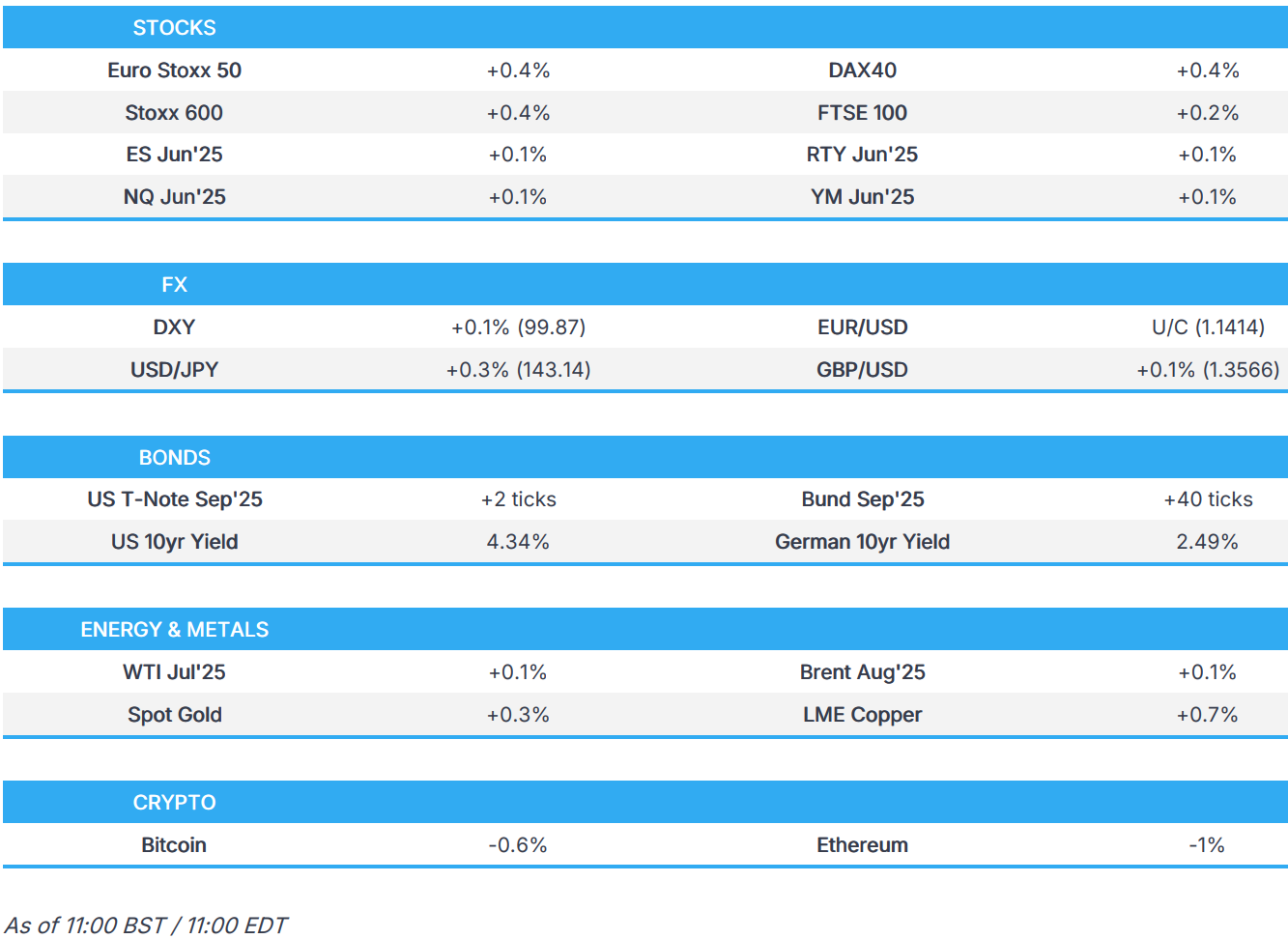

US Market Open: DXY lacklustre & US equity futures firmer but off best ahead of the ECB, US data and Trump-Merz

05 Jun 2025, 11:25 by Newsquawk Desk

- US President Trump is to meet with German Chancellor Merz at 11:45EDT/16:45BST today.

