Europe Market Open: Crude +8%, ES -1.5% after Israel conducts strikes on Iranian nuclear & military targets

13 Jun 2025, 06:45 by Newsquawk Desk

- APAC stocks traded lower and US equity futures were pressured amid the worsening geopolitical situation in the Middle East.

- Israel conducted pre-emptive strikes on Iranian nuclear and military targets; Iran warned that Israel and the US will pay a heavy price.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 future down 1.9% after the cash market closed with losses of 0.6% on Thursday.

- DXY has been boosted by geopolitical risk, antipodeans hit, EUR/USD is back on a 1.15 handle.

- Crude futures have rallied, given geopolitics; Iran says refining facilities and oil storage did not sustain damage in the Israeli attack.

- Looking ahead, highlights include UoM Sentiment (Prelim), S&P to Review Germany's Credit Rating, ECB's Panetta & Elderson

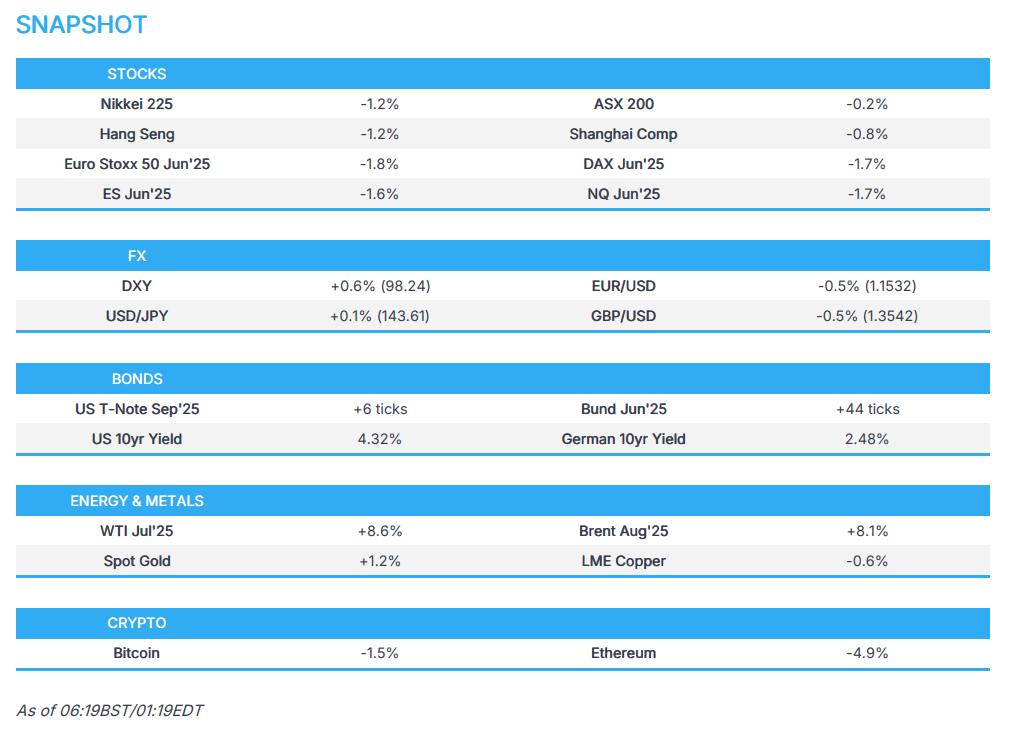

SNAPSHOT

US TRADE

EQUITIES

- US stocks were choppy but ultimately finished mostly higher as tailwinds from the softer-than-expected May PPI report offset the geopolitical concerns in the Middle East. Sectors were predominantly firmer in which Utilities, Tech, and Healthcare led the advances while Industrials, Communications and Discretionary lagged in the red with the former weighed on by Boeing (BA) (-4.8%) after a 787-8 Dreamliner crashed shortly after taking off in India.

- SPX +0.38% at 6,045, NDX +0.24% at 21,913, DJI +0.24% at 42,968, RUT -0.38% at 2,140.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said auto tariffs may go up in the not-too-distant future.

