Europe Market Open: Chinese Y/Y CPI remains in deflationary territory & Equity futures steady ahead of US-China talks

09 Jun 2025, 06:50 by Newsquawk Desk

- APAC stocks traded mostly higher following last Friday's gains on Wall St; participants also digested mixed Chinese data.

- Chinese Y/Y CPI remained in deflationary territory, trade data saw imports and exports fall short of expectations.

- US President Trump said they are very far advanced on a China deal ahead of high-level talks in London on Monday.

- US President Trump said he is thinking about the next Fed Chair and it is coming out very soon.

- European equity futures indicate a slightly lower cash market open with Euro Stoxx 50 future down 0.2% after the cash market finished with gains of 0.4% on Friday.

- DXY has pulled back a touch after gaining on Friday, antipodeans lead, EUR/USD has returned to a 1.14 handle.

- Looking ahead, highlights include ECB's Elderson, Holiday Closures in Switzerland, Norway, Hungary, Greece & Cyprus.

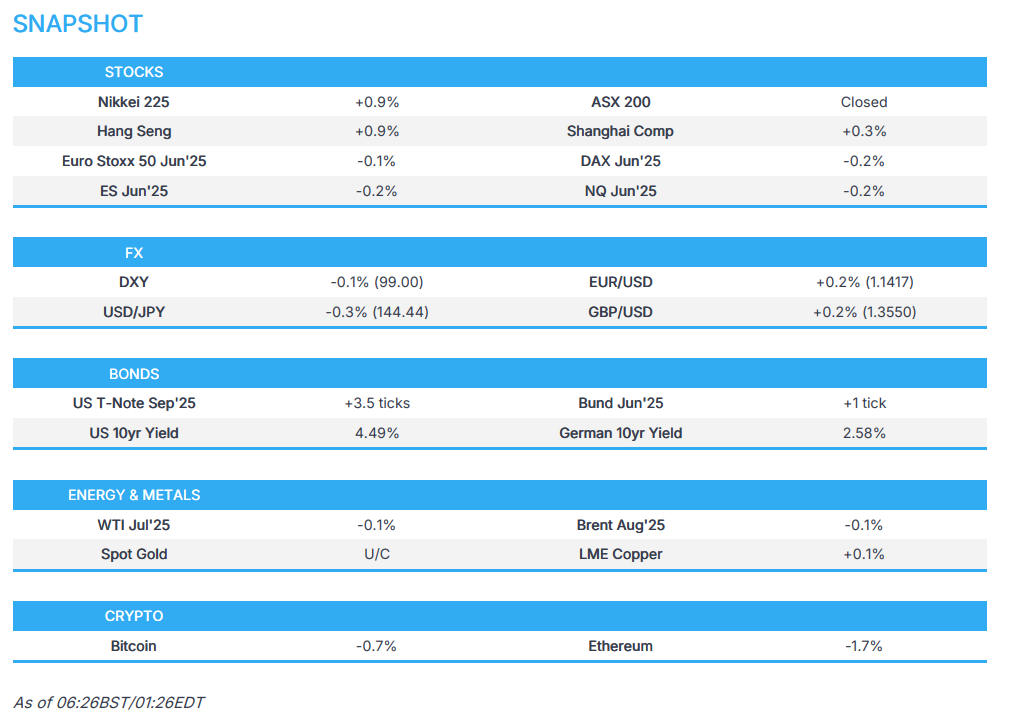

SNAPSHOT

US TRADE

EQUITIES

- US stocks gained on Friday and Treasuries sold off in the wake of the US jobs report in which the headline Non-Farm Payrolls topped expectations and the unemployment rate remained at 4.2%, as expected, albeit with a revision lower to the headline NFP print. Nonetheless, the metrics indicated that the labour market was still healthy and helped offset some of the economic fear seen in the wake of Trump's tariffs.

