US Market Open: US/China reach Geneva framework, markets await CPI

11 Jun 2025, 11:55 by Newsquawk Desk

- US Commerce Secretary Lutnick said they have reached a framework to implement the Geneva consensus; will return to the US to see if Trump approves.

- Chinese Vice Commerce Minister Li Chenggang said the two sides reached a consensus regarding the Geneva meeting; will report on the framework to leaders.

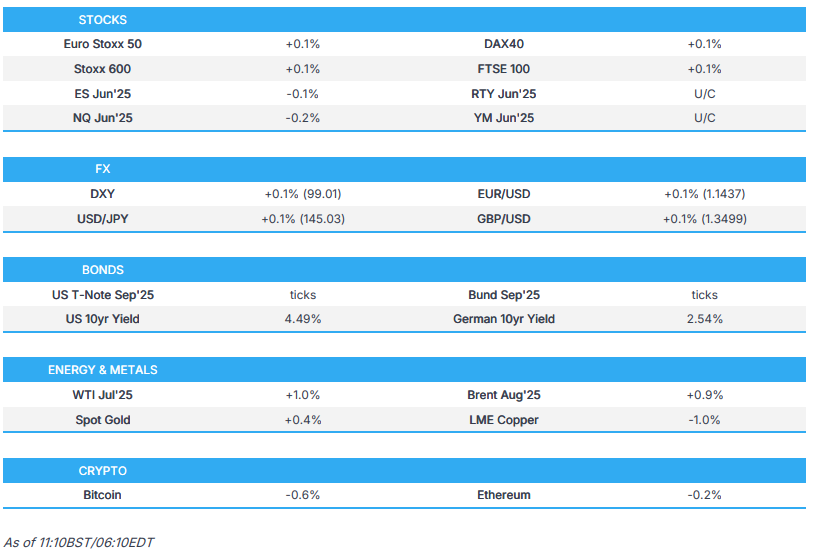

- European bourses are firmer this morning, though with Retail lagging; Stateside, futures are just into the red into CPI.

- DXY choppy but contained within Tuesday's parameters so far. Fixed benchmarks pressured into CPI, Gilts lag.

- Crude has seen notable two-way action on reporting around Iran. XAU edges higher, base metals mixed.

- Looking ahead, highlights include US CPI & Weekly Earnings, UK Spending Review, Speakers including ECB's Cipollone, Supply from the US, Earnings from Oracle.

- Click for the Newsquawk Week Ahead.

TARIFFS/TRADE

US-CHINA

- US Commerce Secretary Lutnick said they have reached a framework to implement the Geneva consensus and the outcome from the leaders' call on June 5th, while he added that they are going to go back and see if US President Trump approves it and if approved, they will implement it. Lutnick noted the idea behind this is to increase trade with China with the framework the first step and they had to get the negativity out. Furthermore, he said they expect the rare earths and magnets issues will be resolved in this framework and he reiterated that they reached a framework to implement the agreements reached.

- USTR Greer said they are focused on full compliance and don't have another meeting scheduled but added they are in constant contact with China and are moving as quickly as they can. Greer stated that they feel positive about engaging with the Chinese and expect to see progress from China on fentanyl, while he noted it is up to the President whether the deadline gets extended.

- Chinese Vice Commerce Minister Li Chenggang said talks with the US had involved in-depth exchanges and communication had been rational and candid, while the two sides reached a consensus regarding the Geneva meeting. Li added he will report on the framework to leaders and hopes the progress is conducive to increasing the trust between China and the US.

- Chinese Foreign Ministry spokesperson Lin says no information to offer on US-China meeting in London.

- China Vice Premier, on China-US talks in London, says China's stance on trade issues with the US is clear and consistent; China not willing to fight but not afraid to fight; vows to reduce misunderstanding with the US. Both sides should enhance consensus. Both sides should jointly safeguard the hard won outcome from the dialogues. Both sides should maintain communication. Should push for stable and long-term China-US trade and economic ties. China is sincere in trade and economic consolations but has its principle.

OTHER

- US Appeals Court decided that Trump tariffs may remain in effect while the appeals proceed.

- US and Mexico are near a deal to cut steel duties and cap imports, while President Trump would need to sign off on a US-Mexico agreement, according to Bloomberg.

- China, Mexico, EU, and Japan urged the Trump administration not to impose new national security tariffs on imported planes and parts, while Boeing (BA) urged the Trump administration to ensure tariff-free treatment for aeroplanes and parts as a condition of any new trade deal.

