US Market Open: Fixed bid, USD on the backfoot & RTY gains ahead of US-Iran and US-China updates

09 Jun 2025, 11:15 by Newsquawk Desk

- US President Trump said they are very far advanced on a China deal ahead of high-level talks in London on Monday.

- US President Trump said he is thinking about the next Fed Chair and it is coming out very soon.

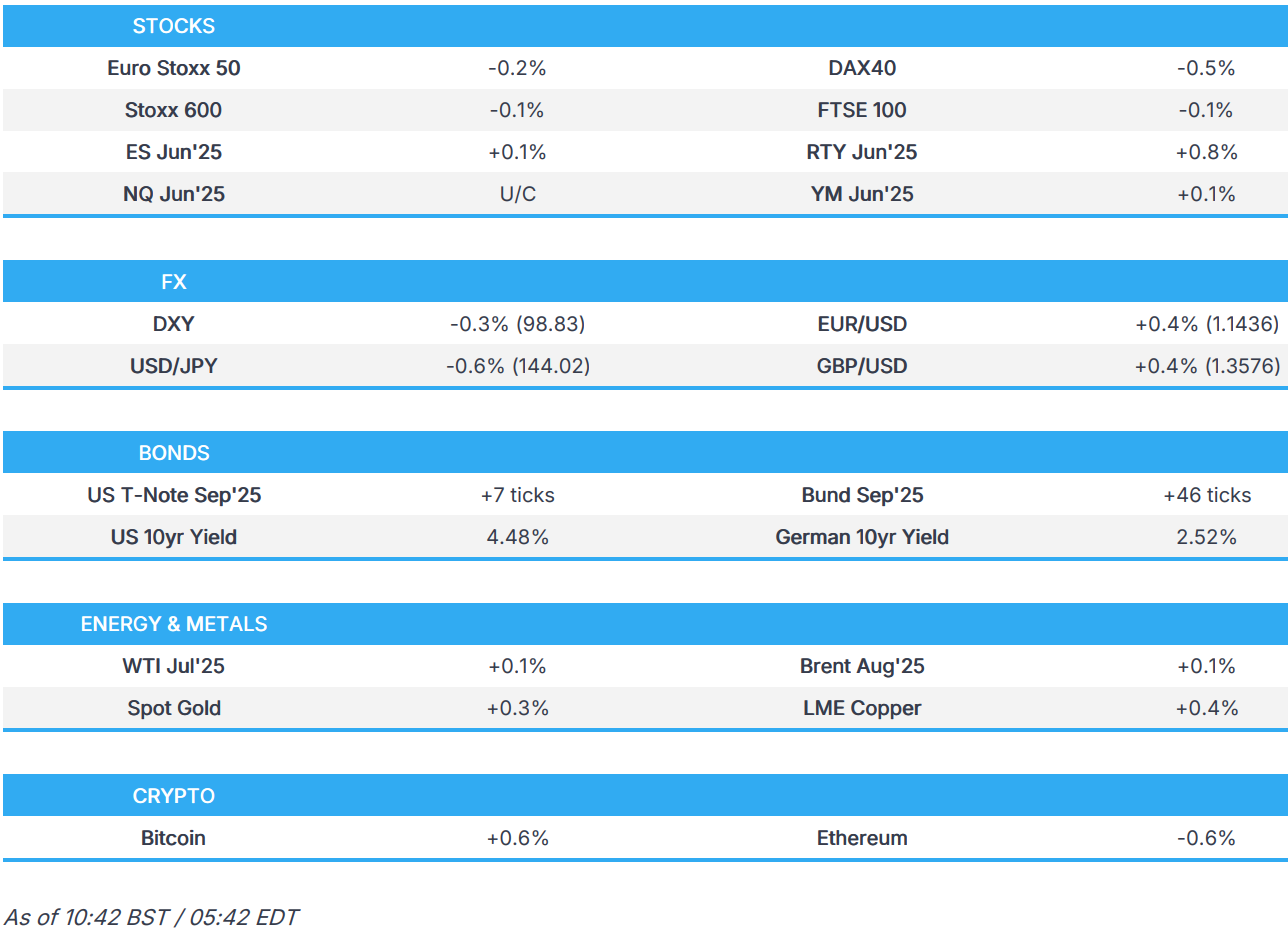

- European bourses are modestly lower in holiday-thinned trade; ES/NQ trade around the unchanged mark whilst the RTY outperforms.