- US Commerce Secretary Lutnick said the China tariff pause likely won't be extended and its best chips were never on the table and won't be regarding the China deal.

- US Commerce Department made steel derivatives products subject to additional tariffs, according to the Federal Register.

- US eyes a plan to use the Defense Production Act for rare earths, although a timeline for the Trump rare earth initiative is unclear, according to Bloomberg citing sources.

- China reportedly delayed approval of the USD 35bln merger between Synopsys (SNPS) and Ansys (ANSS) amid Trump's trade war, according to FT.

NOTABLE HEADLINES

- US President Trump signed a resolution nixing California's EV rules.

- US judge temporarily restricted the military's law enforcement activities in Los Angeles and temporarily barred President Trump from deploying the California National Guard in Los Angeles, although the US Appeals Court later paused the lower court's order and allowed President Trump to deploy the National Guard to LA for now.

APAC TRADE

EQUITIES

- APAC stocks traded lower and US equity futures were pressured amid the worsening geopolitical situation in the Middle East after Israel conducted pre-emptive strikes on Iranian nuclear and military targets, with the Israeli military said to have struck dozens of sites across Iran, while Israeli PM Netanyahu said the operation will last for as many days as it takes and Iran has warned that Israel and the US will pay a heavy price for the Israeli attack.

- ASX 200 was dragged lower by losses in cyclicals but with the downside stemmed as energy and gold miners benefitted from the geopolitical-fuelled upside in the respective underlying commodity prices.

- Nikkei 225 slipped beneath the 38,000 level after recent currency strength and heightened geopolitical tensions.

- Hang Seng and Shanghai Comp conformed to the negative mood as Israel's numerous strikes and Iran's retaliation threats dominated the headlines.

- US equity futures (ES -1.6%, NQ -1.8%) retreated following the geopolitical escalation which dragged the Emini S&P beneath the 6,000 level and although the US said it had no involvement in the strikes, an Iranian armed forces spokesman warned that both Israel and the US will pay a heavy price for the attack.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 future down 1.9% after the cash market closed with losses of 0.6% on Thursday.

FX

- DXY returned to above the 98.00 level amid the geopolitical escalation which helped the dollar nurse some of this week's data-triggered losses.

- EUR/USD pared some of the gains from yesterday's outperformance with price action in the single currency largely at the whim of the recent moves in the greenback.

- GBP/USD pulled back from a multi-year high and reverted to beneath the 1.3600 territory as cyclicals were hit by the geopolitical escalation.

- USD/JPY trickled lower and briefly dipped beneath the 143.00 level owing to the haven flows into yen but later rebounded.

- Antipodeans underperformed due to their high-beta statuses as risk sentiment took a hit from Israel's strikes on Iran.

FIXED INCOME

- 10yr UST futures mildly extended on this week's data-fuelled advances which were spurred by softer-than-expected CPI and PPI, with recent upside facilitated by haven demand.

- Bund futures breached through near-term resistance at the 131.50 level to print a 2-month peak.

- 10yr JGB futures surged and briefly reclaimed the 140.00 due to the haven bid and as yields softened on war fears.

COMMODITIES

- Crude futures rallied as all focus centred on the geopolitical escalation in the Middle East after Israel conducted a pre-emptive strike on Iran.

- National Iranian Oil Refining and Distribution Company says refining facilities and oil storage did not sustain damage in the Israeli attack.

- US President Trump’s administration is expected to release a renewable fuel volume proposal on Friday, according to Reuters citing sources.

- Spot gold climbed back above the USD 3,400/oz level as the Israeli offensive against Iran spurred a flight to quality.

- Copper futures were pressured amid the increased geopolitical tensions and downbeat risk tone.

CRYPTO

- Bitcoin was pressured and briefly tested the USD 103k level to the downside before bouncing off lows.

