Europe Market Open: European futures lower despite optimism surrounding US-China talks, to resume 10:00BST

10 Jun 2025, 06:55 by Newsquawk Desk

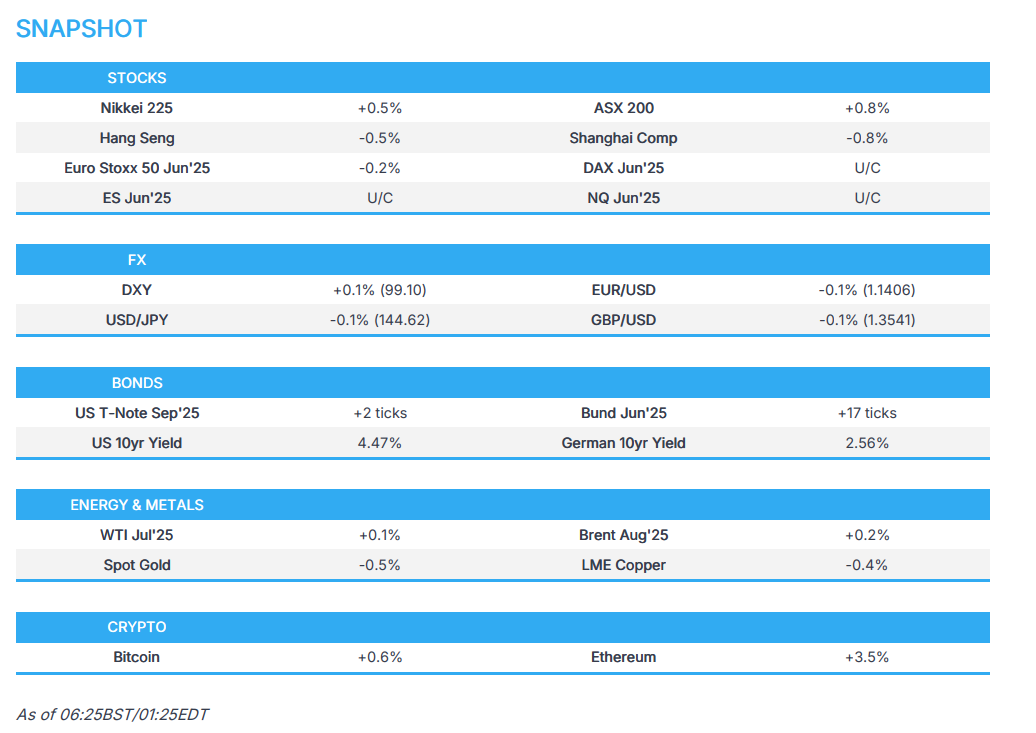

- APAC stocks traded mostly higher with risk sentiment underpinned amid some optimism surrounding US-China talks; to resume 10:00BST.

- US Treasury Secretary Bessent said it was a 'good meeting' with China, Commerce Secretary Lutnick said talks were "fruitful".

- European equity futures indicate a marginally negative cash market open with Euro Stoxx 50 future down 0.2% after the cash market closed with losses of 0.2% on Monday.

- USD is net positive vs. peers, EUR/USD sits around the 1.14 mark, JPY sits towards the bottom of the pile.

- Bunds are off lows but with the rebound relatively limited, crude futures are supported by the positive risk tone.

- Looking ahead, highlights include UK Employment & Average Earnings, ECB Survey of Monetary Analysts, EIA STEO, US-China Talks in London, US-Iran Nuclear deal "counter offer", ECB's Rehn, Supply from Netherlands, Germany & US.

SNAPSHOT

US TRADE

EQUITIES

- US stocks mostly eked mild gains in rangebound trade with most sectors higher, led by outperformance in Consumer Discretionary, Materials and Energy, while Utilities, Financials and Consumer Staples lagged. The main developments on Monday included US/China trade talks in a meeting that lasted for nearly 7 hours, which the US side described as "good" and "fruitful" so far, and with talks to resume on Tuesday at 10:00BST/05:00EDT, while the attention was also on the latest NY Fed SCE which saw consumer inflation expectations ease across the 1, 3 and 5-year horizons.

