Europe Market Open: EUR and European Equities lacklustre ahead of ECB and Trump-Merz meeting

05 Jun 2025, 07:00 by Newsquawk Desk

- US President Trump is to meet with German Chancellor Merz at 11:45EDT/16:45BST today.

- US President Trump said the "debt limit should be entirely scrapped..."; separately, he banned travel from certain nations

- APAC trade was mixed, European futures point to a flat open

- DXY saw a slight reprieve, EUR/USD took a breather and GBP was rangebound

- Fixed benchmarks held onto recent gains, JGBs were briefly knocked by the 30yr auction

- Crude lacklustre, and unreactive to Trump and Putin holding a conversation

- Looking ahead, highlights include German Industrial Orders, Swedish CPI, Italian Retail Sales, EZ Producer Prices, US Jobless Claims, Challenger Layoffs, US International Trade, Canadian Trade, ECB Policy Announcement; BoE DMP, Danish Holiday, Speakers including ECB President Lagarde, BoE's Greene, Fed’s Kugler, Harker, Schmid & BoC’s Kozicki, Supply from Spain & France, Earnings from Broadcom, DocuSign, Wise & CMC Markets.

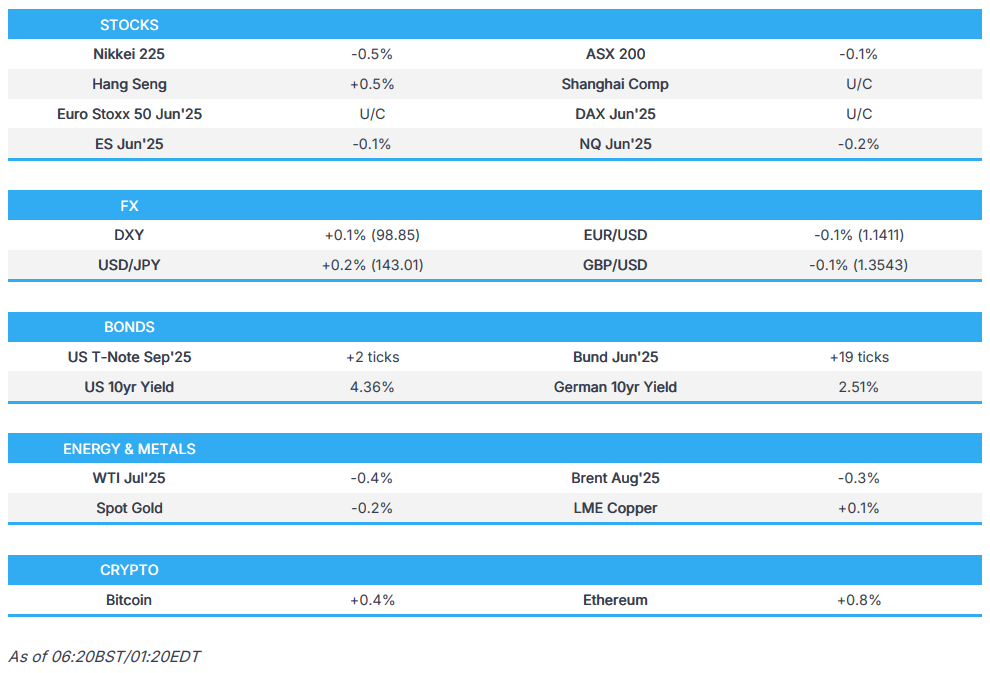

As of 06:20BST/01:20EDT

LOOKING AHEAD

- Highlights include German Industrial Orders, Swedish CPI, Italian Retail Sales, EZ Producer Prices, US Jobless Claims, Challenger Layoffs, US International Trade, Canadian Trade, ECB Policy Announcement; BoE DMP, Danish Holiday, Speakers including ECB President Lagarde, BoE's Greene, Fed’s Kugler, Harker, Schmid & BoC’s Kozicki, Supply from Spain & France, Earnings from Broadcom, DocuSign, Wise & CMC Markets.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks finished mixed following a choppy performance throughout the session as participants digested weak data releases including the significantly lower-than-expected ADP job numbers and with ISM Services PMI slipping into contraction territory. The disappointing data spurred a drop in yields and constrained the major indices although there was slight outperformance in the Nasdaq amid firm gains in Meta (META) and as Alphabet (GOOGL) recouped some of the prior day's losses.

