US Market Open: EU-US trade deal said to be close, seven letters expected today

09 Jul 2025, 11:50 by Newsquawk Desk

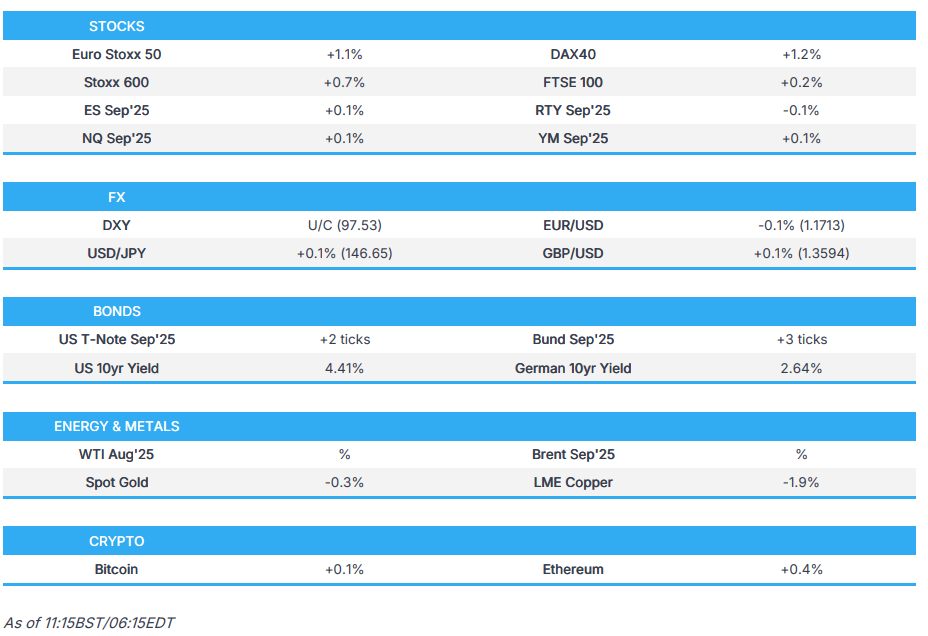

- US President Trump flagged the release of at least 7 tariff letters today. Reports that the EU is closing in on a temporary "framework" agreement, via FT.

- European bourses began modestly firmer and have been grinding higher since, Euro Stoxx 50 +1.1%; German autos bid on trade nuances, Basic Resources hit by non-US copper performance, Media lags after WPP

- Stateside, futures are in the green and directionally in-fitting with Europe but gains are much more muted, ES +0.2%; updates around AAPL, NVDA, AMZN in focus

- USD steady with G10s mixed but essentially flat. RBNZ as expected, no significant NZD move.

- Fixed benchmarks have a modest upward bias, though they remain markedly lower on the week; today's action in Europe is a retracement of Tuesday's supply-induced pressure rather than a pronounced move higher.

- Crude has an upward bias, specifics light. XAU softer. Front-running of US copper into potential tariffs has widened the Comex-LME arbitrage to over USD 2,000/t.

- Looking ahead, highlights include FOMC Minutes, Speakers include ECBʼs Lane, Nagel & de Guindos, Supply from the US.

- Click for the Newsquawk Week Ahead.

TARIFFS/TRADE

- US President Trump delayed reciprocal tariffs as Treasury Secretary Bessent wanted more time on deals, according to WSJ.

- US President Trump posted they "will be releasing a minimum of 7 Countries having to do with trade" on Wednesday morning and with an additional number of countries to be released in the afternoon.

- EU negotiators are closing in on a trade deal with US President Trump that would leave the EU facing higher tariffs than the UK, with the EU not expecting to achieve the same access to the US market as British steel, cars and other products subject to sectoral duties. Furthermore, Brussels is ready to sign a temporary “framework” agreement that sets Trump's “reciprocal” tariff at 10% while talks continue, according to FT.

- China's Commerce Ministry placed eight Taiwanese companies on its export control list due to concerns regarding dual-use technologies.