- SPX +1.03% at 6,000, NDX +0.99% at 21,761, DJI +1.05% at 42,763, RUT +1.66% at 2,132.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said they are very far advanced on a China deal ahead of high-level talks in London on Monday and a China deal is complex but will bring in a lot of money, while he added Chinese President Xi agreed to restart exporting rare earth minerals.

- China’s Foreign Ministry said Vice Premier He Lifeng will visit the UK from June 8th-13th and the first meeting of the China-US economic and trade consultation mechanism will be held with the US during this visit.

- China’s Commerce Ministry said it approved a certain number of compliant rare earth applications and will continue to strengthen the examination and approvals, while it added that China is ready to further strengthen communication and dialogue with relevant countries on export controls.

- China’s Commerce Ministry said negotiations over the price commitment between China and the EU on electric vehicles have entered the final stage and it noted that French companies and relevant associations have voluntarily submitted an application for a price undertaking to China regarding brandy, while Chinese investigators reached an agreement with the Chinese side on the core terms of the price pledge and plan to issue a final announcement by July 5th. Furthermore, China is willing to establish a green channel for eligible applications from European firms to speed up examination and approval on rare earths and China hopes the EU will take effective measures to facilitate, guarantee and promote the trade of high-tech products with China.

- Japanese Economy Minister Akazawa said he urged the US again to reconsider tariff measures and believes they have made further progress in trade talks with the US, while he noted tariffs are having a major impact on Japan’s economy and it was also reported that Akazawa is arranging a sixth visit to the US for tariff talks.

- Japan and the EU are to launch a competitive alliance to deepen trade and economic security ties, according to diplomatic sources.

NOTABLE HEADLINES

- Fed’s Musalem (voter) said he sees a 50-50 chance that Trump tariffs could either boost inflation for a quarter or two, or cause sustained inflation, according to an FT interview. Musalem said this means the Fed will likely face uncertainty right through the summer and political interference could make it harder for the Fed to lower interest rates.

- US President Trump thinks support has solidified for the tax bill over the last 24 hours and will take a look at Elon Musk’s government contracts, while he has no plans to speak to Musk and noted that DOGE helped a lot. Trump stated he is thinking about the next Fed Chair and it is coming out very soon, as well as suggested a good Fed Chair would lower rates.

- US President Trump said Elon Musk will face ‘very serious consequences’ if he decides to fund Democratic candidates, while Trump replied “I would assume so, yeah” when asked if his relationship with Musk is over.

- US Defense Secretary Hegseth said active-duty troops will be mobilised if violence continues in Los Angeles, while President Trump deployed the National Guard to LA immigration ‘riots’ after claiming state officials cannot do their jobs, according to Sky News. Furthermore, reports noted that as many as 500 Marines are “in a prepared-to-deploy status” should they be needed to protect federal property and personnel and US President Trump posted on Truth Social "Looking really bad in L.A. BRING IN THE TROOPS!!!"

APAC TRADE

EQUITIES

- APAC stocks traded mostly higher following last Friday's gains on Wall St, but with trade somewhat quietened amid the holiday closure in Australia and as participants digested mixed Chinese data.

- Nikkei 225 reclaimed the 38,000 level after last week's currency weakness and with upward revisions to Japanese GDP data.

- Hang Seng and Shanghai Comp gained amid some trade-related optimism with officials from the US and China set to meet in London today, although the gains in the mainland are capped as participants also digested key data releases which showed a continued deflation and mostly softer trade data.

- US equity futures (ES -0.2%, NQ -0.3%) pared some of last week's post-NFP gains.

- European equity futures indicate a slightly lower cash market open with Euro Stoxx 50 future down 0.2% after the cash market finished with gains of 0.4% on Friday.

FX

- DXY marginally pulled back after gaining on Friday due to the better-than-expected NFP report, with demand contained to start the week owing to the lack of fresh major catalysts and with the Fed in a blackout period.

- EUR/USD recouped some of its lost ground and reverted to the 1.1400 territory as the greenback softened, while there were several ECB comments from over the weekend but had little sway on price action as Lagarde reiterated that the central bank is in a good position on rates and Nagel said the ECB can take its time on interest rates.

