Europe Market Open: US Stocks finish lower ahead of NFP, with Trump-Xi call overshadowed by dramatic Musk-Trump bust-up

06 Jun 2025, 06:55 by Newsquawk Desk

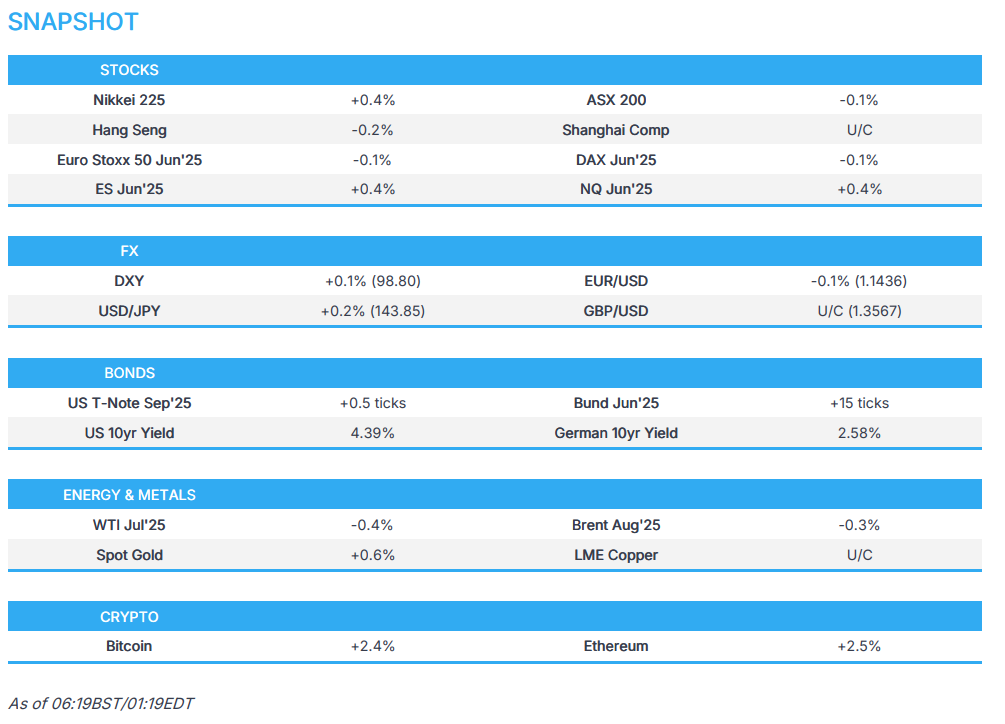

- APAC stocks traded mixed following the subdued handover from the US amid a stunning online bust-up between US President Trump and Elon Musk.

- US President Trump said that trade talks with China have never been off track and straightened out the complexity.

- European equity futures indicate a slightly lower cash market open with Euro Stoxx 50 future down 0.1% after the cash market finished with gains of 0.1% on Thursday.

- DXY is a touch higher, EUR/USD ran out of steam ahead of 1.15, JPY marginally lags with FX markets otherwise steady.

- RBI cut the Repurchase Rate by 50bps to 5.50% (exp. 25bps cut) and changed its stance to neutral from accommodative.

- Looking ahead, highlights include German Industrial Output & Trade Balance, French Trade Balance, EZ Employment, GDP & Retail Sales, US NFP, Canadian Jobs, Bundesbank Semi-Annual Forecasts, ECB President Lagarde & BoE's Pill.

SNAPSHOT

US TRADE

EQUITIES

- US stocks were choppy and ended the session lower with risk sentiment pressured following a stunning escalation in the public feud between US President Trump and Elon Musk in which they exchanged a war of words over social media after President Trump threatened to terminate Musk's government contracts, while Musk even claimed that President Trump "is in the Epstein files" and that this was the reason why they have not been made public. The public spat overshadowed an earlier Trump-Xi phone call and hit Tesla shares which suffered a near-15% drop and resulted in the underperformance of the Consumer Discretionary sector.

- SPX -0.53% at 5,939, NDX -0.80% at 21,547, DJI -0.25% at 42,320, RUT -0.05% at 2,097.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said regarding talks with Chinese President Xi that trade talks have never been off track and straightened out complexity, while he added they'll meet with their top people and are in good shape regarding a China trade deal and are straightening out rare earths. Furthermore, he said they have a deal with China and want to make sure all understand it, as well as stated he will be going to China at some point and that Xi will be going to the US.

- US President Trump said they will have a great relationship with Germany and that Chancellor Merz is a good man to deal with, but difficult. Trump said they will have a good German trade deal and it will be determined by the EU, while German Chancellor Merz said they have a good basis for cooperation.

- German Chancellor Merz said Europe is looking for more independence from China and tariffs are having a "terrible" impact on German automakers, while the Chancellery and White House agreed to even closer cooperation on trade talks, according to CNN. Merz also commented that US tariffs are threatening our economy and we are looking for ways to bring them down, according to a Fox News interview.

