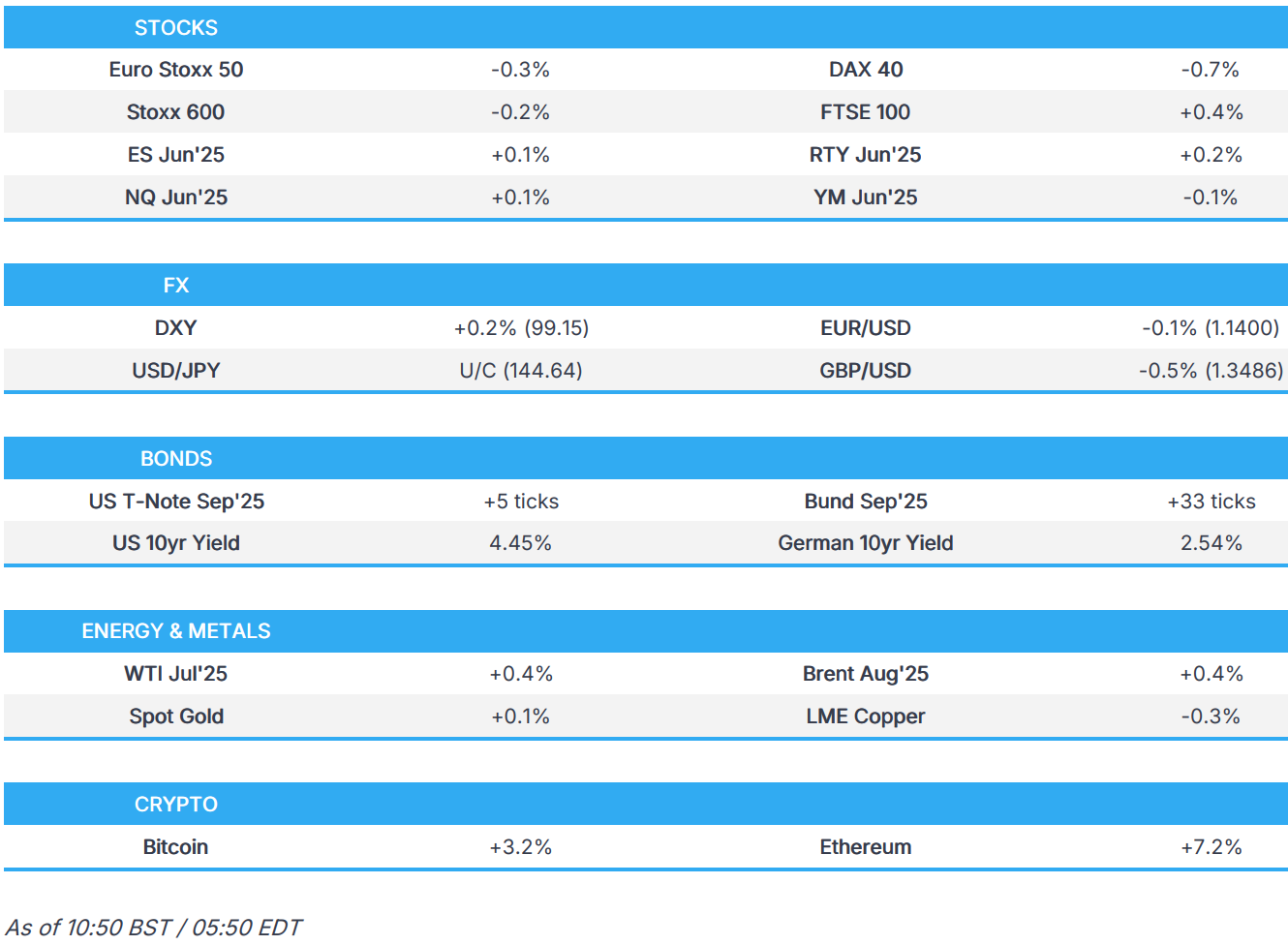

US Market Open: US equity futures lacklustre and Fixed bid as US-China talks commence; Lutnick says they are “going well”

10 Jun 2025, 11:20 by Newsquawk Desk

- US-China talks in London have commenced.

- US Commerce Secretary Lutnick says discussions with China are "going well"; talks to continue all day Tuesday.

- European stocks move lower ahead of US-China talks, FTSE 100 bid post-jobs data.

- GBP lags after jobs data which saw a slump in HMRC Payrolls and a further cooling in average earnings, USD ekes out mild gains.

- Gilts outperform as the UK labour market cools, USTs await US-China day two and 3yr supply.

- Crude is incrementally firmer, with XAU also modestly in the green.

- Looking ahead, US NFIB Business Optimism, EIA STEO, US-China Talks in London, Supply from the US.