- GBP/USD continued its gradual rebound from Friday's trough amid light-UK specific newsflow, aside from reports that Chancellor Reeves is to announce a transformative GBP 86bln in the Spending Review to boost the fastest growing sectors.

- USD/JPY faded some of Friday's advances after hitting resistance near the 145.00 level, and with Japan's Q1 GDP data revised upwards.

- Antipodeans benefitted from the slightly softer dollar and the mostly constructive mood but with price action restricted amid the extended weekend in Australia.

- PBoC set USD/CNY mid-point at 7.1855 vs exp. 7.2010 (Prev. 7.1845).

FIXED INCOME

- 10yr UST futures regained some composure and just about reclaimed the 110.00 level after sliding last Friday in the aftermath of the NFP data.

- Bund futures were uneventful following the prior week's choppy performance and as the slew of ECB rhetoric from over the weekend did little to shift the dial.

- 10yr JGB futures tracked the recent declines in US counterparts with demand also constrained following upward GDP revisions.

COMMODITIES

- Crude futures were rangebound amid a lack of fresh energy-specific catalysts but remained near last week's best levels after climbing on the back of the better-than-expected US jobs data.

- Venezuela is planning to increase gasoline prices by 50% as it braces for a decline in oil revenue following the suspension of operations by Chevron (CVX) and other foreign energy firms, according to Bloomberg citing people familiar with the decision.

- Spot gold lacked firm demand following Friday's selling pressure and tested the USD 3,300/oz level to the downside.

- Copper futures struggled for direction after last week's choppy performance and as participants digested the latest Chinese inflation data which was mixed but continued to show a deflation for both CPI and PPI Y/Y, while Chinese Exports and Imports also missed forecasts.

CRYPTO

- Bitcoin traded indecisively with upward momentum thwarted by resistance at the USD 106k level.

NOTABLE ASIA-PAC HEADLINES

- BoJ Deputy Governor Uchida said central banks are shrinking their balance sheet but many of them are unlikely to return to conventional monetary adjustment methods, while he added that many central banks are likely to use interest payment on reserves to guide short-term interest rates while maintaining the balance sheet size that meets market demand.

DATA RECAP

- Chinese Trade Balance (USD)(May) 103.22B vs. Exp. 101.3B (Prev. 96.18B)

- Chinese Exports YY (USD)(May) 4.8% vs. Exp. 5.0% (Prev. 8.1%)

- Chinese Imports YY (USD)(May) -3.4% vs. Exp. -0.9% (Prev. -0.2%)

- Chinese Trade Balance (CNY)(May) 750B (Prev. 690B)

- Chinese Exports YY (CNY)(May) 6.3% (Prev. 9.3%)

- Chinese Imports YY (CNY)(May) -2.1% (Prev. 0.8%)

- Chinese CPI MM (May) -0.2% vs. Exp. -0.2% (Prev. 0.1%)

- Chinese PPI YY (May) -3.3% vs. Exp. -3.2% (Prev. -2.7%)

- Chinese CPI YY (May) -0.1% vs. Exp. -0.2% (Prev. -0.1%)

- Chinese FX Reserves (USD)(May) 3.285tln vs. Exp. 3.292tln (Prev. 3.282tln)

- Japanese GDP Revised QQ (Q1) 0.0% vs. Exp. -0.2% (Prev. -0.2%)

- Japanese GDP Rev QQ Annualised (Q1) -0.2% vs. Exp. -0.7% (Prev. -0.7%)

GEOPOLITICS

MIDDLE EAST

- Israel’s military said it struck a Hamas member in southern Syria.

- US-based Gaza Humanitarian Foundation said it did not distribute aid on Saturday because Hamas made direct threats against its operations, while a Hamas official said he had no knowledge of alleged threats to the US-backed aid group in Gaza. Furthermore, Al Jazeera reported that Israeli attacks killed more than 40 in Gaza as aid seekers were shot dead.