- USD is on the backfoot, giving back some of Friday’s NFP induced gains, Antipodeans lead.

- Bunds surge in early trade, dragging global fixed income higher.

- Crude is essentially flat with catalysts light, focus on Iran's counter offer to the US nuclear proposal.

- Looking ahead, ECB's Elderson, Holiday Closures in Switzerland, Norway, Hungary, Greece & Cyprus.

TARIFFS/TRADE

- Chinese Foreign Ministry spokesman Lin avoids a question on the reported US-China meeting in London today, according to Bloomberg.

- US President Trump said they are very far advanced on a China deal ahead of high-level talks in London on Monday and a China deal is complex but will bring in a lot of money, while he added Chinese President Xi agreed to restart exporting rare earth minerals.

- China’s Foreign Ministry said Vice Premier He Lifeng will visit the UK from June 8th-13th and the first meeting of the China-US economic and trade consultation mechanism will be held with the US during this visit.

- China’s Commerce Ministry said it approved a certain number of compliant rare earth applications and will continue to strengthen the examination and approvals, while it added that China is ready to further strengthen communication and dialogue with relevant countries on export controls.

- China’s Commerce Ministry said negotiations over the price commitment between China and the EU on electric vehicles have entered the final stage and it noted that French companies and relevant associations have voluntarily submitted an application for a price undertaking to China regarding brandy, while Chinese investigators reached an agreement with the Chinese side on the core terms of the price pledge and plan to issue a final announcement by July 5th. Furthermore, China is willing to establish a green channel for eligible applications from European firms to speed up examination and approval on rare earths and China hopes the EU will take effective measures to facilitate, guarantee and promote the trade of high-tech products with China.

- Japanese Economy Minister Akazawa said he urged the US again to reconsider tariff measures and believes they have made further progress in trade talks with the US, while he noted tariffs are having a major impact on Japan’s economy and it was also reported that Akazawa is arranging a sixth visit to the US for tariff talks.

- Japan and the EU are to launch a competitive alliance to deepen trade and economic security ties, according to diplomatic sources.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX600 -0.1%) are broadly modestly lower across the board and with price action fairly muted, given parts of Europe are off today on account of Whit Monday.

- European sectors mixed and with the breadth of the market exceptionally narrow, given the holiday-thinned conditions for some parts of Europe. Real Estate leads given the relatively lower yield environment in Europe; Travel & Leisure follows closely behind.

- US equity futures are mixed with the ES/NQ ultimately trading on either side of the unchanged mark, ahead of what is a very quiet day in terms of scheduled events. The RTY is the clear outperformer today, building on the post-NFP upside seen in the prior session.

- Citi raises S&P 500 Y/E price target to 6300 (prev. exp. 5800) (prev. close 6000).

- Tesla (TSLA) exported 23,074 (prev. 29,728) Chinese-made vehicles in May, according to China's CPCA

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY has kicked the week off on the backfoot after being boosted on Friday post-NFP. Focus at the start of the week has been on the trade front ahead of an anticipated meeting between US-China officials in London to discuss the trade situation; note, Chinese Foreign Ministry spokesman avoided a question on the matter at a briefing today. Elsewhere, whilst the Fed is in its blackout period, US President Trump has teased over a potential imminent decision on who will replace Fed Chair Powell when his term expires next year. DXY has delved as low as 98.81 but is holding above Friday's trough at 98.65.

- EUR/USD has moved back onto a 1.14 handle following last Friday's NFP-induced selling. Fresh macro drivers for the Eurozone are lacking following the hawkish reaction to last week's ECB policy announcement. We have seen further commentary from Bank officials over the weekend with Nagel noting that the central bank has maximum flexibility on rates, whilst Schnabel stated we should not expect a sustained decoupling between the ECB and the Fed. EUR/USD has ventured as high as 1.1429 but is yet to approach Friday's 1.1457 peak.