- US President Trump and Canadian PM Carney reportedly held secret talks on trade and security, according to the Globe and Mail citing the US Special Envoy.

- Canadian PM Carney spoke with Chinese Premier Li Qiang and exchanged views on bilateral relations, while they emphasised the importance of engagement and both leaders agreed to regularise communication channels between Canada and China. Furthermore, they also discussed trade between the two nations and Carney’s office stated that both governments committed to collaborating on addressing the fentanyl crisis.

- US Commerce Secretary Lutnick reiterated the July 9th deadline for a trade deal and the need for market access for farmers, while he added expect no tariffs on things we can't make in the US. Lutnick also commented that they are trying to get to 5mln wafers during the Trump admin and that Trump wants a full chip supply chain in the US, as well as noted the US will train 5mln US workers for chip factories.

- Japan's government said trade negotiator Akazawa met with US Commerce Secretary Lutnick and Akazawa strongly sought a review of US tariffs, while they discussed non-tariff barriers and trade expansion.

NOTABLE HEADLINES

- Fed's Kugler (voter) said she continues to support maintaining the policy rate at the current setting if upside risks to inflation remain and noted monetary policy is well-positioned for any changes in the macroeconomic environment. Furthermore, Kugler said she views inflation as a bigger risk right now than weaker employment and has not seen the full extent of the impact of tariffs on prices, while she added inflation will be the first-order effect with other effects down the road, as well as noted it is not clear that inflation effects from tariffs will be one-time.

- Fed's Schmid (2025 voter) said he is uncomfortable with the look-through policy approach to tariff-driven price increases and policy needs to be 'nimble' to balance two sides of the mandate, while he is focused on maintaining the Fed's credibility on inflation.

- Fed's Harker (2026 voter) said the Fed must wait and see on the next policy steps amid uncertainty, while it is entirely possible the Fed may face climbing inflation and unemployment at the same time. Furthermore, he said slow disinflation by itself justified the Fed holding steady on interest rates.

- US President Trump said regarding Elon Musk that the bill is incredible and Musk is upset because they took away the EV mandate, while Trump added he does not know if they will have a great relationship anymore and said Musk hasn't said a bad about him but that'll be next.

- US President Trump commented "Elon was “wearing thin,” I asked him to leave, I took away his EV Mandate that forced everyone to buy Electric Cars that nobody else wanted (that he knew for months I was going to do!), and he just went CRAZY!"

- US President Trump said he does not mind Elon Musk turning against him but noted that "This is one of the Greatest Bills ever presented to Congress", while he wants the tax bill passed "without delay".

- US President Trump replied "Oh it's okay" when asked about the public breakup with Elon Musk and said "It's going very well, never done better", while White House aides scheduled a call with Musk on Friday to broker a peace, according to Politico.

- Elon Musk posted on X “Without me, Trump would have lost the election, Dems would control the House and the Republicans would be 51-49 in the Senate”. Musk later posted that President Trump "is in the Epstein files" which is the reason why they have not been made public, while he also commented "Yes" to a post saying President Trump should be impeached. Furthermore, Musk said Trump tariffs will cause a recession in the second half of this year and in light of Trump's statement about cancellation of his government contracts, SpaceX will begin decommissioning its Dragon Spacecraft immediately but later backtracked and said they won't decommission Dragon.

- Top White House aides held multiple meetings to discuss the fallout from Elon Musk's tweets, according to a source with knowledge of the matter cited by Reuters.

- US Senate Republicans are eyeing possible Medicare provisions to help offset the cost of their mega bill as they try to appease budget hawks who want more spending cuts embedded in the legislation.

APAC TRADE

EQUITIES

- APAC stocks traded mixed following the subdued handover from the US where a stunning online bust-up between US President Trump and Elon Musk overshadowed the recent call between President Trump and Chinese President Xi in which the leaders agreed to start a new round of talks ASAP.

- ASX 200 saw two-way, rangebound trade as outperformance in the energy and utilities sectors was counterbalanced by losses in gold miners and the top-weighted financial industry, while a lack of pertinent data releases also contributed to the uneventful picture.

- Nikkei 225 gained with the index supported by recent currency weakness although further upside was capped following disappointing Household Spending data which showed a steeper-than-feared M/M decline and a surprise Y/Y contraction.

- Hang Seng and Shanghai Comp were indecisive despite the recent phone call between US President Trump and Chinese President Xi which the White House had been touting throughout the week, while Xi reiterated calls for the US to handle the Taiwan issue with caution.

- US equity futures (ES +0.4%, NQ +0.3%) were kept afloat in rangebound trade as participants awaited the latest key jobs data from the US.

- European equity futures indicate a slightly lower cash market open with Euro Stoxx 50 future down 0.1% after the cash market finished with gains of 0.1% on Thursday.

FX

- DXY eked marginal gains in rangebound trade after yesterday's fluctuations as participants reacted to the Trump-Xi phone call and US data, while there were several Fed speakers, but had little sway on the dollar, as the attention centred on the Trump-Musk war of words and with the key NFP report on the horizon.