- European bourses opened flat before climbing, which supported US futures, but are now off best.

- FX markets broadly contained as EUR awaits the upcoming ECB rate announcement.

- Bonds broadly trading near session highs, Bunds benefit after strong auctions from Spain/France.

- Crude prices stabilise after sinking post-Saudi report, technical breakout boosts spot silver.

- Looking ahead, US Jobless Claims, Challenger Layoffs, US International Trade, Canadian Trade, ECB Policy Announcement; BoE DMP, Danish Holiday, Speakers including ECB President Lagarde, BoE's Greene, Fed’s Kugler, Harker, Schmid & BoC’s Kozicki. Earnings from Broadcom & DocuSign.

TARIFFS/TRADE

- US President Trump is to meet with German Chancellor Merz at 11:45EDT/16:45BST today.

- US auto supplier group said immediate and decisive action is needed to prevent widespread disruption and economic fallout across the vehicle supplier sector on the Chinese rare earth issue.

- Vietnam sent a document with replies to US requests on trade and the Trade Minister met with USTR Greer to discuss the main points in Vietnam's replies to the US's requests on trade.

- Chinese Foreign Ministry says there is no information to share on a US President Trump/Chinese President Xi call, via Bloomberg.

- EU Trade Commissioner Sefcovic says China's "impressive" rise must not come at the expense of the European economy "Our objective is straightforward, to identify real and highest vulnerability across political areas. I am talking about advanced semiconductors, AI and quantum tech".

- EU Businesses are lobbying Beijing to set up a "special channel" to fast track Chinese approval of rare earth export licenses for "reliable" companies, according to FT sources; proposal was made at a meeting with European companies and MOFCOM officials.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.4%) opened on either side of the unchanged mark, but soon after the cash open, indices caught a bid to depict a mostly positive environment. Nothing behind the move higher, but it occurred alongside a pick-up in US equity futures. Indices are currently trading at highs. Focus now turns to the ECB, where a 25bps cut is widely expected.

- European sectors are mixed, with the breadth of the market fairly narrow today. Construction takes the top spot, joined closely by Tech and then Healthcare. Travel & Leisure sits at the foot of the pile, with the downside stemming from very poor FY results from Wizz Air (-22%).

- US equity futures are modestly in the green, (ES +0.1%), with indices moving in tandem with the pick-up seen in Europe. Focus now turns to US Jobless Claims and Unit Labour Cost Revisions alongside a few Fed speakers.

- Foxconn (2317 TT) May Revenue +11.92% Y/Y (prev. +25.54%); based on current visibility, operational outlook for Q2 anticipates Q/Q + Y/Y growth but impact of evolving political and economic conditions and FX changed will need continued close monitoring.

- UMC (2303 TT) May (TWD): Revenue 19.48bln (prev. 19.51bln) , -0.15% Y/Y. January to May sales 97.79bln (prev. 93.88bln).

- Procter & Gamble (PG) over the next two years will cut 7k jobs (or roughly 15% of its non-manufacturing workforce) globally, according to WSJ.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is a touch higher with the USD showing a mixed performance vs. peers (weaker vs. antipodeans, firmer vs. havens). This follows a session of losses on Wednesday which were triggered by soft outturns for US ADP and ISM services PMIs. Newsflow since has been on the quiet side, aside from President Trump calling for a scrapping of the debt limit; something that appears to be very unlikely to be implemented. As such, focus will remain on the labour market for now (pending any major trade updates) with weekly claims, Challenger Layoffs due on today's docket, with Fed speak also due. DXY currently in a 99.68-94 range.