- EU aims for US trade talks to extend past Trump's July 9th deadline, according to Bloomberg sources; EU reportedly sees reaching an agreement on the principles of a deal by July 9th as a "best-case scenario".

- Japanese PM Ishiba says Japan is making steady progress with the US on tariffs.

EUROPEAN TRADE

EQUITIES

- European bourses are generally marginally firmer, EuroStoxx 50 +0.2%, defying indications for a slightly softer cash open. However, this comes with the exception of the IBEX 35 -0.8%, given marked pressure in Inditex (-3.3%).

- Sectors are mixed with Retail -1.0% the laggard given the above Inditex action. Basic Resources, Tech, Consumer Products & Services all benefit from the US-China updates.

- Stateside, futures are modestly into the red with subdued trade despite the framework agreement between US-China officials as we now await the response from President's Trump & Xi; ES -0.3%. Attention in the meantime firmly on CPI.

- ADNOC is reportedly mulling the possibility of buying some BP (BP/ LN) assets, according to Bloomberg sources; unlikely to pursue full takeover of BP.

- NVIDIA (NVDA) CEO Huang says there is an inflection point happening in Quantum computing.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY has seen a bit of two-way action this morning. Initially contained in the wake of US-China talks before coming under a little bit of pressure and losing 99.0 to the downside as EUR and GBP picked up. Nonetheless, the index remains within yesterday's 98.86-99.39 range.

- EUR unreactive to ECB officials this morning with macro drivers for the bloc light. Latest ECB wage tracker was hawkish but sparked no move. Given US CPI shortly, the USD-side of the equation will likely dictate the Single Currencies fortunes, currently in Tuesday's 1.1373-1.1447 band.

- JPY a touch softer, USD/JPY holding above 145 in a 144.66 to 145.24 band. Japanese PPI metrics printed softer-than-expected overnight, which is also adding to the weakness in the JPY. Handful of remarks from Ishiba recently, though no follow through just yet.

- Cable unable to recoup much of the lost ground seen in the wake of yesterday's soft UK jobs report which sent the pair to a 1.3457 session low. Currently just about in the green against the USD, holding at 1.35.

- PBoC set USD/CNY mid-point at 7.1815 vs exp. 7.1801 (Prev. 7.1840).

- JPMorgan revises USD/CNY target to 7.15 (prev. 7.30), cites moderating tariff risks and de-dollarisation theme, expects "gentle downtrend" to 7.10 by Q2 25.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Fixed benchmarks pressured across the board. Gilts the underperformer after Tuesday’s session of pronounced gains. Gilts opened softer by a handful of ticks, before extending to current losses of c. 30 ticks; marginal pressure around supply, largely awaiting the Spending Review.

- Aside from ECB speak, which has not influenced price action, updates for EGBs have been light. Bunds in the red by around 15 ticks, but still higher by around 40 ticks WTD.

- USTs softer but, compared to the above, are much closer to the unchanged mark. As we await updates from the US and/or China President, CPI and then 10yr supply (3yr passed without impact). Amidst this, yields firmer across the curve which is slightly steeper.

- UK sells GBP 4.25bln 4.50% 2035 Gilt: b/c 2.98x (prev. 3.13x), average yield 4.588% (prev. 4.673%) & tail 0.3bps (prev. 0.3bps).

- Germany sells EUR 2.336bln vs exp. EUR 3.0bln 2.50% 2035 Bund: b/c 2.7x (prev. 2.4x), average yield 2.54% (prev. 2.66%) & retention 22.13% (prev. 23.7%).

- Hong Kong pensions intend to cut USTs if the US loses its AAA grade, via Bloomberg.

- PIMCO’s fixed income CIO Balls said, on BBG TV, the five to ten year part of the US curve is where you would want to be. Adds, Japan looks like an opportunity. On today’s UK Spending Review, Balls remarked that it should not be a significant market event.

- Click for a detailed summary

COMMODITIES

- Initially, a mild upward tilt across the crude benchmarks after Tuesday's declines. However, the complex returned to earlier lows amid commentary from the Iranian Foreign Minister on the potential for a nuclear agreement this weekend.

- WTI Jul moved to the bottom of a USD 64.60-65.68/bbl range while Brent Aug sits in a USD 66.47-67.10/bbl parameter on the above; since, the benchmarks have bounced and are now marginally firmer once again. Potentially picking up as Trump says he is less confident about an Iran deal, speaking with the NY Post.

- Spot gold gradually edges higher but just about remains within yesterday's parameters after recent choppy performance and with US CPI on the horizon.