TARIFFS/TRADE

- US-China talks in London were scheduled to continue on Tuesday at 10:30BST/05:30EDT (delayed from 10:00BST/05:00ET, no reason provided) following talks on Monday which concluded after 6 hours and 40 minutes; the US Treasury announced Tuesday's talks began around 10:44BST/05:44ET. Heading into the talks, US Commerce Secretary Lutnick said discussions with China are "going well", and talks are to continue all day Tuesday.

- US DoJ requested that judges extend a hold on the ruling against Trump tariffs.

- Japanese PM Ishiba and US President Trump will hold bilateral talks on the sidelines of the G7 summit in Canada.

- Japanese Economy Minister Akazawa said the key is if Japan and the US can agree on a trade package, while it was separately reported that he is to visit the US and Canada from June 13th-18th for tariff talks, according to Nikkei.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.1%) opened mixed and on either side of the unchanged mark; sentiment did gradually improve just after the cash open but then a bout of hefty pressure took most European indices back into negative territory. No clear driver for the downside, but perhaps in anticipation of the US-China talks.

- European sectors are mixed and with no clear theme or bias. Energy takes the top spot, following closely by Autos & Parts; the latter likely benefitting from the optimism surrounding the US-China talks. Financial Services sits at the foot of the pile, with the downside driven by losses in UBS (-6.6%), reversing some of the upside seen on Friday and as traders digest the latest government proposals which aim to force the bank to hold an extra USD 26bln in extra capital.

- US equity futures (ES +0.1%, NQ +0.1%, RTY +0.2%) are flat/modestly firmer, as traders remain cautious going into day two of US-China talks. US docket ahead is very light but now attention is on any readout from US-China talks in London.

- TSMC (TSM / 2330 TT) May (TWD): Revenue 320.52bln (prev. 349.6bln M/M), Monthly Sales +39.6% Y/Y (prev. +48.1%)

- Meta's (META) Zuckerberg is reportedly forming a new AI "superintelligence" team, via Bloomberg citing sources; focus will be on artificial general intelligence.

- The US Data Centre Coalition, includes Microsoft (MSFT), Amazon (AMZN), Meta (META) and others, wrote to Senate Majority Leader Thune asking him to retain clean energy subsidies that are set to be phased out in the tax bill that passed the House, via WSJ.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD has kicked the session off on the front foot with support stemming from the positive readout of the US-China trade talks which saw US Treasury Secretary Bessent state that it was a 'good meeting' with China, whilst Commerce Secretary Lutnick said talks were "fruitful". Focus today will be on the US 3yr auction, to give further indication of if the "Sell America" theme is still at play. DXY currently around 99.15.

- EUR is a touch softer vs. the broadly firmer USD with fresh macro drivers lacking for the Eurozone. Markets continue to be drip-fed ECB speak with known hawk Holzmann noting the pause in cutting rates could last a while. Elsewhere, France's Villeroy remarked that the Bank has successfully normalised policy, adding that policy and inflation are now in a favourable zone. However, being in a favourable zone does not mean the Bank is static. EUR/USD continues to pivot around the 1.14 mark and is currently contained within Monday's 1.1386-1.1439 range.

- JPY is fractionally lower vs. the USD, albeit off worst levels which saw the pair hit a new high for the month during APAC trade at 145.29. The price action took place alongside the broad pick-up in the USD and mostly positive risk appetite, which eventually faded. In terms of Japanese-specific newsflow, BoJ Governor Ueda reaffirmed the familiar rate hike signal but also stated the BoJ has limited room to underpin growth with rate cuts if the economy and prices come under strong downward pressure. On the trade front, Japanese Economy Minister Akazawa is reportedly to visit the US and Canada from June 13th-18th for tariff talks. USD/JPY has returned to a 144 handle but is holding above its 50DMA at 144.34.

- GBP is sat at the foot of the G10 leaderboard in the wake of the latest UK jobs which report which showed an expected uptick in the unemployment rate to 4.6% from 4.5%, a 109k slump in the HMRC payrolls change metric for May (largest decline since May 2020) and a further cooling of average earnings. In reaction, BoE market pricing moved dovishly, now fully pricing in a 25bps cut in September vs November pre-data. Cable has slipped onto a 1.34 handle for the first time since June 2nd with a current session low at 1.3457 (June 2nd low was at 1.3451).

- Antipodeans are both are slightly softer vs. the USD with price action choppy during APAC hours on account of mixed Business Sentiment data from Australia and the overall constructive risk tone. However, of greater interest for both will likely be the outcome of the US-China trade talks in London today given that China is both nation's largest trading partner.

