Europe Market Open: Europe Primed for a lower open after Middle-East evacuations & trade updates

12 Jun 2025, 07:00 by Newsquawk Desk

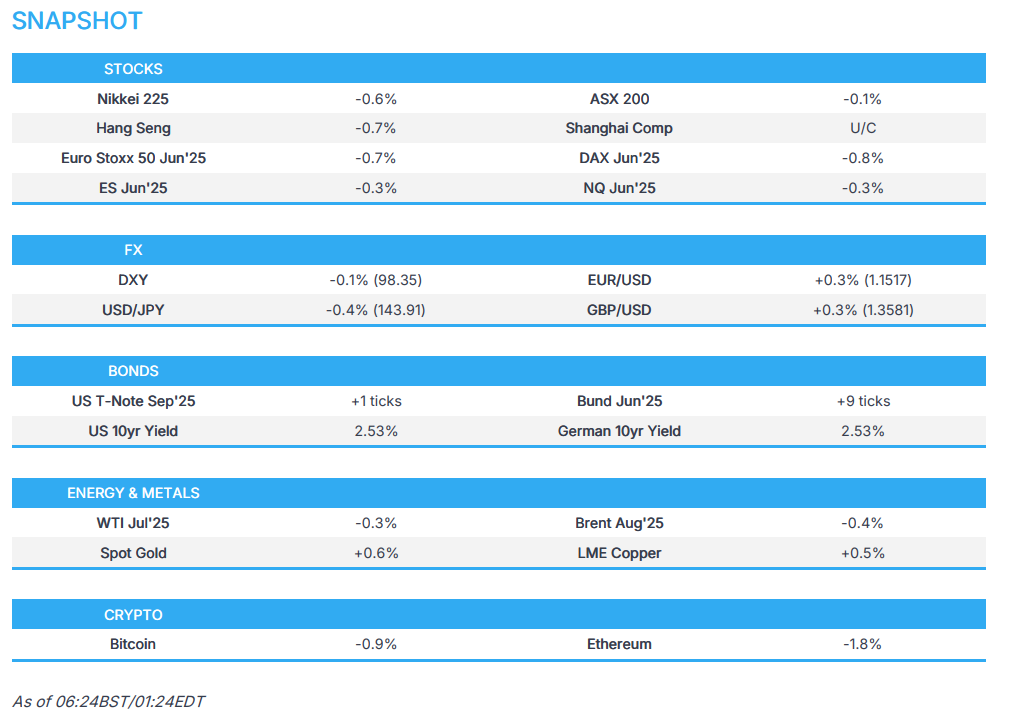

- APAC stocks traded mixed following the subdued handover from Wall St; Europe primed for a lower open (Eurostoxx 50 future -0.7%)

- US President Trump said he would be willing to extend the trade talks deadline but doesn't think it will be necessary

- US President Trump is planning to send letters in a week and a half for countries to take it or leave it regarding a trade deal.

- US evacuated non-emergency US government personnel from several Middle Eastern countries due to heightened regional tensions

- US officials were told that Israel is fully ready for an Iran operation, according to CBS

- DXY has extended losses, EUR/USD has made its way onto a 1.15 handle, USD/JPY is sub-144

- Looking ahead, highlights include UK GDP Estimate, US Initial Jobless Claims & PPI, ECB's Schnabel, de Guindos & Elderson, Supply from Italy & US.

SNAPSHOT

US TRADE

EQUITIES

- US stocks were choppy with initial gains seen following the conclusion of the US-China trade talks and with risk appetite supported early in the session following softer-than-expected US CPI data which spurred Fed rate cut bets. However, the major indices then gave back their gains amid geopolitical concerns after reports that the US State Department was authorising the departure of nonessential personnel and family members from Bahrain and Kuwait, while the US embassy in Iraq was also preparing for an ordered evacuation due to heightened security risks in the region.

- SPX -0.27% at 6,022, NDX -0.37% at 21,861, DJI unch at 42,866 , RUT -0.38% at 2,148.

- Click here for a detailed summary.

TARIFFS/TRADE

- US Treasury Secretary Bessent said they are prepared to roll the date forward for trading partners negotiating in good faith.

- US President Trump said he would be willing to extend the trade talks deadline but doesn't think it will be necessary, while he added they are dealing with Japan and South Korea on trade. Trump also stated at a certain point, they will send letters out for countries to take or leave and will send those letters out in a week and a half. Furthermore, he said the EU wants to negotiate and will weigh in again in a week if he’s satisfied.

- White House said US President Trump was talking to the trade team about the China trade deal and liked what he heard.

- China is putting a six-month limit on rare-earth export licenses for US automakers and manufacturers, according to WSJ citing sources who noted the "Tentative deal reached in London gives Beijing continued leverage in trade negotiations".

- Canada and the US are reportedly exchanging potential terms on an economic and security deal, according to The Globe and Mail.

NOTABLE HEADLINES

- CNN's Manu Raju posted that GOP senators emerged from the meeting on Trump’s big bill but details are lacking on how tax overhaul and Medicaid cuts would be structured, while it was indicated that changes would be made to pare back SNAP provisions to lessen burden on states and the SALT cap is likely to be reduced.

APAC TRADE

EQUITIES

- APAC stocks traded mixed following the subdued handover from Wall St where the major indices were choppy and wiped out initial data-driven gains as geopolitical concerns clouded over risk sentiment.

- ASX 200 was initially led higher by strength in energy and gold miners after the recent rallies in their respective underlying commodity prices, although the gains in the broader market were limited and the index eventually returned to flat territory.

- Nikkei 225 underperformed as exporters suffered the ill effects of the recent currency strength.

- Hang Seng and Shanghai Comp were mixed alongside a similar overall picture across the Asia-Pac region and with markets somewhat unimpressed following the lack of solid details from the recent US-China agreement.