- SPX +0.09% at 6,006, NDX +0.17% at 21,798, DJI unch. at 42,762, RUT +0.57% at 2,144.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said they are doing well with China and that China is not easy although he noted they are getting good reports from London and will see on lifting export controls.

- US Treasury Secretary Bessent said regarding US-China talks that it was a 'good meeting', while Commerce Secretary Lutnick said US-China talks were "fruitful".

- US-China talks in London will continue on Tuesday at 10:00BST/05:00EDT following talks on Monday which concluded after 6 hours and 40 minutes.

- US DoJ requested that judges extend a hold on the ruling against Trump tariffs.

- Japanese PM Ishiba and US President Trump will hold bilateral talks on the sidelines of the G7 summit in Canada

- Japanese Economy Minister Akazawa said the key is if Japan and the US can agree on a trade package, while it was separately reported that he is to visit the US and Canada from June 13th-18th for tariff talks, according to Nikkei.

NOTABLE HEADLINES

- US President Trump said "that is okay" if the budget bill takes a little longer than the target .

- US House Speaker Johnson said they are on track to get a budget bill passed by Independence Day and urged the Senate to modify SALT as little as possible.

- US GOP Rep. Green notified the Speaker he would resign from Congress after the reconciliation package vote.

- US CBO said the US is to hit the debt limit deadline between mid-August and end-September.

- US military confirmed it has activated 700 marines to help protect federal personnel and federal property in the greater Los Angeles area.

APAC TRADE

EQUITIES

- APAC stocks traded mostly higher with risk sentiment underpinned amid some optimism surrounding US-China talks which are set to resume on Tuesday and have been described so far by US officials as a 'good meeting' and "fruitful".

- ASX 200 gained on return from the long weekend with the advances led by outperformance in Consumer Discretionary, Financials, Energy and Tech, while further upside was capped amid mixed consumer and business sentiment surveys.

- Nikkei 225 initially outperformed as it coat-tailed on the recent upside in USD/JPY which was partially facilitated alongside comments from BoJ Governor Ueda who stated that the BoJ is keeping the real interest rate negative, so underlying inflation achieves 2% and keeps inflation sustainably and stably at 2%.

- Hang Seng and Shanghai Comp kept afloat as the attention centred on US-China talks in London which are scheduled to extend for a second day.

- US equity futures (ES U/C, NQ U/C) edged higher alongside the positive mood in Asia spurred by the US-China trade discussions.

- European equity futures indicate a marginally negative cash market open with Euro Stoxx 50 future down 0.2% after the cash market closed with losses of 0.2% on Monday.

FX

- DXY mildly strengthened and reclaimed the 99.00 status amid the optimism surrounding US-China trade talks although the gains were limited amid light newsflow and with the Fed in a blackout period. Furthermore, participants await a readout from US-China talks in London which are set to continue from 10:00BST/05:00EDT, while key data also looms with US CPI scheduled on Wednesday and the Fed's preferred PPI inflation gauge on Thursday.

- EUR/USD gave way to the dollar strength and briefly dipped back below the 1.1400 handle, despite recent comments from ECB officials including Holzmann who said the pause in cutting rates could last a while but added that there could be more cuts if economic data worsens.

- GBP/USD pared some of its recent gains and trickled beneath Monday's lows amid the firmer dollar, while participants await jobs and earnings data.

- USD/JPY momentarily reclaimed the 145.00 level to the upside amid the firmer buck and mostly positive risk appetite, with the advances also facilitated by comments from BoJ Governor Ueda who reaffirmed the familiar rate hike signal but also stated the BoJ has limited room to underpin growth with rate cuts if the economy and prices come under strong downward pressure, as well as noted the BoJ is keeping real interest rate negative, so underlying inflation achieves 2% and keeps inflation sustainably and stably at 2%.

- Antipodeans were choppy amid mixed Business Sentiment data from Australia and the overall constructive risk tone.

- PBoC set USD/CNY mid-point at 7.1840 vs exp. 7.1853 (Prev. 7.1855).

FIXED INCOME

- 10yr UST futures lacked direction as tailwinds from falling consumer inflation expectations waned.

