US Market Open: DXY, USTs and US futures gain ground ahead of US jobs

06 Jun 2025, 11:00 by Newsquawk Desk

- European bourses trade flat/lower following the fallout of the dramatic Trump-Musk spat, but with traders setting their sights on the US jobs report.

- USD is slightly firmer in what has ultimately been a week of losses for DXY. EUR is trivially softer vs. the USD. JPY is the laggard across the majors.

- USTs are a touch higher ahead of the US jobs report and following yesterday's ECB-led losses. Bunds are attempting to atone for yesterday's downside. Gilts are being led by the upside in German paper.

- Crude Futures are subdued amid a firmer Dollar and overall cautious risk tone heading into the US job. Spot gold and silver are largely treading water. Base metals are mixed.

- Looking head, highlights include US NFP, Canadian Jobs, Speakers include BoE's Pill.

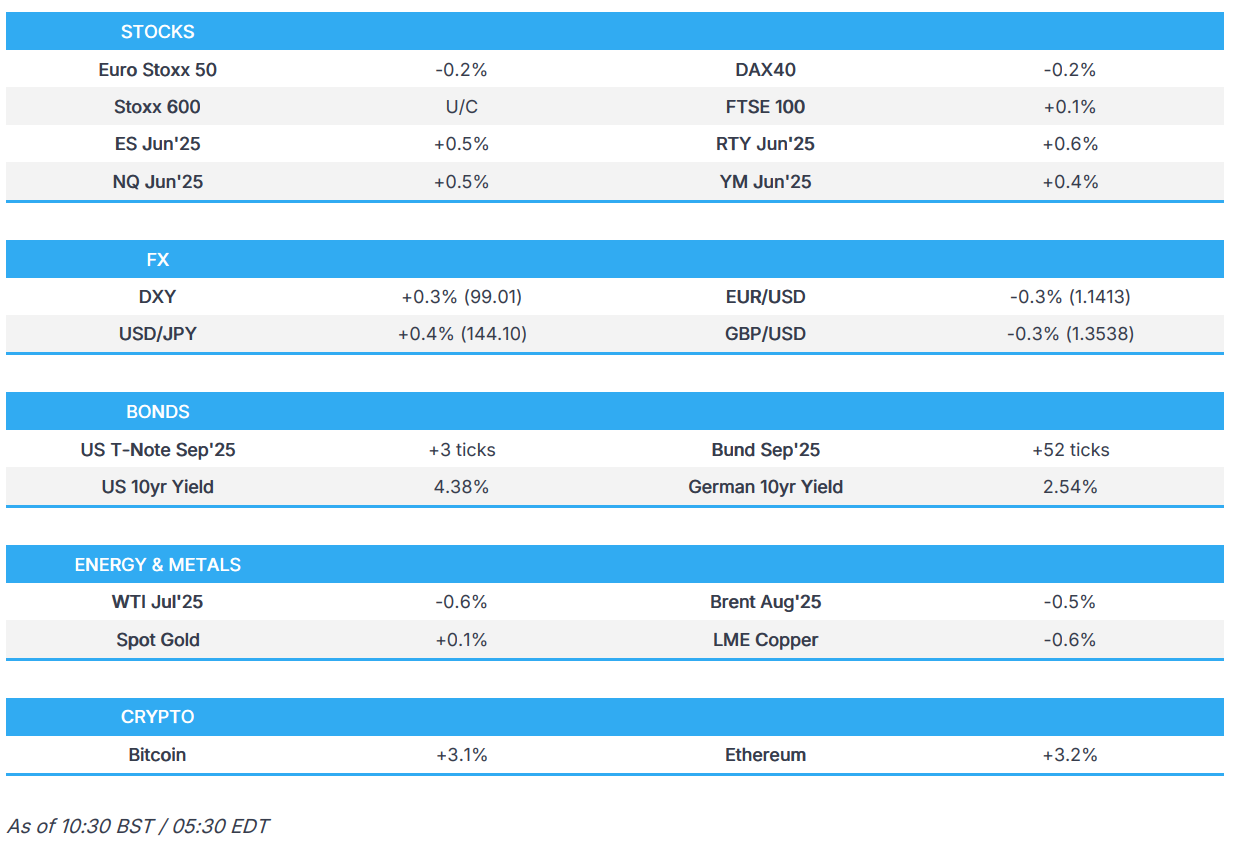

SNAPSHOT

TARIFFS/TRADE

- German Chancellor Merz said Europe is looking for more independence from China and tariffs are having a "terrible" impact on German automakers, while the Chancellery and White House agreed to even closer cooperation on trade talks, according to CNN. Merz also commented that US tariffs are threatening our economy and we are looking for ways to bring them down, according to a Fox News interview. German Chancellor Merz said this US admin is open for discussions, and hearing other opinions; no doubts US will stick with NATO

- Canadian PM Carney spoke with Chinese Premier Li Qiang and exchanged views on bilateral relations, while they emphasised the importance of engagement and both leaders agreed to regularise communication channels between Canada and China. Furthermore, they also discussed trade between the two nations and Carney’s office stated that both governments committed to collaborating on addressing the fentanyl crisis.

- Chinese Premier Li held talks with Canadian PM Carney, according to Xinhua; China willing to safeguard multilaterals and free trade with Canada. There is 'great potential' for cooperation between China & Canada. Both should strengthen cooperation in clean energy, climate change, and innovation.

- Japan's government said trade negotiator Akazawa met with US Commerce Secretary Lutnick and Akazawa strongly sought a review of US tariffs, while they discussed non-tariff barriers and trade expansion.

NOTABLE US HEADLINES

