kellogg believes the Russia Sanctions Act is "ready to drop and said he spoke to Senator Graham about Russia sanctions.

- Russia's top security official Shoigu is to discuss Ukraine with North Korean leader Kim, according to Russian agencies.

- Russia's Deputy Foreign Minister said NATO's planned Baltic drills are part of the alliance's preparations for a potential military clash with Russia, according to TASS.

OTHER

- South Korean President Lee said peace achieved at a high cost is better than war and he will seek dialogue with North Korea to secure peace in the Korean peninsula.

- US Secretary of State Rubio commemorated the bravery of the Chinese people killed in the Tiananmen crackdown in 1989.

- Taiwan's President Lai posted on Facebook regarding the Tiananmen crackdown anniversary in which he stated that authoritarian governments often choose to silence and forget history, while he added that they cannot ignore the infringement on global democracy and the rule of law caused by the expansion of authoritarianism.

CRYPTO

- Lacklustre trade in the crypto complex thus far; Bitcoin is essentially flat and trading around USD 105.5k.

APAC TRADE

- APAC stocks traded mostly higher following the gains on Wall St where sentiment was lifted by better-than-expected JOLTS data and with some slight optimism with US President Trump and Chinese President Xi reportedly set to speak this Friday.

- ASX 200 was led higher by outperformance in the energy sector and with participants unfazed by recent data releases including the miss on Q1 GDP.

- Nikkei 225 advanced at the open following recent currency weakness but with further upside capped by a lack of drivers.

- KOSPI outperformed and is on course for a bull market following the Presidential Election which was won by the DP's Lee Jae-Myung who was later sworn in.

- Hang Seng and Shanghai Comp conformed to the positive mood but with gains capped as China remained quiet regarding a potential Trump-Xi call.

DATA RECAP

- Australian Real GDP QQ SA (Q1) 0.2% vs. Exp. 0.4% (Prev. 0.6%); YY SA (Q1) 1.3% vs. Exp. 1.5% (Prev. 1.3%)