- Israeli Defence Minister Katz threatened to “take all necessary measures” to prevent a humanitarian ship carrying climate campaigner Greta Thunberg from reaching Gaza, according to The Guardian. It was later reported that the Freedom Flotilla Coalition said it ship was 'under assault' and the Israeli Army had boarded the Gaza-bound ship.

RUSSIA-UKRAINE

- Russian forces captured Zoria in Ukraine’s Donetsk region and reached the Dnipropetrovsk region in Ukraine, according to TASS and Interfax. However, it was later reported that Ukrainian General Staff spokesman Kovalev denied claims by the Russian Defence Ministry that its forces advanced into Ukraine’s eastern Dnipropetrovsk region for the first time since it launched its full-scale invasion.

- Head of the Russian delegation at talks with Ukraine in Istanbul said Russia handed over to Ukraine the first list of 640 POWs for exchange, according to TASS. Furthermore, the Russian Defence Ministry said Russia launched a large-scale humanitarian operation to repatriate more than 6,000 bodies of deceased Ukrainian military personnel and exchange prisoners of war, while Ukrainian officials rejected Russian claims that Ukraine was delaying the exchange of soldiers’ bodies.

- Ukrainian drone attack sparked a short-lived fire at the Azot chemical plant in Russia’s Tula region, although there was no threat to air quality near the plant, according to the regional governor.

- US believes Russian retaliation for Ukraine’s drone attack is not over yet and it expects a multi-pronged strike.

- Poland scrambled aircraft to ensure airspace security after Russia launches strikes on Ukraine.

OTHER

- US expressed concern to the UK government about allowing China to build a large embassy in London that security officials believe would pose a risk to sensitive communications infrastructure serving the City, according to FT. It was also reported that the UK government promised to assess any security concerns related to the construction of a Chinese embassy near the City of London, which is an issue that could potentially complicate trade talks with the US, according to Bloomberg.

- Thai army said provocations by Cambodia and buildup of military forces show a clear intent to use force, and the Thai army is to control the opening and closing of all border checkpoints along the Thailand-Cambodia border, while it added that Cambodia enforced its military presence, equipment and constructed fortifications.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves is to announce a transformative GBP 86bln in the Spending Review to turbo-charge the fastest growing sectors, from tech and life sciences to advanced manufacturing and defence, as part of the government’s plan to invest in Britain’s renewal through the Modern Industrial Strategy.

- BoE’s Greene said the disinflation process is ongoing and expects inflation to continue to come down to the target over the medium-term, while she noted their view is they can look through it but added there is a pretty big risk.

- ECB President Lagarde reiterated that the central bank is in a good position on rates and to deal with uncertainties ahead.

- ECB’s Escriva said the path of monetary policy easing in the eurozone could require further adjustments if the current macroeconomic and inflation outlooks are confirmed, while he added the central scenario of GDP growth around 1% and inflation of 2% could require some fine-tuning, according to Reuters.

- ECB’s Nagel said the ECB can take its time on interest rates with monetary policy now set at a neutral level that is no longer restrictive and that the central bank has maximum flexibility on rates.

- ECB’s Schnabel said do not expect a sustained decoupling between the ECB and the Fed, while she expects the trade conflict to play out as a global shock that’s working through both lower demand and supply.

- ECB’s Vujcic said a small deviation on either side of the 2% inflation target is not a problem and the central bank should not overreact to inflation edging below the target, while he added the bar for QE will be higher in light of past experience.

- EU was urged to exempt more companies from supply chain law although rules on curbing environmental and rights abuses should not be scrapped, according to Swedish conservative MEP Warborn cited by FT.

- Fitch cut Austria’s sovereign rating from AA+ to AA; Outlook Stable, while it affirmed Hungary at BBB: Outlook Stable, while S&P raised Slovenia’s rating from AA- to AA; Outlook Stable.