EUROPEAN TRADE

EQUITIES

- European bourses began the day with modest gains and have been grinding higher throughout the morning, Euro Stoxx 50 +1.1%; strength comes with the EU said to be nearing a deal with the US, with modest outperformance in the DAX 40 +1.2% amid associated auto strength.

- Amidst this, sectors began mixed but have been moving toward an overall positive bias. Banks lead with UniCredit (+3%) raising its stake in Commerzbank (+1%). Basic Resources weaker given pressure in non-US copper, hitting London-based minders, while Media lags after WPP's (-17%) profit warning.

- Stateside, futures spent the early European morning marginally mixed but essentially flat. Since, they have picked up with European peers though magnitudes are much more contained, ES +0.2%. Ahead of FOMC Minutes, trade updates and supply.

- Updates include: Apple (+0.3%) COO transition, may bid for F1 rights; China plans to install banned NVIDIA (+0.2%) chips; Meta (+0.3%) stake in EssilorLuxottica (+6%); Bezos sells Amazon (+0.4%) shares

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD steady as markets digest Tuesday's trade updates and await another batch later today. DXY contained in a 97.49-72 band. Amidst this, G10 peers are slightly mixed vs the USD but are broadly contained thus far.

- GBP the marginal best performer, Cable to a 1.3608 peak at best but hasn't spent much time above the figure in 1.3565-1.3608 confines. No reaction to the FSR and as trade updates for the UK are expected to be light, the USD-side of the equation will likely do the heavy lifting for today.

- EUR marginally softer vs the USD, EUR/USD holding just above 1.17 in a 1.1702-29 confine, and well within yesterday's 1.1682-1.1765 parameter. Specifics light thus far as we await updates on trade, after Trump said a letter was two days away which means a deal. Ahead, a handful of ECB speakers.

- Antipodeans relatively contained, particularly when compared to the RBA-led outperformance in the AUD earlier in the week. AUD/USD currently holding around highs of 0.6544, but essentially flat. Overnight, the RBNZ was unchanged as expected but guided towards further cuts if data moves as projected, essentially taking a data-dependent approach; as such,Kiwi is flat at 0.6000 vs the USD.

- JPY softer. We continue to await updates on the US-Japanese trade front with rhetoric earlier in the week not indicative of a near-term breakthrough. That aside, the firmer risk tone this morning has potentially been exerting some modest pressure. However, despite the continued improvement in the risk tone, USD/JPY is off overnight highs above 147.00, closer to a 146.54 trough.

- PBoC set USD/CNY mid-point at 7.1541 vs exp. 7.1806 (Prev. 7.1534).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A modest upward bias for benchmarks after a few sessions of relatively marked pressure.

- Strength comes despite the constructive risk tone. But, the magnitude of today's move is limited in nature with Bunds for instance still lower by over 60 ticks WTD, and the move more a function of Bunds retracing some of Tuesday’s supply-induced pressure (primarily from EU debt) than a pronounced move higher.

- No move in EGBs to the day's dual-tranche Bund supply. Now awaiting ECB speak and potential comments from the German Chancellor in a Bundestag Q&A on the draft 2026 budget.

- USTs a similar story with specifics light into supply and FOMC Minutes. Thus far, confined to a 110-24 to 110-29+ band, within Tuesday’s slightly more expansive 110-21+ to 111-01+ parameters, and by extension shy of Monday’s 111-12+ WTD peak.

- Gilts in-fitting with USTs and EGBs. Firmer by a handful of ticks with newsflow light as the UK has already secured a trade deal. Off best, but still firmer, in a 91.63-83 band; as is the case for USTs and Bunds remains shy of peaks at 91.98 and 92.63 from the last two sessions.