NOTABLE ASIA-PAC HEADLINES

- BoJ officials see prices rising a little stronger than they expected earlier in the year and expect the interest rate to be maintained at 0.5% next week, according to Bloomberg.

GEOPOLITICS

MIDDLE EAST

- Israel's military struck nuclear and military targets in Iran as well as dozens of sites and said the Iranian nuclear programme is an existential threat to Israel, while it said the Iranian regime is advancing a secret program to build a nuclear weapon and Iran has enough fusion material to make 15 nuclear bombs within days.

- Israeli PM Netanyahu said their pilots were striking many targets in Iran and that the operation would continue for as many days as it takes which will hurt Iran's nuclear infrastructure, ballistic missile factories and military capabilities. Netanyahu also said they struck at the heart of Iran's nuclear enrichment programme and nuclear weaponisation programme, as well as Iran's main enrichment facility in Natanz. Furthermore, he said they targeted Iran's leading nuclear scientists working on the Iranian bomb and he later declared that they delivered a successful opening strike.

- Israeli Defence Minister Katz declared a special state of emergency on the home front throughout the entire state of Israel and said following Israel's preemptive strike against Iran, that a missile and drone attack against Israel is expected in the immediate future. It was separately reported that two Israeli officials said Israel is bracing for an Iranian response in the coming hours and the Iranian response could include the launch of hundreds of ballistic missiles.

- Iran's Supreme Leader Khamenei said Israel will receive a harsh punishment and that Israel "unleashed its wicked and bloody" hand in a crime against Iran, while he added that several commanders and several scientists were "martyred" and with this attack, Israel has prepared a bitter fate for itself, which it will surely receive.

- Iran Revolutionary Guards said Israel will pay a heavy price for the killing of IRGC Chief Commander Salami and that the attack was carried out with full knowledge and support of 'wicked rulers in the White House and terrorist US regime', while it was also reported that supreme leader advisor and IRGC commander Shamkhani was critically injured and that the head of Iran's armed force Bagheri was killed in the Israeli attack.

- Iran's Foreign Ministry said responding to Israel is its right under international law, and the US as Israel's main supporter will be responsible for the consequences of Israel's adventurism, while Iran's armed forces spokesman earlier warned that Israel and the US will pay a heavy price for the Israeli attack.

- US Secretary of State Rubio said Israel took unilateral action against Iran and the US is not involved in strikes against Iran, while he added the top priority is protecting American forces in the region and that Iran should not target US interests or personnel.

- US officials said they still intend to have talks on Sunday between US and Iran envoys.

- US President Trump earlier said that an Israeli strike was not imminent but looks like it could happen. Trump also stated that he wanted to have an agreement with Iran and they are fairly close to an agreement but added that Iran is going to have to negotiate tougher and Iran will have to give the US things they are not willing to. Furthermore, he said there was a chance of massive conflict and that something could happen soon.

- US reportedly told Israel it won't be directly involved in any strike on Iran, according to Axios.

- White House envoy Witkoff warned Republican senators that Iran could respond to an Israeli attack on its nuclear facilities with a massive missile attack that would overcome Israeli defences and cause massive damage and casualties, according to Axios’s Ravid.

- According to US intelligence estimates, Iran has about 2,000 ballistic missiles with warheads capable of carrying tons of explosives or even more, many of which are within range of Israel, according to Axios.

- UN General Assembly demanded an immediate, unconditional and permanent ceasefire in Gaza, while it adopted the Gaza resolution with 149 votes in favour.

RUSSIA-UKRAINE

- US President Trump said they will get a Russia-Ukraine deal and he is disappointed it is not done.

OTHER

- North Korea leader Kim said there are plans to build two more 5,000-ton destroyers next year and US provocation has become dangerous, while he added that North Korean battleships will soon roam the Pacific Ocean, according to KCNA.

EU/UK

NOTABLE HEADLINES

- Leading economist has warned that UK Chancellor Reeves is a "gnat's whisker" away from having to raise taxes in the autumn budget despite the chancellor insisting her plans are "fully funded", according to Sky News.