- EUR flat vs. the USD as markets await the latest ECB policy announcement which is widely expected to see the GC deliver a 25bps cut in the Deposit Rate to 2.0%. With the decision itself nailed on, focus will be on any hints over future easing plans. Lagarde is unlikely to offer any explicit guidance on this front given the uncertainties presented by the trade war. EUR/USD briefly matched Wednesday's best at 1.1435 before ebbing lower as a beat on German Industrial Output failed to support the currency.

- JPY softer vs. the USD and at the bottom of the G10 leaderboard alongside the other notable haven, CHF. Losses were spurred alongside a pick-up in risk sentiment in early European trade as the pair attempted to atone for Wednesday's USD-led losses. 143.39 is the high water mark thus far which is a point below Wednesday's best.

- GBP is a touch firmer vs. the USD with UK-specific newsflow remaining on the light side as has been the case throughout the week. From a fiscal standpoint, Times Political Editor Swinford posts UK Chancellor Reeves will next week set out plans to restore winter fuel payments and then claw them back from millions of better-off pensioners through higher tax bills. Cable is yet to test Wednesday's best at 1.3580. If breached, the YTD peak from 26th May at 1.3593.

- Antipodeans are holding onto recent spoils with both currencies underpinned by a pick up in sentiment in early European trade. AUD digested mixed Australian data overnight including the latest trade figures and household spending.

- PBoC set USD/CNY mid-point at 7.1865 vs exp. 7.1762 (Prev. 7.1866).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- JGBs were contained through much of the APAC session before selling off on the 30yr JGB auction. A sale that featured a softer cover than the prior and a wider price tail, pushing JGBs lower by around 20 ticks to a 139.01 base. Then move did mostly pare given the outing was not as bad-as-feared.

- USTs are higher by a handful of ticks and within a 110-12 to 111-07 parameters. Specifics light in the European morning and no catalyst behind it but US equity futures, and European peers, saw a jump just after the European cash equity open. This weighed on USTs slightly to a 111-00+ base. From a US standpoint, Fed speak, Jobless Claims and Challenger Layoffs are all due.

- Bunds are on a stronger footing, a small bout of pressure following German Industrial Orders, which was a little better than expected. Pressure which then accelerated around the cash open when stocks caught a bid but this was short lived. Thereafter, a strong set of auctions from both France and Spain has, alongside a pullback in the risk tone, fuelled the upside. Currently trading at the upper end of a 130.79 to 131.35 parameter, going into the ECB where the Bank is expected to deliver a 25bps cut.

- Gilts are heading into the resumption of trade, the bias for Gilts was for a contained to slightly softer open. As the benchmark closed towards highs on Wednesday and while USTs were contained Bunds had come off slightly after Industrial Orders. However, an announcement from the ONS that the most recent inflation headline was being revised lower by 0.1pps offset this and provided modest bullish impetus for Gilts, causing them to open higher by eight ticks and then extend a few more.

- Spain sells EUR 5.5bln vs exp. EUR 4.5-5.5bln 2.40% 2028, 2.70% 2030 & 0.70% 2032 & EUR 0.563bln vs exp. EUR 0.25-0.75bln 2.05% 2039 I/L.

- France sells EUR 12bln vs exp. EUR 10-12bln 3.20% 2035, 1.25% 2036 & 3.75% 2056 OAT.

- Japan sells JPY 604.8bln 30-yr JGBs; b/c 2.92x (prev. 3.07x), and average yield 2.904% (prev. 2.941%). Lowest accepted price 91.45 vs prev. 91.10; Average accepted price 91.94 vs prev. 91.40; Tail in price 0.49 vs prev. 0.30.

- Click for a detailed summary

COMMODITIES

- Crude is slightly firmer and trading attempting to claw back Wednesday’s hefty energy specific losses, most notably the Bloomberg reports that Saudi Arabia wants more super size OPEC+ cuts. WTI and Brent reside within narrow USD 62.50-63.15 and 64.60-65.25/bbl bounds.