- Base metals mixed, copper struggled for direction overnight awaiting US-China developments. Elsewhere, a handful of production updates from Codelco, Collahuasi, Escondida and China also factoring.

- US Private Inventory Data (bbls): Crude -0.4mln (exp. -2mln), Distillates +3.7mln (exp. +0.8mln), Gasoline +3.0mln (exp. +0.9mln), Cushing -0.7mln.

- Chinese steel production is expected to decline by 4% in 2025, according to the China Iron and Steel Association.

- Click for a detailed summary

NOTABLE DATA RECAP

- ECB Wage Tracker: 2025 Annual 3.114% (prev. 3.055%). Quarterly: Q1 4.635% (prev. 4.64%), Q2 3.936% (prev. 3.879%), Q3 2.230% (prev. 2.133%), Q4 1.703% (prev. 1.620%)

NOTABLE EUROPEAN HEADLINES

- ECB and PBoC sign MoU on cooperation in the field of central banking, according to a press release.

- BoE confirms re-calibration of indexed long-term repo operation.

- ECB's Vujcic says he's looking for more clarity on the trade front.

- ECB's Kazaks says it is "quite likely" that 2% inflation will require some further cuts for fine tuning, via Econostream on X; market pricing of one or more cut is not out of the realm of the baseline. May at some point go into accommodative territory. So far, seems the deflationary effect of trade tensions could dominate, but the final outcome is open.

- ECB's Lane says last week's rate cut will guard against any uncertainty about the Bank's reaction function by showing they are committed to returning inflation to target; conditions today are far more favourable for blue EU bond issuance on prudent scale.

- UK Foreign Secretary Lammy is reportedly en-route to Brussels to sign off on UK-Spain deal over Gibraltar's post-Brexit future, via Telegraph's Barnes.

NOTABLE US HEADLINES

- Los Angeles Mayor said they declared a local emergency and a curfew for Downtown Los Angeles from 8pm-6am which is expected to last several days.

- Tesla (TSLA) CEO Musk posts "I regret some of my posts about President Trump last week. They went too far."

GEOPOLITICS

- Iranian Foreign Minister "As we resume talks on Sunday, it is clear that an agreement that can ensure the continued peaceful nature of Iran's nuclear program is within reach—and could be achieved rapidly.". Thereafter, US President Trump is less confident about the Iran deal, according to a New York Post podcast interview.

- Iranian Foreign Minister says "Trump's position on Iran's possession of nuclear weapons could form the basis of the agreement ", according to Al Arabiya.

- US Secretary of State Rubio said the US condemns sanctions imposed by the governments of the UK, Canada, Norway, New Zealand, and Australia on two sitting members of the Israeli cabinet. Rubio also stated that Israel sanctions do not advance US-led efforts to achieve a ceasefire, bring all hostages home, and end the war, while he added that the US urges a reversal of the sanctions.

- "Iran's Defense Minister warns on US officials' threats of conflict should negotiations falter: We hope for successful talks, but if conflict is imposed on us, Iran will respond decisively, targeting all US bases in host countries.", via Journalist Aslani.

- "Iran successfully tested a missile equipped with a two-ton warhead last week", according to Iran International citing the Iranian Defence Minister.

CRYPTO

- Bitcoin finds itself in the red this morning, specifics for the space light after a handful of equity-related updates for the complex overnight.

APAC TRADE

- APAC stocks were mostly higher amid the recent trade-related optimism stemming from the US-China trade talks in London which have now concluded and where officials reached a framework to implement the Geneva consensus and outcome from the recent Trump-Xi call.

- ASX 200 advanced to print a fresh record high in early trade before paring some of the gains amid little fresh catalysts.

- Nikkei 225 marginally benefitted from recent currency weakness and softer-than-expected PPI data.

- Hang Seng and Shanghai Comp gained following the progress in US-China trade talks, albeit with the upside in the mainland capped given the lack of solid details.

NOTABLE ASIA-PAC HEADLINES

- Hong Kong Financial Secretary Chan said expect equity markets to continue to be strong and the IPO pipeline remains strong.

- BoJ Governor Ueda said markets' risk adverse moves are subsidising somewhat but uncertainty is very high, according to a cabinet member; Ueda said the BoJ will continue to scrutinise market moves, and its impact on the economy. Told those in the Monthly economic report: that domestic financial conditions remain accommodative

DATA RECAP

- Japanese Corp Goods Price MM (May) -0.2% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.3%); YY (May) 3.2% vs. Exp. 3.5% (Prev. 4.0%, Rev. 4.1%)