- JPY is firmer vs. the USD and towards the top of the G10 leaderboard after suffering in the wake of last Friday's US jobs report. Newsflow out of Japan has been on the light side aside from an upwards revision to Q1 GDP and Japanese Economy Minister Akazawa continuing to urge the US again to reconsider tariff measures, whilst suggesting that further progress has been made in trade talks with the US. USD/JPY has crossed back below its 50DMA at 144.43 and is currently holding above the 144 mark.

- As is the case across G10 FX, GBP is firmer vs. the USD in a reversal of the price action seen post-NFP on Friday. Over the weekend, BoE's Greene remarked that the disinflation process is ongoing and expects inflation to continue to come down to the target over the medium-term. Cable remains on a 1.35 handle but sub-Friday's 1.3585 peak.

- Antipodeans are both firmer vs. the USD and towards the top of the G10 leaderboard. Newsflow for Australia and New Zealand has been light over the weekend, with the former away from market. Of note for both however, was the latest round of Chinese trade which saw both imports and exports fall short of expectations on account of the trade war.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- US paper is attempting to atone for Friday's losses which were brought about by the firmer-than-expected US jobs report, which avoided the soft outcome that some in the market had been positioning for. Quiet schedule today, but focus will be on the US-China meeting in London today; time still not disclosed. Sep'25 UST contract has been as high as 110.05+ but is some way off Friday's peak at 110.29+.

- Bunds have very much started the week off on the front foot and are leading global fixed income markets higher. From a fundamental perspective, fresh macro drivers for the Eurozone are lacking following the hawkish reaction to last week's ECB policy announcement. We have seen further commentary from Bank officials over the weekend with Nagel noting that the central bank has maximum flexibility on rates, whilst Schnabel stated we should not expect a sustained decoupling between the ECB and the Fed. Sep'25 Bunds have eclipsed Friday's best at 130.77 with focus on a test of 131.00.

- Gilts are higher, being dragged up by the moves in German paper with fresh UK drivers lacking. Over the weekend, BoE's Greene remarked that the disinflation process is ongoing and expects inflation to continue to come down to the target over the medium-term. UK docket today is light, more focus on Wednesday's UK spending review. Sep'25 Gilts have moved back onto a 92 handle but thus far are respecting Friday's peak at 92.36.

- Japanese government is considering buying back some super-long JGBs issued in the past, according to Reuters sources.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks are flat, with price action fairly muted in catalyst thin trade thus far. Some modest upticks on commentary out of Iran, which noted that Tehran will be proposing a counter offer to the US nuclear proposal by tomorrow (Tuesday). WTI and Brent reside within tight USD 64.20-64.86 and 66.07-66.69/bbl ranges respectively, and currently rest within the middle of these bounds.

- Spot gold is firmer, and benefitting from the softer dollar (DXY -0.3%), and subdued risk environment. The yellow-metal saw fleeting support on the aforementioned news from Iran, which pushed the metal towards session highs of USD 3,328/oz, before it faced resistance at this level.

- Copper is on the front foot, shrugging off mixed Chinese data, which showed Y/Y CPI remaining in deflationary territory. Elsewhere, LME data showed copper stocks fell 10k. The industrial metal was choppy on this update, though ultimately rose after ten minutes. 3M LME copper trades within a range of USD 9,670.75-9,738.1/t.

- Venezuela is planning to increase gasoline prices by 50% as it braces for a decline in oil revenue following the suspension of operations by Chevron (CVX) and other foreign energy firms, according to Bloomberg citing people familiar with the decision.

- Click for a detailed summary

NOTABLE EUROPEAN HEADLINES

-

NATO Secretary General Rutte will reportedly call for a 400% increase in air and missile defence in his London speech.

- UK Chancellor Reeves is to announce a transformative GBP 86bln in the Spending Review to turbo-charge the fastest growing sectors, from tech and life sciences to advanced manufacturing and defence, as part of the government’s plan to invest in Britain’s renewal through the Modern Industrial Strategy.

- BoE’s Greene said the disinflation process is ongoing and expects inflation to continue to come down to the target over the medium-term, while she noted their view is they can look through it but added there is a pretty big risk.