- Top White House aides held multiple meetings to discuss the fallout from Elon Musk's tweets, according to a source with knowledge of the matter cited by Reuters.

- BofA Flow Show: Cash biggest inflow since Jan, Gold a record inflow year, European equities see inflows & US sees outflows. Cash saw largest inflow since Jan of almost USD 95bln in the latest week. Gold is having a record inflow year, worth USD 75bln in YTD. US equities seen outflows in past three weeks, European equites see inflows for eight weeks. EM Equities & Debt strongest inflow in eight weeks

EUROPEAN TRADE

EQUITIES

- European bourses - Flat/lower trade across Europe following the fallout of the dramatic Trump-Musk spat, but with traders setting their sights on the US jobs report due 13:30 BST/08:30 EDT. On the week, futures of the broad Stoxx 600 and Euro Stoxx 50 indices are currently poised for a second week of gains, though not by much at this stage, and will depend on how the aforementioned data comes in.

- European sectors - Sectors display a mixed picture with the breadth of the market also narrow, with no real bias. Top gainers at the time of writing include Health Care (+0.6%), Energy (+0.5%), and Retail (+0.3%); losers include Basic Resources (-0.9%), Industrial Goods and Services (-0.4%), and Media (-0.3%).

- European movers - HSBC (+0.3%) chairman Mark Tucker will step down on September 30th. Adidas (-1.3%), JD Sports (-0.5%), and Puma (-1.6%) are all slipping after US apparel maker Lululemon (LULU) saw its shares tumble by over 20% in extended trading. Airbus (-0.9%) confirmed that it delivered 51 jets in May (-4% Y/Y),

- US equity futures - Firmer intraday (ES +0.4%, NQ +0.4%, YM +0.1%, RTY +0.6%) and rebounding following yesterday's Trump-Musk-induced downside as traders await the latest US jobs report Elsewhere, Tesla shares are rebounding pre-market (+4.8%) after slumping some 14.3% yesterday, with traders attributing the bounce to Politico reports that White House aides scheduled a call with Elon Musk.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD - USD is slightly firmer in what has ultimately been a week of losses for DXY. Attention now is firmly fixated on today's NFP report which is set to see payroll growth slow to 130k from 177k and unemployment rate hold steady @ 4.2%. As it stands, the next 25bps cut is not fully priced until September with 54bps of loosening seen by year-end. DXY is towards the top end of yesterday's 98.35-98.94 range.