- PBoC set USD/CNY mid-point at 7.1840 vs exp. 7.1853 (Prev. 7.1855).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Gilts are outperforming, gapped higher by 55 ticks after a dovish UK labour market series. This caused Gilts to open at 92.36 before extending to a 92.66 peak with gains in excess of 80 ticks on the session at best. In brief, HMRC Payrolls fell more-than-expected with the accompanying wage figures also cooler than expected. In the near term, there is around a 10% implied probability of a June cut while August has increased to -18bps vs 15bps pre-release - a cut is now fully priced in September vs November pre-data.

- Bunds are in the green but with upside of only around half of that seen in Gilts at best. Specifics for the bloc include the latest ECB SMA and remarks from Villeroy, who said that while policy has now been normalised and the ECB is in a “favourable zone” this does not mean they are “static”. Bunds were only a little firmer in APAC trade, then caught a slight bid as the risk tone dipped in early morning trade before taking another leg higher alongside the Gilt open. Currently at 130.63, if the move continues, Friday’s high is just above at 130.77 before 130.99 from Monday and then last week’s 131.47 peak.

- USTs are broadly in-line with Bunds though the magnitude of gains is a little less, given that US equity futures have proven to be more resilient than European peers this morning; though, US equity sentiment is still very much on the back foot. Thus far, this has taken USTs to a 110-12 peak. If surpassed, Friday’s pre-NFP high resides at 110-29. The US data docket is light, focus turns to US-China talks in London and a 3yr auction thereafter.

- Netherlands sells EUR 2.45bln vs exp. EUR 2-2.5bln 2.50% 2035 DSL: average yield 2.749% (prev. 3.011%).

- Germany sells EUR 3.078bln vs exp. EUR 4bln 2.40% 2030 Bobl: b/c 1.8x (prev. 1.20x), average yield 2.14% (prev. 2.07%) & retention 23.05% (prev. 22.67%)

- Books have opened on the UK's 1.75% September 2038 I/L Gilt via syndication; price guidance 11.75-12.25bps above November 2037 I/L. Orders for the UK's 2038 I/L are in excess of GBP 46bln; price guidance unchanged. Orders for new UK 2038 I/L Gilt exceed GBP 58bln, according to a bookrunner; guidance set at 2037 I/L +11.75bps.

- Click for a detailed summary

COMMODITIES

- Crude prices are indecisive on a day when two major events (US-China talks and the Iranian nuclear counteroffer) are taking place. Ahead of the Iranian proposal, both sides confirmed the sixth round of nuclear talks will take place this weekend - the timing is unclear. Brent Aug'25 currently trades in a USD 66.95-67.40/bbl range.

- Spot gold is looking to build on Monday’s gains, as ongoing US-China tariff negotiations continue to support safe-haven demand - but with gains capped by modest Dollar strength. XAU/USD trades around 3,330/oz.

- Base metals are broadly lower, tracking the mood seen in Gold ahead of further trade/mineral-specific updates. EV sensitive metal Lithium is the outperformer, however, Palladium, used only in combustion cars, is suffering, given optimism on a rare earth deal. Copper has been rangebound, though is ultimately lower after the prior session of gains. The industrial metal looks to test the USD 9,760 mark, and sits within a USD 9,724-9,782.55 range.

- Kazakhstan says its oil exports to Germany via Druzhba pipeline +48% Y/Y in Jan-May; via Baku-Tbilisi-Ceyhan pipeline at +10% Y/Y in Jan-May.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK HMRC Payrolls Change (May) -109k (Prev. -33k, Rev. -55k); ONS highlights the drop is the largest since May 2020, but caution about timing effects.

- UK Avg Earnings (Ex-Bonus) (Apr) 5.2% vs. Exp. 5.3% (Prev. 5.6%, Rev. 5.5%); Avg Wk Earnings 3M YY 5.3% vs. Exp. 5.5% (Prev. 5.5%, Rev. 5.6%)

- UK ILO Unemployment Rate (Apr) 4.6% vs. Exp. 4.6% (Prev. 4.5%); Claimant Count Unemployment Change (May) 33.1k (Prev. 5.2k, Rev. -21.2k)

- UK BRC Retail Sales YY (May) 0.6% (Prev. 6.8%); Total Sales YY (May) 1.0% (Prev. 7.0%)

- Barclays UK May Consumer Spending rose 1.0% Y/Y (prev. +4.5%)

- EU Sentix Index (Jun) 0.2 vs. Exp. -6.0 (Prev. -8.1)

- Italian Industrial Output YY WDA (Apr) 0.3% vs. Exp. -1.4% (Prev. -1.8%); Industrial Output MM SA (Apr) 1.0% vs. Exp. -0.2% (Prev. 0.1%, Rev. 0.0%)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves is planning a ‘housing bank’ to provide cheaper financing for builders and is considering a funding settlement of up to GBP 25bln for social housing in Wednesday’s spending review, according to FT.