- EUR/USD traded rangebound after it stalled just shy of the 1.1500 handle and pulled back from the highs seen following the ECB's hawkish cut, while recent source reports noted a visible majority in the ECB meeting expressed preference for holding rates unchanged in July. Furthermore, there was little groundbreaking information from the meeting between German Chancellor Merz and US President Trump, which the former stated was a very good discussion.

- GBP/USD price action was little changed amid light UK-specific catalysts and after recently failing to sustain a brief return to 1.3600 territory.

- USD/JPY edged higher following disappointing Household Spending data but remained beneath resistance near the 144.00 level alongside the mixed risk tone.

- Antipodeans marginally softened as the greenback remained afloat and alongside a quiet overnight calendar.

- PBoC set USD/CNY mid-point at 7.1845 vs exp. 7.1935 (Prev. 7.1865).

- US Treasury Currency Report stated no major US trading partners manipulated currency to gain an unfair trade advantage in the four quarters through December 2024.

FIXED INCOME

- 10yr UST futures lingered near the prior day's lows after retreating as participants digested the Trump-Xi call readouts, Fed speak and the Trump-Musk war of words.

- Bund futures attempted to nurse some of its losses after slumping in the aftermath of the ECB's hawkish cut.

- 10-year JGB futures took a breather from the recent whipsawing and were off worst levels following disappointing Household Spending data.

COMMODITIES

- Crude futures traded rangebound after the prior day's fluctuations which were largely at the whim of risk sentiment following the Trump-Xi call and Trump-Musk feud.

- Spot gold continued its gradual recovery from yesterday's trough but with the rebound limited as the dollar steadies heading into the key US jobs data.

- Copper futures struggled for direction after recent fluctuations and amid the lack of conviction across Asia-Pac bourses.

CRYPTO

- Bitcoin gradually climbed higher overnight and breached back above the USD 102k level.

NOTABLE ASIA-PAC HEADLINES

- RBI cut the Repurchase Rate by 50bps to 5.50% (exp. 25bps cut) and changed its stance to neutral from accommodative, while it cut the Standing Deposit Facility Rate and Marginal Standing Facility Rate by 50bps each to 5.25% and 5.75%, respectively. RBI Governor Malhotra said growth remains lower than aspirations and it is important to stimulate growth, as well as noted that front-loading rate cuts to support growth was felt necessary. Malhotra also stated that inflation has softened significantly over the last six months and inflation is likely to undershoot the full-year target at the margin, while he noted that monetary policy has limited space left to support growth and they retained the FY26 Real GDP growth forecast at 6.5%. Furthermore, the RBI Governor announced to cut the Cash Reserve Ratio by 100bps in four equal tranches, which will release INR 2.5tln, as well as noted that they will continue to monitor and take measures as necessary and that the CRR cut is to reduce the cost of funding of banks and help accelerate policy transmission.

DATA RECAP

- Japanese All Household Spending MM (Apr) -1.8% vs. Exp. -0.8% (Prev. 0.4%)

- Japanese All Household Spending YY (Apr) -0.1% vs. Exp. 1.4% (Prev. 2.1%)

GEOPOLITICS

MIDDLE EAST

- Israeli military said it will soon attack several underground infrastructures for the production of UAVs that were established in Beirut's southern suburbs.

- Israel assured the US it won't strike Iran unless talks fail, according to Axios.

- Iran is said to have ordered material from China that could make hundreds of ballistic missiles, according to Wall Street Journal.

- Hamas chief said the group did not reject Witkoff’s Gaza ceasefire proposal but demanded some changes and improvement to secure the end to the war, while they are ready to engage in a new round of ceasefire talks and noted that ceasefire talks with the mediators are ongoing.

RUSSIA-UKRAINE

- Ukraine said Russia launched a drone and missile attack with explosions and air defence activity heard over Kyiv.

- US President Trump said he will be very tough on Russia when he sees the moment when the war will not stop and could also be tough on Ukraine, while he does not think that Russia and Ukraine will sign a deal. Trump also commented that Congress is waiting for him to decide on Russian sanctions and that the Russia sanctions bill is harsh.

- German Chancellor Merz said the US is in a strong position to help end the Ukraine war. Merz also commented that he invited President Trump to Germany and noted it was a very good discussion in which both agreed Russia started the war in Ukraine, while he added that he set the foundation today for good talks with Trump at the G7 and NATO.

- EU is weighing adding Russia to its money laundering 'grey list', according to FT.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves reaffirmed she will not have a UK budget like October's again but can't rule out any tax changes over the next four years.

- UK government unveiled new concessions to private equity firms regarding its tax break crackdown in which it proposed changes to tax treatment of carried interest that will make the regime less onerous, according to FT.

- A visible majority in the ECB meeting expressed preference for holding rates unchanged in July and some argued for a longer pause, according to Reuters sources. A separate report also noted that ECB officials expect rate cuts to be paused at the July meeting, according to Bloomberg.

- ECB's Muller says ECB can be happy with inflation where it is; and he agrees with ECB President Lagarde that cycle almost finished. Hard to say what's coming next on rates.