Europe Market Open: European futures modestly lower post-US/China talks, framework to be approved by leaders

11 Jun 2025, 06:00 by Newsquawk Desk

- APAC stocks were mostly higher amid the recent trade-related optimism stemming from the US-China trade talks in London which have now concluded.

- US Commerce Secretary Lutnick said they have reached a framework to implement the Geneva consensus; will return to the US to see if Trump approves.

- Chinese Vice Commerce Minister Li Chenggang said the two sides reached a consensus regarding the Geneva meeting; will report on the framework to leaders.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.4% after the cash market closed with losses of 0.1% on Tuesday.

- USD is broadly firmer vs. peers, EUR/USD is retaining a 1.14 handle, USD/JPY is oscillating around the 145 mark, GBP eyes the UK spending review.

- Looking ahead, highlights include ECB Wage Tracker, US CPI & Weekly Earnings, UK Spending Review, Speakers including ECB's Lagarde, Lane & Cipollone, Supply from Australia, UK, Germany & US, Earnings from Oracle and Inditex.

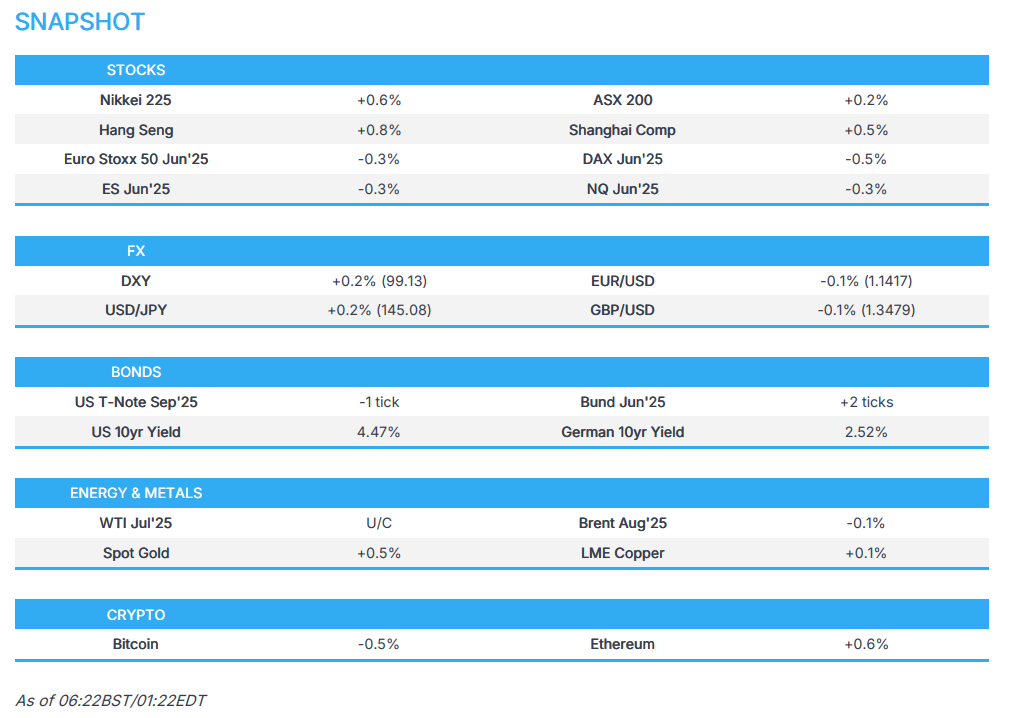

SNAPSHOT

US TRADE

EQUITIES

- US stocks finished higher as focus remained on US-China trade talks with comments from US Commerce Secretary Lutnick providing some optimism as he reiterated that trade talks are going well which underpinned stocks to fresh session highs, although gains were capped amid a lack of concrete details at the time. In terms of sectors, they predominantly closed in the green with gains led by strength in Energy and Consumer Discretionary, while Industrials lagged and was the only industry in the red.

- SPX +0.55% at 6,039, NDX +0.66% at 21,942, DJI +0.25% at 42,867, RUT +0.56% at 2,156.

- Click here for a detailed summary.

TARIFFS/TRADE

- US Commerce Secretary Lutnick said they have reached a framework to implement the Geneva consensus and the outcome from the leaders' call on June 5th, while he added that they are going to go back and see if US President Trump approves it and if approved, they will implement it. Lutnick noted the idea behind this is to increase trade with China with the framework the first step and they had to get the negativity out. Furthermore, he said they expect the rare earths and magnets issues will be resolved in this framework and he reiterated that they reached a framework to implement the agreements reached.

- USTR Greer said they are focused on full compliance and don't have another meeting scheduled but added they are in constant contact with China and are moving as quickly as they can. Greer stated that they feel positive about engaging with the Chinese and expect to see progress from China on fentanyl, while he noted it is up to the President whether the deadline gets extended.

- Chinese Vice Commerce Minister Li Chenggang said talks with the US had involved in-depth exchanges and communication had been rational and candid, while the two sides reached a consensus regarding the Geneva meeting. Li added he will report on the framework to leaders and hopes the progress is conducive to increasing the trust between China and the US.

- US Appeals Court decided that Trump tariffs may remain in effect while the appeals proceed.

- US and Mexico are near a deal to cut steel duties and cap imports, while President Trump would need to sign off on a US-Mexico agreement, according to Bloomberg.

- China, Mexico, EU, and Japan urged the Trump administration not to impose new national security tariffs on imported planes and parts, while Boeing (BA) urged the Trump administration to ensure tariff-free treatment for aeroplanes and parts as a condition of any new trade deal.

- India and the US reportedly advance toward interim trade deal after four-day talks, according to Reuters citing sources.