- UK sells GBP 4.5bln 4.50% 2035 Gilt: b/c 2.89x (prev. 2.98x), average yield 4.635% (prev. 4.588%) & tail 0.2bps (prev. 0.3bps)

- Germany sells EUR 1.135bln vs exp. EUR 1.5bln 2.60% 2041 and EUR 0.794bln vs exp. EUR 1.0bln 2.50% 2044 Bund

- Click for a detailed summary

COMMODITIES

- Upward bias across the crude contracts with Brent front-month settling north of USD 70/bbl yesterday following the OPEC+ surprise over the weekend, in the form of a larger-than-expected supply increase for August.

- WTI resides in a USD 67.78-68.94/bbl range while its Brent counterpart trades in a USD 69.85-70.71/bbl range.

- Softer trade across precious metals despite a relatively stable Dollar. Weakness in the complex could be a function of optimism regarding trade deals. Spot gold continues yesterday's weakness and resides in a USD 3,282.66-3,308.15/oz range, with the next point the 30th June trough at USD 3,244.42/oz.

- Base metals are softer, in Europe, despite the commentary from Trump on copper tariffs lifting to 50%. Front-running of US copper ahead of the potential 50% tariff has widened the Comex-LME arbitrage to over USD 2,000/t and pushed Comex inventories above combined LME and SHFE levels, writes ING.

- US Private Inventory Data (bbls): Crude +7.1mln (exp. -2.1mln), Distillate -0.8mln (exp. -0.3mln), Gasoline -2.2mln (exp. -1.5mln), Cushing +0.1mln.

- Mexico's Economy Minister said he will have a call with US authorities to discuss copper tariffs and see what they apply to.

- UAE Energy Minister says not worried about oil supply overhang, not seen an increase in inventories. Adds, they are losing some of the world's spare oil capacity Y/Y as some nations cannot produce what they did last year or last month and nobody is talking about peak oil demand anymore, demand has surpassed predictions.

- Goldman Sachs maintains its December 2025 LME Copper price forecast at USD 9.7k. Changes the baseline view on US tariffs on copper imports to 50% (prev. exp. 25%).

- West African cocoa production is likely to see another 10% decline in the upcoming 2025/26 season, according to Reuters citing industry sources.

- Click for a detailed summary

NOTABLE EUROPEAN HEADLINES

- BoE Financial Stability Report - July 2025; maintains CCyB at 2%. Uncertainty around the global risk outlook remains materially elevated compared to the time of the November FSR. Bank plans to engage with industry through an upcoming discussion paper, which will seek views on potential options to help mitigate gilt repo market vulnerabilities.

- BoE's Bailey (at the FSR) says risks and uncertainty still elevated. UK borrowers are resilient and can be supported by banks. Steepening in yield curves is not particularly UK-focused. Steepening in yield curves will need to be looked at carefully when it comes to the QT decision. QT is an open decision.

- Union confirms that UK Junior Doctors will go on strike between July 25-30th.

NOTABLE US HEADLINES

- White House NEC Director Kevin Hassett has emerged as a contender for the next Fed Chair in a possible threat to early favourite Kevin Warsh and has met with President Trump at least twice in June regarding the job, according to WSJ.

- DoJ said to be investing UnitedHealth's (UNH) Medicare billing, according to WSJ sources.

- US Speaker Johnson, when asked on government funding state of play, said “We want to appropriate at lower levels. We just have to determine what those levels are exactly", via Punchbowl.

GEOPOLITICS

MIDDLE EAST

- US President Trump exerted strong pressure on Israeli PM Netanyahu during their meeting to end the war, according to Yedioth Ahronoth citing informed sources.

- Qatari delegation arrived on Tuesday for talks at the White House regarding the hostage deal and ceasefire in Gaza, according to Axios citing a source familiar.

- IDF presence in Gaza is understood to be the 'only issue' still to be resolved in the push for Israel-Hamas ceasefire and the two sides have bridged significant differences on several other issues, according to Sky News citing sources.

- Kann News citing Saudi royal family sources believes that the agreement being formulated between Israel, Syria and the United States could have a positive effect and prepare the ground for an agreement with the Saudis as well.

- US Envoy Witkoff said to have postponed travel to Doha for Israel-Hamas peace talks, according to Times of Israel.