- SPX +0.01% at 5,970, NDQ +0.27% at 21,722, DJI -0.22% at 42,427, RUT -0.21% at 2,098.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump is to meet with German Chancellor Merz at 11:45EDT/16:45BST today.

- Canadian PM Carney said Ottawa is preparing reprisals against the US if talks to remove tariffs do not succeed.

- Canada’s Industry Minister said they are looking at different scenarios on how to react to the latest US tariffs and need a bit more time, while they have not removed from the table the idea of more counter-tariffs.

- Alberta Premier Smith said Canada is optimistic about a near-term trade deal with the US.

- US auto supplier group said immediate and decisive action is needed to prevent widespread disruption and economic fallout across the vehicle supplier sector on the Chinese rare earth issue.

- Vietnam sent a document with replies to US requests on trade and the Trade Minister met with USTR Greer to discuss the main points in Vietnam's replies to the US's requests on trade.

NOTABLE HEADLINES

- US President Trump commented "The Debt Limit should be entirely scrapped to prevent an Economic catastrophe", while he added "It is too devastating to be put in the hands of political people that may want to use it despite the horrendous effect it could have on our Country and, indirectly, even the World".

- US Senate Majority Leader Thune said Senate Republicans had a positive budget bill talk with President Trump and feel good about where they are on the Trump tax bill, while GOP Senator Crapo said Republicans have very strong support and unity on the Trump tax bill.

- US President Trump signed a proclamation to ban travel from certain countries whereby the proclamation fully restricts and limits the entry of nationals from 12 countries, including Afghanistan, Burma, Chad, Republic of Congo, Equatorial Guinea, Eritrea, Haiti, Iran, Libya, Somalia, Sudan, and Yemen, while Trump said travel ban list is subject to revision and new countries could be added as threats emerge around the world. Furthermore, President Trump signed a proclamation to restrict foreign student visas at Harvard University.

- Fed Beige Book noted reports across the twelve Federal Reserve Districts indicate that economic activity has declined slightly since the previous report, while half of the Districts reported slight to moderate declines in activity, three Districts reported no change, and three Districts reported slight growth.

- Fed's Kashkari (2026 voter) said they are still not all the way back to the 2% inflation target and the labour market is showing some signs of slowing, while he added that the Fed must wait and see as the economy faces uncertainty, via a CNN interview.

- US Senate confirmed that Fed's Bowman is to serve as Federal Reserve Vice Chair for Supervision.

- White House official said Elon Musk's opposition is one disagreement in an otherwise harmonious relationship and it will not consult every policy decision with Elon Musk, while the official added that President Trump is committed to getting the bill passed, despite opposition from Musk.

- OMB chief Vought said the White House doesn't support the debt ceiling being removed from the reconciliation bill and that the Trump spending bill will improve the deficit, while he added they are having very good conversations with the Senate on the Trump spending bill and opposing views from outside aren't hurting bill's prospects.

- Non-partisan CBO said Trump tariffs on foreign goods could potentially reduce the budget deficit by USD 2.8tln over 10 years and noted that economic output is to fall as a result of Trump tariffs, according to Reuters citing a letter.

APAC TRADE

EQUITIES

- APAC stocks were mixed after the choppy performance in US where markets digested disappointing data and a drop in yields.

- ASX 200 struggled for direction following mixed data including the latest trade figures and household spending for Australia.

- Nikkei 225 retreated amid headwinds from recent currency strength and following softer-than-expected Labour Earnings.

- Hang Seng and Shanghai Comp were somewhat varied as tech and property names led the outperformance in Hong Kong, while the mainland was contained following mixed Caixin PMI data and as participants wait and see if a Trump-Xi call will materialise this week.

- US equity futures proceeded sideways following the recent indecision and as participants looked ahead to further incoming data releases.

- European equity futures indicate an uneventful open with Euro Stoxx 50 futures unchanged after the cash market closed with gains of 0.6% on Wednesday.

FX

- DXY got some slight reprieve after declining yesterday as yields dropped in the aftermath of soft US data whereby the ADP employment report significantly missed expectations and ISM Services PMI unexpectedly slipped into a contraction. Nonetheless, participants await more data releases heading into Friday's NFP report, as well as comments from Fed speakers and key talks, with President Trump to meet with German Chancellor Merz.

- EUR/USD took a breather after benefitting yesterday from the dollar selling and EU PMIs, while focus now turns to the ECB.

- GBP/USD lacked firm direction amid light UK-specific newsflow although it was reported that Chancellor Reeves ruled out increasing income tax, NI and VAT for 'working people' in the autumn Budget.