NOTABLE HEADLINES

- US Treasury Secretary Bessent was reportedly seen as a contender to be the next Fed Chair, although formal interviews for the next Fed Chair haven't yet begun and Kevin Warsh is also seen as a possible contender, according to Bloomberg. However, the White House later stated the Bloomberg report was false.

- US Senate Republicans are reportedly to send House counterparts a list of fatal flaws in US President Trump's tax/budget bill, according to Politico.

- Los Angeles Mayor said they declared a local emergency and a curfew for Downtown Los Angeles from 8pm-6am which is expected to last several days.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher amid the recent trade-related optimism stemming from the US-China trade talks in London which have now concluded and where officials reached a framework to implement the Geneva consensus and outcome from the recent Trump-Xi call.

- ASX 200 advanced to print a fresh record high in early trade before paring some of the gains amid little fresh catalysts.

- Nikkei 225 marginally benefitted from recent currency weakness and softer-than-expected PPI data.

- Hang Seng and Shanghai Comp gained following the progress in US-China trade talks, albeit with the upside in the mainland capped given the lack of solid details.

- US equity futures (ES -0.3%, NQ -0.4%) mildly pulled back from recent peaks as participants now brace for incoming US inflation data.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.4% after the cash market closed with losses of 0.1% on Tuesday.

FX

- DXY gradually strengthened following the conclusion of the US-China trade talks in London where officials reached a framework to implement the Geneva consensus and outcome of last week's Trump-Xi call although little details were provided with officials to report the framework to their leaders for approval prior to implementation, while attention now turns to upcoming data stateside with CPI and PPI scheduled for Wednesday and Thursday, respectively.

- EUR/USD slightly softened amid a firmer buck although downside was limited as the single currency retained the 1.1400 status.

- GBP/USD failed to sustain the 1.3500 handle after yesterday's data-induced selling pressure and with the focus in the UK shifting to the government's spending review.

- USD/JPY traded indecisively on both sides of the 145.00 level with mild support seen amid the positive risk tone and after US-China talks concluded.

- Antipodeans pulled back after recent choppy performances and amid a quiet overnight calendar with no tier-1 releases.

- PBoC set USD/CNY mid-point at 7.1815 vs exp. 7.1801 (Prev. 7.1840).

FIXED INCOME

- 10yr UST futures were little changed following an uneventful 3yr auction and as participants awaited CPI data and 10yr supply.

- Bund futures took a breather after advancing to just shy of the 131.00 level and with a EUR 3bln Bund offering scheduled later.

- 10yr JGB futures marginally edged higher in the aftermath of softer-than-expected PPI data from Japan which showed a surprise M/M deflation.

COMMODITIES

- Crude futures were contained after the prior day's declines despite comments from OPEC Secretary General Al Ghais who sees no peak in oil demand on the horizon, while prices were not helped by bearish private sector inventory data.

- US Private Inventory Data (bbls): Crude -0.4mln (exp. -2mln), Distillates +3.7mln (exp. +0.8mln), Gasoline +3.0mln (exp. +0.9mln), Cushing -0.7mln.

- EIA STEO stated 2025 world oil demand is seen at 103.5mln BPD (prev. 103.7mln BPD in prior forecast) and 2026 world oil demand is seen at 104.6mln BPD (prev. 104.6mln BPD).

- OPEC Secretary General Al Ghais said there is no peak in oil demand on the horizon and OPEC is very concerned by the IEA's "flip-flopping" on oil investment. Furthermore, he sees a 24% increase in world energy needs between now and 2050 and said oil demand will surpass 120M barrels per day by 2050.

- US President Trump is poised to repeal former US President Biden’s curbs on power-plant pollution.

- Spot gold gradually edged higher but remained within yesterday's parameters after a recent choppy performance and with US CPI on the horizon.

- Copper futures struggled for direction despite the positive risk tone with trade restricted amid light details from the US-China trade talks.

- Chile's Codelco Copper Production rose 20.5% Y/Y in April to 114,600 tonnes, while Collahuasi copper production fell 13.5% Y/Y in April to 36.6k tonnes and Escondida copper production rose 31% Y/Y in April to 128.4k tonnes.

- Chinese steel production is expected to decline by 4% in 2025, according to the China Iron and Steel Association.

CRYPTO

- Bitcoin retreated overnight after pulling back beneath the USD 110k level.

NOTABLE ASIA-PAC HEADLINES

- Hong Kong Financial Secretary Chan said expect equity markets to continue to be strong and the IPO pipeline remains strong.

- White House AI and Crypto Czar Sacks said China is only 3-6 months behind the US in AI.

DATA RECAP

- Japanese Corp Goods Price MM (May) -0.2% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.3%)

- Japanese Corp Goods Price YY (May) 3.2% vs. Exp. 3.5% (Prev. 4.0%, Rev. 4.1%)

GEOPOLITICS

MIDDLE EAST

- US President Trump said to Israeli PM Netanyahu that he still wants to defuse the Iran crisis with talks, not bombs..

- US Secretary of State Rubio said the US condemns sanctions imposed by the governments of the UK, Canada, Norway, New Zealand, and Australia on two sitting members of the Israeli cabinet. Rubio also stated that Israel sanctions do not advance US-led efforts to achieve a ceasefire, bring all hostages home, and end the war, while he added that the US urges a reversal of the sanctions.

- US senior administration officials told Fox News that Iran appears to be dragging negotiations on without concrete progress while pushing forward with its nuclear efforts.

RUSSIA-UKRAINE

- US State Department spokesperson said Russia's strikes against Ukraine's cities need to stop immediately.