US Market Open: Risk off as Geopolitics takes centre stage, Boeing -8% after Air India incident

12 Jun 2025, 12:05 by Newsquawk Desk

- US President Trump said at a certain point, they will send letters out for countries to take or leave and will send those letters out in a week and a half.

- Geopolitics is driving newsflow as Iran was judged to have violated IAEA rules. An update which has sparked increasingly escalatory rhetoric.

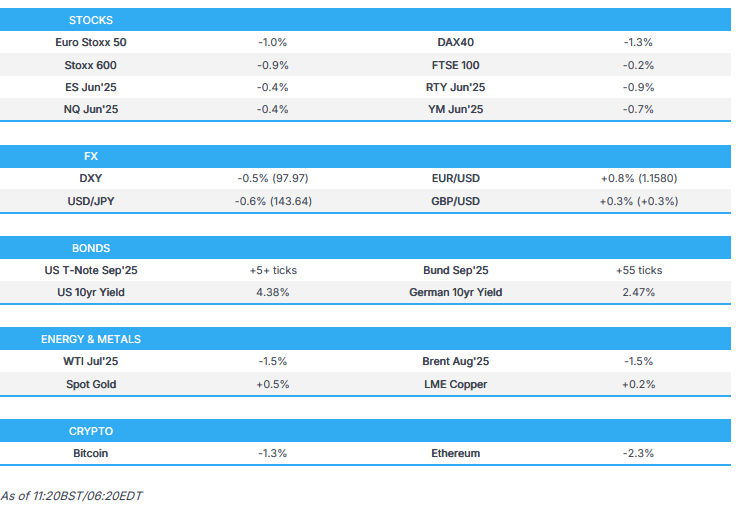

- Given the above, equities are in the red with the DXY pressured and havens leading FX while EUR/USD hits a new YTD peak and XAU climbs.

- Crude pressured despite the above, given the gains seen on Tuesday, Trump's tariff rhetoric, ongoing OPEC+ action and the lack of specificity on what the Iranian response will be.

- EGBs benefiting from the risk tone, Gilts outperform after soft GDP. USTs in-fitting but with magnitudes more contained into data.

- Air India flight AI171 to the UK from Ahmedabad, India crashed outside the airport after takeoff. Craft was a Boeing (BA) 787-8 Dreamliner; Boeing lower by as much as 8% in pre-market trade.

- Looking ahead, highlights include US Initial Jobless Claims & PPI, ECB's de Guindos & Elderson, Supply from the US, Earnings from Adobe & Carnival.

- Click for the Newsquawk Week Ahead.

TARIFFS/TRADE

- US President Trump said he would be willing to extend the trade talks deadline but doesn't think it will be necessary, while he added they are dealing with Japan and South Korea on trade. Trump also stated at a certain point, they will send letters out for countries to take or leave and will send those letters out in a week and a half. Furthermore, he said the EU wants to negotiate and will weigh in again in a week if he’s satisfied.

- Chinese Foreign Ministry says the nation will always honour its commitments when commenting on US President Trump's remarks that a deal with China is "done"

- US President Trump is expected to sign off on key components of the US/UK trade deal, according to FT; relating to the "cars for agriculture" deal. Officials cited by the FT say negotiations are ongoing on delivering tariff-free entry for UK steelmakers

EUROPEAN TRADE

EQUITIES

- European bourses are very much on the backfoot, in a catch-up play to some of the losses seen late in the US session; EuroStoxx 50 -1.0%. Newsflow focussed on trade and geopols.

- Sectors are mostly negative given this, with the exception of Energy (+0.4%), given the rally in crude seen on Wednesday; a narrative which is cushioning the FTSE 100 -0.2%. At the other end of the spectrum, Travel & Leisure (-2.4%) lags given recent gains in energy prices and with focus on Boeing (-7.5%) after the Air India crash.

- Stateside, futures in the red ES -0.4%. Weighed on in-line with the broader risk tone given geopols and as we await new trade updates. Docket ahead focussed firmly on PPI (after a cooler-than-expected CPI release). Afterhours, Adobe due.

- Air India flight AI171 to the UK from Ahmedabad, India has crashed outside the airport on take off. Craft was a Boeing (BA) 787-8 Dreamliner (twin-jet). Reports suggest 242 passengers on board. Boeing (BA) lower by over 7.5% in pre-market trade.