- ECB's Kazimir says he thinks the bank is nearly done with, if not already at the end of the easing cycle; sees clear downside risks to growth but would be a mistake to ignore upside inflation risks. Need to keep all options open. Data over the summer will indicate whether additional fine-tuning is required.

- ECB President Lagarde reiterated that the central bank is in a good position on rates and to deal with uncertainties ahead.

- ECB’s Escriva said the path of monetary policy easing in the eurozone could require further adjustments if the current macroeconomic and inflation outlooks are confirmed, while he added the central scenario of GDP growth around 1% and inflation of 2% could require some fine-tuning, according to Reuters.

- ECB’s Nagel said the ECB can take its time on interest rates with monetary policy now set at a neutral level that is no longer restrictive and that the central bank has maximum flexibility on rates.

- ECB’s Schnabel said do not expect a sustained decoupling between the ECB and the Fed, while she expects the trade conflict to play out as a global shock that’s working through both lower demand and supply.

- ECB’s Vujcic said a small deviation on either side of the 2% inflation target is not a problem and the central bank should not overreact to inflation edging below the target, while he added the bar for QE will be higher in light of past experience.

- EU was urged to exempt more companies from supply chain law although rules on curbing environmental and rights abuses should not be scrapped, according to Swedish conservative MEP Warborn cited by FT.

- Fitch cut Austria’s sovereign rating from AA+ to AA; Outlook Stable, while it affirmed Hungary at BBB: Outlook Stable, while S&P raised Slovenia’s rating from AA- to AA; Outlook Stable.

NOTABLE US HEADLINES

- Citi expects the Fed to deliver 75bps of rate cuts this year, 25bps in September, October and December, comes after Friday's NFP data; expects Fed to deliver 50bps in 2026, via 25bps in Jan and March.

- Fed’s Musalem (voter) said he sees a 50-50 chance that Trump tariffs could either boost inflation for a quarter or two, or cause sustained inflation, according to an FT interview. Musalem said this means the Fed will likely face uncertainty right through the summer and political interference could make it harder for the Fed to lower interest rates.

- US President Trump thinks support has solidified for the tax bill over the last 24 hours and will take a look at Elon Musk’s government contracts, while he has no plans to speak to Musk and noted that DOGE helped a lot. Trump stated he is thinking about the next Fed Chair and it is coming out very soon, as well as suggested a good Fed Chair would lower rates.

- US President Trump said Elon Musk will face ‘very serious consequences’ if he decides to fund Democratic candidates, while Trump replied “I would assume so, yeah” when asked if his relationship with Musk is over.

- US Defense Secretary Hegseth said active-duty troops will be mobilised if violence continues in Los Angeles, while President Trump deployed the National Guard to LA immigration ‘riots’ after claiming state officials cannot do their jobs, according to Sky News. Furthermore, reports noted that as many as 500 Marines are “in a prepared-to-deploy status” should they be needed to protect federal property and personnel and US President Trump posted on Truth Social "Looking really bad in L.A. BRING IN THE TROOPS!!!"

- Canadian PM Carney is to announce Canada's national defence spending will meet the 2% of GDP NATO goal, according to the Globe & Mail.

GEOPOLITICS

MIDDLE EAST

- Iran will reportedly propose a counter offer to the US nuclear proposal soon, according to state TV; will be sent by tomorrow.

- Israel’s military said it struck a Hamas member in southern Syria.

- US-based Gaza Humanitarian Foundation said it did not distribute aid on Saturday because Hamas made direct threats against its operations, while a Hamas official said he had no knowledge of alleged threats to the US-backed aid group in Gaza. Furthermore, Al Jazeera reported that Israeli attacks killed more than 40 in Gaza as aid seekers were shot dead.

- Israeli Defence Minister Katz threatened to “take all necessary measures” to prevent a humanitarian ship carrying climate campaigner Greta Thunberg from reaching Gaza, according to The Guardian. It was later reported that the Freedom Flotilla Coalition said it ship was 'under assault' and the Israeli Army had boarded the Gaza-bound ship.