RUSSIA-UKRAINE

- White House considers giving Ukraine another Patriot air defence system, according to the Wall Street Journal.

- Ukrainian attack on a beach in the Russian city of Kursk killed three people, according to the regional governor.

- Russia launched a "record" 728 drones overnight and 13 missiles, according to Ukraine's Air Force.

- German Chancellor Merz says diplomatic means to resolve the Ukraine war have been exhausted.

- Russia's Kremlin says "we are calm" about US President Trump's criticism of Russian President Putin. Trump has a tough style in the phrases he uses. Will continue to try to fix the broken Russia-US relationship.

- Ukrainian President Zelensky is due to meet with US Special Envoy Kellogg during his visit to Rome, according to Ifax.

CRYPTO

- Bitcoin contained, in a relatively narrow range with specifics light as we await further tariffs updates later in the session. At best, still just under 1k from the in-focus USD 110k mark.

APAC TRADE

- APAC stocks traded mixed following the similar performance stateside where tariff updates remained in focus after the US flagged more tariff letters and President Trump suggested a 50% tariff on copper.

- ASX 200 marginally retreated with most sectors in the red although price action was confined within tight parameters.

- Nikkei 225 swung between gains and losses amid global trade uncertainty, while there were balanced comments from BoJ's Koeda who stated it is inappropriate to say the specific timing of the next rate hike now due to high uncertainty but added the BoJ must debate how much it should eventually shrink its expanded balance sheet and balance of JGB holdings.

- Hang Seng and Shanghai Comp conformed to the mixed overall picture in the region as property names dragged the Hong Kong benchmark lower, while the mainland remained afloat as participants reflected on mixed inflation data from China.

NOTABLE ASIA-PAC HEADLINES

- China's state planner chair said to expect the size of China's economy to exceed CNY 140tln this year and noted that foreign tech curbs can only strengthen China's tech innovation and resolve on self-reliance.

- BoJ's Koeda said recent rises in Japan's food and rice prices were stronger than expected at the time of BoJ's May policy meeting and they are watching the development carefully, while he added the BoJ's weighted median inflation is still below 2% and must scrutinise whether momentum for stable inflation is becoming embedded in Japan's economy. Koeda also commented that it is inappropriate to say the specific timing of the next rate hike now due to high uncertainty over the economic outlook and stated the BoJ must debate how much it should eventually shrink its expanded balance sheet and balance of JGB holdings.

- ex-BoJ policymaker Sakurai says BoJ will hold off rate hikes until March due to the US tariffs, according to Reuters.

- RBNZ kept the OCR at 3.25%, as expected, while it stated that if medium-term inflation pressures continue to ease as projected, the Committee expects to lower the OCR further and annual consumer price inflation will likely increase towards the top of the Monetary Policy Committee's 1-3% target band over mid-2025. RBNZ stated the economic outlook remains highly uncertain and further data on the speed of New Zealand's economic recovery, the persistence of inflation, and the impacts of tariffs will influence the future path of the OCR. The minutes from the meeting stated the Committee expects to lower the official cash rate further, broadly consistent with the projection outlined in May and the case for keeping the OCR on hold at this meeting highlighted the elevated level of uncertainty and the benefits of waiting until August in light of near-term inflation risks. Furthermore, the Committee discussed the options of cutting the OCR by 25bps or keeping the OCR on hold at this meeting and some members emphasised that further monetary easing in July would provide a guardrail to ensure the recovery of economic activity.

- China State Council issues notice on stepping up support for employment, via Xinhua; will support enterprises in stabilising jobs; will expand the scope of social insurance subsidies. To further enrich the policy toolkit in order to stabilise employment.

DATA RECAP

- Chinese CPI MM (Jun) -0.1% vs. Exp. -0.1% (Prev. -0.2%); YY 0.1% vs. Exp. 0.0% (Prev. -0.1%)

- Chinese PPI YY (Jun) -3.6% vs. Exp. -3.2% (Prev. -3.3%)