- US equity futures (ES -0.3%, NQ -0.3%) retreated overnight amid geopolitical concerns with the US evacuating non-emergency US government personnel from several Middle Eastern countries due to heightened regional tensions, while US President Trump is planning to send letters out in a week and a half for countries to take it or leave it regarding a trade deal.

- European equity futures indicate a lower open with Euro Stoxx 50 futures down 0.7% after the cash market closed with losses of 0.4% on Wednesday.

FX

- DXY continued to weaken overnight following the recent softer-than-expected US CPI data and with the dollar not helped by tariff comments from US President Trump who suggested they will set unilateral tariff rates within two weeks, while participants also awaited more data with Initial Jobless Claims and PPI due later today.

- EUR/USD benefitted from recent dollar weakness and breached through resistance to above the 1.1500 level, while there was little impact from recent ECB comments.

- GBP/USD edged higher but with gains capped beneath the 1.3600 handle heading into the latest monthly UK GDP estimates.

- USD/JPY retreated to sub-144.00 territory owing to the softer buck and as geopolitical fears facilitated haven flows.

- Antipodeans were indecisive after recent fluctuations and lack of tier-1 data, while there were comments from Westpac's Chief Economist and former RBA Assistant Governor Luci Ellis who sees the Cash Rate bottoming at 2.85% next year.

- PBoC set USD/CNY mid-point at 7.1803 vs exp. 7.1703 (Prev. 7.1815)

FIXED INCOME

- 10yr UST futures held on to its spoils after the bull steepening seen in the aftermath of the softer-than-expected US CPI.

- Bund futures lingered near this week's best levels and eyed a retest of resistance at the 131.00 level.

- 10yr JGB futures followed suit to the recent gains in global peers although briefly wobbled after weaker demand in the enhanced liquidity auction for longer-dated JGBs.

COMMODITIES

- Crude futures pulled back overnight after rallying by more than 5% yesterday following the latest inventory data and amid geopolitical concerns with the US State Department authorising the departure of non-essential personnel and family members from several Middle Eastern countries due to heightened security risks in the region.

- US Energy Secretary Wright and Secretary of the Interior of Burgum joined Japan's JERA and US energy producers to finalise agreements expected to add over USD 200bln to US GDP. It was also reported that Energy Secretary Wright said a US oil output drop in 2026 is unlikely and sees a multi-year process for refilling the SPR, while he anticipates repairs to the SPR will be completed by the end of the year.

- Alberta Premier Smith said they are working to present a route to PM Carney for a potential new crude pipeline from Alberta to the Port of Prince Rupert, while the proposal is for a 1mln BPD pipeline.

- Spot gold climbed on the back of a softer dollar and amid geopolitical concerns to breach through post-CPI highs.

- Copper futures were rangebound after slumping yesterday and with price action contained by the mixed risk appetite in Asia.

CRYPTO

- Bitcoin was gradually pressured and eventually slipped beneath the USD 108.0k level.

NOTABLE ASIA-PAC HEADLINES

- China's 240-hour visa-free policy was extended to 55 countries, according to Xinhua.

GEOPOLITICS

MIDDLE EAST

- US President Trump responded you are going to have to figure that out, when asked why people were being asked to leave the Middle East.

- US Defense Secretary Hegseth authorised of voluntary departure of military dependants from locations across the Middle East, according to Reuters citing a US official. It was also reported that Naval Support Activity Bahrain was placed on “High Alert”, with the dependents of servicemembers being told to prepare for evacuation, possibly due to concerns of military action related to Iran, according to OSINTdefender on X.

- US State Department is authorising the departure of nonessential personnel and family members from Bahrain and Kuwait, according to AP. It was later reported that the US State Department said it ordered the departure of non-emergency US government personnel due to heightened regional tensions.

- US embassy in Iraq was reportedly preparing for an ordered evacuation due to heightened security risks in the region, while an Iraqi government source said steps related to the evacuation of US diplomatic presence are not only for Iraq but several states in the Middle East.

- US officials were told that Israel is fully ready for Iran operation, according to CBS.

- Iran's President Pezeshkian said they are holding talks with the US and Europe, but they will not surrender to force.

- Iran International posted "The sixth round of Iran-US talks had been tentatively scheduled for this weekend in Oman but it looked increasingly unlikely that the talks would happen, The Washington Post reported on Wednesday citing two US officials". However, it was reported that US envoy Witkoff is to meet with Iran's Foreign Minister Araghchi in Muscat on Sunday to discuss Iran's response to the US proposal for a nuclear deal, according to a senior US official cited by Axios's Ravid.

- Sources cited by The Washington Post noted that US intelligence officials are increasingly concerned about the fear of Israel striking Iran without Washington's approval, according to Al Jazeera.

- US sent a diplomatic cable strongly discouraging countries from participating in a UN conference on a two-state solution between Israel and Palestinians, according to Reuters citing sources. Furthermore, it was stated that the US opposes any steps that would unilaterally recognise a conjectural Palestinian state and opposes implied support of conference for potential actions, including sanctions against Israel.

RUSSIA-UKRAINE

- EU proposed sanctioning two small China banks for Russia trade, according to Bloomberg.

- Russian President Putin said special attention should be paid to the nuclear triad in the new state arms programme.

OTHER

- Pentagon reportedly launched a review to decide if the US should scrap AUKUS, according to FT.

EU/UK

NOTABLE HEADLINES

- ECB's Villeroy said the ECB's situation is favourable and it doesn't mean that policy is static.

DATA RECAP

- UK RICS Housing Survey (May) -8.0 vs. Exp. -4.0 (Prev. -3.0)

- UK RICS House Buyer Demand (May) -26 vs (Prev. -32)