- Oracle shares are up nearly 8% in pre-market trade after it forecast solid cloud infrastructure revenue growth for the next fiscal year, with orders seen more than doubling.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY has for the most part been in the red. Losses were modest in the early morning, and indeed the DXY briefly made a foray into positive territory testing 98.50 to the upside. However, the general direction of travel remains lower after CPI and the unilateral tariff comments from Trump. DXY has slipped onto a 97 handle and is now eyeing the YTD trough @ 97.92

- CHF and JPY the current outperformers. As the risk tone deteriorates and geopolitical tensions in the Middle East escalate after Iran was judged to be in violation of IAEA rules, paving the way for a return to sanctions. USD/CHF slumped as reporting around from Iran around "potential Israel attack" emerged, at a 0.8140 low. Similarly, USD/JPY at lows of 143.58, driven by the same factors and ahead of a busy week for Japan.

- GBP faded initial gains in the wake of disappointing UK GDP metrics. Cable hit an overnight high at 1.3593 before slipping into the red and to a 1.3524 low post-data. Action which has helped to support the EUR, as EUR/GBP peaks at 0.8519 just shy of 0.8522 from May 8th. In recent trade, as the USD gave ground, Cable has moved back into the green.

- EUR/USD is on the front foot and continuing to climb, at a new YTD peak at 1.1587 as traders seek a liquid alternative to the USD. Numerous ECB speakers so far and scheduled for the day ahead, though none have moved the dial just yet.

- Antipodeans initially softer, following the soft risk tone before moving higher as the dollar lost ground. AUD/USD Is now back on a 0.65 handle.

- PBoC set USD/CNY mid-point at 7.1803 vs exp. 7.1703 (Prev. 7.1815).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Gilts outperform on soft growth data, a release which has caused markets to once again imply two more 25bps cuts by the BoE in 2025. Though, some caveats to the release around frontloading due to US tariffs and UK stamp duty changes do apply. As high as 93.13, eclipsing Tuesday’s 92.87 best (after a dovish labour report), to a fresh WTD peak.

- Bunds were contained overnight, holding around the 130.97 peak seen after US CPI. Since, despite a very brief bout of pressure early doors, the bullish direction has resumed lifting Bunds to a 131.40 peak and counting given the risk tone and potentially in sympathy with Gilts. If breached Bunds then look to 131.47 from June 5th before 131.50 from the week of May 9th.

- USTs an echo of the above, though are comparably more contained as we count down to the afternoon's PPI data for further insight into the inflation picture and how it squares with the dovish CPI report. At a 110-29 peak, near-enough matching 110-29+ from June 6th. Yields began mixed but have come under growing pressure as the benchmark itself lifts, with a modest flattening bias emerging but 2s30s remains in proximity to the steepest points seen post-CPI.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks on the backfoot, benchmarks posting downside in excess of USD 1.00/bbl and at lows of USD 67.03/bbl and USD 68.64/bbl for WTI and Brent respectively; pressure which comes as a modest pullback from the upside seen on Wednesday. The main headline-driver this morning has been geopols, as the IAEA board voted to censure Iran over violations to the nuclear commitment. A decision which has sparked increasingly escalatory rhetoric over the morning.

- However, geopols have not spurred too much action so far for crude, given the gains seen on Tuesday, Trump's tariff rhetoric, ongoing OPEC+ action and the lack of specificity on what the Iranian response will be.

- As it stands, we await details on Iran's full response (they have confirmed a new enrichment site so far), how Israel and others will respond and if the 6th round of talks between the US and Iran will occur on Sunday, June 15th as scheduled.

- Spot gold is firmer on the session. However, price action has seen significant whipsawing as XAU got slammed to a USD 3338/oz trough in the early European morning, with no clear driver aside from a pickup in the USD at the time. Since, the yellow metal has been climbing and is comfortably in the green and at a USD 3377/oz peak, moving alongside other havens as the geopolitical tone intensifies.

- Specifics for base metals a little light aside from broader updates on trade and those impacting the risk tone as discussed.

- US Energy Secretary Wright and Secretary of the Interior of Burgum joined Japan's JERA and US energy producers to finalise agreements expected to add over USD 200bln to US GDP. It was also reported that Energy Secretary Wright said a US oil output drop in 2026 is unlikely and sees a multi-year process for refilling the SPR, while he anticipates repairs to the SPR will be completed by the end of the year.

- Japan is reportedly concluding plans to conduct an auction for tax-free "minimum access" import rice, during June, via NHK.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK GDP Estimate MM (Apr) -0.3% vs. Exp. -0.1% (Prev. 0.2%); 3M/3M (Apr) 0.7% vs. Exp. 0.7% (Prev. 0.7%); YY (Apr) 0.9% vs. Exp. 1.1% (Prev. 1.1%)

- UK Services MM (Apr) -0.4% vs. Exp. 0.0% (Prev. 0.4%); YY (Apr) 0.9% vs. Exp. 1.3% (Prev. 1.3%)

- UK Goods Trade Balance GBP (Apr) -23.206B vs. Exp. -20.400B (Prev. -19.869B, Rev. -19.86B)

- UK RICS Housing Survey (May) -8.0 vs. Exp. -4.0 (Prev. -3.0); House Buyer Demand -26 vs (Prev. -32)

- German Ifo Forecasts: GDP; upward revisions driven by the expected impact of new government measures. 2025: 0.3% (prev. exp. 0.2%), 2026: 1.5% (prev. exp. 0.8%)

- Norges Bank Regional network: Increased exports despite international trade uncertainty.