- EUR - EUR is trivially softer vs. the USD after gaining yesterday on account of the ECB rate decision which saw policymakers pull the trigger on a 25bps rate cut, whilst noting that policy is "well-positioned"; suggesting that the ECB could be nearing or at the end of its cutting cycle. ECB speak this morning hasn't shifted the dial with policymakers signalling flexibility going forward, whilst acknowledging progress on inflation. EUR/USD is contained within yesterday's 1.1404-1.1495 range.

- JPY - JPY is the laggard across the majors following disappointing Household Spending data. Subsequently, USD/JPY briefly made its way back onto a 144 handle with a current session peak @ 144.13, stopping shy of the WTD high @ 144.39. On the trade front, Japan's government said trade negotiator Akazawa met with US Commerce Secretary Lutnick and Akazawa strongly sought a review of US tariffs. Elsewhere, Japan's former top FX diplomat says narrowing US-Japan rate gap will likely support the yen at around 135-140 against USD by year-end.

- GBP - GBP is softer vs. the broadly firmer USD with UK-specific newsflow on the light side ahead of next week's UK spending review. On which, UK Chancellor Reeves reaffirmed she will not have a UK budget like October's again, but can't rule out any tax changes over the next four years. For today's agenda, BoE Chief Economist Pill is due to speak @ 13:00BST, but given the subject matter of "AI and Households", it is unclear how much he will touch on monetary policy. After printing a multi-year high yesterday @ 1.3616, Cable has since retreated and moved back below the 1.3550 mark.

- Antipodeans - Antipodeans are steady vs. the USD following a light data docket and relevant newsflow overnight. Both continue to keep an eye on US-Sino relations following the Xi-Trump call yesterday given their trade exposure. However, the readout had little follow-through into either currency. AUD/USD has moved back onto a 0.64 handle and pulled back from yesterday's YTD peak @ 0.6538. NZD/USD has also retreated from yesterday's YTD high @ 0.6080 but is still holding above the 0.60 mark.

- NBP's Litwiniuk said they need to be cautious regarding the disinflation path; MPC can return to the subject of cuts in July or September; rates can still be cut by 100-125bps this year.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs - USTs are a touch higher ahead of the US jobs report and following yesterday's ECB-led losses which outmuscled a spike higher in weekly claims metrics. As it stands, the next 25bps cut is not fully priced until September with 54bps of loosening seen by year-end. Sep'25 USTs are currently within yesterday's 110.23+ to 111.14+ range. From a yield perspective, the US curve is fractionally in bull flattening mode, whilst the 10yr yield has moved back to the 4.37% after venturing as low as 4.318% yesterday.

- Bunds - Bunds are attempting to atone for yesterday's losses which were seen in the wake of the ECB rate decision. Sep'25 Bunds have been as high as 130.72 but are still some way away from yesterday's peak @ 131.47. The 10yr yield is back below the 2.55% mark after climbing as high as 2.581% yesterday.

- Gilts - Gilts are currently being led by the upside in German paper as UK-specific newsflow remains light ahead of next week's UK spending review. Sep'25 Gilts have been as high as 92.31 but still have some ground to cover before approaching yesterday's best @ 92.63. The 10yr yield currently sits just above the 4.6% mark and within yesterday's 4.557-4.648% range.

- Click for a detailed summary

COMMODITIES

- Crude Futures - Subdued trade amid a firmer Dollar and overall cautious risk tone heading into the US jobs report before the weekend. Contracts saw a leg lower likely on technicals as WTI dipped under USD 63.00/bbl at the same time as Brent fell under USD 65.00/bbl, although prices thereafter stabilised. News flow has been light for the complex, with nothing major to report in geopolitics either.

- Precious Metals - Spot gold and silver are largely treading water amid a lack of catalysts during the European morning in the run-up to the US jobs report. Spot gold currently resides in a current USD 3,351.49-3,375.29/oz range, well within yesterday's USD 3,338.29-3,403.15/oz parameter.

- Base Metals - Mixed trade across base metals, in fitting with the cautious risk tone ahead of the US jobs report, with the Trump-Xi phone call doing little to keep broader prices underpinned during this session. 3M LME copper dipped back under USD 9,700/t to trade in a USD 9,659.00-9,768.00/t range at the time of writing. Dalian iron ore futures rose to a one-week peak overnight with traders citing strong Chinese demand coupled with some optimism following the Trump-Xi call, with the front-month contract ending daytime trade +0.9%.