- USD/JPY partially nursed losses after slipping to sub-143.00 territory as US-Japanese yield differentials narrowed following the dismal US data.

- Antipodeans held on to recent spoils but with the upside capped by mixed data from Australia and the somewhat cautious sentiment overnight.

- PBoC set USD/CNY mid-point at 7.1865 vs exp. 7.1762 (Prev. 7.1866).

FIXED INCOME

- 10yr UST futures held on to recent spoils after ascending on weak ISM Services and ADP jobs data.

- Bund futures calmed down after yesterday's fluctuations, with German Industrial Orders and the ECB meeting on the horizon.

- 10yr JGB futures played catch up to the advances in US counterparts following softer-than-expected Labour Cash Earnings from Japan, while prices briefly wobbled following mixed results from the latest 30yr JGB auction, before extending on gains.

- Japan sells JPY 604.8bln 30-yr JGBs; b/c 2.92x (prev. 3.07x), and average yield 2.904% (prev. 2.941%). Lowest accepted price 91.45 vs prev. 91.10; Average accepted price 91.94 vs prev. 91.40; Tail in price 0.49 vs prev. 0.30

COMMODITIES

- Crude futures remained lacklustre after declining yesterday owing to a source report that Saudi Arabia wants more super-sized OPEC+ hikes.

- Spot gold traded little changed after yesterday's choppy performance and as the dollar stabilised overnight.

- Copper futures kept afloat but with upside capped amid the somewhat indecisive mood in Asia and after mixed Caixin PMIs.

- Peru's government restored formal mining operations in violence-affected areas in northern Peru.

CRYPTO

- Bitcoin edged higher albeit in a choppy fashion and returned to above the USD 105k level.

NOTABLE ASIA-PAC HEADLINES

- China's Commerce Minister met with the OECD Secretary General at the WTO meeting in France and said China is willing to share experience with the OECD in trade and investment, digital economy and green developments. China is willing to carry out personnel exchanges and promote practical cooperation with the OECD and hopes that the OECD will firmly stand on the side of international fairness and justice.

- US SEC called for public comment on potential rules requiring more US-listed Chinese and other foreign firms to provide more regular investor disclosures.

- Apple (AAPL) and Alibaba's (9988 HK) AI rollout in China has been delayed by US President Trump's trade war, according to FT.

DATA RECAP

- Chinese Caixin Services PMI (May) 51.1 vs. Exp. 51.0 (Prev. 50.7)

- Chinese Caixin Composite PMI (May) 49.6 (Prev. 51.1)

- Japanese Overall Lab Cash Earnings (Apr) 2.3% vs. Exp. 2.6% (Prev. 2.1%)

- Australian Household Spending MM (Apr) 0.1% vs Exp. 0.2% (Prev. -0.3%)

- Australian Household Spending YY (Apr) 3.7% vs Exp. 3.6% (Prev. 3.5%)

- Australian Balance on Goods (Apr) 5413M vs. Exp. 5900M (Prev. 6900M)

- Australian Goods/Services Exports (Apr) -2.4% (Prev. 7.6%)

- Australian Goods/Services Imports (Apr) 1.1% (Prev. -2.2%)

GEOPOLITICS

RUSSIA-UKRAINE

- US President Trump said he spoke with Russian President Putin in which the conversation lasted 15 minutes and they discussed Ukraine’s attack on Russia’s docked aeroplanes, as well as various other attacks that have been taking place by both sides. Trump added it was a good conversation, but not a conversation that will lead to immediate peace, while Trump noted that Putin said very strongly, that he will have to respond to the recent attack on the airfields.

- US is redirecting critical anti-drone technology from Ukraine to US forces in a move that reflects the Pentagon's waning commitment to Kyiv's defence, according to WSJ.

- Ukrainian drone attacks hit energy targets in Russian-held areas of Zaporizhzhia and the Kherson region, with tens of thousands without power, according to Russian-installed officials.

- Ukraine's Economy Minister said the first meeting of the Ukraine minerals fund is expected in July and Ukraine has discussed with the US about how to make the minerals fund operational by year-end.

OTHER

- China's Guangzhou Public Security Bureau issued a bounty for cyber attack suspects that it said are linked to the Taiwan authorities.

EU/UK

NOTABLE HEADLINES

- UK is to unveil pension reform aimed at boosting retirement savings with the parliamentary bill to be presented on Thursday set to include a reserve power that could force schemes to invest more in Britain, according to FT