NOTABLE EUROPEAN HEADLINES

- NBP's Kotecki says rates could be lowered in July, via ISBNews; end of 2025 main rate could fall to 4.75%, perhaps to 4.5% if projection in November shows lower inflation path.

- ECB's Villeroy says a 5.4% budget deficit in 2025 remains in reach, even with lowering forecasts.

- ECB's Simkus says rates may still have to come down as risk has increased that inflation will be below projections; ECB has arrived at the neutral rate.

- ECB's Patsalides says the ECB is flexible and agile on rates.

- ECB's Schnabel (Hawk) says the monetary policy cycle is coming to an end, growth outlook is broadly stable despite the trade conflict; financing conditions are no longer restrictive. Medium term inflation stabilises at the target. Medium term inflation stabilises at the target. EZ Headline inflation will ease further in Q1 2026, due to energy price base effect, return to 2% over the medium term.

NOTABLE US HEADLINES

- CNN's Manu Raju posted that GOP senators emerged from the meeting on Trump’s big bill but details are lacking on how tax overhaul and Medicaid cuts would be structured, while it was indicated that changes would be made to pare back SNAP provisions to lessen burden on states and the SALT cap is likely to be reduced.

GEOPOLITICS

MIDDLE EAST

Overnight:

- Iran International posted "The sixth round of Iran-US talks had been tentatively scheduled for this weekend in Oman but it looked increasingly unlikely that the talks would happen, The Washington Post reported on Wednesday citing two US officials". However, it was reported that US envoy Witkoff is to meet with Iran's Foreign Minister Araghchi in Muscat on Sunday to discuss Iran's response to the US proposal for a nuclear deal, according to a senior US official cited by Axios's Ravid.

- Sources cited by The Washington Post noted that US intelligence officials are increasingly concerned about the fear of Israel striking Iran without Washington's approval, according to Al Jazeera.

- US President Trump responded you are going to have to figure that out, when asked why people were being asked to leave the Middle East.

- US officials were told that Israel is fully ready for Iran operation, according to CBS.

European Hours:

- Senior Iranian Official says the nation will not abandon its right to Uranium enrichment; a "friendly" country in the region has alerted Tehran about a potential Israel attack.

- IAEA Board of Governors has passed the resolution declaring Iran as being in non-compliance with nuclear safeguards. Iran condemns the IAEA resolution, says it is a political decision without technical or legal foundations; no other choice than to respond to the IAEA resolution. Will launch a new enrichment site in a safe zone; additional countermeasures are being planned and will announced later.

- IAEA report says Iran conducted undeclared nuclear activities at 4 sites: Turquzabad, Mariwan, Pharmin and Lavisan Xi'an, according to Sky News Arabia

- Israeli Minister of Strategic Affairs and Mossad director will travel to meet US envoy Whitkov ahead of the round of nuclear negotiations with Iran scheduled for Sunday, via Israeli media cited by Sky News Arabia.

- US Embassy in Israel restricts travel for staff and families.

- Israel Foreign Ministry says the international community must respond to Iran's non-compliance and take measures to prevent it from developing nuclear weapons.

- Journalist Stein says "Western diplomats tell i24NEWS: They are concerned about a meltdown between the two countries." (Iran and Israel).

- Iraqi Military says the US evacuation decision has nothing to do with the presence of any field security indicators in the territory. Intelligence and field reports do not indicate actual threats. Additionally, US embassy in Bahrain says reports that the embassy has changed its posture in any way are false; staffing and operations are unchanged, activities continue as normal.

APAC TRADE

- APAC stocks traded mixed following the subdued handover from Wall St where the major indices were choppy and wiped out initial data-driven gains as geopolitical concerns clouded over risk sentiment.

- ASX 200 was initially led higher by strength in energy and gold miners after the recent rallies in their respective underlying commodity prices, although the gains in the broader market were limited and the index eventually returned to flat territory.

- Nikkei 225 underperformed as exporters suffered the ill effects of the recent currency strength.

- Hang Seng and Shanghai Comp were mixed alongside a similar overall picture across the Asia-Pac region and with markets somewhat unimpressed following the lack of solid details from the recent US-China agreement.