- HSBC expects OPEC+ to accelerate supply hikes in August and September; weaker fundamentals after the summer, raise downside risks to the Bank's USD 65/bbl brent forecast from Q425.

- LME has intervened to make Mercuria roll its "huge" position in aluminium, according to Bloomberg.

- India's Mines Minister said exploring critical mineral assets in Australia, Argentina and Chile.

- EU Ags Commissioner said EU-Ukraine trade has reverted to conditions of pre-war trade deal, after the expiry of wartime exemptions; could conclude a longer-term trade arrangement by summer. New EU-Ukraine trade arrangement will be in between the quotas under pre-war trade deal and war-time exemptions

- Click for a detailed summary

NOTABLE DATA RECAP

- EU Retail Sales YY (Apr) 2.3% vs. Exp. 1.3% (Prev. 1.5%, Rev. 1.9%)

- EU Employment Final YY (Q1) 0.7% vs. Exp. 0.8% (Prev. 0.8%, Rev. 0.8%)

- EU Employment Final QQ (Q1) 0.2% vs. Exp. 0.3% (Prev. 0.3%)

- EU Retail Sales MM (Apr) 0.1% vs. Exp. 0.1% (Prev. -0.1%, Rev. 0.4%)

- EU GDP Revised YY (Q1) 1.5% vs. Exp. 1.2% (Prev. 1.2%)

- EU GDP Revised QQ (Q1) 0.6% vs. Exp. 0.4% (Prev. 0.3%)

- German Exports MM SA (Apr) -1.7% vs. Exp. -0.7% (Prev. 1.1%)

- German Trade Balance, EUR, SA (Apr) 14.6B vs. Exp. 20.0B (Prev. 21.1B)

- German Industrial Output MM (Apr) -1.4% vs. Exp. -1.0% (Prev. 3.0%)

- German Imports MM SA (Apr) 3.9% vs. Exp. 0.5% (Prev. -1.4%)

- UK Halifax House Prices MM (May) -0.4% vs. Exp. -0.1% (Prev. 0.3%)

- UK BBA Mortgage Rate (May) 7.09% (Prev. 7.21%, Rev. 7.19%).

- French Industrial Output MM (Apr) -1.4% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.1%)

- French Trade Balance, EUR, SA (Apr) -7.968B (Prev. -6.248B, Rev. -6.272B)

- French Imports, EUR (Apr) 57.225B (Prev. 58.799B, Rev. 58.639B)

- French Exports, EUR (Apr) 49.256B (Prev. 52.551B, Rev. 52.367B)

- French Current Account (Apr) -4.1B (Prev. 1.4B, Rev. 1B)

- Norwegian Manufacturing Output MM (Apr) 2.8%

NOTABLE EUROPEAN HEADLINES

- UK government unveiled new concessions to private equity firms regarding its tax break crackdown in which it proposed changes to tax treatment of carried interest that will make the regime less onerous, according to FT.

- ECB's Holzmann says "I dissented" at the rate decision on Thursday (as expected)Lowering rates at a time of high savings and low investments ha no effect except a monetary effectCurrently expansive in monetary policyLagarde said we are at the end of the cycle, wanted to discuss whether that is the caseCurrent nominal neutral rate is around 3%

- ECB's Muller said ECB can be happy with inflation where it is; and he agrees with ECB President Lagarde that cycle almost finished. Hard to say what's coming next on rates.

- ECB's Villeroy said the ECB has won the battle against inflation in Europe, and we will not again see the low rates we saw a few years ago, and added that French inflation is now under control but debt remains a serious issue, "France cannot continue like this", according to Bloomberg.

- ECB's Simkus said interest rates are now at neutral; its important to keep full flexibility, according to Reuters. Stournaras said the best thing for the ECB is to wait and see, ECB rate cutting is nearly done, ECB has achieved a soft landing, and ECB may cut if the economy weakens and inflation falls. Stournaras noted of downside risks to growth, and the bank is "quite" confident in its forecasts, and said he's afraid the Dollar may lose some of its status.