RUSSIA-UKRAINE

- Russian forces captured Zoria in Ukraine’s Donetsk region and reached the Dnipropetrovsk region in Ukraine, according to TASS and Interfax. However, it was later reported that Ukrainian General Staff spokesman Kovalev denied claims by the Russian Defence Ministry that its forces advanced into Ukraine’s eastern Dnipropetrovsk region for the first time since it launched its full-scale invasion.

- Head of the Russian delegation at talks with Ukraine in Istanbul said Russia handed over to Ukraine the first list of 640 POWs for exchange, according to TASS. Furthermore, the Russian Defence Ministry said Russia launched a large-scale humanitarian operation to repatriate more than 6,000 bodies of deceased Ukrainian military personnel and exchange prisoners of war, while Ukrainian officials rejected Russian claims that Ukraine was delaying the exchange of soldiers’ bodies.

- Ukrainian drone attack sparked a short-lived fire at the Azot chemical plant in Russia’s Tula region, although there was no threat to air quality near the plant, according to the regional governor.

- US believes Russian retaliation for Ukraine’s drone attack is not over yet and it expects a multi-pronged strike.

- Poland scrambled aircraft to ensure airspace security after Russia launches strikes on Ukraine.

OTHER

- US expressed concern to the UK government about allowing China to build a large embassy in London that security officials believe would pose a risk to sensitive communications infrastructure serving the City, according to FT. It was also reported that the UK government promised to assess any security concerns related to the construction of a Chinese embassy near the City of London, which is an issue that could potentially complicate trade talks with the US, according to Bloomberg.

- Thai army said provocations by Cambodia and buildup of military forces show a clear intent to use force, and the Thai army is to control the opening and closing of all border checkpoints along the Thailand-Cambodia border, while it added that Cambodia enforced its military presence, equipment and constructed fortifications.

CRYPTO

- Bitcoin is a little firmer and trades just below the USD 106k mark; Ethereum moves lower and just shy of the USD 2.5k.

APAC TRADE

- APAC stocks traded mostly higher following last Friday's gains on Wall St, but with trade somewhat quietened amid the holiday closure in Australia and as participants digested mixed Chinese data.

- Nikkei 225 reclaimed the 38,000 level after last week's currency weakness and with upward revisions to Japanese GDP data.

- Hang Seng and Shanghai Comp gained amid some trade-related optimism with officials from the US and China set to meet in London today, although the gains in the mainland are capped as participants also digested key data releases which showed a continued deflation and mostly softer trade data.

NOTABLE ASIA-PAC HEADLINES

- BoJ Deputy Governor Uchida said central banks are shrinking their balance sheet but many of them are unlikely to return to conventional monetary adjustment methods, while he added that many central banks are likely to use interest payment on reserves to guide short-term interest rates while maintaining the balance sheet size that meets market demand.

- China sold 1.96mln passenger cars in May, +13.9% Y/Y, according to China's auto industry body CPCA.

- China to raise minimum wage standard and expand coverage of social insurance, via Xinhua.

DATA RECAP

- Chinese Trade Balance (USD)(May) 103.22B vs. Exp. 101.3B (Prev. 96.18B)

- Chinese Exports YY (USD)(May) 4.8% vs. Exp. 5.0% (Prev. 8.1%)

- Chinese Imports YY (USD)(May) -3.4% vs. Exp. -0.9% (Prev. -0.2%)

- Chinese Trade Balance (CNY)(May) 750B (Prev. 690B)

- Chinese Exports YY (CNY)(May) 6.3% (Prev. 9.3%)

- Chinese Imports YY (CNY)(May) -2.1% (Prev. 0.8%)

- Chinese CPI MM (May) -0.2% vs. Exp. -0.2% (Prev. 0.1%)

- Chinese PPI YY (May) -3.3% vs. Exp. -3.2% (Prev. -2.7%)

- Chinese CPI YY (May) -0.1% vs. Exp. -0.2% (Prev. -0.1%)

- Chinese FX Reserves (USD)(May) 3.285tln vs. Exp. 3.292tln (Prev. 3.282tln)

- Japanese GDP Revised QQ (Q1) 0.0% vs. Exp. -0.2% (Prev. -0.2%)

- Japanese GDP Rev QQ Annualised (Q1) -0.2% vs. Exp. -0.7% (Prev. -0.7%)