- ECB's Holzmann said the pause in cutting rates could last a while and if economic data worsens there could be more cuts, while he is moderately optimistic about what will happen with Trump and tariffs, according to Orf TV.

- ECB's Villeroy says ECB has successfully normalised policy; policy and inflation are now in a favourable zone Being in a favourable zone does not mean the Bank is static. ECB will be as agile as needed.

- ECB's Rehn says will take decisions on a meeting by meeting basis, must avoid complacency over the inflation outlook.

- French President Macron says he does not rule out the possibility of dissolving the National Assembly and calling snap elections, according to Bloomberg.

NOTABLE US HEADLINES

- US House Speaker Johnson said they are on track to get a budget bill passed by Independence Day and urged the Senate to modify SALT as little as possible.

- US GOP Rep. Green notified the Speaker he would resign from Congress after the reconciliation package vote.

- US military confirmed it has activated 700 marines to help protect federal personnel and federal property in the greater Los Angeles area.

GEOPOLITICS

MIDDLE EAST

- The sixth round of nuclear talks between the US and Iran will take place either on Friday in Oslo or on Sunday in Muscat, according to an Axios reporter citing a US official, while Iran's Foreign Ministry spokesman confirmed that the sixth round of Iran-US talks is being scheduled for Sunday, June 15th in Muscat.

- Security sources estimated if nuclear talks fail, Israel would have to decide whether to attack Iran, according to the Israeli Broadcasting Authority.

- Israel launched strikes on Yemen's port city of Hodeidah, according to Houthi-affiliated Al Masirah TV.

- Israel's navy attacked Houthi targets in the Hodeidah port of Yemen, via an army statement.

RUSSIA-UKRAINE

- Russia launched an air attack on Kyiv which Ukraine's defence systems attempted to repel, while emergency units were dispatched to several districts in Kyiv after Russian drone attacks, according to the mayor.

- Flights were halted at all airports serving Moscow following a Ukrainian drone attack, according to Russia's civil aviation authority.

CRYPTO

- Bitcoin is on a firmer footing and surges past USD 109k; Ethereum soars past USD 2.5k, with the broader crypto complex boosted.

- Societe Generale's (GLE FP) stablecoin subsidiary will launch its first USD-backed stablecoin. On the Ethereum and Solana public blockchains.

APAC TRADE

- APAC stocks traded mostly higher with risk sentiment underpinned amid some optimism surrounding US-China talks which are set to resume on Tuesday and have been described so far by US officials as a 'good meeting' and "fruitful".

- ASX 200 gained on return from the long weekend with the advances led by outperformance in Consumer Discretionary, Financials, Energy and Tech, while further upside was capped amid mixed consumer and business sentiment surveys.

- Nikkei 225 initially outperformed as it coat-tailed on the recent upside in USD/JPY which was partially facilitated alongside comments from BoJ Governor Ueda who stated that the BoJ is keeping the real interest rate negative, so underlying inflation achieves 2% and keeps inflation sustainably and stably at 2%.

- Hang Seng and Shanghai Comp kept afloat as the attention centred on US-China talks in London which are scheduled to extend for a second day.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi and South Korean President Lee held a phone talk, while Xi said that China and South Korea should promote strategic cooperative partnership to a higher level and he urged the countries to inject more certainty into regional and international situation. Furthermore, Xi urged they jointly safeguard multilateralism and free trade and ensure stable, smooth global and regional industrial and supply chains.

- Chinese Vice President Han Zheng met with French President Macron in France and said that China is ready to work with the EU to further expand areas of cooperation and promote new development in China-EU relations, while Han said at the UN Ocean Conference that China will carry out bilateral and multilateral cooperation projects to support small island states and other developing countries in implementing sustainable development goals.

- Chinese Finance Ministry announced that China is working on setting up a childcare subsidy system.

- BoJ Governor Ueda said if the economy and prices come under strong downward pressure, the BoJ has limited room to underpin growth with rate cuts with the short-term rate still at 0.5% and noted that underlying inflation is still below 2%. Ueda stated the BoJ is keeping the real interest rate negative, so underlying inflation achieves 2% and keeps inflation sustainably and stably at 2%, but reiterated that the BoJ will raise interest rates if it has enough confidence that underlying inflation nears or moves around 2%.

DATA RECAP

- Australian NAB Business Confidence (May) 2.0 (Prev. -1.0); Conditions (May) 0.0 (Prev. 2.0)

- Australian Westpac Consumer Sentiment (Jun) 0.5% (Prev. 2.2%)