- Bundesbank semi-annual report: German recovery delayed further; economy to tread water in 2025; German GDP to stagnate in 2025, grow by 0.7% in 2026. Increased defence, infrastructure spending to significantly increase growth by the end of 2027. German exports will decline significantly in 2025, increase only slightly next year.

- Italian Stats Bureau ISTAT cut Italy's 2025 GDP growth to 0.6% from 0.8% forecast in December.

- SNB noted that it does not engage in any manipulation of the CHF; does not seek to prevent adjustments in the balance of trade or to gain unfair competitive advantages for the Swiss economy. In addition, the use of FX market interventions may be necessary under certain circumstances to ensure appropriate monetary conditions. SNB monetary policy is geared towards the needs of Switzerland.

GEOPOLITICS

MIDDLE EAST

- Israel assured the US it won't strike Iran unless talks fail, according to Axios.

- Iran is said to have ordered material from China that could make hundreds of ballistic missiles, according to Wall Street Journal.

- "Lebanese Army: Israel's continued violation of the agreement may push us to freeze cooperation with the monitoring committee regarding site inspection", via Al Hadath.

RUSSIA-UKRAINE

- Ukraine said Russia launched a drone and missile attack with explosions and air defence activity heard over Kyiv.

- Russian Deputy Minister of Foreign Affairs Ryabkov said returning to the arms control agreement with the US is becoming less and less realistic amid the US' Golden Dome project.

- EU is weighing adding Russia to its money laundering 'grey list', according to FT.

- French Minister for Europe and Foreign Affairs hopes the European Commission will put new Russian sanctions package before the end of June, according to Reuters.

CRYPTO

- Bitcoin gradually climbed higher overnight and breached back above the USD 102k level.

APAC TRADE

- APAC stocks traded mixed following the subdued handover from the US where a stunning online bust-up between US President Trump and Elon Musk overshadowed the recent call between President Trump and Chinese President Xi in which the leaders agreed to start a new round of talks ASAP.

- ASX 200 saw two-way, rangebound trade as outperformance in the energy and utilities sectors was counterbalanced by losses in gold miners and the top-weighted financial industry, while a lack of pertinent data releases also contributed to the uneventful picture.

- Nikkei 225 gained with the index supported by recent currency weakness although further upside was capped following disappointing Household Spending data which showed a steeper-than-feared M/M decline and a surprise Y/Y contraction.

- Hang Seng and Shanghai Comp were indecisive despite the recent phone call between US President Trump and Chinese President Xi which the White House had been touting throughout the week, while Xi reiterated calls for the US to handle the Taiwan issue with caution.

NOTABLE ASIA-PAC HEADLINES

- RBI cut the Repurchase Rate by 50bps to 5.50% (exp. 25bps cut) and changed its stance to neutral from accommodative, while it cut the Standing Deposit Facility Rate and Marginal Standing Facility Rate by 50bps each to 5.25% and 5.75%, respectively. RBI Governor Malhotra said growth remains lower than aspirations and it is important to stimulate growth, as well as noted that front-loading rate cuts to support growth was felt necessary. Malhotra also stated that inflation has softened significantly over the last six months and inflation is likely to undershoot the full-year target at the margin, while he noted that monetary policy has limited space left to support growth and they retained the FY26 Real GDP growth forecast at 6.5%. Furthermore, the RBI Governor announced to cut the Cash Reserve Ratio by 100bps in four equal tranches, which will release INR 2.5tln, as well as noted that they will continue to monitor and take measures as necessary and that the CRR cut is to reduce the cost of funding of banks and help accelerate policy transmission.

- PBoC set USD/CNY mid-point at 7.1845 vs exp. 7.1935 (Prev. 7.1865).

- Japan's former top FX diplomat says narrowing US-Japan rate gap will likely support the yen at around 135-140 against USD by year-end.

DATA RECAP

- Japanese All Household Spending MM (Apr) -1.8% vs. Exp. -0.8% (Prev. 0.4%)

- Japanese All Household Spending YY (Apr) -0.1% vs. Exp. 1.4% (Prev. 2.1%)