- Bund futures were off the prior day's lows but with the rebound limited after recent whipsawing and as supply looms.

- 10yr JGB futures conformed to the humdrum mood in global peers amid the positive risk tone and absence of tier-1 data, with pressure following weaker demand at the enhanced liquidity auction for 10yr, 20yr and 30yr JGBs.

COMMODITIES

- Crude futures kept afloat amid the positive risk tone but with the upside capped amid light energy-specific catalysts.

- Spot gold continued to pull back from yesterday's peak amid a firmer greenback and lack of haven demand.

- Copper futures steadily faded the prior day's gains despite the mostly positive risk appetite in the region.

CRYPTO

- Bitcoin gradually retreated overnight to beneath the USD 110,000 level.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi and South Korean President Lee held a phone talk, while Xi said that China and South Korea should promote strategic cooperative partnership to a higher level and he urged the countries to inject more certainty into regional and international situation. Furthermore, Xi urged they jointly safeguard multilateralism and free trade and ensure stable, smooth global and regional industrial and supply chains.

- Chinese Vice President Han Zheng met with French President Macron in France and said that China is ready to work with the EU to further expand areas of cooperation and promote new development in China-EU relations, while Han said at the UN Ocean Conference that China will carry out bilateral and multilateral cooperation projects to support small island states and other developing countries in implementing sustainable development goals.

- Chinese Finance Ministry announced that China is working on setting up a childcare subsidy system.

- BoJ Governor Ueda said if the economy and prices come under strong downward pressure, the BoJ has limited room to underpin growth with rate cuts with the short-term rate still at 0.5% and noted that underlying inflation is still below 2%. Ueda stated the BoJ is keeping the real interest rate negative, so underlying inflation achieves 2% and keeps inflation sustainably and stably at 2%, but reiterated that the BoJ will raise interest rates if it has enough confidence that underlying inflation nears or moves around 2%.

DATA RECAP

- Australian NAB Business Confidence (May) 2.0 (Prev. -1.0)

- Australian NAB Business Conditions (May) 0.0 (Prev. 2.0)

- Australian Westpac Consumer Sentiment (Jun) 0.5% (Prev. 2.2%)

GEOPOLITICS

MIDDLE EAST

- US President Trump said they are doing a lot of work with Iran now and that they are tough negotiators, while he discussed Iran and other things with Israeli PM Netanyahu. Furthermore, Trump said the Iran meeting is on Thursday and that they are asking for things you cannot do, while he added they seek enrichment and can't have it and so far, they're not there, as well as noted that alternatives are ‘very very dire’.

- The sixth round of nuclear talks between the US and Iran will take place either on Friday in Oslo or on Sunday in Muscat, according to an Axios reporter citing a US official, while Iran's Foreign Ministry spokesman confirmed that the sixth round of Iran-US talks is being scheduled for Sunday, June 15th in Muscat.

- Security sources estimated if nuclear talks fail, Israel would have to decide whether to attack Iran, according to the Israeli Broadcasting Authority.

- Israel launched strikes on Yemen's port city of Hodeidah, according to Houthi-affiliated Al Masirah TV.

RUSSIA-UKRAINE

- Russia launched an air attack on Kyiv which Ukraine's defence systems attempted to repel, while emergency units were dispatched to several districts in Kyiv after Russian drone attacks, according to the mayor.

- Flights were halted at all airports serving Moscow following a Ukrainian drone attack, according to Russia's civil aviation authority.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves is planning a ‘housing bank’ to provide cheaper financing for builders and is considering a funding settlement of up to GBP 25bln for social housing in Wednesday’s spending review, according to FT.

- ECB's Holzmann said the pause in cutting rates could last a while and if economic data worsens there could be more cuts, while he is moderately optimistic about what will happen with Trump and tariffs, according to Orf TV.

- French President Macron says he does not rule out the possibility of dissolving the National Assembly and calling snap elections, according to Bloomberg.

DATA RECAP

- UK BRC Retail Sales YY (May) 0.6% (Prev. 6.8%)

- UK BRC Total Sales YY (May) 1.0% (Prev. 7.0%)

- Barclays UK May Consumer Spending rose 1.0% Y/Y (prev. +4.5%)