- Spot gold is trading on a firmer footing but underperforming vs spot silver, which has caught a bid in recent trade. Nothing fundamental for the recent surge in silver prices, instead the move appears to be more of a technical breakout with perhaps some impetus coming from the risk tone easing from initial highs in recent trade. XAU/USD currently trades towards the upper end of a USD 3,361.27-3,390/oz parameter; Spot silver outperforms, just off a USD 35.80 peak.

- Copper looks to build on the prior session’s gains, despite mixed Caixin PMIs, which showed the composite slip into contractionary territory, and services remain afloat, ticking up moderately. 3M LME Copper trades in a USD 9,622.65-9,692.2/t range.

- Peru's government restored formal mining operations in violence-affected areas in northern Peru.

- Click for a detailed summary

NOTABLE DATA RECAP

- Swedish CPIF Flash YY (May) 2.3% vs. Exp. 2.50% (Prev. 2.30%); Ex Energy Flash YY (May) 2.5% vs. Exp. 2.60% (Prev. 3.10%)

- German Industrial Orders MM (Apr) 0.6% vs. Exp. -1.0% (Prev. 3.6%).

- ONS says UK CPI was overstated by 0.1pp in April due to an error in the Vehicle Excise Duty (VED) data provided by the Department for Transport, meaning CPI was 3.4% not 3.5%.

- EU Producer Prices YY (Apr) 0.7% vs. Exp. 1.2% (Prev. 1.9%); MM (Apr) -2.2% vs. Exp. -1.8% (Prev. -1.6%, Rev. -1.7%)

- Italian Retail Sales NSA YY (Apr) 3.7% (Prev. -2.8%); MM (Apr) 0.7% (Prev. -0.5%)

- EU HCOB Construction PMI (May) 45.6 (Prev. 46)

- French HCOB Construction PMI (May) 43.1 (Prev. 43.6)

- Italian HCOB Construction PMI (May) 50.5 (Prev. 50.1)

- German HCOB Construction PMI (May) 44.4 (Prev. 45.1)

- UK S&P Global Construction PMI (Ma]y) 47.9 vs. Exp. 47.2 (Prev. 46.6)

NOTABLE EUROPEAN HEADLINES

- UK is to unveil pension reform aimed at boosting retirement savings with the parliamentary bill to be presented on Thursday set to include a reserve power that could force schemes to invest more in Britain, according to FT

- Times Political Editor Swinford posts UK Chancellor Reeves will next week set out plans to restore winter fuel payments and then claw them back from millions of better-off pensioners through higher tax bills.

- BoE Monthly Decision Maker Panel data - May 2025: Expectations for year-ahead CPI inflation remained unchanged at 3.2% in the three months to May. Expectations for three year-ahead CPI inflation remained unchanged at 2.8% in the three months to May. Expected year-ahead wage growth fell by 0.1 percentage points to 3.7% on a three-month moving-average basis in May. Across all questions on sales, prices and investment over 70% of firms reported that changes to US trade policy would have no material impact on their firms. US trade policy was reported to be one of the top three sources of uncertainty for 12% of businesses, significantly lower than the 22% who reported it to be a top-three source of uncertainty in April.

NOTABLE US HEADLINES

- Punchbowl reports, citing sources: "There’s no resolution yet on SALT, which Senate Republicans want to change significantly. We’re told Trump didn’t object when GOP senators reiterated their desire to water down the House’s USD 40,000 deduction cap."

- US Senate Majority Leader Thune said Senate Republicans had a positive budget bill talk with President Trump and feel good about where they are on the Trump tax bill, while GOP Senator Crapo said Republicans have very strong support and unity on the Trump tax bill.

- US President Trump signed a proclamation to ban travel from certain countries whereby the proclamation fully restricts and limits the entry of nationals from 12 countries, including Afghanistan, Burma, Chad, Republic of Congo, Equatorial Guinea, Eritrea, Haiti, Iran, Libya, Somalia, Sudan, and Yemen, while Trump said travel ban list is subject to revision and new countries could be added as threats emerge around the world. Furthermore, President Trump signed a proclamation to restrict foreign student visas at Harvard University.

- Fed's Kashkari (2026 voter) said they are still not all the way back to the 2% inflation target and the labour market is showing some signs of slowing, while he added that the Fed must wait and see as the economy faces uncertainty, via a CNN interview.

- US Senate confirmed that Fed's Bowman is to serve as Federal Reserve Vice Chair for Supervision.

- White House official said Elon Musk's opposition is one disagreement in an otherwise harmonious relationship and it will not consult every policy decision with Elon Musk, while the official added that President Trump is committed to getting the bill passed, despite opposition from Musk.

- OMB chief Vought said the White House doesn't support the debt ceiling being removed from the reconciliation bill and that the Trump spending bill will improve the deficit, while he added they are having very good conversations with the Senate on the Trump spending bill and opposing views from outside aren't hurting bill's prospects.

GEOPOLITICS

RUSSIA-UKRAINE

- US President Trump has told people he met with in recent days that the Ukraine drone attack likely would push Russian President Putin to retaliate very significantly, according to Axios sources.

- US President Trump said he spoke with Russian President Putin in which the conversation lasted 15 minutes and they discussed Ukraine’s attack on Russia’s docked aeroplanes, as well as various other attacks that have been taking place by both sides. Trump added it was a good conversation, but not a conversation that will lead to immediate peace, while Trump noted that Putin said very strongly, that he will have to respond to the recent attack on the airfields.

- US is redirecting critical anti-drone technology from Ukraine to US forces in a move that reflects the Pentagon's waning commitment to Kyiv's defence, according to WSJ.

- Ukrainian drone attacks hit energy targets in Russian-held areas of Zaporizhzhia and the Kherson region, with tens of thousands without power, according to Russian-installed officials.

- Ukraine's Economy Minister said the first meeting of the Ukraine minerals fund is expected in July and Ukraine has discussed with the US about how to make the minerals fund operational by year-end.

OTHER

- China's Guangzhou Public Security Bureau issued a bounty for cyber attack suspects that it said are linked to the Taiwan authorities.

CRYPTO

- Bitcoin is a little weaker and trades just shy of the USD 105k mark.

APAC TRADE

- APAC stocks were mixed after the choppy performance in US where markets digested disappointing data and a drop in yields.

- ASX 200 struggled for direction following mixed data including the latest trade figures and household spending for Australia.

- Nikkei 225 retreated amid headwinds from recent currency strength and following softer-than-expected Labour Earnings.

- Hang Seng and Shanghai Comp were somewhat varied as tech and property names led the outperformance in Hong Kong, while the mainland was contained following mixed Caixin PMI data and as participants wait and see if a Trump-Xi call will materialise this week.

NOTABLE ASIA-PAC HEADLINES

- China's Commerce Minister met with the OECD Secretary General at the WTO meeting in France and said China is willing to share experience with the OECD in trade and investment, digital economy and green developments. China is willing to carry out personnel exchanges and promote practical cooperation with the OECD and hopes that the OECD will firmly stand on the side of international fairness and justice.

- China warns BYD and rivals to self regulate as the price war heats up, according to Bloomberg.

DATA RECAP

- Chinese Caixin Services PMI (May) 51.1 vs. Exp. 51.0 (Prev. 50.7); Composite PMI (May) 49.6 (Prev. 51.1)

- Japanese Overall Lab Cash Earnings (Apr) 2.3% vs. Exp. 2.6% (Prev. 2.1%)

- Australian Household Spending MM (Apr) 0.1% vs Exp. 0.2% (Prev. -0.3%); YY (Apr) 3.7% vs Exp. 3.6% (Prev. 3.5%)

- Australian Balance on Goods (Apr) 5413M vs. Exp. 5900M (Prev. 6900M)

- Australian Goods/Services Exports (Apr) -2.4% (Prev. 7.6%); Imports (Apr) 1.1% (Prev. -2.2%)